Global Heat Treating Market Size, Share, Growth and Forecast 2032

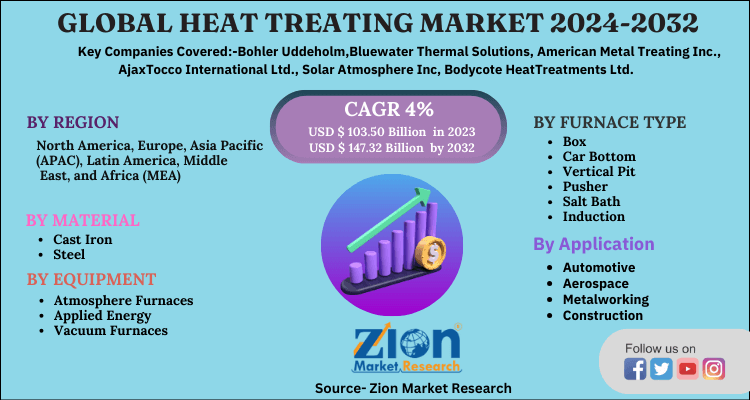

Global Heat Treating Market By Material (Cast Iron, Steel and Others), By Equipment (Atmosphere Furnaces, Applied Energy, Vacuum Furnaces and Others), By Furnace Type (Box, Car Bottom, Vertical Pit, Pusher, Salt Bath, Induction and Others) By Application (Automotive, Aerospace, Metalworking, Construction and Others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

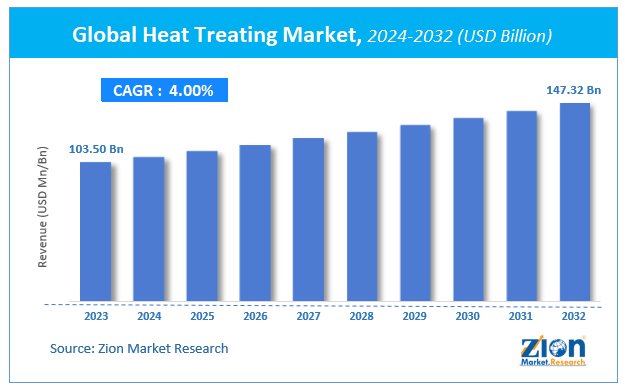

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 103.50 Billion | USD 147.32 Billion | 4% | 2023 |

Global Heat Treating Market Insights

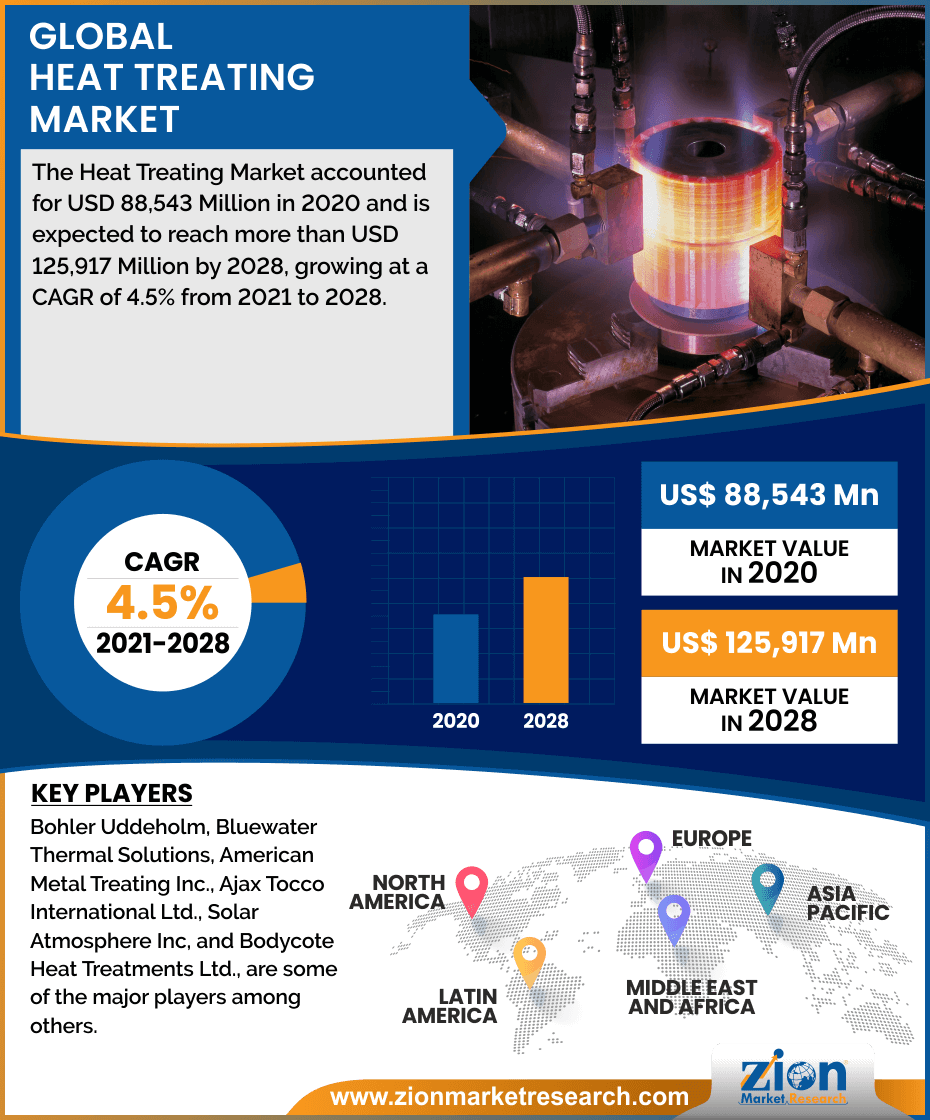

According to a report from Zion Market Research, the global Global Heat Treating Market was valued at USD 103.50 Billion in 2023 and is projected to hit USD 147.32 Billion by 2032, with a compound annual growth rate (CAGR) of 4% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Global Heat Treating Market industry over the next decade.

Heat Treating Market: Overview

Heat treatment is a method that is utilized for alteringfeatures of alloys & metals through cooling & heatingprocesses. The heat treating method is utilized for achievingrequired product fit for a particular application. Apart from this, heat treatment also raises the ductile strength & durability ofconstruction metals such as steel. Furthermore, there are myriadkinds of heat treating processes which vary based on the heating temperature & rate of cooling based on the need. Heat treatmentalso helps in annealing of the steel.

Heat Treating Market: Growth Factors

Heat treatment is a method that is utilized for alteringfeatures of alloys & metals through cooling & heating processes.The heat treating method is utilized for achieving required productfit for a particular application. Heat treating makes material moreapplication specific based on the end use in various industries.Automotive and aerospace are two crucial application segments forheat treating services. Alloys and other high performing metals aresignificantly adopted in these industries to produces vehicles.Therefore, Growing demand for heat treating services in aerospacecan be attributed to rapidly increasing demand for commercial vehicles due to high aviation demand and rising air passengertraffic.

Heat treatment industry is mainly dominated by the steel metalas it acquired 80% of the market share and single handily dominatedthe industry. Therefore, heat treatment is more of steel driven.Heat treatment is a method that is utilized for altering featuresof alloys & metals through cooling & heating processes. The heattreating method is utilized for achieving required product fit fora particular application. Heat treatment of steel makes it moreapplication specific with improved properties.

Heat Treating Market: Segment Analysis Preview

Based on the material, the global heat treating market issegmented into cast iron, steel, and others. Steel is emerged asthe largest revenue generating segment in 2020 with 80% marketshare and it is further anticipated to be at dominant position.Heat treated steel segment emerged as the largest revenuegenerating segment in the global heat treatment market and it isanticipated to be the leading segment in terms of revenue by theend of forecast period. Steel is the dominant material in thecivilization and evolution of human history.

Based on the Equipment, the global heat treating market issegmented into atmospheric furnaces, applied energy, vacuum energy,and others. Atmospheric furnaces are emerged as the largest revenuegenerating segment. Atmospheric furnace emerged as the largestrevenue generating segment in the global heat-treating market withover 60% of the global market share in 2020, and the similarsegment anticipated being at dominant position by the end of theforecast period.

Global Heat Treating Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Global Heat Treating Market |

| Market Size in 2023 | USD 103.50 Billion |

| Market Forecast in 2032 | USD 147.32 Billion |

| Growth Rate | CAGR of 4% |

| Number of Pages | 188 |

| Key Companies Covered | Bohler Uddeholm,Bluewater Thermal Solutions, American Metal Treating Inc., AjaxTocco International Ltd., Solar Atmosphere Inc, Bodycote HeatTreatments Ltd |

| Segments Covered | By Material, By Equipment, By Furnace Type, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Heat Treating Market: Regional Analysis Preview

Asia-Pacific heat treatment market is studies across countries like China, India, Japan, Southeast Asia, Korea, and others. Marketshares in the global heat treating market and further projected tocontinue its dominance in the years to come. Asia Pacific dominatedthe metal heat treating market in terms of revenue. These servicesin the region are largely driven by rapidly growing automotive,aerospace, and construction industries across key emergingeconomies such as India, China, and Indonesia. The rising demandfor commercial and heavy-duty vehicles anticipated to boost themarket share in the countries like China, India, and Japan.

Key Market Players & Competitive Landscape

Some of key players in Heat Treating Market are

- Bohler Uddeholm

- Bluewater Thermal Solutions

- American Metal Treating Inc

- AjaxTocco International Ltd

- Solar Atmosphere Inc

- Bodycote HeatTreatments Ltd

The Heat Treating Market is segmented as follows:

By Material

-

Cast Iron

- Steel

- Others

By Equipment

- Atmosphere Furnaces

- Applied Energy

- Vacuum Furnaces

- Others

By Furnace Type

- Box

- Car Bottom

- Vertical Pit

- Pusher

- Salt Bath

- Induction

- Others

By Application

- Automotive

- Aerospace

- Metalworking

- Construction

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a report from Zion Market Research, the global Global Heat Treating Market was valued at USD 103.50 Billion in 2023 and is projected to hit USD 147.32 Billion by 2032.

According to a report from Zion Market Research, the global Global Heat Treating Market a compound annual growth rate (CAGR) of 4% during the forecast period 2024-2032.

some of the key factors driving the Heat Treating Market growth are Massive demand for the product in automotive, aviation, construction, and manufacturing sectors and Heat treatment makes metals more application specific

Asia pacific held a substantial share of the Heat Treating Market in 2023.

some of key players in Heat Treating Market are Bohler Uddeholm, Bluewater Thermal Solutions, American Metal Treating Inc., Ajax Tocco International Ltd., Solar Atmosphere Inc, and Bodycote Heat Treatments Ltd., are some of the major players among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed