Graphic Paper Market Size, Growth, Global Trends, Forecast 2034

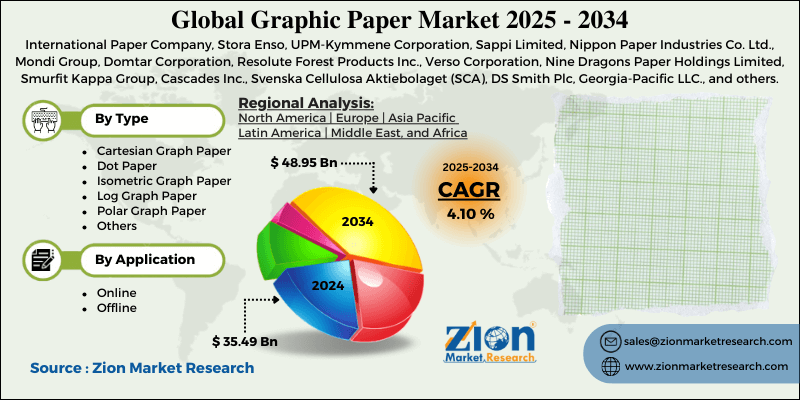

Graphic Paper Market By Type (Cartesian Graph Paper, Dot Paper, Isometric Graph Paper, Log Graph Paper, Polar Graph Paper, and Others), By Application (Online, Offline), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

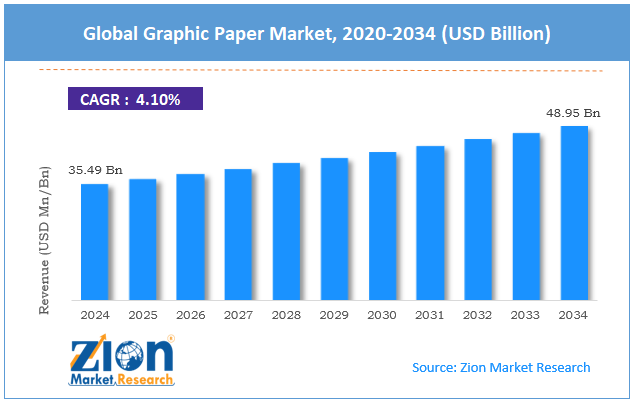

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 35.49 Billion | USD 48.95 Billion | 4.10% | 2024 |

Graphic Paper Market: Industry Perspective

The global graphic paper market size was approximately USD 35.49 billion in 2024 and is projected to reach around USD 48.95 billion by 2034, with a compound annual growth rate (CAGR) of approximately 4.10% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global graphic paper market is estimated to grow annually at a CAGR of around 4.10% over the forecast period (2025-2034)

- In terms of revenue, the global graphic paper market size was valued at around USD 35.49 billion in 2024 and is projected to reach USD 48.95 billion by 2034.

- The graphic paper market is projected to grow significantly due to the increasing use in promotional materials and advertising, the growing demand for printed books and magazines in developing economies, and the rising literacy rates and urbanization.

- Based on type, the Cartesian graph paper segment is expected to lead the market, while the isometric graph paper segment is expected to grow considerably.

- Based on application, the offline segment is the dominant segment, while the online segment is projected to witness sizable revenue growth over the forecast period.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Graphic Paper Market: Overview

Graphic paper is a type of paper specially designed for graphic and printing applications like brochures, magazines, newspapers, books, advertising materials, and catalogs. It is characterized by its smooth surface, superior printability, and high brightness, enabling vibrant color output and sharp image reproduction. The global graphic paper market is poised for notable growth, driven by rising demand for print advertising, the development of the publishing industry, and an increase in commercial printing activities. Print media continues to hold significant value for brand promotion, primarily through brochures, magazines, and newspapers. Despite the growth of digital platforms, several businesses prefer printed advertisements for local reach and credibility. The need for high-quality prints drives the demand for graphic papers.

Moreover, educational materials, books, and periodicals remain crucial, particularly in developing economies with rapidly increasing literacy rates. The publishing industry demands premium-quality graphic papers for image and text reproduction. This growth majorly boosts the industry growth in Latin America and the Asia Pacific.

Additionally, the commercial printing industry, which encompasses marketing materials, packaging inserts, and catalogs, heavily relies on graphic papers. Businesses primarily use printed materials for branding, events, and product launches. This trend is adding to consistent demand for uncoated and coated graphic papers.

Nevertheless, the global market faces limitations due to factors such as digital media disturbances and the high cost of raw materials. The rapid shift towards digital platforms for advertising, books, and news has significantly decreased the consumption of printed materials. Online media offers instant access at low costs, reducing the dependency on graphic paper. This remains a significant challenge for the industry's growth. The volatility in fiber and pulp prices affects production costs for graphic paper producers. Varying prices of energy and chemicals used in paper processing add financial burdens. These cost intricacies may restrict the profitability of manufacturers.

Still, the global graphic paper industry benefits from several favorable factors, including the development of recycled and eco-friendly paper, as well as the premium packaging segment. The inclination towards sustainability offers fresh opportunities for graphic paper made from recycled fibers. Producers investing in green technologies may appeal to eco-conscious users. This trend supports corporate sustainability goals worldwide. Luxury brands need high-end printed packaging and brand image enhancement and differentiation. Graphic papers with advanced finishes, glossy coatings, and embossing cater to this demand. This premium segment offers significant profit margins.

Graphic Paper Market: Growth Drivers

Recycled-fiber demand and sustainability regulations drive the market growth

Global sustainability initiatives are fueling the demand for certified and recycled graphic paper products. Governments have imposed stringent rules on single-use plastics, pushing industries to adopt fiber-based substitutes. Key brands are committing to circular economy goals and carbon reduction objectives, which need eco-friendly paper solutions. Mills are upgrading recycling facilities and investing in clean production solutions to meet these standards. Subsequently, sustainability has become a key driver of growth, driving innovation in premium-grade and recycled graphic papers.

How are short-term economics and digital printing favorable for the growth of the graphic paper market?

Improvements in digital printing technology are transforming the graphic paper market by allowing short-run and personalized printing. Brands are demanding variable data printing and customized packaging for targeted marketing campaigns. This results in the growth of 'digital-ready' papers that assure compatibility with high-speed toner-based presses and inkjet. These substrates require accurate costing, smoothness, and ink absorption to achieve high-quality print results. As digital printing adoption grows, specialty graphic papers designed for flexibility are witnessing strong demand growth.

Graphic Paper Market: Restraints

How are high energy and production costs negatively impacting the progress of the graphic paper market?

Graphic paper production requires significant energy, and mills face intensifying pressures due to shortages of raw materials and volatile energy prices. Energy cost increases in Europe during 2022-2023 led several paper mills to shut down or temporarily reduce capacity. Growing pulp prices, which surpassed USD 1,200 per ton during peak supply scarcity, have squeezed margins. These cost pressures often result in high-end user prices, decreasing competitiveness against substitute materials. The combination of thin profit margins and high input costs remains a key limitation to market growth.

Graphic Paper Market: Opportunities

How are advancements in coated and specialty paper segments creating promising avenues for the graphic paper industry?

Manufacturers are actively investing in advanced coatings, finishes, and textures for graphic papers to meet the rising performance and design needs. Functional coatings, such as greaseproof, water-resistant, and barrier properties, are primarily demanded for promotional and packaging applications. Recent advancements comprise AR-based printed materials and interactive textures that improve customer engagement. These specialty products enable graphic paper manufacturers to differentiate themselves from commoditized grades and maintain premium margins. Innovation-based diversification will be a key driver of growth in the graphic paper industry, enhancing future competitiveness.

Graphic Paper Market: Challenges

Pressure from green alternatives and environmental activism limits the market growth

Consumer awareness of carbon footprint and deforestation puts the paper industry under continuous pressure and scrutiny. While paper is renewable, environmental activists frequently highlight unsustainable forestry practices and primary water usage. Substitute substrates, such as bioplastics, synthetic papers, and digital displays, are ranked as greener solutions by some sectors. Brands are cautious about associating with suppliers that lack strong ecological certifications, which affects their procurement decisions. These pressures compel mills to invest heavily in sustainability certifications and branding to remain competitive in the market.

Graphic Paper Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Graphic Paper Market |

| Market Size in 2024 | USD 35.49 Billion |

| Market Forecast in 2034 | USD 48.95 Billion |

| Growth Rate | CAGR of 4.10% |

| Number of Pages | 222 |

| Key Companies Covered | International Paper Company, Stora Enso, UPM-Kymmene Corporation, Sappi Limited, Nippon Paper Industries Co. Ltd., Mondi Group, Domtar Corporation, Resolute Forest Products Inc., Verso Corporation, Nine Dragons Paper Holdings Limited, Smurfit Kappa Group, Cascades Inc., Svenska Cellulosa Aktiebolaget (SCA), DS Smith Plc, Georgia-Pacific LLC., and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Graphic Paper Market: Segmentation

The global graphic paper market is segmented based on type, application, and region.

Based on type, the global graphic paper industry is divided into cartesian graph paper, dot paper, isometric graph paper, log graph paper, polar graph paper, and others. The Cartesian graph paper segment holds a leadership position in the market due to its widespread use in educational institutions, mathematics, and engineering for plotting both linear and non-linear functions. It is the standard choice for technical drawings, academic printing, and design work, making it the broadly consumed type worldwide. Its compatibility with both digital and manual plotting further enhances its leadership position in the industry.

Conversely, the isometric graph paper segment holds a second-leading share in the market because of its vital role in engineering applications, architecture, and 3D design. It is widely used for technical drawings, product design, and isometric projections in industries such as civil and mechanical engineering. Rising demand in the design and industrial sectors supports its substantial industry share, although its use is more specialized than that of Cartesian paper.

Based on application, the global graphic paper market is segmented into online and offline. The offline segment dominates the market, as most graphic paper purchases are still made through traditional distribution channels, including printing suppliers, retail stores, and wholesalers. Large-volume buyers, such as print houses, educational institutions, and publishers, prefer offline procurement for bulk discounts and quick availability. Offline channels also enable physical quality checks, which remain essential for selecting graphic paper.

Nonetheless, the online segment holds a second rank due to the growth of B2B digital procurement platforms and e-commerce. Small businesses, schools, and freelancers are actively purchasing graphic papers online for better access and convenience to a broader range of products. Digital platforms are offering doorstep delivery and subscription models, thereby augmenting adoption despite their offline prominence.

Graphic Paper Market: Regional Analysis

What enables the Asia Pacific to maintain a strong foothold in the global Graphic Paper Market?

The Asia Pacific is projected to maintain its dominant position in the global graphic paper market, driven by the rising publishing and printing industry, rapid commercial growth and industrialization, as well as the cost benefits and availability of raw materials. The Asia Pacific has progressed as a publishing market due to its increasing literacy rates and large population.

Economies like China and India have expanding educational industries, with India printing more than 2.5 billion textbooks early. This high demand for newspapers, books, and magazines mainly drives the consumption of graphic paper. The growth of the advertising, corporate, and e-commerce sectors in the Asia Pacific is driving demand for print media. India and China have experienced a double-digit increase in advertising expenditure, with print media still capturing the leading share in local markets.

Therefore, the demand for brochures, promotional materials, and catalogs on graphic papers continues to grow. The Asia Pacific region benefits from abundant raw materials, such as recycled fibers and wood pulp, which reduces production costs. Additionally, low labor costs and government incentives for the paper sector enhance the region's competitiveness. This cost-benefit analysis appeals to global buyers, thereby enhancing regional market dominance.

Europe maintains its position as the second-largest region in the global graphic paper industry, thanks to a strong publishing and printing sector, advanced printing technology and quality standards, and high demand for premium packaging. Europe has a long-established tradition of print media, with nations like France, Germany, and the United Kingdom leading the way in publishing. Germany alone publishes more than 70,000 new book titles each year, further solidifying its dominance as the world's largest book market. This strong demand for magazines, journals, and books assures steady consumption of graphic papers.

European markets prioritize high-class printed material for luxury and commercial applications. The region leads in premium printing solutions, such as digital printing and offset, which require top-grade graphic papers. This technological edge fuels the demand for specialty and coated graphic paper products in industries.

Luxury brands in Italy, France, and Switzerland drive demand for high-end packaging solutions utilizing graphic paper. The European luxury packaging industry is estimated to be worth more than USD 15 billion in 2024, making a significant contribution to the consumption of graphic paper. This segment comprises perfumes, cosmetics, and fashion packaging that need textured and glossy graphic papers.

Graphic Paper Market: Competitive Analysis

The key players profiled in the global graphic paper market are:

- International Paper Company

- Stora Enso

- UPM-Kymmene Corporation

- Sappi Limited

- Nippon Paper Industries Co. Ltd.

- Mondi Group

- Domtar Corporation

- Resolute Forest Products Inc.

- Verso Corporation

- Nine Dragons Paper Holdings Limited

- Smurfit Kappa Group

- Cascades Inc.

- Svenska Cellulosa Aktiebolaget (SCA)

- DS Smith Plc

- Georgia-Pacific LLC.

Graphic Paper Market: Key Market Trends

Growth of specialty and premium papers:

Luxury packaging, art prints, and high-end magazines are propelling the demand for coated and textured papers. Glossy or embossed surfaces and premium finishes improve product aesthetics and brand appeal. Businesses are actively investing in high-quality papers to differentiate themselves in competitive markets.

Adoption of digital printing:

On-demand and short-run printing solutions are driving demand for graphic papers that are compatible with digital presses. High-quality and smooth documents are vital for vibrant, sharp, and customized prints. This trend supports the use of personalized marketing materials, packaging, and catalogs. Manufacturers are innovating finishes and coatings to enhance the performance of digital printing.

The global graphic paper market is segmented as follows:

By Type

- Cartesian Graph Paper

- Dot Paper

- Isometric Graph Paper

- Log Graph Paper

- Polar Graph Paper

- Others

By Application

- Online

- Offline

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Graphic paper is a type of paper specially designed for graphic and printing applications like brochures, magazines, newspapers, books, advertising materials, and catalogs. It is characterized by its smooth surface, superior printability, and high brightness, enabling vibrant color output and sharp image reproduction.

The global graphic paper market is projected to grow due to heavy demand from the packaging industry, advancements in printing techniques, and the growth of the commercial printing sector.

According to study, the global graphic paper market size was worth around USD 35.49 billion in 2024 and is predicted to grow to around USD 48.95 billion by 2034.

The CAGR value of the graphic paper market is expected to be approximately 4.10% from 2025 to 2034.

Market trends and consumer preferences are shifting toward premium, eco-friendly, and digitally compatible graphic papers, driven by surging demand in developing economies.

Investment and partnership opportunities exist in sustainable paper production, digital printing solutions, specialty and premium papers, as well as emerging market growth.

The value chain of the graphic paper industry encompasses sourcing of raw materials, pulping and manufacturing, finishing and coating, printing and packaging, distribution and sales, end-use consumption, and recycling.

Asia Pacific is expected to lead the global graphic paper market during the forecast period.

The key players profiled in the global graphic paper market include International Paper Company, Stora Enso, UPM-Kymmene Corporation, Sappi Limited, Nippon Paper Industries Co., Ltd., Mondi Group, Domtar Corporation, Resolute Forest Products Inc., Verso Corporation, Nine Dragons Paper Holdings Limited, Smurfit Kappa Group, Cascades Inc., Svenska Cellulosa Aktiebolaget (SCA), DS Smith Plc, and Georgia-Pacific LLC.

The report examines key aspects of the graphic paper market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed