Green Packaging Market Size, Share, Trends, Growth and Forecast 2034

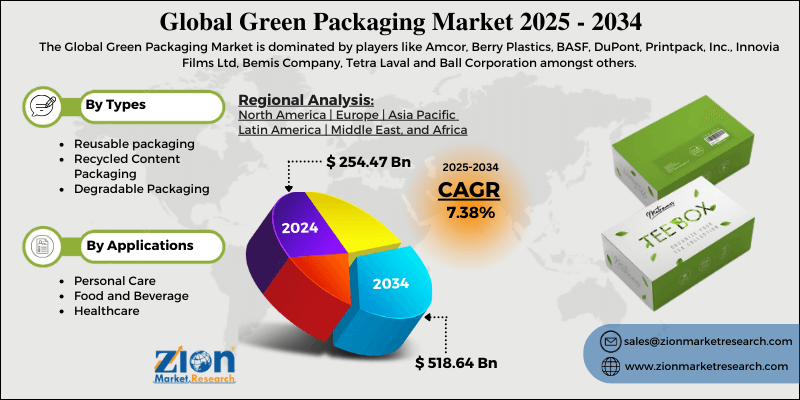

Green Packaging Market by Type (Reusable packaging, Recycled Content Packaging, and Degradable Packaging), By Application (Personal Care, Food and Beverage, and Healthcare): Global Industry Perspective, Comprehensive Analysis and Forecast, 2025-2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 254.47 Billion | USD 518.64 Billion | 7.38% | 2024 |

Green Packaging Market: Industry Perspective

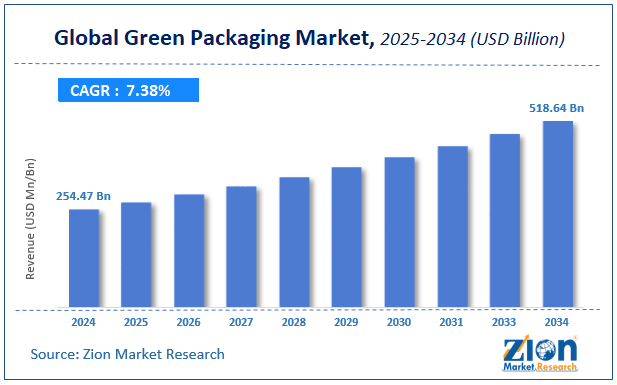

The global green packaging market accounted for USD 254.47 Billion in 2024 and is expected to reach USD 518.64 Billion by 2034, growing at a CAGR of around 7.38% between 2025 and 2034.

Green Packaging Market Overview

Packaging is the most important entity that helps to attract the customer attention towards the product. In various packaging techniques, green packaging is the most popular technique that is in great demand due to its excellent characteristics. Green packaging is the eco-friendly type of packaging which uses recyclable material for packaging process. It also helps to reduce the environmental impact. It does not harm ozone layer as well as does not emit volatile organic compounds and greenhouse gasses such as carbon dioxide and methane. Thus, it has the great scope of food and beverages application in coming future years.

Green Packaging Market Growth Factors

The global green packaging market is primarily driven by a paradigm shift for products related to green packaging due to rising health awareness among consumers coupled with rising disposable incomes. Secondly, increasing environmental concerns and stringent rules and regulation is projected to bolster the demand for green packaging within the forecast period. However, lack of information about green packaging and its benefits is a major restraint that is likely to hinder the demand of the market.

Nonetheless, environmental issues are expected to offer new avenues to the major manufacturers of global green packaging market over the coming years.

COVID-19 Impact Analysis

The global green packaging market has witnessed a slight decline in the sales for short term due to the lockdown enforcement introduced by governments in order to contain COVID spreading. The restrictions imposed by various nations to contain COVID had stopped the production resulting in a disruption across the whole supply chain. However, the global markets are slowly opening to their full potential and theirs a surge in demand. The market would remain bullish in upcoming year. The significant decrease in the global Green packaging market size in 2024 is estimated on the basis of the COVID-19 outbreak and its negative impact on the economies and industries across the globe. Various scenarios have been analyzed on the basis of inputs from various secondary sources and the current data available about the situation.

Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Green Packaging Market Size Report |

| Market Size in 2024 | USD 254.47 Billion |

| Market Forecast in 2034 | USD 518.64 Billion |

| Growth Rate | CAGR of 7.38% |

| Number of Pages | 160 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Amcor, Berry Plastics, BASF, DuPont, Printpack, Inc., Innovia Films Ltd, Bemis Company, Tetra Laval and Ball Corporation amongst others. |

| Segments Covered | By Type, By Application , By Process, and By Region |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2024 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Segment Analysis Preview

Reusable packaging, recycled content packaging, and degradable packaging are the major types of global green packaging market. Among all these, recycled content packaging dominated the global green packaging market in 2015. It accounted for significant share of the total market. In addition, reusable packaging was the second largest type of green packaging in the same. Further, it is also expected to have remarkable growth over the years to come owing to the government regulations coupled with rapidly growing demand for bio-plastic packaging. Moreover, the degradable packaging is also projected to have moderate growth in coming years.

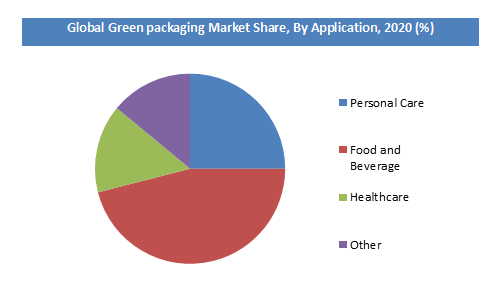

The major applications of global green packaging are personal care, food and beverages, healthcare and other applications. The food and beverages held as leading application segment of the market in 2024. It accounted for more than 45.0% shares of the entire market and further it is expected to continue this trend in near future. This growth is attributed to the robust demand for eco-friendly packaging coupled with stringent government regulations. Moreover, healthcare and personal care are expected to have exponential growth during coming years.

Key Market Players & Competitive Landscape

- Amcor

- Berry Plastics

- BASF

- DuPont

- Printpack

- Innovia Films Ltd

- Bemis Company

- Tetra Laval

- Ball Corporation

The global green packaging market is segmented as follows:

By Types

- Reusable packaging

- Recycled Content Packaging

- Degradable Packaging

By Applications

- Personal Care

- Food and Beverage

- Healthcare

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Green packaging Market was valued at USD 254.47 Billion in 2024.

The global Green packaging Market is expected to reach USD 518.64 Billion by 2034, growing at a CAGR of 7.38% between 2025-2034.

Some of the key factors driving the global Green packaging market growth are a paradigm shift for products related to green packaging due to rising health awareness among consumers and rising disposable incomes.

North America was the largest market for green packaging in 2020. It accounted for more than 30% shares of the entire market. Furthermore, it is expected to follow this trend within the forecast period. U.S. was the major revenue contributor in the region in the year 2020. North America was followed by Europe. Moreover, Asia Pacific is expected to be one of the fastest growing markets for green packaging in near future.

Some of the major players of global green packaging market are Amcor, Berry Plastics, BASF, DuPont, Printpack, Inc., Innovia Films Ltd, Bemis Company, Tetra Laval and Ball Corporation amongst others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed