Generic Drugs Market Size, Share, Trends, and Forecast 2032

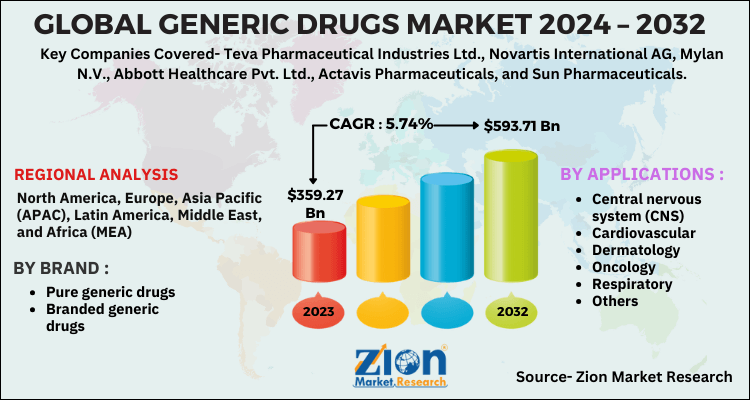

Generic Drugs Market By Brand (Pure generic drugs, Branded generic drugs) By Application (Central nervous system (CNS), Cardiovascular, Dermatology, Oncology, Respiratory, and Others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

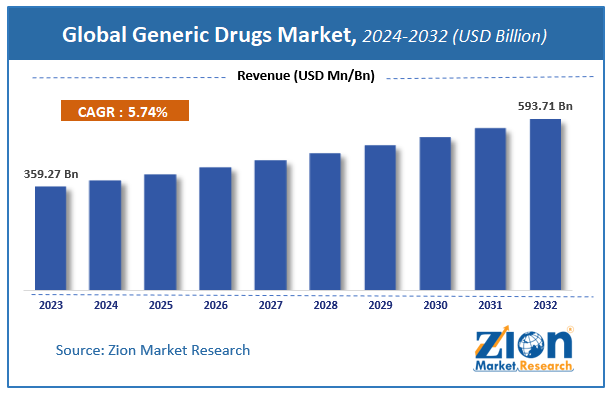

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 359.27 Billion | USD 593.71 Billion | 5.74% | 2023 |

Generic Drugs Market Insights

Zion Market Research has published a report on the global Generic Drugs Market, estimating its value at USD 359.27 Billion in 2023, with projections indicating that it will reach USD 593.71 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 5.74% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Generic Drugs Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Generic Drugs Market: Overview

Pharmacology is the study of drugs and medicines, including their uses, effects, and characteristic. Generic drugs are chemically identical to their branded counterparts. Although, generic drugs are bioequivalent to branded drugs, they are sold at the significant discount from branded drugs prices. As per the FDA approval, the generic drug should contain the same active ingredient as their branded counterpart; it should be bioequivalent and should meet batch requirements for identity, quality, purity, and strength. It should be identical on the route of administration and dosage form.

It should be manufactured under the same rules and regulation of FDA’s good manufacturing practice required for branded drugs. Generic drugs manufacturing companies are capable of selling generic drugs at the lower price because they are not required to repeat costly clinical trials and pay for marketing and promotion strategies.

India is the largest provider of generic drugs across the globe. Pharmaceutical sector in India supplies over 50% of global demand for various vaccines, 40% of generic demand in the US and 25% of all medicine in the UK. India ranks 3rd in terms of production of various Pharma medicines by volume and 14th by value.

Generic Drugs Market: Growth Factors

Globally, the market for the generic drug has been propelled by new government initiatives to produce generic drugs and mainly to promote the use of generic drugs against chronic diseases. Patent expiration of branded drugs is one of the key influencers for the growth and prime reason for generating more revenue for generic drugs market. Moreover, new emerging markets of developing countries and low cost of generic drugs are majorly responsible for thickening the growth of generic drugs market.

In spite of this, the market is affected by high competition within the globe and it is due to, economic expenditure required for the production of generic drugs is the very low thus number of leading companies taking interest in the production of generic drugs. In future, new developing and uncovered markets may responsible for the generation of new opportunities.

Generic Drugs Market: Segment Analysis

Based on the various types of Generic Drugs, the global Generic Drugs market is segmented into pure generic drugs and Branded generic drugs.

The market of the generic drug has been segmented on the basis of the brand as pure generic drug and branded generic drugs. Branded generic drugs are marketed under another company’s brand name but they are bioequivalent to their generic counterparts. Due to high involvement of companies in manufacturing pure generic drugs, pure generic drug segment is dominating the market.

Based on the application the market of generic drugs has been segmented as central nervous system (CNS), cardiovascular, dermatology, oncology, respiratory and others. With more than 20.5% revenue contribution, the cardiovascular segment was leading the generic drug market in 2020 due to a number of patent expiries of cardiovascular drugs. With more than 15.2% revenue contribution, central nervous system (CNS) will show significant growth in the forecast period.

Generic Drugs Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Generic Drugs Market |

| Market Size in 2023 | USD 359.27 Billion |

| Market Forecast in 2032 | USD 593.71 Billion |

| Growth Rate | CAGR of 5.74% |

| Number of Pages | 160 |

| Key Companies Covered | Teva Pharmaceutical Industries Ltd., Novartis International AG, Mylan N.V., Abbott Healthcare Pvt. Ltd., Actavis Pharmaceuticals, and Sun Pharmaceuticals, |

| Segments Covered | By Brand, By Applications and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Generic Drugs Market: Regional Preview

North America is dominating the generic drug market due to high demand and increasing the prevalence of chronic diseases. Asia-Pacific is expected to show good growth in the forecast period. In Asia Pacific, India and China are leading countries in the genetic drug market.

Key Market Players & Competitive Landscape

The major players operating Generic Drugs market are

- Teva Pharmaceutical Industries Ltd.

- Novartis International AG

- Mylan N.V.

- Abbott Healthcare Pvt. Ltd.

- Actavis Pharmaceuticals

- and Sun Pharmaceuticals

The global Generic Drugs market is segmented as follows:

By Brand

- Pure generic drugs

- Branded generic drugs

By Applications

- Central nervous system (CNS)

- Cardiovascular

- Dermatology

- Oncology

- Respiratory

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Zion Market Research has published a report on the global Generic Drugs Market, estimating its value at USD 359.27 Billion in 2023, with projections indicating that it will reach USD 593.71 Billion by 2032.

The market is expected to expand at a compound annual growth rate (CAGR) of 5.74% over the forecast period 2024-2032.

Some of the key factors driving the global Generic Drugs Market growth are new government initiatives to produce generic drugs and mainly to promote the use of generic drugs against chronic diseases.

North America is dominating the generic drug market due to high demand and increasing the prevalence of chronic diseases. Asia-Pacific is expected to show good growth in the forecast period.

Some of the major players of global Generic Drugs market Teva Pharmaceutical Industries Ltd., Novartis International AG, Mylan N.V., Abbott Healthcare Pvt Ltd, Actavis Pharmaceuticals and Sun Pharmaceuticals.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed