Flexible Screens Market Size, Share, Global Trends, Forecast 2034

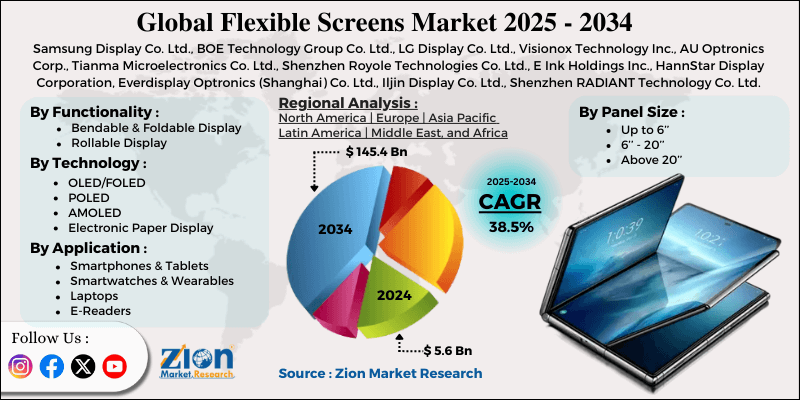

Flexible Screens Market By Functionality (Bendable and Foldable Display and Rollable Display), By Technology (OLED/FOLED, POLED, AMOLED, and Electronic Paper Display (EPD)), By Panel Size (Up to 6’’, 6’’ - 20’’ and Above 20’’), By Application (Smartphones & Tablets, Smartwatches & Wearables, Laptops, E-Readers, and Television), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034-

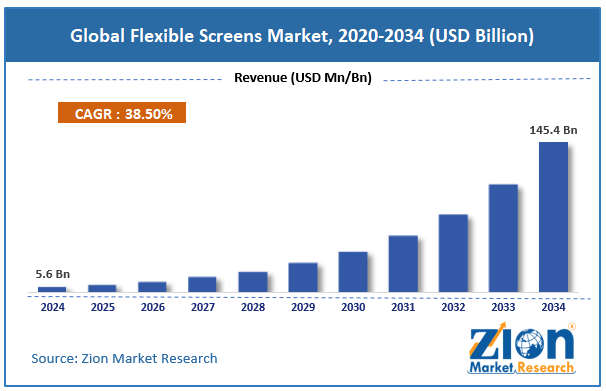

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.6 Billion | USD 145.4 Billion | 38.5% | 2024 |

Flexible Screens Industry Perspective:

What is the size of the global flexible screens market during the projected period (2025 to 2034)?

The global flexible screens market size was worth around USD 5.6 billion in 2024 and is predicted to grow to around USD 145.4 billion by 2034, with a compound annual growth rate (CAGR) of roughly 38.5% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global flexible screens market is estimated to grow annually at a CAGR of around 38.5% over the forecast period (2025-2034).

- In terms of revenue, the global flexible screens market size was valued at around USD 5.6 billion in 2024 and is projected to reach USD 145.4 billion by 2034.

- Rising consumer electronics sector is expected to drive the flexible screens market over the forecast period.

- Based on the functionality, the bendable and foldable display segment is expected to dominate the market over the projected period.

- Based on the technology, the OLED/FOLED segment is expected to capture the largest market share over the projected period.

- Based on the panel size, the 6’’ - 20’’ segment is expected to capture the largest market share over the projected period.

- Based on the application, the smartphones & tablets segment is expected to capture the largest market share over the projected period.

- Based on region, the Asia Pacific is expected to dominate the market during the forecast period.

Flexible Screens Market: Overview

Flexible screens (also known as flexible displays) are next-generation electronic displays that can be bent, folded, rolled, or curved without loss of visual quality or functionality. Flexible screens are made of plastic or ultrathin substrates and integrated with OLED technology that delivers high resolution, brightness, and color fidelity while maintaining plasticity. Unlike conventional, non-flexible glass displays, flexible screens are always going to be a major player in the market, as they have been a key driver of new device forms such as foldable phones, rollable TVs, curved car dashboards, and smart hairstyles. The new screens’ lightness, thinness, and improved impact resistance make them well-suited for future consumer electronics, automotive interiors, medical devices, and smart wearables, positioning them as a leading player in the modern display technology revolution.

Flexible Screens Market Dynamics

Growth Drivers

How does the boom in innovative consumer electronics propel the growth of the flexible screens market?

The flexible screens market is driven primarily by a wave of innovative consumer electronics, which manufacturers increasingly view as a means to achieve product differentiation through advanced design and an enriched user experience. The demand for foldable smartphones, rollable TVs, curved laptops, tablets, and smart wearables is so high that flexible-screen manufacturers can't keep up with production for these new applications, which are large and thin yet light and portable. Flexible displays allow devices to blend functionality, appearance, and durability with the sleeker, more versatile consumer demands of the day.

Moreover, leading premium consumer electronics brands are using flexible display technology to roll out new top-notch products aimed at tech-savvy consumers willing to pay more, which in turn drives significant market demand and, consequently, accelerates the innovation cycle in flexible screen technologies. For instance, in December 2025, Huawei launched its flagship smartphone, the Mate 80 Pro Max, featuring a tandem OLED structure to achieve 8,000 nits of peak brightness, and the new Mate X7 with an 8-inch foldable LTPO OLED display.

Restraints

High manufacturing and production costs are impeding the industry’s growth

The high manufacturing and production costs are the main reason the flexible screens market remains underdeveloped. Complex, expensive processes are required to produce flexible displays, especially flexible OLED panels. One of these processes involves the use of specialized materials such as plastic substrates or ultra-thin glass, advanced thin-film encapsulation, and precise deposition techniques—all of which increase initial investment and operational costs.

Moreover, low output, high defect rates, and strict quality control add to production costs. This is why flexible displays are limited to top-tier consumer gadgets, which naturally limits their availability to those with very limited options, i.e., the mid-range and low-end segments. The price factor is a significant barrier to adoption, making it difficult for manufacturers to bring the product to market. Consequently, the firm is responsible for creating a market large enough to support the incremental growth of the entire industry.

Opportunities

Will the launch of flexible smartphones offer a potential opportunity for the flexible screens market?

The advent of flexible smartphones is likely to provide a considerable boost to the flexible screens industry. Flexible smartphones are among the most commercially viable and high-volume applications of flexible screens, demonstrating foldable, flip, and rollable designs that combine smallness and portability with large screen sizes. The more consumers want multitasking, immersive viewing, and premium aesthetics, the more smartphone makers will be putting flexible OLED displays in their top-range and mid-premium models. Moreover, ongoing improvements in hinge design, screen toughness, and manufacturing yields will reduce total cost and improve quality, thereby supporting wider adoption of the technology.

For instance, in August 2025, Samsung Display unveiled a new foldable display brand, MONT FLEX™, which would be different from others on the market and would also feature the best foldable OLED technology. MONT FLEX ™ will be showcased at the K-Display 2025 Korea Display Exhibition, taking place from August 7 to 9 at COEX Hall A in Seoul, Korea. The term MONT FLEX™ was borrowed from the French word mont, meaning mountain, and signifies the highest point of innovation in foldable screens. It is a representation not only of Samsung Display's persistence in making the perfect foldable technology but also of its clear technological vision for the future. The letters in MONT stand for the four key qualities of Samsung Display's foldable OLED. M indicates that the product is mechanically durable, ensuring excellent folding reliability; O refers to an optically flat mechanical design, with a bright display and little creasing; N stands for narrow bezels that give more screen space; and T stands for thin, light construction, making it more portable.

Challenges

Why do the performance and integration limitations pose a major challenge to the flexible screens market expansion?

One of the main issues the flexible screen market faces is the performance and integration limitations, as these displays must balance the technical complexity of mechanical flexibility with consistent visual and functional performance. Flexible displays, unlike rigid ones, often exhibit uneven brightness, reduced or absent touch sensitivity in curved or folded regions, visible creases, and color changes with bending. The integration of these displays with other components, such as touch sensors, batteries, protective layers, and hinges, further complicates the issue, as each component must be flexible yet durable and perform well.

All these engineering hurdles, combined with design time, increase production costs and may even lead to reliability issues, which is why manufacturers are so careful when it comes to large-scale deployment. As a result, the performance and integration limitations delay product commercialization, limit adoption to high-end devices, and thus keep the flexible screens market from wider expansion.

Flexible Screens Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Flexible Screens Market |

| Market Size in 2024 | USD 5.6 Billion |

| Market Forecast in 2034 | USD 145.4 Billion |

| Growth Rate | CAGR of 38.5% |

| Number of Pages | 214 |

| Key Companies Covered | Samsung Display Co. Ltd., BOE Technology Group Co. Ltd., LG Display Co. Ltd., Visionox Technology Inc., AU Optronics Corp., Tianma Microelectronics Co. Ltd., Shenzhen Royole Technologies Co. Ltd., E Ink Holdings Inc., HannStar Display Corporation, Everdisplay Optronics (Shanghai) Co. Ltd., Iljin Display Co. Ltd., Shenzhen RADIANT Technology Co. Ltd., Osel Technology Pvt. Ltd., and others. |

| Segments Covered | By Functionality, By Technology, By Panel Size, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Flexible Screens Market: Segmentation

Functionality Insights

The bendable and foldable display segment is expected to dominate the market with a revenue share of 64% in 2024. The segment's growth can be attributed to its widespread use in next-generation consumer electronics, especially mobile and tablet computers. These screens deliver new designs that combine small size and light weight with large screens, meeting consumers' needs for working with multiple applications, watching high-quality movies, and having nice-looking equipment. Bendable and foldable screens are mostly found in high-end and flagship devices, which are priced considerably higher than standard models, thereby driving higher average sales prices and overall market revenue.

Moreover, ongoing advances in flexible OLED technology, improved hinge mechanics, and enhanced durability are helping to build consumer trust and accelerate commercialization. The adoption of bendable and foldable displays in new applications such as laptops, wearables, and automotive interfaces not only expands their revenue base but also makes this segment a major driver of the flexible screens market's continued growth.

Technology Insights

The OLED/FOLED segment is expected to grow at a significant rate over the projected period, with the highest revenue of over 55% in 2024. This technology is characterized by its exceptional display performance and compatibility with bendable and foldable products. OLED/FOLED technology has surpassed traditional display technologies in areas such as contrast ratios, color reproduction, response speed, and energy consumption, making it the best choice for not only foldable smartphones, wearables, and curved automotive displays but also hi-tech consumer electronics. Because OLEDs emit light themselves, they do not require backlighting, allowing thinner, lighter, and more flexible displays that are precisely what manufacturers request for innovative form factors.

Besides, the introduction of the new technology brand is expected to significantly contribute to the market growth. One example is LG Display, the world's major innovator of display technologies, announcing in December 2025 that it is launching its first new OLED technology brands—Tandem WOLED and Tandem OLED—for the first time in 13 years, as well as seeking to actively communicate its OLED technology philosophy and differentiated customer value.

Panel Size Insights

The 6’’ - 20’’ segment is expected to grow substantially over the forecast period. The reason is that it encompasses a whole variety of highly versatile devices that offer both portability and a good-sized screen. Devices included in this range are foldable and bendable smartphones (around 6"), larger foldable tablets, compact laptops, and flexible infotainment or digital signage panels. As consumer demand for devices that deliver immersive experiences without compromising convenience increases, manufacturers are adopting increasingly flexible screens in this segment, which will lead to higher unit shipments and, in turn, stronger revenue generation. The mentioned sizes are also used in high-end devices, which typically have the highest average selling prices, thereby further increasing market value.

Besides, continuous development in flexible OLED/FOLED technology and manufacturing processes has improved the performance and yields of displays in this range, enabling their commercialization on a larger scale. The 6"-20" category is a key driver of the flexible screen market, as it can be applied to mobile devices, tablets, automotive applications, and emerging applications.

Application Insights

The smartphones & tablets segment is expected to grow substantially over the forecast period. Flexible displays have been commercially used mainly in the most common devices. Manufacturers are equipping high-end devices with flexible screens, primarily foldable and bendable OLED panels, because consumers are gradually becoming accustomed to large screens, improved multitasking, and immersive experiences that are not constrained by device size. This not only increases shipment volume but also raises average selling prices, as flexible-screen smartphones and tablets usually cost more than their rigid-screen counterparts. Innovations in hinge mechanisms, durability, and display performance continue to attract consumers who repeatedly buy the product, thereby contributing to market growth.

Regional Insights

What factors help Asia Pacific dominate the Flexible Screens market during the forecast period?

The Asia Pacific dominates the flexible screens market with a revenue share of more than 40% over the projected period. The demand for foldable and bendable consumer electronics, including smartphones, tablets, and wearables, is a major reason for the growth, and it is especially high in countries with large populations like China, South Korea, Japan, and India, along with their rising disposable incomes, which make it easier for people to adopt the latest display technologies.

Furthermore, the region is home to the largest players in display manufacturing, such as Samsung Display, LG Display, and BOE Technology Group, which not only have the highest production capacities for flexible OLEDs but also engage in R&D that inevitably drives supply and technological sophistication.

Moreover, the convergence of government support, robust supply chain ecosystems, and expansion into new applications, such as automotive dashboards and smart wearables, has made the market substantially more diverse. All these elements working together make Asia Pacific the central growth engine for the flexible screens market.

Flexible Screens Market: Competitive Analysis

The global flexible screens market is dominated by players like:

- Samsung Display Co. Ltd.

- BOE Technology Group Co. Ltd.

- LG Display Co. Ltd.

- Visionox Technology Inc.

- AU Optronics Corp.

- Tianma Microelectronics Co. Ltd.

- Shenzhen Royole Technologies Co. Ltd.

- E Ink Holdings Inc.

- HannStar Display Corporation

- Everdisplay Optronics (Shanghai) Co. Ltd.

- Iljin Display Co. Ltd.

- Shenzhen RADIANT Technology Co. Ltd.

- Osel Technology Pvt. Ltd.

The global flexible screens market is segmented as follows:

By Functionality

- Bendable and Foldable Display

- Rollable Display

By Technology

- OLED/FOLED

- POLED

- AMOLED

- Electronic Paper Display (EPD)

By Panel Size

- Up to 6’’

- 6’’ - 20’’

- Above 20’’

By Application

- Smartphones & Tablets

- Smartwatches & Wearables

- Laptops

- E-Readers

- Television

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed