Global Household and DIY Hand Tools Market Size, Share, Growth Analysis Report - Forecast 2034

Household and DIY Hand Tools Market By Type (General Purpose Tools, Metal Cutting Tools, Layout & Measuring Tools, Taps & Dies), By Application (Household Appliances, Entertainment & Consumer Electronics, IT & Telecommunications, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

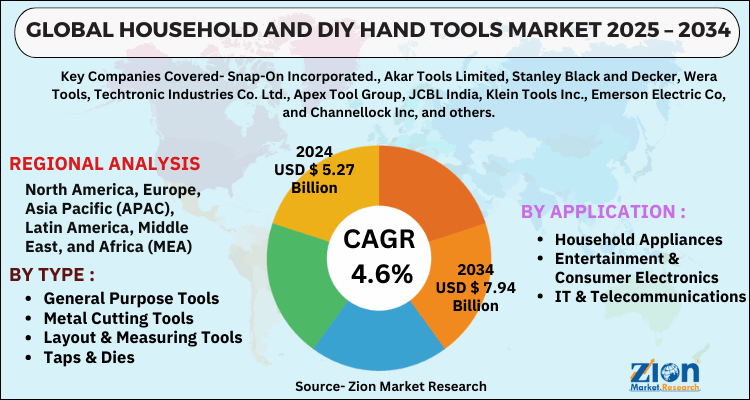

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.27 Billion | USD 7.94 Billion | 4.6% | 2024 |

Household and DIY Hand Tools Market Size

The global household and DIY hand tools market size was worth around USD 5.27 Billion in 2024 and is predicted to grow to around USD 7.94 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 4.6% between 2025 and 2034.

The report analyzes the global household and DIY hand tools market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the household and DIY hand tools industry.

Household and DIY Hand Tools Market: Overview

Any tool that is powered by hand rather than a motor is referred to as a hand tool. Pliers, wrenches, cutters, screwdrivers, striking tools, hammering tools, vises, saws, clamps, knives, drills, and other hand tools are only a few examples of DIY and household tools. Garden forks, rakes, and pruning shakes are further examples of outdoor tools. The importance of these tools is increasing as the effect of rapid urbanization and construction works.

The hand tools offer convenience and flexibility to DIY for activities like drilling, screw driving, routing, chiseling, sanding, polishing, buffing, and leveling. For general purposes, the most commonly used power tools among DIY’ers include drilling machine, nail guns, wall chasers, circular saws jack-hammers, and others. The hand tools are simple and handy in nature. Basically, it involves in manual labor. In a regular day to day basis, the hand tools and the household tools play a crucial role in solving day to day machine activities.

Key Insights

- As per the analysis shared by our research analyst, the global household and DIY hand tools market is estimated to grow annually at a CAGR of around 4.6% over the forecast period (2025-2034).

- Regarding revenue, the global household and DIY hand tools market size was valued at around USD 5.27 Billion in 2024 and is projected to reach USD 7.94 Billion by 2034.

- The household and DIY hand tools market is projected to grow at a significant rate due to growing interest in home improvement projects, increasing DIY culture, advancements in tool design and functionality, and rising consumer demand for easy-to-use, durable, and cost-effective tools.

- Based on Type, the General Purpose Tools segment is expected to lead the global market.

- On the basis of Application, the Household Appliances segment is growing at a high rate and will continue to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Household and DIY Hand Tools Market: Growth Drivers

Rapidly growing residential and commercial infrastructure projects may drive market growth.

The demand for infrastructure development and fast urbanization is constantly expanding over the world. Governments from all major nations have been seen making efforts toward infrastructure development and making required expenditures in the sector to facilitate such advancements. Projects including the construction of roads, trains, airports, utilities, energy, and commercial & residential structures are among the infrastructure development projects. Countries such as the United States, China, India, and Japan are substantially investing in building projects, influencing their infrastructure development, and are projected to have rapid expansion in the next years. The need for hand tools is increasing as the construction industry's expectations change, and hand tool makers can be observed focused on improving their goods to meet the newest global household and DIY hand tools market demands.

Household and DIY Hand Tools Market: Restraints

Upsurge in concerns and safety risks due to improper use of hand tools may hamper the market growth.

Hand tools include heavy-weight, sharp-edged, potentially dangerous equipment that is typically used in cutting, drilling, shaping, fitting, and mending tasks. Because of inappropriate usage or handling, such equipment might pose a threat to human safety. These catastrophes are frequently caused by a lack of knowledge, expertise, or professionalism, thus it is important that these products should only be used with proper instruction and safeguards. Also, while carrying them, essential measures should be taken, and they should be carried in sheaths, holsters, or dedicated toolboxes. Furthermore, as more people utilize hand tools for home improvement projects, the risk of injury increases owing to inappropriate or insufficient understanding of how to use them. These factors can cause slow growth of the global household and DIY hand tools market.

Household and DIY Hand Tools Market: Opportunities

A surge in the use of automatic hand tools to decrease physical work may fuel the market growth.

Every country in the world is currently headed toward automation. This development is required for all industries to survive the impending difficult era and meet ever-increasing consumer demands. Furthermore, automation benefits producers in several ways including dropping overall operating costs, lessening human effort, improving labor safety, refining production output, and improving work quality. Likewise, automated hand tools may be used to replace manual tools, such as self-acting tools that combine dexterity with automated functionality and give smart solutions. Automated hand tools can be a clever way to replace time-consuming and exhausting tasks while increasing productivity and quality.

Household and DIY Hand Tools Market: Challenges

A major challenge to make hand tools with every possible dimension for every application may hinder the market growth.

There aren't enough all dimensions or specification hand tools to cover every application scenario. Every hand tool has a different application depending on its size, shape, intensity, material, and the application area's criteria. As a result, only hand tools with specified specifications for the targeted application should be owned and used. In practice, it is nearly difficult for household users or experts to get and handle all hand tools of all sizes necessary to complete the task.

Household and DIY Hand Tools Market: Segmentation Analysis

The global household and DIY hand tools market is segmented based on Type, Application, and region.

Based on Type, the global household and DIY hand tools market is divided into General Purpose Tools, Metal Cutting Tools, Layout & Measuring Tools, Taps & Dies.

On the basis of Application, the global household and DIY hand tools market is bifurcated into Household Appliances, Entertainment & Consumer Electronics, IT & Telecommunications, Others.

Household and DIY Hand Tools Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Household and DIY Hand Tools Market |

| Market Size in 2024 | USD 5.27 Billion |

| Market Forecast in 2034 | USD 7.94 Billion |

| Growth Rate | CAGR of 4.6% |

| Number of Pages | 199 |

| Key Companies Covered | Snap-On Incorporated., Akar Tools Limited, Stanley Black and Decker, Wera Tools, Techtronic Industries Co. Ltd., Apex Tool Group, JCBL India, Klein Tools Inc., Emerson Electric Co, and Channellock Inc, and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

- March 2021, the Slain Lineman Tribute Knife, a limited-edition knife honoring the lives of lost utility line workers, was released by Klein Tools, Inc.

- February 2021, Klein Tools, Inc. launched the Klein-Kurve Wire Stripper/Cutter, a sturdy stamped wire remover with six strip holes and shear blades for cutting, as well as a comfortable grip and improved lock.

- November 2020, Klein Tools, Inc. has released two new extendable screwdrivers that may be used as both multi-bit screwdrivers and impact driver attachments, featuring onboard bit storage and precise control.

Household and DIY Hand Tools Market: Regional Landscape

Asia Pacific is projected to dominate the global market during the forecast period.

Due to increased urbanization and infrastructure developments, Asia Pacific is predicted to dominate the global household and DIY hand tools market throughout the study period. Furthermore, China is a significant supplier of hand tools worldwide. The fast industrial expansion of China has prompted hand tool and accessory manufacturers to set up production facilities there. China's cheap labor and material costs enable manufacturers to make hand tools and accessories at reduced costs while also increasing production productivity. Many small manufacturers operate in the Chinese hand tool industry, catering to the Asian need for hand tools. Furthermore, China's growing automotive, aerospace, and electronics industries provide the potential for hand tool expansion. The Middle East is also expected to offer better opportunities for market expansion owing to the rapid growth in the construction sector.

Household and DIY Hand Tools Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the household and DIY hand tools market on a global and regional basis.

The global household and DIY hand tools market is dominated by players like:

- Snap-On Incorporated.

- Akar Tools Limited

- Stanley Black and Decker

- Wera Tools

- Techtronic Industries Co. Ltd.

- Apex Tool Group

- JCBL India

- Klein Tools Inc.

- Emerson Electric Co

- and Channellock Inc

The global household and DIY hand tools market is segmented as follows;

By Type

- General Purpose Tools

- Metal Cutting Tools

- Layout & Measuring Tools

- Taps & Dies

By Application

- Household Appliances

- Entertainment & Consumer Electronics

- IT & Telecommunications

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global household and DIY hand tools market is expected to grow due to increasing home renovation and repair activities, rising DIY culture, and growing urbanization leading to increased demand for basic and specialized hand tools.

According to a study, the global household and DIY hand tools market size was worth around USD 5.27 Billion in 2024 and is expected to reach USD 7.94 Billion by 2034.

The global household and DIY hand tools market is expected to grow at a CAGR of 4.6% during the forecast period.

North America is expected to dominate the household and DIY hand tools market over the forecast period.

Leading players in the global household and DIY hand tools market include Snap-On Incorporated., Akar Tools Limited, Stanley Black and Decker, Wera Tools, Techtronic Industries Co. Ltd., Apex Tool Group, JCBL India, Klein Tools Inc., Emerson Electric Co, and Channellock Inc, among others.

The report explores crucial aspects of the household and DIY hand tools market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed