Flow cytometry Market Size, Share, And Growth Report 2032

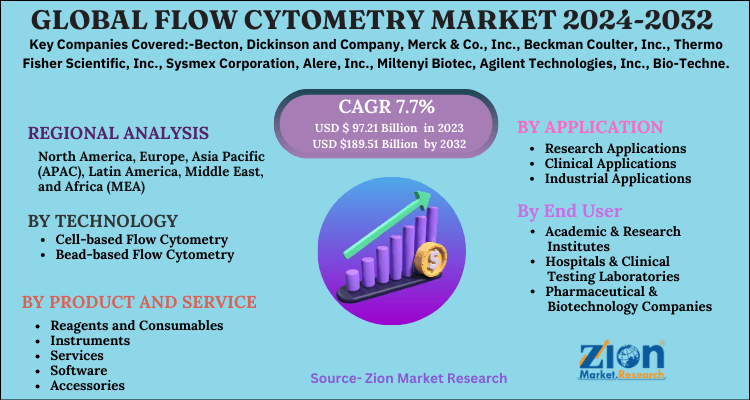

Flow cytometry Market By Technology (Cell-based Flow Cytometry, Bead-based Flow Cytometry) By Product and Service (Reagents and Consumables, Instruments, Services, Software, Accessories) By Application (Research Applications, Clinical Applications, Industrial Applications) By End User (Academic & Research Institutes, Hospitals & Clinical Testing Laboratories, Pharmaceutical & Biotechnology Companies), and By Region - Global and Regional Industry Overview, Comprehensive Analysis, Historical Data, and Forecasts 2024-2032

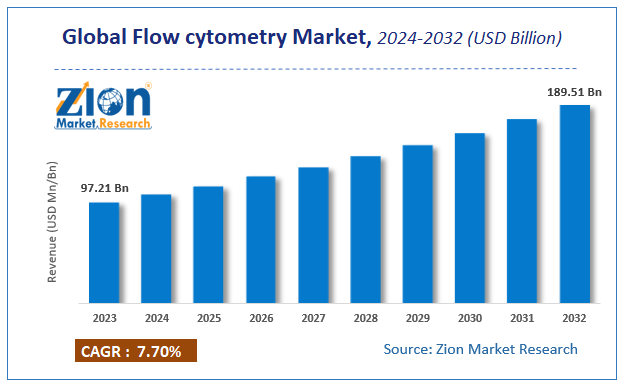

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 97.21 Billion | USD 189.51 Billion | 7.7% | 2023 |

Flow cytometry Market Size

According to Zion Market Research, the global Flow cytometry Market was worth USD 97.21 Billion in 2023. The market is forecast to reach USD 189.51 Billion by 2032, growing at a compound annual growth rate (CAGR) of 7.7% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Flow cytometry Market industry over the next decade.

Flow cytometry Market: Overview

Flow cytometry is a laser-based biophysical technology which has application in various fields such as protein engineering, biomarker detection, cell sorting, cell counting, cell analysis, etc. Flow cytometry analyzes fluid by suspending fluid in the light or laser beam. Cell components in the fluid are fluorescently labeled and then they are passed through beam which later on emits light by the laser at the diversified wavelength. The fluorescence light helps determine various properties of single particles and cells from different wavelengths.

Flow cytometry is used to detect various diseases like cancer, HIV, and hematological malignancies. According to the American Cancer Society, approximately 1 million new cancer cases were registered in U.S. Due to this increase in the number of cancer patients, demand for flow cytometry is high. Similarly, there is an increase in HIV patients across the globe, which is expected to further drive industry growth. Flow Cytometry has precise and accurate results over the traditional analytical methods; therefore there is an increase in demand for flow cytometry. The growth of flow cytometry market can also be attributed to the technological advancements in the techniques and also use of the method in research and diagnostic applications. However, high cost associated with the instrument and lack of technical experts hinders the market growth. Lack of awareness about the process also acts as a restraint for the growth of the market.

COVID-19 Impact Analysis:

For all business sectors around the world, the coronavirus pandemic has produced a health problem as well as a difficult situation. During this pandemic, many national governments have provided guidelines to perform a clinical trial, perceiving the objective of the value of patient safety and protecting the credibility of the trial. In order to maintain the impact of the pandemic, the guidelines identified the need to adjust the trial and suggested that the regulatory agencies be flexible in the composition of the protocol adjustments. The bio-pharma industries have shifted their attention on developing the vaccines and therapies in rebound to the Covid-19 and the pressure of the crisis that is putting on the medical centers worldwide. There was concern about the effect on the global economy of a U.S.-China trade war, the U.S. presidential election, and Brexit in 2019. The IMF had therefore projected modest global growth of almost 3.4%, but Covid-19 suddenly modified the outlook. In terms of financial turnover, the clinical trial industry has increased further, for example, in India, the clinical trials industry has grown by 100 times at the rate of nearly 1414 percent annually between 2003 and 2010. Most industries accept that the guidance is a framework for drug developers to move dynamically forward and respond to trial changes and to tackle the unusual challenges with independence.

Flow cytometry Market: Growth Factors

Over the past few decades, there is rising prevalence of oncology disease across the developed and developing countries. 3D cell culturing makes it easy to develop new drug. 3D cell cultures are generally used in preclinical trials to test the pharmacodynamic and pharmacokinetic effects of new or novel drug/ medicine. 3D cell culturing is fulfilling the rising demand of drug discovery for chronic diseases. According to the Centers for Disease Control and Prevention (CDC) in the 2019, almost 6 in 10 people in the US suffer from at least one oncology disease and 4 in 10 people have two or more oncology diseases.

Cancer is one of the leading causes of death among population worldwide. The American Cancer Society (ACS) estimated that, approximately 1,735,350 new cancer cases were diagnosed in 2018. 3D scaffolds and 3D cell spheroids in vitro are useful in testing the pharmacokinetic effects of ontological drugs in preclinical trails. For instance, CellASIC ONIX Gradient Plate is the microfluidic system offered by Sigma Aldrich. It will drive the 3D cell culture market in the forecasted period. The expression of cell surface and intracellular compounds can be studied using flow cytometry. It helps measure the purity of isolated subpopulations by characterizing and defining different types of cells in a heterogeneous cell population.

The introduction of new products and the widespread use of 3D protocols in biological research are two other important drivers driving market expansion. For example, eNUVIO Inc., a biotechnology company based in Canada, launched EB-Plate, a 100% reusable microplate for 3D cell culture, in December 2020. This is projected to reduce single-use plastic waste, boost the utility of 3-dimensional microplates, and encourage laboratories to go zero-waste.

Such developments in 3D cell culture market are expected to bolster the demand for flow cytometry market during the years to come.

Flow cytometry Market: Segmentation

Based on technology, the market is segmented into cell-based and bead-based. Cell-based Flow Cytometry is expected to dominate the market in the forecast period because of its various applications in different fields.

Based on product, the market is segmented into reagents and consumables, instruments, software. The instrument segment is expected to dominate the global flow cytometry market.

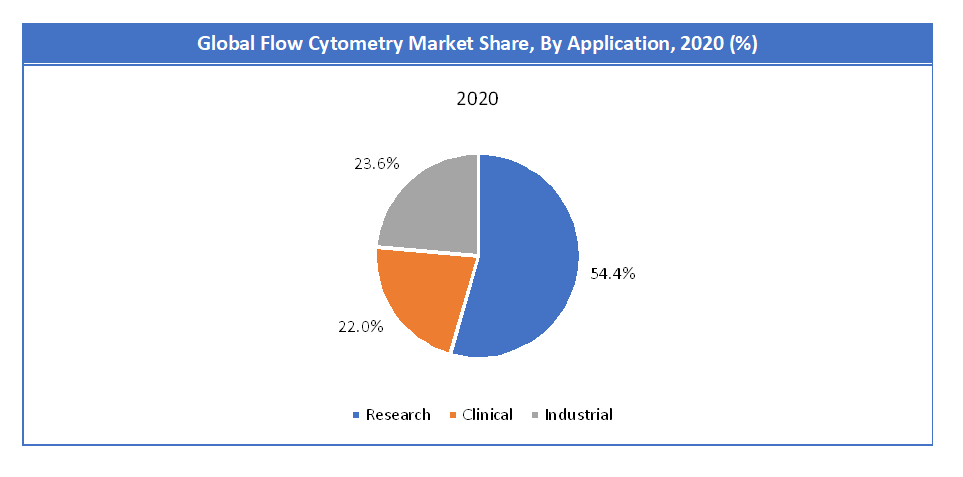

Based on application, the market is segmented into pharmaceutical and drug discovery, diagnostics and others category. Due to the increasing research in cancer and other infectious diseases, the research segment is anticipated to grow in the forecast period.

Based on end users, the market is segmented into hospitals & diagnostic labs, academic and research institutions and others category. Academic and research institutions are expected to dominate the market in the forecast period.

Flow cytometry Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Flow cytometry Market |

| Market Size in 2023 | USD 97.21 Billion |

| Market Forecast in 2032 | USD 189.51 Billion |

| Growth Rate | CAGR of 7.7% |

| Number of Pages | 110 |

| Key Companies Covered | Becton, Dickinson and Company, Merck & Co., Inc., Beckman Coulter, Inc., Thermo Fisher Scientific, Inc., Sysmex Corporation, Alere, Inc., Miltenyi Biotec, Agilent Technologies, Inc., Bio-Techne, and Bio-Rad Laboratories, Inc., among others |

| Segments Covered | By Technology, By Product and Service, By Application, By End User and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

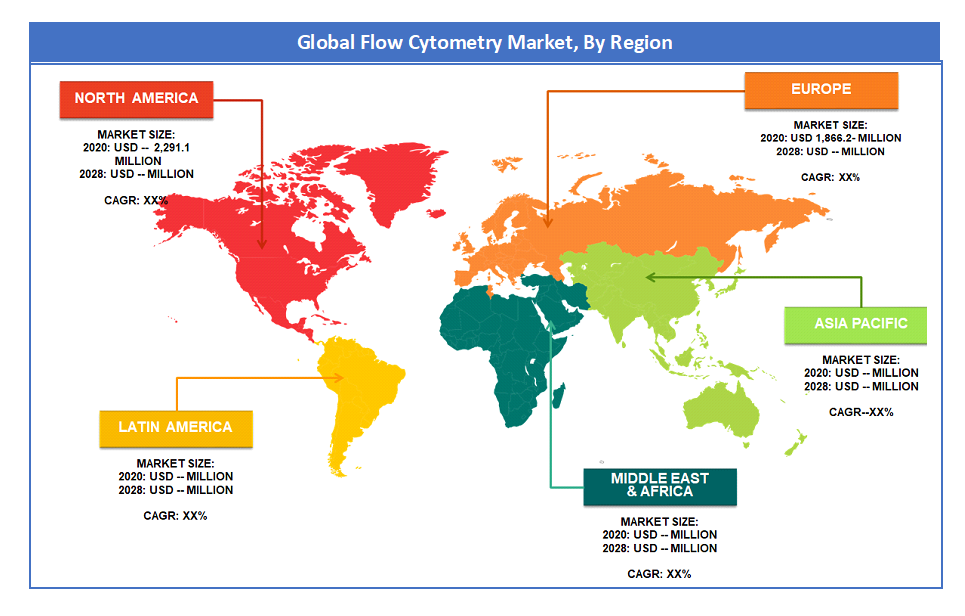

Flow cytometry Market: Regional Analysis

North America region dominated the global flow cytometry market in 2020 and is expected to dominate the market in 2028. United States and Canada have experienced significant growth in development of new point of care diagnostics and testing technologies and increase in the number of medical and diagnostic laboratories. The point of care diagnostics and testing market in United States should reach to a market value of approximately USD 27.5 Billion by 2022, owing to advancement in diagnostics and testing and increasing awareness among individuals regarding health awareness. Further, presence of major vendors operating in the flow cytometry market in North America should also drive the adoption of new technologies by organizations and institutions as companies are introducing new products into the market, which may generate new opportunities for the market growth

Europe has foreseen rise in investment in research from government and private organizations in stem cell therapies and research, which has been driving the Europe stem cell market. According to Eurostat, in 2018, over 30 000 patients in the European Union (EU) received healthy blood-forming cells (stem cells) to replace their own that had been destroyed. Stem cell transplants in Germany, France, Italy, UK, and Spain were 7,700, 5,500, 5,100, 3,800, and 3,100 respectively in 2018. Further, cell research in Europe has increased as companies focus on developing advance cell therapies for treating disease, which is anticipated to stimulate the Europe flow cytometry market growth.

Flow cytometry Market: Competitive Players

Some of key players in flow cytometry market are:

- Becton

- Dickinson and Company

- Merck & Co. Inc.

- Beckman Coulter Inc.

- Thermo Fisher Scientific Inc.

- Sysmex Corporation

- Alere Inc.

- Miltenyi Biotec

- Agilent Technologies Inc.

- Bio-Techne

- Bio-Rad Laboratories Inc.

- Among others

The Global Flow cytometry Market is segmented as follows:

Technology Segment Analysis

- Cell-based Flow Cytometry

- Bead-based Flow Cytometry

Product and Service Segment Analysis

- Reagents and Consumables

- Instruments

- Cell Analyzers

- High-Range

- Mid-Range

- Low-Range

- Cell Sorters

- High-Range

- Mid-Range

- Low-Range

- Cell Analyzers

- Services

- Software

- Accessories

Application Segment Analysis

- Research Applications

- Pharmaceuticals and Biotechnology

- Immunology

- Cell Sorting

- Apoptosis

- Cell Cycle Analysis

- Cell Viability

- Cell Counting

- Other

- Clinical Applications

- Cancer Diagnostics

- Hematology

- Immunodeficiency Diseases

- Organ Transplantation

- Other

- Industrial Applications

End User Segment Analysis

- Academic & Research Institutes

- Hospitals & Clinical Testing Laboratories

- Pharmaceutical & Biotechnology Companies

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Flow cytometry is a laboratory technique used to analyze the physical and chemical characteristics of cells or particles suspended in a fluid. It works by passing cells through a laser beam and detecting their properties, such as size, complexity, and fluorescence, enabling applications in research, diagnostics, and medical treatments like immunophenotyping and cancer detection.

According to study, the Flow cytometry Market size was worth around USD 97.21 billion in 2023 and is predicted to grow to around USD 189.51 billion by 2032.

The CAGR value of Flow cytometry Market is expected to be around 7.7% during 2024-2032.

North America has been leading the Flow cytometry Market and is anticipated to continue on the dominant position in the years to come.

The Flow cytometry Market is led by players like Becton, Dickinson and Company, Merck & Co. Inc., Beckman Coulter Inc., Thermo Fisher Scientific Inc., Sysmex Corporation, Alere Inc., Miltenyi Biotec, Agilent Technologies Inc., Bio-Techne, and Bio-Rad Laboratories Inc., among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed