Gas Engine Market Size, Share, Growth Report 2032

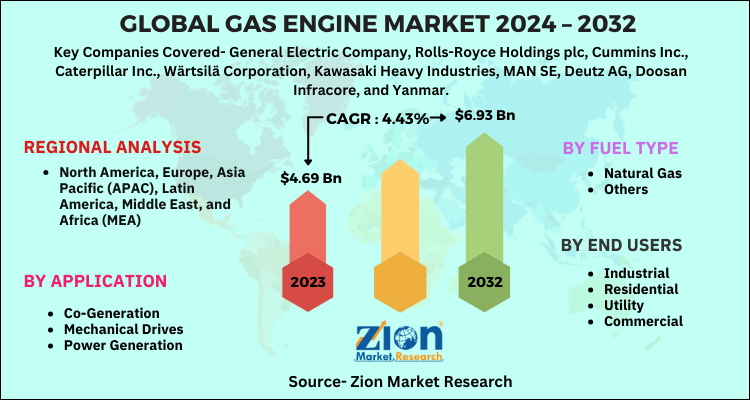

Gas Engine Market By Fuel Type (Natural Gas, and Others), By End Users (Industrial, Co-Generation, Utility, and Commercial), By Application (Co-Generation, Mechanical Drives, and Power Generation), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

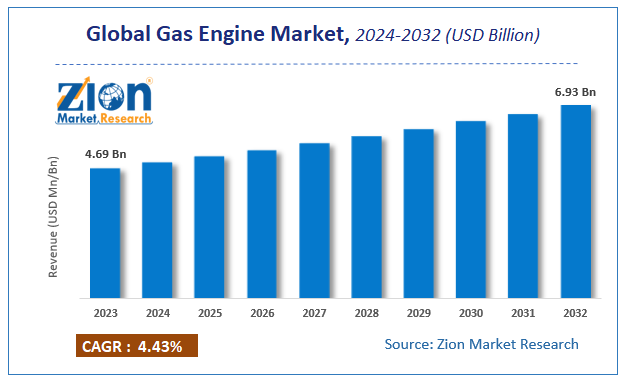

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.69 Billion | USD 6.93 Billion | 4.43% | 2023 |

Gas Engine Market Insights

According to a report from Zion Market Research, the global Gas Engine Market was valued at USD 4.69 Billion in 2023 and is projected to hit USD 6.93 Billion by 2032, with a compound annual growth rate (CAGR) of 4.43% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Gas Engine Market industry over the next decade.

Gas Engine Market Overview

A global gas engine market is a reciprocating combustion engine that runs on natural gas, shale gas, biogas, and sewage gas, among others. These engines generally achieve an efficiency of 90% owing to their high electrical and thermal efficiency, low cost, and high reliability. These gas engines are widely used in power generation, cogeneration, mechanical drive, and tri-generation applications.

Key players are focusing on the advancement of products and integrating the equipment with new features. The manufacturers are emphasizing mergers & acquisitions to strengthen their position in the market. For instance, In October 2019, Caterpillar, a leading manufacturer of construction and mining equipment, diesel, and natural gas engines, launched the first natural gas-powered generator set—Cat G3516C. The generator is optimized to run on Lean Coal Mine Methane (LCMM) for local mining applications. The generator has benefits to local customers to enhance product support and optimize cost efficiencies.

Growth Factors

Escalating demand for clean and reliable power supply is predicted to impel the growth prospects of the gas engine market over the coming years. Apart from this, the growing need for reducing air pollution and greenhouse effects occurring as a result of fuel emissions in both developed and emerging economies is projected to fuel the expansion of the gas engine market in the years ahead. In addition, the rapid evolution of gas-based power generation is anticipated to succor the demand for gas engines in the power & utility sector.

Gas Engine Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Gas Engine Market |

| Market Size in 2023 | USD 4.69 Billion |

| Market Forecast in 2032 | USD 6.93 Billion |

| Growth Rate | CAGR of 4.43% |

| Number of Pages | 130 |

| Key Companies Covered | General Electric Company, Rolls-Royce Holdings plc, Cummins Inc., Caterpillar Inc., Wärtsilä Corporation, Kawasaki Heavy Industries, MAN SE, Deutz AG, Doosan Infracore, and Yanmar |

| Segments Covered | By Fuel Type, By End Users, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Type Segment Analysis Preview

Based on fuel type, the global Gas Engine market is segmented into Natural Gas and Others. Among these fuel type, Natural Gas was the leading segment of the global Gas Engine market in 2020. Natural gas fuel is used in base load power generation and CHP (combined heat and power) applications

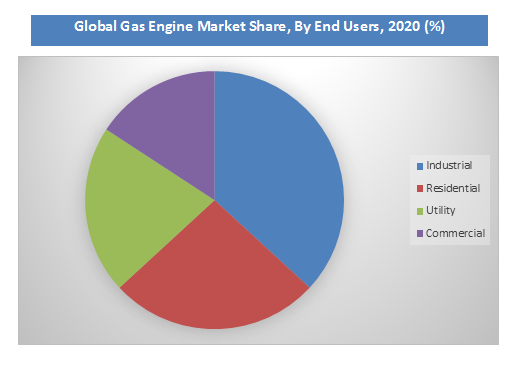

End User Segment Analysis Preview

On the basis of end users, the Gas Engine market is segmented into industrial, residential, utilities, and commercial. The Gas Engine market for industrial accounted for the largest share in 2020. In industries such as steel mills, chemical, paper & pulp mills, and district heating plants, the gas engine is widely used, as it produces power along with energy for space heating and water heating.

Application Segment Analysis Preview

On the basis of application, the Gas Engine market is segmented into Co-Generation, Mechanical Drives, and Power Generation. The cogeneration segment is likely to gain major traction in the market and is anticipated to remain dominant throughout the forecast period. The gas engine is an efficient method of power generation using gas engines and enables energy savings of up to 60%.

Regional Segment Analysis Preview

Europe has been leading the worldwide gas engine market and is anticipated to continue in the dominant position in the years to come, states the gas engine market study. European Union policies to restrict carbon emissions in the atmosphere and enhanced production of biogas as a result of the strong distribution network in the region are the key factors behind the dominance of the Europe gas engine market.

Key Market Players & Competitive Landscape

The major players operating in the Gas Engine market are:

- General Electric Company

- Rolls-Royce Holdings plc

- Cummins Inc.

- Caterpillar Inc.

- Wärtsilä Corporation

- Kawasaki Heavy Industries

- MAN SE

- Deutz AG

- Doosan Infracore

- Yanmar.

The global Gas Engine market is segmented as follows:

By Fuel Type

- Natural Gas

- Others

By End Users

- Industrial

- Residential

- Utility

- Commercial

By Application

- Co-Generation

- Mechanical Drives

- Power Generation

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Gas Engine market was valued at USD 4.69 Billion in 2023.

The global Gas Engine market is expected to reach USD 6.93 Billion by 2032, growing at a CAGR of around 4.43% between 2024-2032.

Major driving factors for the growth of Gas Engine market are Escalating demand for clean and reliable power supply.

Europe has been leading the worldwide gas engine market and is anticipated to continue on the dominant position in the years to come, states the gas engine market study. European Union policies to restrict carbon emissions in atmosphere and enhanced production of biogas as a result of strong distribution network in the region are the key factors behind the dominance of the Europe gas engine market.

The major players operating in the Gas Engine market are General Electric Company, Rolls-Royce Holdings plc, Cummins Inc., Caterpillar Inc., Wärtsilä Corporation, Kawasaki Heavy Industries, MAN SE, Deutz AG, Doosan Infracore, and Yanmar.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed