Global Healthcare and Laboratory Labels Market Size, Share, Growth Analysis Report - Forecast 2034

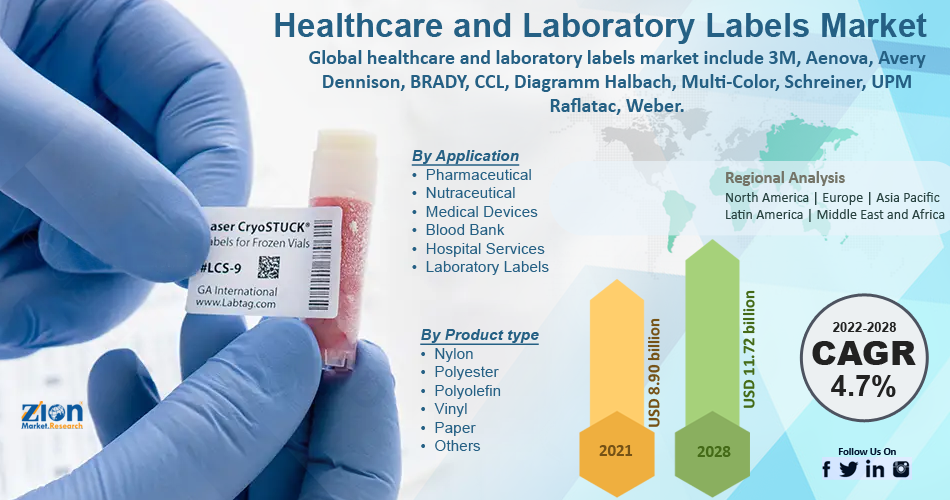

Healthcare and Laboratory Labels Market By Material Type (polyolefin, PET, PVC, paper, others), By Printing Technology (direct thermal, thermal transfer, inkjet printing, laser printing), Adhesive (Permanent, Removable), End Use (hospitals, laboratories, clinical trials, independent clinics, blood banks, diagnostic centers, veterinary labs, ambulatory surgery centers (ASCs), outpatient surgery centers), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.12 Billion | USD 6.19 Billion | 4.15% | 2024 |

Healthcare and Laboratory Labels Market: Industry Perspective

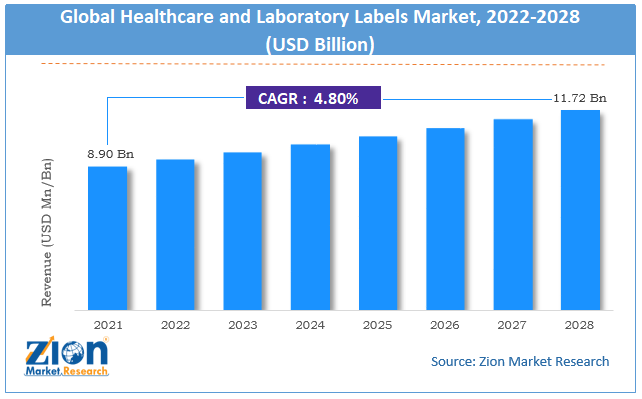

The global healthcare and laboratory labels market size was worth around USD 4.12 Billion in 2024 and is predicted to grow to around USD 6.19 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 4.15% between 2025 and 2034.

The report analyzes the global healthcare and laboratory labels market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the healthcare and laboratory labels industry.

Healthcare and laboratory Labels Market: Overview

Medical labels include healthcare and laboratory labels. These labeling techniques are employed in a number of healthcare settings, including the labeling of pharmaceuticals, ophthalmic equipment, eyedrops, and consumer goods, including over-the-counter (OTC) drugs. Additionally, it has uses in laboratory goods and nutraceuticals. Throughout the forecast period, factors such as a high frequency of illnesses increased hospital patient admissions, and an increase in product releases are anticipated to fuel market revenue growth. In the pharmaceutical and healthcare industries, labels are crucial. To improve patient safety, healthcare and laboratory labels are used in a variety of clinical care, administrative, and operational settings. Many different labels may streamline the process, increase effectiveness and patient safety, decrease mistakes, safeguard and manage patient data, and organize overall workflow. These labels are also used to track assets like instruments or medical equipment.

Key Insights

- As per the analysis shared by our research analyst, the global healthcare and laboratory labels market is estimated to grow annually at a CAGR of around 4.15% over the forecast period (2025-2034).

- Regarding revenue, the global healthcare and laboratory labels market size was valued at around USD 4.12 Billion in 2024 and is projected to reach USD 6.19 Billion by 2034.

- The healthcare and laboratory labels market is projected to grow at a significant rate due to rising demand for patient safety, stringent regulatory compliance, increasing adoption of barcode labeling, and growth in pharmaceutical and biotech industries.

- Based on Material Type, the polyolefin segment is expected to lead the global market.

- On the basis of Printing Technology, the direct thermal segment is growing at a high rate and will continue to dominate the global market.

- Based on the Adhesive, the Permanent segment is projected to swipe the largest market share.

- By End Use, the hospitals segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Healthcare and Laboratory Labels Market: Growth Drivers

The responsibility for increased medical device adoption is likely to boost the market growth

The labeling of medical devices helps patients or their caregivers understand the item, its use, how to maintain it, how it interacts with the body to serve its purpose, and any disposal or safety concerns. Medical device labeling is crucial to guarantee equipment’s safe and efficient use. It provides clear information in a language that patients or their careers may understand regarding the device's correct usage, dangers, and advantages. In addition, to make gadgets safe and functional, proper operation instructions are required. For instance, medical device labeling is now required as more patients utilize sophisticated medical equipment at home in order to improve communication with the user.

Healthcare and Laboratory Labels Market: Restraints

Strict government regulations may hamper the surge of global healthcare and laboratory labels market

For several reasons, including laws from government bodies to assure compliance, greater competent authority surveillance, language needs, and many more, healthcare and laboratory labeling has grown challenging for manufacturers. The requirement of national language by individual nations has made medical device labeling one of the more challenging concerns for manufacturers. Legal issues surface for medical diagnostics and products to be offered in both EU and non-EU nations. Large amounts of information must be included on labels, yet there isn't much room for them. Technically exact translations could be necessary, but it is usually literal.

Healthcare and Laboratory Labels Market: Opportunity

Growing need for tamper-evident packaging, smart labeling, and continuous advancements will provide opportunities for the market growth

Both new and established market participants could benefit from the attractive growth prospects that the increasing demand for smart labels, tamper-evident packaging, and ongoing labeling technology improvements will bring about. In addition, leading market companies are also concentrating on creating inventive and original labels to meet the growing number of launches of pharmaceutical or nutraceutical products, which is anticipated to generate substantial development potential for the global healthcare and laboratory labels market.

Healthcare and Laboratory Labels Market: Challenges

Healthcare labeling expectations of millennials might be difficult to follow

It appears that millennials are a generation that sets trends. Healthcare brands need to be ready for millennial attitudes and habits about how consumers consume and learn before making decisions. They like to connect with transparent and open companies by tackling socio-economic and environmental challenges. Due to market competitiveness, brands that don't adhere to these ideals will soon be replaced.

Healthcare and Laboratory Labels Market: Segmentation

The global healthcare and laboratory labels market is segmented based on Material Type, Printing Technology, Adhesive, End Use, and region.

Based on Material Type, the global healthcare and laboratory labels market is divided into polyolefin, PET, PVC, paper, others.

On the basis of Printing Technology, the global healthcare and laboratory labels market is bifurcated into direct thermal, thermal transfer, inkjet printing, laser printing.

By Adhesive, the global healthcare and laboratory labels market is split into Permanent, Removable.

In terms of End Use, the global healthcare and laboratory labels market is categorized into hospitals, laboratories, clinical trials, independent clinics, blood banks, diagnostic centers, veterinary labs, ambulatory surgery centers (ASCs), outpatient surgery centers.

Healthcare and Laboratory Labels Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Healthcare and Laboratory Labels Market |

| Market Size in 2024 | USD 4.12 Billion |

| Market Forecast in 2034 | USD 6.19 Billion |

| Growth Rate | CAGR of 4.15% |

| Number of Pages | 210 |

| Key Companies Covered | CCL Industries Inc., Brady Corp, Sato Holdings Corporation, InkREADible Labels Limited, Schreiner Group, Shamrock Labels, Chicago Tag & Label Inc., Caresfield, United Ad Label, Medlabel, T&L Graphic System, Zebra Technologies, Typenex Medical LLC, TSC Auto ID Technology Co. Ltd. (Diversified Labeling Solutions Inc. (DLS)), Watson Label Products, ETISOFT Sp. z o.o., CILS International Limited, Taylor Healthcare, Leland Company, Polyfuze Graphics Corporation, Cardinal Health, Chicago Tag & Label, Computype, Avantor Inc., GA International (LabTag), DAKLAPACK GROUP, Glenwood Labels, and others. |

| Segments Covered | By Material Type, By Printing Technology, By Adhesive, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Development:

- April 2021: Herrods, an Australian and New Zealand-based developer of in-mold label solutions (IML), was purchased by Multi-Color Corporation (MCC), a top supplier of label solutions for a variety of industries. This purchase would be anticipated to expand their product offering and create new chances for local and worldwide growth.

- January 2022: PRISYM ID, a producer, and supplier of solutions for managing regulated content and labels for hospitals and labs, has been acquired by Loftware Inc. With the help of PRISYM ID's sophisticated clinical trial labeling, the purchase is anticipated to improve Loftware's end-to-end, cloud-based labeling platform and expand its labeling solutions for the pharmaceutical and medical device sectors.

Healthcare and Laboratory Labels Market: Regional Analysis

The North American area dominates the global market for healthcare and laboratory labels

North America, led by the U.S., is expected to continue being the largest market in the global healthcare and laboratory labels market during the course of the projected period. Due to a stringent regulatory environment set up by the Food and Drug Administration (FDA), the region is anticipated to account for one-fourth of the worldwide market value throughout the assessment year. As a result, the need for accurate and trustworthy healthcare labels is growing rapidly in labs, hospitals, and the pharmaceutical sector. Regulatory groups impose strict standards on the healthcare industry to decrease these avoidable fatalities, including labeling.

Asia Pacific is anticipated to increase at the quickest rate over the projected period. According to Harvard University research, medical mistakes cause almost 5 million fatalities in India each year.

Healthcare and Laboratory Labels Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the healthcare and laboratory labels market on a global and regional basis.

The global healthcare and laboratory labels market is dominated by players like:

- CCL Industries Inc.

- Brady Corp

- Sato Holdings Corporation

- InkREADible Labels Limited

- Schreiner Group

- Shamrock Labels

- Chicago Tag & Label Inc.

- Caresfield

- United Ad Label

- Medlabel

- T&L Graphic System

- Zebra Technologies

- Typenex Medical LLC

- TSC Auto ID Technology Co. Ltd. (Diversified Labeling Solutions Inc. (DLS))

- Watson Label Products

- ETISOFT Sp. z o.o.

- CILS International Limited

- Taylor Healthcare

- Leland Company

- Polyfuze Graphics Corporation

- Cardinal Health

- Chicago Tag & Label

- Computype

- Avantor Inc.

- GA International (LabTag)

- DAKLAPACK GROUP

- Glenwood Labels

The global healthcare and laboratory labels market is segmented as follows;

By Material Type

- polyolefin

- PET

- PVC

- paper

- others

By Printing Technology

- direct thermal

- thermal transfer

- inkjet printing

- laser printing

By Adhesive

- Permanent

- Removable

By End Use

- hospitals

- laboratories

- clinical trials

- independent clinics

- blood banks

- diagnostic centers

- veterinary labs

- ambulatory surgery centers (ASCs)

- outpatient surgery centers

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global healthcare and laboratory labels market is expected to grow due to increasing demand for labeling solutions in healthcare for safety, regulatory compliance, and tracking, along with advancements in printing technology.

According to a study, the global healthcare and laboratory labels market size was worth around USD 4.12 Billion in 2024 and is expected to reach USD 6.19 Billion by 2034.

The global healthcare and laboratory labels market is expected to grow at a CAGR of 4.15% during the forecast period.

North America is expected to dominate the healthcare and laboratory labels market over the forecast period.

Leading players in the global healthcare and laboratory labels market include CCL Industries Inc., Brady Corp, Sato Holdings Corporation, InkREADible Labels Limited, Schreiner Group, Shamrock Labels, Chicago Tag & Label Inc., Caresfield, United Ad Label, Medlabel, T&L Graphic System, Zebra Technologies, Typenex Medical LLC, TSC Auto ID Technology Co. Ltd. (Diversified Labeling Solutions Inc. (DLS)), Watson Label Products, ETISOFT Sp. z o.o., CILS International Limited, Taylor Healthcare, Leland Company, Polyfuze Graphics Corporation, Cardinal Health, Chicago Tag & Label, Computype, Avantor Inc., GA International (LabTag), DAKLAPACK GROUP, Glenwood Labels, among others.

The report explores crucial aspects of the healthcare and laboratory labels market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed