Global Healthcare BPO Market Size, Share, Growth Analysis Report - Forecast 2034

Healthcare BPO Market By Service Type (Provider Outsourcing Services, Payer Outsourcing Services, Operational Outsourcing Services, IT Infrastructure Management Services), By Provider Service (Revenue Cycle Management, Patient Enrollment & Strategic Planning, Patient Care), Payer Service (Claims Management, Member Management, Provider Management, Integrated Front-End Services & Back-Office Operations, Billing & Accounting Management, HR Services), End User (Healthcare Providers, Healthcare Payers, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 392.40 Billion | USD 984.97 Billion | 9.64% | 2024 |

Healthcare BPO Market: Industry Perspective

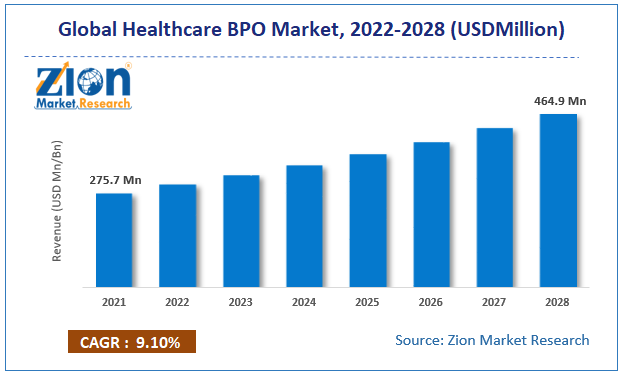

The global healthcare BPO market size was worth around USD 392.40 Billion in 2024 and is predicted to grow to around USD 984.97 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 9.64% between 2025 and 2034.

The report analyzes the global healthcare BPO market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the healthcare BPO industry.

Healthcare BPO Market: Overview

Healthcare BPO, or business process outsourcing in the healthcare industry, first appeared in the 1980s. Instead of having an internal department for operations like medical billing, healthcare providers use healthcare BPO activity to outsource some of their job tasks. To put it another way, healthcare providers employ a third-party company to complete the work on their behalf.

Medical billing & coding, claims to process, and data entry services are the three most important BPO services. Healthcare BPO has several benefits, including helping healthcare professionals concentrate on their strengths, lowering costs, improving operational efficiency, and enhancing patient experience by spending time on patient care.

Key Insights

- As per the analysis shared by our research analyst, the global healthcare BPO market is estimated to grow annually at a CAGR of around 9.64% over the forecast period (2025-2034).

- Regarding revenue, the global healthcare BPO market size was valued at around USD 392.40 Billion in 2024 and is projected to reach USD 984.97 Billion by 2034.

- The healthcare BPO market is projected to grow at a significant rate due to cost reduction needs, focus on core competencies by healthcare providers, rising patient volumes, and increasing complexity of healthcare regulations.

- Based on Service Type, the Provider Outsourcing Services segment is expected to lead the global market.

- On the basis of Provider Service, the Revenue Cycle Management segment is growing at a high rate and will continue to dominate the global market.

- Based on the Payer Service, the Claims Management segment is projected to swipe the largest market share.

- By End User, the Healthcare Providers segment is expected to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Healthcare BPO Market: Growth Drivers

An increase in pressure to reduce rising healthcare cost to spur market growth

Saving money is crucial when outsourcing because it allows businesses to spend less on personnel, space, and resource management. The growth of health insurance exchanges (online marketplaces to buy health insurance from competing providers) puts pressure on healthcare payers' margins. This makes it possible for customers to get insurance from rival private healthcare providers and will probably hasten the adoption of outsourcing to reduce costs.

Structure changes, such as the drive toward paying for value, more emphasis on care management, and increased cost-sharing with customers, are taking root more firmly as healthcare continues to consume an increasing portion of the wider economy, slowing the growth of healthcare spending.

Healthcare BPO Market: Restraints

High prices and additional fees of outsourcing to hamper market growth

The cost savings and potential business value of outsourcing are frequently negatively impacted by improper planning and financial allocation for outsourcing activities. Companies that prepare their financial resources for outsourcing their business operations fail to account for unforeseen expenditures, such as those incurred during vendor evaluation and selection, contract management offshore, process transformation, and boosting security and severance pay for employees.

Rising labor expenses in emerging nations due to economic expansion raise concerns about the value of money these nations will provide. Additionally, providers' customized services and solutions will cost 15–30% more than their usual offerings. If a client terminates a contract early, costs rise, and both the buyer and the provider are subject to legal action, raising legal costs as well. Clients don't outsource when the predicted cost savings aren't as substantial. The global healthcare BPO market could suffer as a result of this.

Healthcare BPO Market: Opportunity

Increasing use of techniques based on artificial intelligence for drug discovery to boost market growth opportunities

In the early stages of medication development, artificial intelligence and machine learning significantly increase success rates and streamline drug discovery. As artificial intelligence also plays a significant part in discovering medications for chronic diseases like cancer, this will assist healthcare BPO service providers in making significant advancements. The time it takes to introduce a cancer-fighting treatment to the market is greatly shortened thanks to A.I.'s capabilities, which will cause the market for healthcare BPO services to increase significantly.

Healthcare BPO Market: Challenges

Concerns related to data security to pose challenges for market expansion

Approximately one-third of data breaches in the healthcare industry result in medical identity theft, primarily caused by a lack of internal controls over patient information, a lack of support from top management, out-of-date policies and procedures, or a disregard for already-existing ones, and insufficient staff training. As a result, maintaining patient anonymity in the healthcare sector is extremely difficult. The National Centre for Biotechnology Information (NCBI) reports 2,216 data breaches from 65 nations were recorded in 2018. 536 of these breaches affected the healthcare sector (the highest number of breaches among all industries). The global healthcare BPO market may suffer as a result until security solutions are available.

Healthcare BPO Market: Segmentation

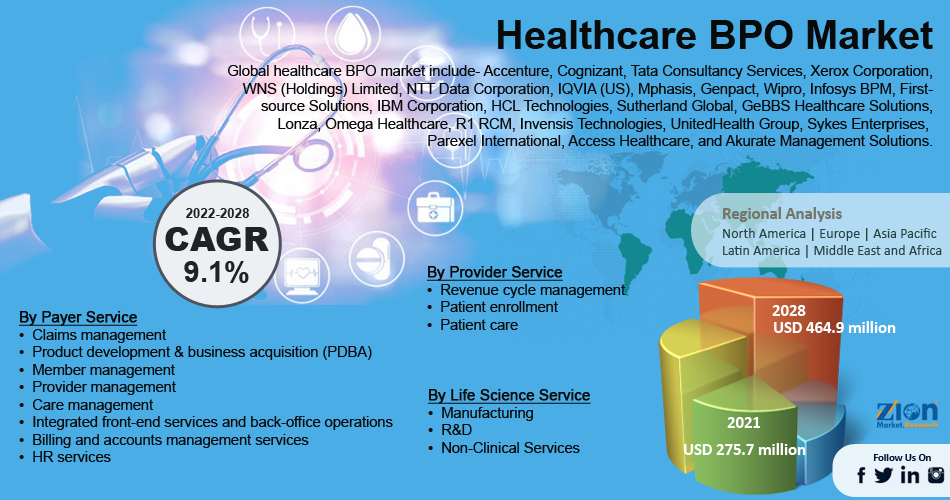

The global healthcare BPO market has been segmented into provider, payer, life science services, and region.

Based on provider service, revenue cycle management, patient enrolment, and patient care are segments of the global healthcare BPO market. Since it lowers healthcare costs, revenue cycle management has reportedly gained the largest market and is the fastest-growing industry. The government's expanding awareness initiatives have also aided in implementing solutions.

Based on payer service, the market is classified into claims management, product development & business acquisition (PDBA), member management, provider management, care management, integrated front-end services & back-office operations, billing & accounts management services, and H.R. services. The claims management category holds the biggest market share for global healthcare BPO in 2021 and is anticipated to keep this position throughout the forecast period. Claim management is a procedure that manages claims while creating plans to reduce expenses and cut fraud while maintaining customer satisfaction. The segment is anticipated to grow as a result.

Based life science services, manufacturing, research & development, and non-clinical services are segments of the global healthcare BPO market. Research & development are predicted to have the fastest growth rate during the projection period. The segment's expansion can be attributed to rising research and development expenditures for novel medications and vaccines in response to an increase in COVID-19 patients.

Healthcare BPO Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Healthcare BPO Market |

| Market Size in 2024 | USD 392.40 Billion |

| Market Forecast in 2034 | USD 984.97 Billion |

| Growth Rate | CAGR of 9.64% |

| Number of Pages | 287 |

| Key Companies Covered | Accenture, Cognizant, IBM, Genpact, IQVIA, Parexel, Infosys BPM, Wipro, Tata Consultancy Services (TCS), GeBBS Healthcare Solutions, Sutherland Global Services, Firstsource Solutions, Omega Healthcare, UnitedHealth Group, Xerox Corporation, and others. |

| Segments Covered | By Service Type, By Provider Service, By Payer Service, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

- May 2021: To deliver its Artificial Intelligence (A.I.) solutions that forecast risk for the early onset of chronic diseases for the health insurance and provider communities, NTT DATA entered into a multi-year collaboration with ScoreData.

- April 2021: By integrating Groupe CT's document management services expertise and leadership with Xerox's portfolio of workplace solutions, Xerox Corporation aims to increase its market share in North America. Groupe CT is an independent document management provider in Eastern Canada.

Healthcare BPO Market: Regional Analysis

North America dominated the healthcare BPO market in 2025

In 2021, North America accounted for the largest market for healthcare BPOs, followed by Europe and the RoW. Due to the Medicare Prescription Medication Coverage (Part D) program, which provides prescription drug coverage to all Medicare beneficiaries, pharmaceutical companies in the region, particularly those in the U.S., are under substantial price pressure. Additionally, it is anticipated that the revenue of major pharmaceutical corporations in the U.S. and Canada will be impacted by the patent expiration of several blockbuster medications. Several pharmaceutical companies are concentrating on cost reduction through outsourcing in light of these considerations, causing market expansion in North America.

Healthcare BPO Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the healthcare BPO market on a global and regional basis.

The global healthcare BPO market is dominated by players like:

- Accenture

- Cognizant

- IBM

- Genpact

- IQVIA

- Parexel

- Infosys BPM

- Wipro

- Tata Consultancy Services (TCS)

- GeBBS Healthcare Solutions

- Sutherland Global Services

- Firstsource Solutions

- Omega Healthcare

- UnitedHealth Group

- Xerox Corporation

The global healthcare BPO market is segmented as follows;

By Service Type

- Provider Outsourcing Services

- Payer Outsourcing Services

- Operational Outsourcing Services

- IT Infrastructure Management Services

By Provider Service

- Revenue Cycle Management

- Patient Enrollment & Strategic Planning

- Patient Care

By Payer Service

- Claims Management

- Member Management

- Provider Management

- Integrated Front-End Services & Back-Office Operations

- Billing & Accounting Management

- HR Services

By End User

- Healthcare Providers

- Healthcare Payers

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global healthcare BPO market is expected to grow due to the need to reduce operational costs, focus on core healthcare services, and rising healthcare data volume and complexity.

According to a study, the global healthcare BPO market size was worth around USD 392.40 Billion in 2024 and is expected to reach USD 984.97 Billion by 2034.

The global healthcare BPO market is expected to grow at a CAGR of 9.64% during the forecast period.

Asia-Pacific is expected to dominate the healthcare BPO market over the forecast period.

Leading players in the global healthcare BPO market include Accenture, Cognizant, IBM, Genpact, IQVIA, Parexel, Infosys BPM, Wipro, Tata Consultancy Services (TCS), GeBBS Healthcare Solutions, Sutherland Global Services, Firstsource Solutions, Omega Healthcare, UnitedHealth Group, Xerox Corporation, among others.

The report explores crucial aspects of the healthcare BPO market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed