Healthcare Equipment Leasing Market Size, Share, Industry Analysis, Trends, Growth, 2034

Healthcare Equipment Leasing Market By End-User (Ambulatory Surgical Services, Hospitals, Homecare, Laboratory & Diagnostic Centers, and Others), By Device Type (Personal & Homecare Leasing Equipment, Digital & Electronic Equipment, Surgical & Therapy Leasing Equipment, Durable Medical Equipment (DME), Storage & Transport Leasing Equipment, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025-2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 52.80 Billion | USD 89.40 Billion | 5.4% | 2024 |

Healthcare Equipment Leasing Industry Perspective:

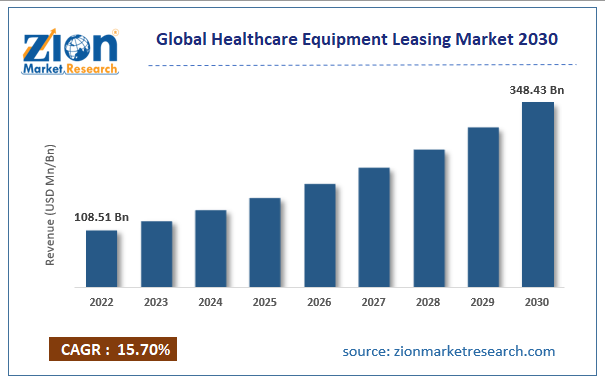

The global healthcare equipment leasing market size was worth around USD 52.80 Billion in 2024 and is predicted to grow to around USD 89.40 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 5.4% between 2025 and 2034.

Healthcare Equipment Leasing Market: Overview

Healthcare equipment leasing is the process of renting medical devices for a longer period. It involves transactions between service consumers and a financial company where the customers are liable to pay monthly installments to the firm in exchange for utilizing their medical devices. The equipment can include items such as X-ray machines, Computer Tomography (CT) scanners, a Magnetic Resonance Imaging (MRI) system, or any other medical device they may need. Once the lease period is complete, there are generally two options available. The consumers can buy the product from the financing company or return the equipment and stop utilizing their services. There are several advantages of renting medical equipment but the process is also plagued with specific issues and constraints. The healthcare industry is evolving at a rapid pace, especially after COVID-19. It has become open to adopting creative solutions that help healthcare providers minimize medical costs while delivering enhanced patient care.

Key Insights:

- As per the analysis shared by our research analyst, the global healthcare equipment leasing market is estimated to grow annually at a CAGR of around 5.4% over the forecast period (2025-2034)

- In terms of revenue, the global healthcare equipment leasing market size was valued at around USD 52.80 Billion in 2024 and is projected to reach USD 89.40 Billion, by 2034.

- The healthcare equipment leasing market is projected to grow at a significant rate due to the increasing number of service providers

- Based on end-user segmentation, hospitals segment was predicted to show maximum market share in the year 2024

- Based on device type segmentation, durable medical equipment (DME) was the leading type in 2024

- On the basis of region, North America was the leading revenue generator in 2024

Healthcare Equipment Leasing Market: Growth Drivers

Increasing number of service providers to drive market growth

The global healthcare equipment leasing market is projected to grow owing to the rising number of service providers in the commercial market. Earlier, the concept of leasing or renting medical devices was limited with a relatively lower number of service providers and restricted knowledge among the potential customer group. However, with the addition of new players offering exceptional products and services, the adoption of the healthcare equipment leasing concept has seen a higher growth rate. The trend is supported by several national banks and financial institutes coming forward to help professionals in the medical field with renting healthcare equipment. For instance, in November 2024, Santander Bank, N.A., a completely owned subsidiary of Spanish Santander Group, announced that it would be expanding its Commercial Equipment and Vehicle Finance business by including financing related to commercial equipment by healthcare organizations. The move has allowed hospitals and medical-care centers across the US access to advanced and modern healthcare equipment at reasonable prices.

Other developments that could trigger higher growth in the industry for healthcare equipment include growing strategic partnerships between financing firms including mergers & acquisitions. In November 2018, TIAA Bank announced that it had acquired GE Capital’s Healthcare Equipment Finance (HEF) segment worth USD 1.5 billion. This has allowed TIAA to strengthen its position as a provider of comprehensive financial solutions.

Increasing costs of medical equipment to contribute toward a higher growth rate

Advanced medical devices are expensive investments. Additionally, with the changing prices of raw materials and surging inflation rate, the expense associated with buying a new piece of medical equipment has further increased, raising concerns for smaller players. In such circumstances, the financing companies operating in the healthcare equipment leasing industry may deliver substantial inputs and assistance.

Healthcare Equipment Leasing Market: Restraints

Questions regarding the overall efficiency of the leasing process to restrict market growth

Leasing medical equipment requires paying smaller installments to a financial firm and this means less expenditure when considered month-to-month basis. However, in the long term, the total cost may turn out to be higher as compared to the expense incurred if the device was bought. Hence, it is crucial that service takers conduct thorough analysis before investing in healthcare equipment leasing processes since even though it may seem like a way to avoid additional costs, it may not be the ideal solution for certain businesses especially if the end cost is higher than expected.

Healthcare Equipment Leasing Market: Opportunities

Growing healthcare infrastructure in emerging economies to create growth opportunities

The global healthcare equipment leasing market growth is projected to witness higher expansion possibilities owing to the increasing expenditure on healthcare infrastructure in emerging countries. These countries are registering greater demand for advanced medical care. Additionally, regional governments have rolled out several supporting policies to promote better healthcare access to the entire population. In June 2025, the World Health Organization (WHO) along with multilateral development banks announced the launch of a new platform that will be used to improve primary care access amongst low and low & middle-income countries (LICs and LMICs). The program is called The Platform and will start with an initial investment of €1.5 billion.

Ever-evolving attributes of medical devices to lead to higher demand for healthcare equipment leasing

One of the key benefits of using renting schemes for healthcare equipment is that consumers have opportunities to trade the existing medical machines with the latest models. This way they can get their hands on the latest technology without spending thousands of dollars. As medical device manufacturers continue to invest in innovation and launch new versions at a rapid rate, the demand for healthcare equipment leasing will grow simultaneously.

Healthcare Equipment Leasing Market: Challenges

Concerns over payment obligations and lack of product ownership to create a challenging environment

Service consumers are liable to make obligatory payments at fixed intervals. The failure to meet the payment deadline not only reflects in the provision seizing the medical device but also can greatly impact the brand reputation of the customer. Moreover, the consumer can never become the true owner of the machine even after incurring expenses that are close to what they would pay in case the machine was bought. These issues are expected to create challenges against the global market growth trend.

Healthcare Equipment Leasing Market: Segmentation

The global healthcare equipment leasing market is segmented based on end-user, device type, and region.

Based on end-user, the global market is segmented into ambulatory surgical services, hospitals, homecare, laboratory & diagnostic centers, and others. The healthcare equipment leasing industry witnessed the highest growth in the hospitals segment followed by the laboratory & diagnostic centers segment. Hospitals are required to invest in advanced medical devices that cost more than a few thousand dollars. For instance, a new CT scanner with 256 + slices may cost between USD 1.3 million to USD 2.15 million. Additionally, hospitals are always seeking the most advanced or latest versions of these machines which become difficult to achieve when buying a machine. However, renting the equipment allows them a better chance of exchanging a current product with the latest version. In the laboratory & diagnostic centers, the demand for chemistry immunoassay analyzers and other items that have shorter replacement periods is growing at a rapid pace.

Based on device type, the healthcare equipment leasing industry is divided into personal & homecare leasing equipment, digital & electronic equipment, surgical & therapy leasing equipment, durable medical equipment (DME), storage & transport leasing equipment, and others. In 2024, the highest growth was registered in the durable medical equipment segment. The segmental growth is a result of increasing demand for safety, personal mobility, and long-term care devices. In addition to this, the companies operating in the DME segment offer more benefits including component replacement, preventive maintenance, uptime guarantee, customer support, and engineer labor which means that consumers have fewer things to worry about. On average, the interest rates for healthcare equipment. Med One Group, one of the largest market players, is at a net worth of USD 26.5 million.

Healthcare Equipment Leasing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Healthcare Equipment Leasing Market |

| Market Size in 2024 | USD 52.80 Billion |

| Market Forecast in 2034 | USD 89.40 Billion |

| Growth Rate | CAGR of 5.4% |

| Number of Pages | 225 |

| Key Companies Covered | Siemens Financial Services, GE Healthcare Financial Services, Hitachi Capital America Corp., Philips Healthcare, Agiliti Health Inc., De Lage Landen International B.V., Hill-Rom Holdings Inc., Radiology Oncology Systems Inc., Stryker Corporation, Amber Diagnostics, Johnson & Johnson Finance Corporation, Transwestern Healthcare, Med One Group, Accord Medical Products Pvt. Ltd., Block Imaging, Nihon Kohden Corporation, Cardinal Health Inc., Arjo, Steris Corporation, Asahi Kasei Corporation., and others. |

| Segments Covered | By End-User, By Device Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Healthcare Equipment Leasing Market: Regional Analysis

North America is expected to deliver the highest revenue share

The global healthcare equipment leasing market will register the highest growth in North America driven by the region’s robust medical and healthcare infrastructure. Growing demand for quality medical care in addition to increasing investments in the development of advanced medical equipment to cater to the needs of expanding healthcare needs will play a crucial role in shaping the regional growth trend during the forecast period. In addition to this, countries such as the US and Canada have multiple financing companies operating in the regional market. These companies have extended portfolios ranging from meeting the requirements of large hospital corporations to smaller medical care centers. One such example is the exceptional delivery by Alliance Funding Group (AFG) which works toward financing firms across sizes. The company has already provided funding of over USD 2.1 billion and provides services to more than 20000 clients across the US. Asia-Pacific is expected to grow at a steady pace as the pressure on the healthcare system continues to grow with an increasing number of patients requiring intense medical care. Growing demand in the personal & homecare leasing equipment segment will be important for regional growth.

Healthcare Equipment Leasing Market: Competitive Analysis

The global healthcare equipment leasing market is led by players like:

- Siemens Financial Services

- GE Healthcare Financial Services

- Hitachi Capital America Corp.

- Philips Healthcare

- Agiliti Health Inc.

- De Lage Landen International B.V.

- Hill-Rom Holdings Inc.

- Radiology Oncology Systems Inc.

- Stryker Corporation

- Amber Diagnostics

- Johnson & Johnson Finance Corporation

- Transwestern Healthcare

- Med One Group

- Accord Medical Products Pvt. Ltd.

- Block Imaging

- Nihon Kohden Corporation

- Cardinal Health Inc.

- Arjo

- Steris Corporation

- Asahi Kasei Corporation.

The global healthcare equipment leasing market is segmented as follows:

By End-User

- Ambulatory Surgical Services

- Hospitals

- Homecare

- Laboratory & Diagnostic Centers

- Others

By Device Type

- Personal & Homecare Leasing Equipment

- Digital & Electronic Equipment

- Surgical & Therapy Leasing Equipment

- Durable Medical Equipment (DME)

- Storage & Transport Leasing Equipment

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Healthcare equipment leasing is the process of renting medical devices for a longer period.

The global healthcare equipment leasing market is projected to grow owing to the rising number of service providers in the commercial market.

According to study, the global healthcare equipment leasing market size was worth around USD 52.80 Billion in 2024 and is predicted to grow to around USD 89.40 Billion by 2034.

The CAGR value of the healthcare equipment leasing market is expected to be around 5.40% during 2025-2034.

The global healthcare equipment leasing market will register the highest growth in North America driven by the region’s robust medical and healthcare infrastructure.

The global healthcare equipment leasing market is led by players like Siemens Financial Services, GE Healthcare Financial Services, Hitachi Capital America Corp., Philips Healthcare, Agiliti Health, Inc., De Lage Landen International B.V., Hill-Rom Holdings, Inc., Radiology Oncology Systems, Inc., Stryker Corporation, Amber Diagnostics, Johnson & Johnson Finance Corporation, Transwestern Healthcare, Med One Group, Accord Medical Products Pvt. Ltd., Block Imaging, Nihon Kohden Corporation, Cardinal Health, Inc., Arjo, Steris Corporation, and Asahi Kasei Corporation.

The report explores crucial aspects of the healthcare equipment leasing market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

List of Contents

Healthcare Equipment LeasingIndustry Perspective:Healthcare Equipment Leasing OverviewKey Insights:Healthcare Equipment Leasing Growth DriversHealthcare Equipment Leasing RestraintsHealthcare Equipment Leasing OpportunitiesHealthcare Equipment Leasing ChallengesHealthcare Equipment Leasing SegmentationHealthcare Equipment Leasing Report ScopeHealthcare Equipment Leasing Regional AnalysisHealthcare Equipment Leasing Competitive AnalysisThe global healthcare equipment leasing market is segmented as follows:By RegionHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed