Telehealth Market Trend, Share, Growth, Size, Analysis and Forecast 2032

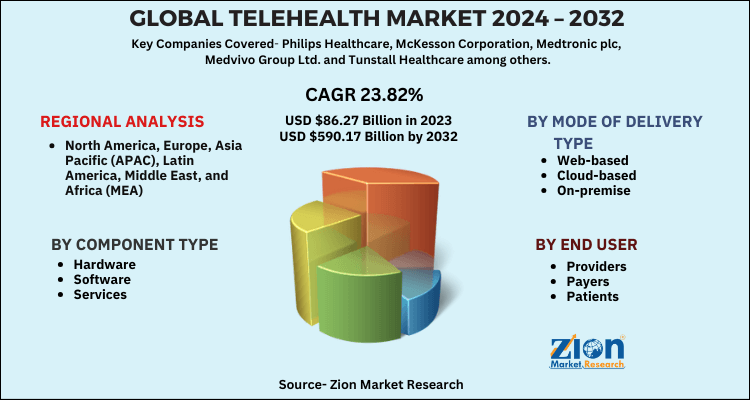

Telehealth Market By Component Type (Hardware, Software, and Services), By Mode of Delivery Type (Web-based, Cloud based, On-premise), By End User (Providers, Payers, Patients, and others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

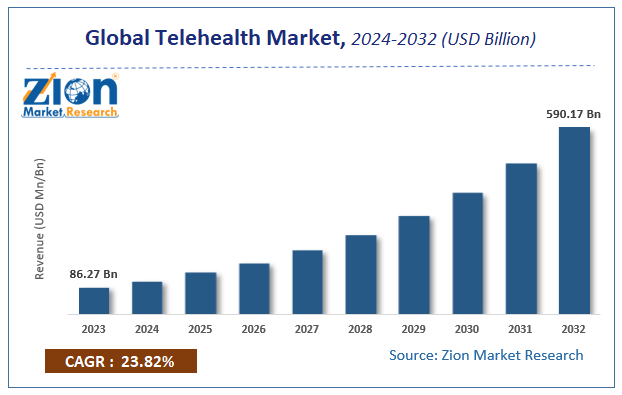

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 86.27 Billion | USD 590.17 Billion | 23.82% | 2023 |

Global Telehealth Market Insights

According to a report from Zion Market Research, the global Telehealth Market was valued at USD 86.27 Billion in 2023 and is projected to hit USD 590.17 Billion by 2032, with a compound annual growth rate (CAGR) of 23.82% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Telehealth Market industry over the next decade.

Telehealth Market: Overview

Telehealth is the communication technology to access health care services remotely and manage your health care. These technologies can be used from home or any place or the doctor’s uses to improve or support health care services. It has various benefits such as limiting physical contact reducing everyone’s exposure to COVID-19, visiting virtually can address health issues wherever patients are, even from the comfort of home, staying put cuts down on commuting, travel in bad weather, time off from work, need for child care, and using virtual health care tools can shorten wait times to see a provider and expand the range of access to specialists who live further away.

Key players are focusing on the advancement of products and integrating the equipment with new features. Citing an instance, on August 29th, 2022, Partners HealthCare, a U.S.-based non-profit network of physicians & hospitals joined hands with Teladoc Inc., a key player across the telehealth market, for introducing a direct-to-consumer telehealth service. Reportedly, the new service will provide health plan members quick access to critical care services through video conferencing.

Growth Factors

Rising incidences of chronic ailments along with hefty expenditure on healthcare activities are the key factors stimulating the demand for telehealth services. Apart from this, the telecommunications sector is witnessing a paradigm shift through the launch of new technologies and this will enable a massive expansion of the telehealth market over the forthcoming years.

Inadequate compensation benefits, rising technological costs, and lacuna in the interoperability rules, however, are likely to hinder the growth of the telehealth market during the forecast timeline. Nevertheless, the inception of cutting-edge technologies such as electronic health records is likely to facilitate the growth of the telehealth market over the ensuing years, thereby normalizing the impact of hindrances on the market, reports the telehealth market study.

Global Telehealth Market: Segmentation

The study provides a decisive view of the telehealth market by segmenting the market based on by component type, by mode of delivery type, by end user and by region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

By component type segment analysis includes hardware, software, services.

By mode of delivery type segment analysis includes web-based, cloud-based, on-premise.

By end user segment analysis includes providers, payers, patients, others.

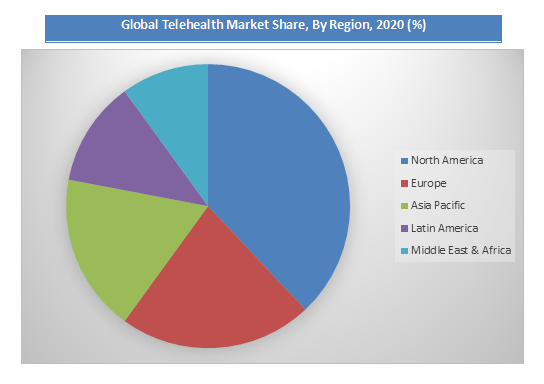

The regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Global Telehealth Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Telehealth Market |

| Market Size in 2023 | USD 86.27 Billion |

| Market Forecast in 2032 | USD 590.17 Billion |

| Growth Rate | CAGR of 23.82% |

| Number of Pages | 125 |

| Key Companies Covered | Philips Healthcare, McKesson Corporation, Medtronic plc, Medvivo Group Ltd. and Tunstall Healthcare among others. |

| Segments Covered | By Component Type, By Mode of Delivery Type, By End User and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Component Type Segment Analysis Preview

Based on Component Type, the global Telehealth market is segmented into services, hardware, and software. Among these component types, the demand for hardware is relatively higher and the trend is anticipated to remain so over the next few years.

End User Segment Analysis Preview

On the basis of Mode of Delivery Type, the Telehealth market is segmented into Web-based, Cloud-based, and, On-premise. The Telehealth market for Cloud-based accounted for the largest share in 2023

End User Segment Analysis Preview

On the basis of End Users, the Telehealth market is segmented into Providers, Payers, Patients, and Others. The provider segment is likely to gain major traction in the market and is anticipated to remain dominant throughout the forecast period. Increasing deployment of telemedicine to reduce the work burden on healthcare facilities and government-funded projects are the major factors for the growth of the market.

Regional Segment Analysis Preview

North America has been leading the worldwide telehealth market and is anticipated to continue in the dominant position in the years to come, states the market study. The rise in the elderly population, high incidence of chronic diseases, and bulging healthcare costs are the key factors behind the dominance of the North American telehealth market.

Key Market Players & Competitive Landscape

The major players operating in the Telehealth market are-

- Philips Healthcare

- McKesson Corporation

- Medtronic plc

- Medvivo Group Ltd.

- Tunstall Healthcare among others

The global Telehealth market is segmented as follows:

By Component Type

- Hardware

- Software

- Services

By Mode of Delivery Type

- Web-based

- Cloud-based

- On-premise

By End User

- Providers

- Payers

- Patients

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

List of Contents

Global Market InsightsOverview Growth Factors SegmentationReport ScopeComponent Type Segment Analysis Preview End User Segment Analysis Preview End User Segment Analysis Preview Regional Segment Analysis Preview Key Market Players Competitive LandscapeThe global market is segmented as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed