Healthcare Predictive Analytics Market Size, Share Report, Analysis, Trends, Growth 2032

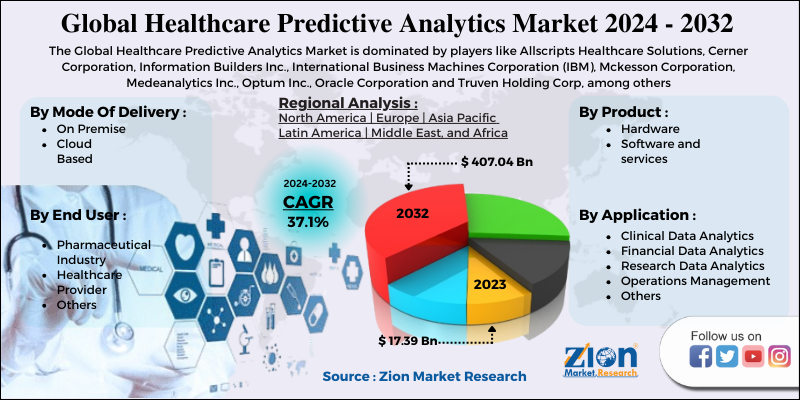

Healthcare Predictive Analytics Market By Application(Clinical Data Analytics, Financial Data Analytics, Research Data Analytics, Operations Management and Others), By Product (Hardware and Software & services), By Modes Of Delivery (On Premise and Cloud Based), By End User(Healthcare Provider, Pharmaceutical Industry and others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-

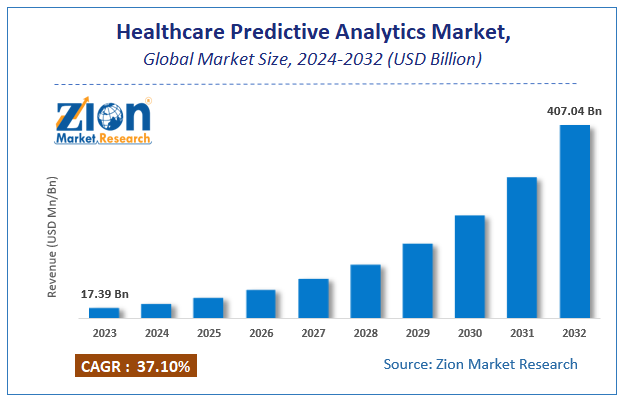

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 17.39 Billion | USD 407.04 Billion | 37.1% | 2023 |

Healthcare Predictive Analytics Market Insights

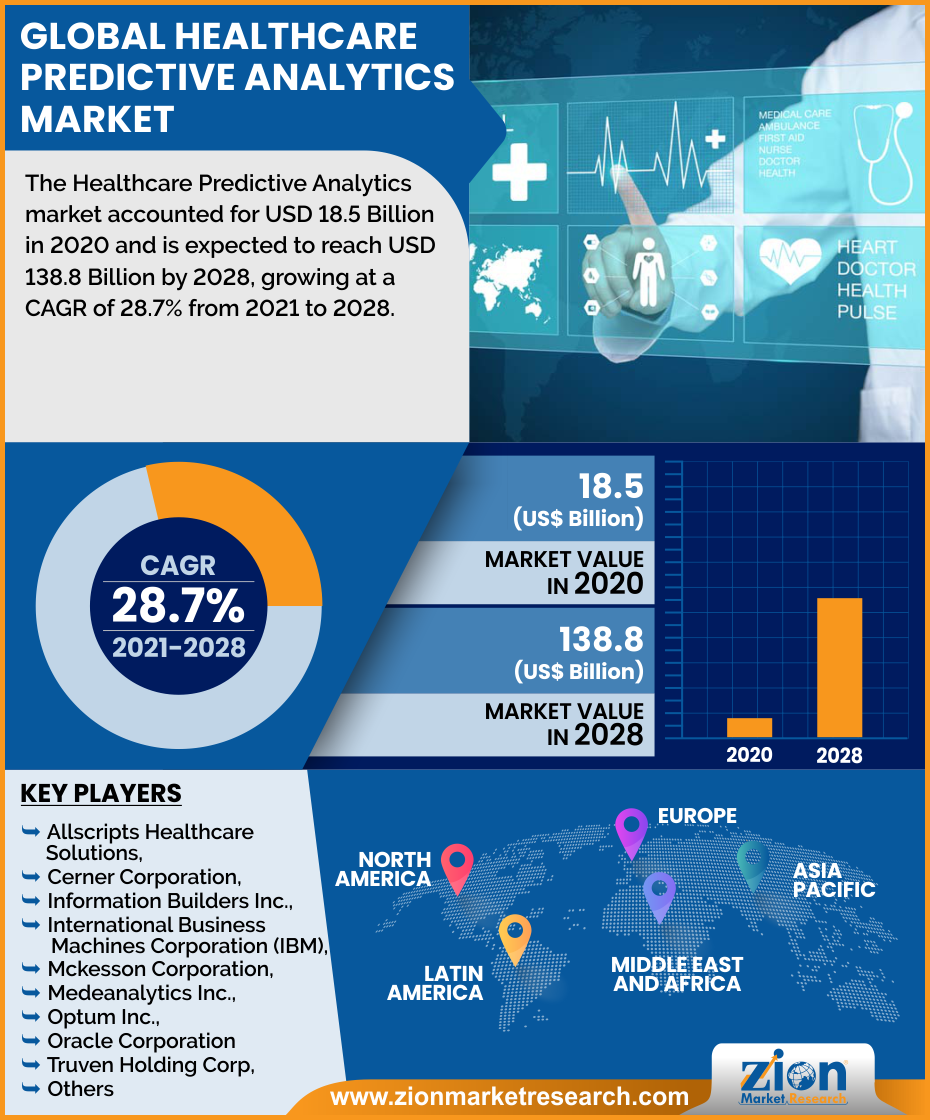

According to a report from Zion Market Research, the global Healthcare Predictive Analytics Market was valued at USD 17.39 Billion in 2023 and is projected to hit USD 407.04 Billion by 2032, with a compound annual growth rate (CAGR) of 37.1% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Healthcare Predictive Analytics Market industry over the next decade.

Healthcare Predictive Analytics Market: Overview

The important point for the development of the medical care for healthcare predictive Analytics market incorporate the rise of customized and proof based medication, developing need for increasing productivity in the medical services area, and expanding request to shorten medical care costs by decreasing superfluous expenses is the major growth factors promoting healthcare predictive analytics market.

Factors, for example, government drives to expand EHR reception, developing funding speculations, developing strain to check medical care spending and working on understanding results, the rise of huge information in medical services, and the rising significance of certifiable proof are relied upon to drive the development of the market.

Healthcare Predictive Analytics Market: COVID-19 Impact Analysis

Due to Covid-19 pandemic, market players in the healthcare predictive analytics market are developing new ways such as incorporating artificial intelligence in medical care facilities and data analytics in healthcare systems, and others. Research & development facilities are promoting new tools for tracking hospital capacity and to identify high risks. Somehow, due to covid-19 pandemic has influenced the growth factor in the medical sector and promoted new developments in the healthcare predictive analytics market. Healthcare Predictive analytics tools are helping healthcare facilities to stay ahead of difficult outcomes, material shortages, and other problems due to COVID-19. The predictive analytics segment is anticipated to witness lucrative CAGR over the forecast period.

Healthcare Predictive Analytics Market: Growth Factors

Predictive Analytics or Predictive modeling is being utilized by the medical care associations to discover the danger rate to a patient's wellbeing. Predictive analytics and investigating to assist the patients and guardians with post-health issues, like critical diseases and response to medication and sensitivities, as medical services suppliers are outfitted with the patient's authentic clinical information, which has been given through the electronic data records.

In addition, with clinics information investigation, patients can find their medical issue to various specialists on ordinary factors. This can be accomplished by a basic investigation interaction of their clinical information, further giving preventive solutions. The development of medical care information examination is required to diminish medical care costs, increment the openness of huge information in medical services industry. The patient information found, shared, and accumulated by these applications is the essential information that medical services organizations examine utilizing these clinical scientific data.

Application Type Segment Analysis Preview

Based on application, the market is segmented into operations management, financial data analytics, population health management, and clinical. The population health management segment is expected to witness lucrative growth during the forecast period, owing to the rise in importance of using predictive analytics to evaluate disease treatment pattern and reduce readmission rates.

End User Segment Analysis Preview

Based on end user, the market is classified into healthcare payers, healthcare providers, and others. Healthcare payers is the largest contributor toward the market growth as this segment mainly includes insurance companies, health plan sponsors where predictive analytics is used to evaluate insurance claims, prevent & detect fraudulent claims, and assess disease risk.

Healthcare Predictive Analytics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Healthcare Predictive Analytics Market |

| Market Size in 2023 | USD 17.39 Billion |

| Market Forecast in 2032 | USD 407.04 Billion |

| Growth Rate | CAGR of 37.1% |

| Number of Pages | 167 |

| Key Companies Covered | Allscripts Healthcare Solutions, Cerner Corporation, Information Builders Inc., International Business Machines Corporation (IBM), Mckesson Corporation, Medeanalytics Inc., Optum Inc., Oracle Corporation and Truven Holding Corp, among others |

| Segments Covered | By Application, By Product, By Mode Of Delivery, By End User and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Regional Analysis Preview

The market is dominated by North America, followed by Europe, Asia, and RoW. The market in North America is expected to witness the highest growth during the forecast period. The high growth of the North American market is attributed to growing federal healthcare mandates to curb rising healthcare costs; increasing regulatory requirements; growing EHR adoption; and rising government initiatives focusing on personalized medicine, population health management, and value-based reimbursements.

The market in the APAC region is likely to grow at the fastest rate in the forecast period. The Australian government’s National Health Information network proposed in 2004, named ‘HealthConnect’, extracts summary records from locally collected patient data and then they are aggregated to create a centralized HealthConnect record that may then be shared among participating authorized providers, which is a premier example of Healthcare Predictive Analytics being used by governmental bodies. Further, the European Union directive 2011/24/EU enacts patients’ rights in cross-border healthcare, suggesting boosting the digital economy by enabling all Europeans to have access to online records anywhere in Europe by 2020.

Key Market Players & Competitive Landscape

Some of key players in Healthcare Predictive Analytics market include

- Allscripts Healthcare Solutions

- Cerner Corporation

- Information Builders Inc.

- International Business Machines Corporation (IBM)

- Mckesson Corporation

- Medeanalytics Inc.

- Optum Inc.

- Oracle Corporation

- Truven Holding Corp

- among others.

These companies have apprehended the major part of the global market in the Healthcare predictive analytics market, entry of new companies is estimated to raise the level of competition in the coming years. Mergers and acquisitions have arrived as the strongest set of strategic measures in the Healthcare predictive analytics market, due to the continued achievement of business growth by the major companies.

IBM is the leading player in the market and provides a comprehensive range of solutions for this market. The company has a strong presence in the commercial and government healthcare payer markets. It also has a robust sales and distribution network across more than 175 countries. IBM invests a significant amount of its revenue in research activities to continuously improve its product portfolio. Since 2005, the company has invested USD 24 billion in the development of its big data and analytics software and services capabilities, and has 6,809 patents to its name. One of the major steps taken by IBM to improve its position in the market is the acquisition of Truven Health Analytics in April 2016. This acquisition helped the company to acquire a major share of the global market.

The Healthcare Predictive Analytics is segmented as follows:

By Application

- Clinical Data Analytics

- Financial Data Analytics

- Research Data Analytics

- Operations Management

- Others

By Product

- Hardware

- Software and services

By Mode Of Delivery

- On Premise

- Cloud Based

By End User

- Pharmaceutical Industry

- Healthcare Provider

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The Healthcare Predictive Analytics market was valued at USD 17.39 Billion in 2023.

The Healthcare Predictive Analytics market is expected to reach USD 407.04 Billion by 2032, growing at a CAGR of 37.1% between 2024 to 2032.

The major factors for the growth of the healthcare predictive analytics market include the emergence of personalized and evidence-based medicine, growing need of increasing efficiency in the healthcare sector, and increasing demand to curtail healthcare costs by reducing unnecessary costs.

The market is dominated by North America, followed by Europe, Asia, and RoW. The market in North America is expected to witness the highest growth during the forecast period. The high growth of the North American market is attributed to growing federal healthcare mandates to curb rising healthcare costs; increasing regulatory requirements; growing EHR adoption; and rising government initiatives focusing on personalized medicine, population health management, and value-based reimbursements.

Some of key players in Healthcare Predictive Analytics market include, Allscripts Healthcare Solutions, Cerner Corporation, Information Builders Inc., International Business Machines Corporation (IBM), Mckesson Corporation , Medeanalytics Inc., Optum Inc., Oracle Corporation and Truven Holding Corp , among others.

List of Contents

Market InsightsOverview COVID-19 Impact Analysis Growth FactorsApplication Type Segment Analysis PreviewEnd User Segment Analysis PreviewReport ScopeRegional Analysis Preview Key Market Players Competitive LandscapeThe is segmented as follows:By ApplicationBy ProductBy Mode Of DeliveryBy End UserBy RegionRelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed