Foam Soap Dispenser Market Size, Trend, Growth, Industry Analysis 2034

Foam Soap Dispenser Market By Type (Automatic, Manual), By Material (Plastic, Stainless Steel, and Others), By Application (Corporate Office, Residential, Hospital, Restaurant, Educational Institutions, and Others), By Distribution Channel (Online, Offline), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

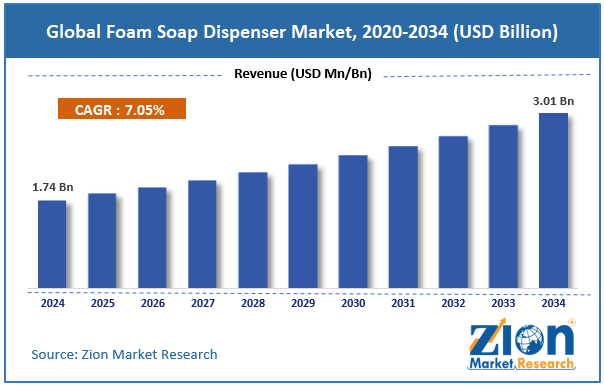

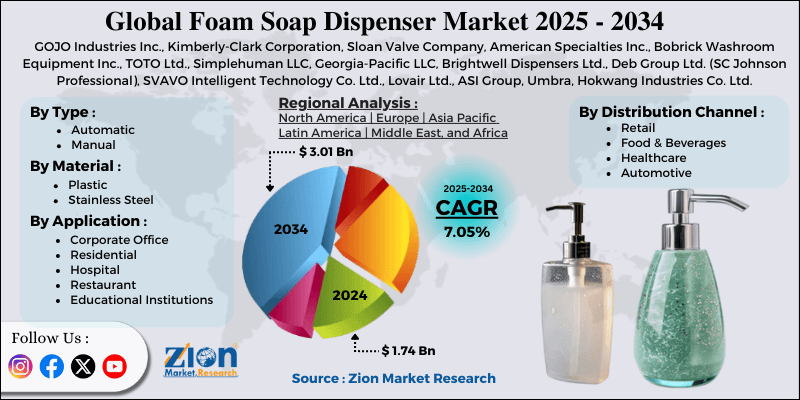

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.74 Billion | USD 3.01 Billion | 7.05% | 2024 |

Foam Soap Dispenser Industry Perspective:

What will be the size of the global foam soap dispenser market during the forecast period?

The global foam soap dispenser market size was around USD 1.74 billion in 2024 and is projected to reach USD 3.01 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.05% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global foam soap dispenser market is estimated to grow annually at a CAGR of around 7.05% over the forecast period (2025-2034)

- In terms of revenue, the global foam soap dispenser market size was valued at around USD 1.74 billion in 2024 and is projected to reach USD 3.01 billion by 2034.

- The foam soap dispenser market is projected to grow significantly, driven by increasing adoption in commercial establishments, technological advancements (automated/touchless systems), and the expansion of smart dispenser solutions.

- Based on type, the automatic segment is expected to lead the market, while the manual segment is expected to grow considerably.

- Based on material, the plastic segment is the dominating segment, while the stainless steel segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the residential segment leads the market, while the hospital segment is expected to grow faster.

- Based on the distribution channel, the offline segment is expected to lead the market, followed by the online segment.

- By region, North America is projected to dominate the global market during the forecast period, followed by the Asia Pacific.

Foam Soap Dispenser Market: Overview

A foam soap dispenser is a device that blends liquid soap with air to create rich foam. It improves handwashing efficiency and cost-effectiveness. It helps reduce waste while still offering effective cleaning because it uses less soap per pump than ordinary liquid dispensers. The global foam soap dispenser market is projected to witness substantial growth, driven by rising hygiene awareness, the cost efficiency of foam soap, and increased use in institutional and commercial spaces. Growing worldwide awareness of public and personal hygiene has significantly elevated the demand for effective handwashing solutions. Foam soap dispensers are believed to be more efficient and cleaner, leading to their adoption in public facilities and households. This behavioral shift continues to support sustained industry growth. Moreover, foam soap dispensers need less soap than liquid soap dispensers. This reduction in consumption drops long-term operational costs for institutional and commercial users. As cost optimization is now a growing priority, foam dispensers are gaining prominence. Furthermore, high-traffic areas such as offices, schools, hospitals, and shopping centers require hygienic, fast handwashing systems. Foam soap dispensers meet these requirements by reducing mess and enabling rapid dispensing. Their efficiency and durability make them ideal for such environments.

Although drivers exist, the global market faces operational and maintenance challenges, as well as limited compatibility with soap. Advanced dispensers need periodic maintenance, technical servicing, and battery replacement. Improper maintenance may lead to user dissatisfaction and malfunctions. These factors raise the total ownership cost. Likewise, foam soap dispensers need specially formulated soap solutions. Using incompatible soap may lead to dispenser failure or poor foam quality, thereby reducing end-user flexibility. Even so, the global foam soap dispenser industry is well-positioned due to integration with smart building systems and product customization and branding. Foam soap dispensers can be integrated into smart facility management systems. Features such as refill alerts and usage tracking enhance operational efficiency, thereby creating value for institutional and commercial users. Additionally, customized dispensers with designs, colors, and logos attract offices, hotels, and retail spaces. Branding converts dispensers into marketing tools, thus offering premium market segments.

Foam Soap Dispenser Market: Dynamics

Growth Drivers

How is the growth of touchless technology positively impacting the development of the foam soap dispenser market?

Touchless and sensor-activated foam soap dispensers have gained prominence for their ability to reduce germ transmission and provide convenience. These systems dispense a controlled amount of foam, minimizing waste and averting overuse. Commercial spaces, healthcare facilities, and public buildings are rapidly adopting automated dispensing systems. The technology also improves user experience by offering reliability and consistent performance. Touchless dispensers are now considered standard rather than a luxury in modern sanitation systems. Their adoption continues to expand the demand for foam soap dispensers significantly.

How do smart features and technological innovation drive the foam soap dispenser market?

Advanced foam soap dispensers are integrating smart technology, comprising usage tracking, IoT connectivity, and refill alerts. Facilities managers benefit from automated monitoring, enhanced maintenance efficiency, and improved supply planning. Smart dispensers also offer data for cost management and hygienic compliance. These features are especially valued in offices, hospitals, and high-traffic commercial places. Constant advancements improve the dispenser’s value beyond basic hygiene. Advancements in technology enhance the growth prospects of the foam soap dispenser market.

Restraints

Maintenance and operational challenges hinder the market's progress

Automatic foam dispensers need periodic maintenance, comprising sensor calibration, battery replacement, and nozzle cleaning. Facilities with limited technical support may experience operational downtime, reducing reliability and user satisfaction. False triggers or clogged sensors may also result in complaints and waste. Maintenance costs add to total ownership costs, dampening purchases. This issue is more noticeable in extensive facilities with hundreds of units. Hence, perceived service complexity hampers industry growth.

Opportunities

How is smart and connected device integration presenting favorable prospects for the expansion of the foam soap dispenser market?

The incorporation of IoT technologies with foam dispensers offers fresh opportunities for automation and facility management. Connected devices may send real-time data on usage, performance analytics, and low-soap alerts, thereby facilitating predictive maintenance. These smart features attract healthcare facilities and large commercial establishments. They also enable integration with wide-ranging building management systems. As smart buildings proliferate, these dispensers with connectivity become an integral part of the strategic sanitation infrastructure. This blend of technology and hygiene is a high-growth product segment, driving the foam soap dispenser industry.

Challenges

Inventory and stock management complexity limit the market growth

In extensive facilities, managing diverse foam dispensers, spare parts, and refills creates operational challenges. Multiple dispenser models with unique parts need meticulous planning. Mistakes in inventory planning may result in overstocking or stockouts, thereby increasing costs. Facility managers may require specialized systems and tools to precisely monitor usage. Training staff for effective supply management adds to the workload, thereby slowing adoption.

Foam Soap Dispenser Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Foam Soap Dispenser Market |

| Market Size in 2024 | USD 1.74 Billion |

| Market Forecast in 2034 | USD 3.01 Billion |

| Growth Rate | CAGR of 7.05% |

| Number of Pages | 214 |

| Key Companies Covered | GOJO Industries Inc., Kimberly-Clark Corporation, Sloan Valve Company, American Specialties Inc., Bobrick Washroom Equipment Inc., TOTO Ltd., Simplehuman LLC, Georgia-Pacific LLC, Brightwell Dispensers Ltd., Deb Group Ltd. (SC Johnson Professional), SVAVO Intelligent Technology Co. Ltd., Lovair Ltd., ASI Group, Umbra, Hokwang Industries Co. Ltd., and others. |

| Segments Covered | By Type, By Material, By Application, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Foam Soap Dispenser Market: Segmentation

The global foam soap dispenser market is segmented based on type, material, application, distribution channel, and region.

Why is the Automatic segment projected to dominate the foam soap dispenser market?

Based on type, the global foam soap dispenser industry is divided into automatic and manual. The automatic segment registers 60% market share due to growing hygiene concerns and the adoption of technology, especially in institutional and high-traffic environments. Strong demand in healthcare, commercial, and public spaces, along with their care-free operation, also propels segmental growth.

Conversely, the manual segment ranks second with 40% market share, driven by surging demand in cost-sensitive and residential markets, and by simplicity and affordability.

What factors help the Plastic segment lead the foam soap dispenser market?

Based on material, the global market is segmented into plastic, stainless steel, and others. The plastic segment captures 55% of the overall market due to its lightweight nature, cost-efficiency, and versatility in commercial and residential applications. Plastic dispensers, which dominate in terms of volume, are easy to manufacture and affordable.

Nonetheless, the stainless steel segment holds a second position in the market. It gains traction mainly in commercial, industrial, and institutional settings where durability, sleek aesthetic, and corrosion resistance are essential.

Which primary factors enable the Residential segment to dominate the foam soap dispenser market?

Based on application, the global foam soap dispenser market is segmented into corporate offices, residential, hospitals, restaurants, educational institutions, and others. The residential segment dominates with 40% market share because of high consumer demand for hygiene solutions in households and surging awareness of cleanliness. The affordability, convenience, and growing trend of modern bathroom fittings contribute to strong residential adoption worldwide.

However, the hospital sector is the fastest-growing, with 30% market share. Here, stringent infection control standards and frequent handwashing requirements drive strong demand for foam soap dispensers in patient care and clinical environments.

What are the key reasons for the leadership of the Offline segment in the foam soap dispenser market?

Based on the distribution channel, the global market is segmented into online and offline. The offline segment accounts for 50% of the total market. This is because they allow institutional buyers and consumers to assess products physically, receive personalized service, and secure bulk purchases of installation support.

Yet, the online channel secures second place owing to the convenience of e-commerce platforms, a broader product selection, competitive pricing, and doorstep delivery, particularly among small businesses and residential buyers.

Foam Soap Dispenser Market: Regional Analysis

What gives North America a competitive edge in the global Foam Soap Dispenser Market?

North America is likely to sustain its leadership in the foam soap dispenser market, with a 6-7% CAGR, driven by substantial market share, early adoption, high hygiene awareness, and a developed commercial and healthcare infrastructure. North America holds a leading share of the global market, backed by early adoption in the commercial and residential sectors. Institutions and businesses have consistency preferred advanced hygiene solutions, driving sales. This early adoption creates a more developed and stable market than other regions.

Moreover, stringent hygiene standards in Canada and the U.S. are fueling the broader use of foam soap dispensers in hospitals, offices, and schools. Businesses and consumers prioritize compliance with health regulations and cleanliness. This emphasis on hygiene is expected to sustain consistent demand and regular upgrades.

Furthermore, the region’s extensive commercial facilities and advanced healthcare systems need frequent handwashing solutions. Clinics, hospitals, offices, and public spaces are heavily investing in dispensers to maintain efficiency and safety. Such infrastructure creates recurring demand for both refills and new units.

Why does Asia Pacific rank second in the global Foam Soap Dispenser Market?

Asia-Pacific continues to hold the second-highest share, with a 11.3% CAGR in the foam soap dispenser industry, owing to rising hygiene awareness, urbanization, the expansion of public and commercial infrastructure, and the increasing adoption of touchless solutions. Speedy urbanization has boosted hygiene awareness, as a surging middle class in India, China, and Southeast Asia invests in advanced sanitation products. Hand hygiene solutions, such as foam soap dispensers, are widely considered vital in workplaces and households. This inclination backs strong industry growth in APAC.

Moreover, large-scale development in healthcare, hospitality, and retail sectors has elevated demand for foam soap dispensers. Economies like India and China have witnessed double-digit annual increases in commercial facility construction. These trends create sustained procurement of dispensers for high-traffic environments. Additionally, demand for sensor-based and automated dispensers is growing in APAC, especially in urban centers. As public health priorities grow, touchless dispensers are increasingly preferred in malls, hospitals, and transit hubs. This technological shift drives growth in the premium segment and increases unit sales.

Foam Soap Dispenser Market: Competitive Analysis

The leading players in the global foam soap dispenser market are:

- GOJO Industries Inc.

- Kimberly-Clark Corporation

- Sloan Valve Company

- American Specialties Inc.

- Bobrick Washroom Equipment Inc.

- TOTO Ltd.

- Simplehuman LLC

- Georgia-Pacific LLC

- Brightwell Dispensers Ltd.

- Deb Group Ltd. (SC Johnson Professional)

- SVAVO Intelligent Technology Co. Ltd.

- Lovair Ltd.

- ASI Group

- Umbra

- Hokwang Industries Co. Ltd.

What are the key trends in the global Foam Soap Dispenser Market?

Integration with IoT and smart technologies:

Manufacturers are integrating smart features like refill alerts, usage tracking, and connectivity with facility management systems. These capabilities help institutions monitor consumption, reduce downtime, and optimize maintenance timelines. Smart dispensers are becoming a value-added option for large public and commercial facilities.

Focus on eco‑friendly designs and sustainability:

Eco-friendly dispensers made from biodegradable, recycled materials, and designs that reduce soap and water use are gaining prominence. Modular, refillable units that reduce single-use plastics support consumer preferences and corporate sustainability goals. This trend backs green building certifications and ecological initiatives.

The global foam soap dispenser market is segmented as follows:

By Type

- Automatic

- Manual

By Material

- Plastic

- Stainless Steel

- Others

By Application

- Corporate Office

- Residential

- Hospital

- Restaurant

- Educational Institutions

- Others

By Distribution Channel

- Retail

- Food & Beverages

- Healthcare

- Automotive

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed