Industrial Gloves Market Size, Share, & Growth Report 2032

Industrial Gloves Market By Product Type (Disposable Gloves And Reusable Gloves), By Application (Food, Chemicals, Healthcare, Pharmaceuticals, Manufacturing, And Others), By Material (Polyethylene, Nitrile, Rubber, Neoprene, Vinyl, And Others), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024-2032

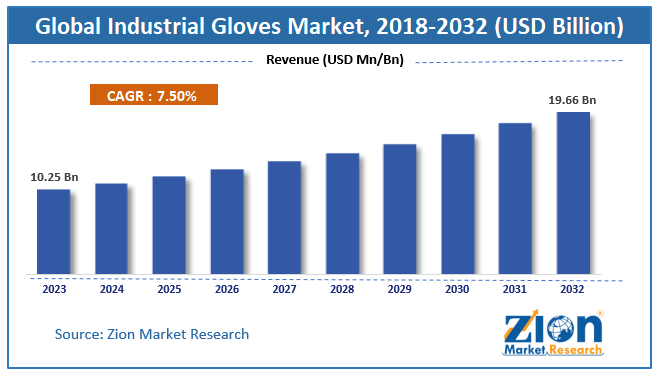

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 10.25 Billion | USD 19.66 Billion | 7.50% | 2023 |

Industrial Gloves Industry Perspective:

The global industrial gloves market size was worth around USD 10.25 billion in 2023 and is predicted to grow to around USD 19.66 billion by 2032 with a compound annual growth rate (CAGR) of roughly 7.50% between 2024 and 2032. The report covers forecast and analysis for the global industrial gloves market on a global and regional level. The study provides historical data for 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD Billion). The study includes drivers and restraints for the global industrial gloves market along with the impact they have on the demand over the forecast period.

Key Insights

- As per the analysis shared by our research analyst, the industrial gloves market is anticipated to grow at a CAGR of 7.50% during the forecast period (2024-2032).

- The global industrial gloves market was estimated to be worth approximately USD 10.25 billion in 2023 and is projected to reach a value of USD 19.66 billion by 2032.

- The growth of the industrial gloves market is being driven by increasing awareness of workplace safety and stringent regulatory standards across industries such as manufacturing, chemicals, oil & gas, healthcare, and construction.

- Based on the product type, the disposable gloves segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the food segment is projected to swipe the largest market share.

- In terms of material type, the polyethylene segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Industrial Gloves Market: Overview

Industrial gloves are important for the protection of an individual from injury, burn, and infection. In biotechnology industry gloves are worn to prevent cross-contamination. Hand protection gloves are mainly used in automobile, electrical, chemical, healthcare, and food & beverage industries for the well-being of the workers. Some industries use reusable hand protection gloves whereas other industries such as food and healthcare prefer disposable hand gloves in order to prevent the contamination.

Flourishing automobile, chemical, pharmaceutical, food & beverage, and biotechnology industries globally is driving the global industrial gloves market growth owing to increasing demand for the diverse variety of industrial gloves in the countries such as Switzerland, the U.S., and New Zealand.

To understand the competitive landscape in the market, an analysis of Porter’s Five Forces model for the global industrial gloves market has also been included. The study encompasses a market attractiveness analysis, wherein type, application, and material type segments are benchmarked based on their market size, growth rate, and general attractiveness.

Industrial Gloves Market: Segmentation

The study provides a decisive view of the global industrial gloves market by segmenting the market based on product type, application, material type, and regions. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032 .

The product type for the global industrial gloves market includes disposable gloves and reusable gloves. In terms of revenue, disposable gloves segment of the product type is anticipated to acquire significantly the highest share as compared to reusable gloves. Zero cost of maintenance, sterilization, and storage are the prime factors that are driving the growth of the disposable industrial gloves segment.

Based on the application, the industrial gloves market is classified into food, chemicals, healthcare, pharmaceuticals, manufacturing, and others. Currently, chemical and pharmaceutical segments are dominating the application segment of industrial gloves market in terms of revenue. However, the food segment is anticipated to show the fastest growth in the near future owing to the growing importance of hygiene in all food operation processes.

The material type segment of industrial gloves market includes polyethylene, nitrile, rubber, neoprene, vinyl, and others. Nitrile gloves in the material segment are anticipated to show the fastest growth in terms of revenue during the forecast period owing to a superior chemical barrier, protection, and durability, as compared to other material.

Recent Development

- In May 2025, Protective Industrial Products, Inc. announced the completion of its acquisition of Honeywell’s Personal Protective Equipment (PPE) Business. The acquired business includes the globally recognized brands Fendall™, Fibre-Metal™, Howard Leight™, KCL™, Miller™, Morning Pride™, North™, Oliver™, and Salisbury™.

- In February 2024, Tilsatec Limited acquired Tilsatec North America LLC, a strategic move to accelerate expansion and broaden its market presence in the cut-resistant hand protection sector. This acquisition is pivotal to driving the company's ambitious growth plans within the hand protection PPE market.

- In February 2023, Ansell Limited, a global leader in personal protection safety solutions, announced it had agreed to acquire the 50 percent shareholding of Careplus Group in Careplus (M) Sdn Bhd for a total consideration of RM 37.5 million (approximately US$9 million).

Industrial Gloves Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Industrial Gloves Market Research Report |

| Market Size in 2023 | USD 10.25 Billion |

| Market Forecast in 2032 | USD USD 19.66 Billion |

| Growth Rate | CAGR of 7.50% |

| Number of Pages | 110 |

| Key Companies Covered | Ansell Ltd., 3M Corporation, Holding Towa Corporation, Honeywell Safety Products, Semperit A.G. Holding, Showa Group, MSA Safety, and E.I. DuPont De Nemours and Company, among others. |

| Segments Covered | By Product Type, By Application, By Material, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Industrial Gloves Market: Regional Analysis

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa with its further bifurcation into major countries including the U.S., Germany, France, the UK, China, Japan, India, and Brazil.

By geography, North America is projected to be the fastest growing region in terms of revenue. Presence of influential developed economies, the presence of service and manufacturing industries is anticipated to accelerate the industrial gloves market in the region. Moreover, strict government norms and regulations regarding safety of workers in the industries are anticipated to boost the industrial gloves market positively. Europe industrial gloves market is anticipated to witness huge demand in the near future owing to stringent safety rules by regulating authorities and government organization. The Asia Pacific is the key industrial gloves supplier owing to the easy availability of raw material. Countries like Indonesia, Thailand, and Malaysia are the chief producers of industrial gloves which are exported to Europe and North America by the key manufacturers in the region. The Middle East and Africa region are projected to grow during the forecast period due to the growing oil industries. However, less attention towards safety norms regarding workers safety may restrain the market growth in the region.

Industrial Gloves Market: Competitive Analysis

The report also includes detailed profiles of key players such as

- Ansell Ltd.

- 3M Corporation

- Holding Towa Corporation

- Honeywell Safety Products

- Semperit A.G. Holding

- Showa Group

- MSA Safety

- E.I. DuPont De Nemours and Company

- Among others.

The global industrial gloves market segmented as follows:

By Product Type

- Disposable Gloves

- Reusable Gloves

By Application

- Food

- Chemicals

- Healthcare

- Pharmaceuticals

- Manufacturing

- Others

By Material Type

- Polyethylene

- Nitrile

- Rubber

- Neoprene

- VINYL

By Region

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Industrial gloves are important for the protection of an individual from injury, burn, and infection.

According to study, the global industrial gloves market size was worth around USD 10.25 billion in 2023 and is predicted to grow to around USD 19.66 billion by 2032.

The CAGR value of industrial gloves market is expected to be around 7.50% during 2024-2032.

North America has been leading the global industrial gloves market and is anticipated to continue on the dominant position in the years to come.

The global industrial gloves market is led by players like Ansell Ltd., 3M Corporation, Holding Towa Corporation, Honeywell Safety Products, Semperit A.G. Holding, Showa Group, MSA Safety, and E.I. DuPont De Nemours and Company, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed