Global Flexible Packaging Market Size, Share, Growth Analysis Report - Forecast 2034

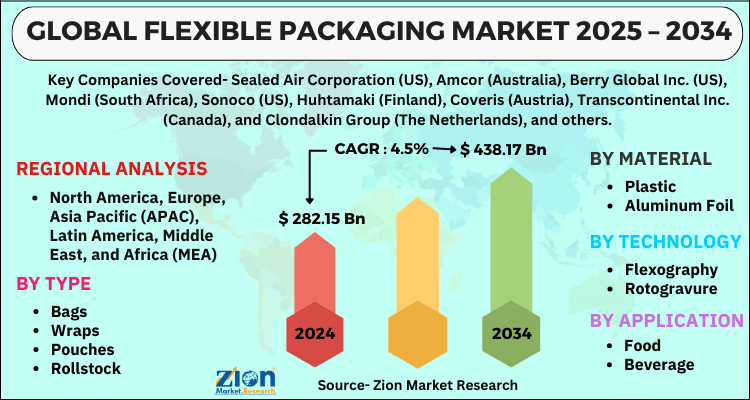

Flexible Packaging Market By Type (Bags, Wraps, Pouches, Rollstock, Others (Include Labels, Stick Packs And Sachets)), By Material (Plastic, Aluminum Foil, Others (Include Coating, Ink, Coating, And Adhesive)), Technology (Flexography, Rotogravure, Digital Printing, Others (Include Screen, Offset, And Letterpress Printing)), Application (Food, Beverage, Pharma & Health Care, Personal Care & Cosmetics, Others (Includes Consumer Goods, Oil & Lubricants, Agriculture, Automotive, Household Products, Tobacco, And Sporting Goods)), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

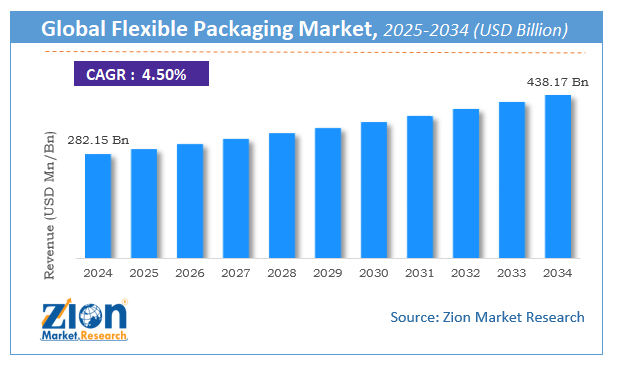

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 282.15 Billion | USD 438.17 Billion | 4.5% | 2024 |

Flexible Packaging Industry Perspective:

The global flexible packaging market size was worth around USD 282.15 Billion in 2024 and is predicted to grow to around USD 438.17 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 4.5% between 2025 and 2034. The report analyzes the global flexible packaging market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the flexible packaging industry.

Flexible Packaging Market: Overview

Flexible packaging has gained substantial demand over the past few years as innovation in the packaging industry has seen a major impetus owing to changing consumer preferences and requirements in multiple end-use applications across various industry verticals.

Rising demand for packaging solutions, increasing sales of multiple products, increasing focus on sustainable packaging, increasing disposable income, the growing popularity of online sales channels, and the emergence of e-commerce are expected to be major factors influencing flexible packaging market growth through 2028.

Flexible packaging market is experiencing the highest growth rate in developed as well as developing countries. The advancements of technology in flexible packaging have resulted in upgradation and innovation in the product development in many sectors of the industry. Many organizations are significantly investing their capital in research and development in order to come up with the exclusive and economical products. Hence, the innovations, particularly in the packaging industry are rising exponentially. In July 2017, the American Packaging Company made investments in a digital system.

That system was designed to serve the purpose for flexible packaging to enable greater choice of products from consumer’s point of view. In addition, the rising middle-class population followed by the significant change in their lifestyle is contributing to the growth of the market. This has led to the ever increasing and growing need of the consumers. In the modern world, there has been a rising consumption of food among the population. So, consumers prefer an easy, simplistic, and convenient method of packaging those food products which are basically ready to eat or ready to serve. Hence, such factors are contributing to the flexible packaging market growth over the forecast period.

Key Insights

- As per the analysis shared by our research analyst, the global flexible packaging market is estimated to grow annually at a CAGR of around 4.5% over the forecast period (2025-2034).

- Regarding revenue, the global flexible packaging market size was valued at around USD 282.15 Billion in 2024 and is projected to reach USD 438.17 Billion by 2034.

- The flexible packaging market is projected to grow at a significant rate due to increasing demand for lightweight, cost-effective, and sustainable packaging solutions in food, pharmaceuticals, and e-commerce industries.

- Based on Type, the Bags segment is expected to lead the global market.

- On the basis of Material, the Plastic segment is growing at a high rate and will continue to dominate the global market.

- Based on the Technology, the Flexography segment is projected to swipe the largest market share.

- By Application, the Food segment is expected to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Flexible Packaging Market: Growth Drivers

Cost-Effective Nature

Research and development in the packaging industry have bolstered over the past few years and the world has seen some major innovations in this field owing to constant changes in the packaging industry landscape. Flexible packaging has emerged as a popular choice due to its cost-effective nature and longer shelf life than that other packaging options. Other than that the changing demand for more nimble and delicate packaging in an affordable manner has fostered the demand for flexible packaging products through 2028

Flexible Packaging Market: Restraints

Lack of Efficient Recycling Infrastructure

Packaging trends have drastically evolved over recent years but the packaging recycling infrastructure has not seen development and is still pretty much outdated which makes it a huge challenge for flexible packaging manufacturers to end their product lifecycle in an eco-friendly manner. With no proper infrastructure to recycle the flexible packaging waste, there will be a drop in the adoption of this type of packaging and thus will act as a major restraining factor to the growth of the flexible packaging market through 2028.

Flexible Packaging Market: Opportunities

Increasing Demand for Sustainable Packaging

Increasing focus on waste management has substantially propelled the demand for sustainable products and since packaging waste is a major contributor to the global waste problem, the need to develop sustainable packaging is more prominent than it was ever before and hence this is expected to provide a lucrative opportunity to flexible packaging market players over the forecast period. Increasing research and development activity to develop eco-friendly sustainable packaging is expected to be a major trend for flexible packaging market growth through 2028 and flexible packaging market players are expected to capitalize on this trend over the forecast period to boost their profit numbers.

Flexible Packaging Market: Challenges

Increasing Environmental Concerns regarding the use of Plastic

Plastic is and has been a major part of all kinds of packaging across the world and since plastic is a major harm to the environment its use is being restricted and limited across the world. These restrictions are expected to be major challenges for flexible packaging market growth through 2028. Increasingly stringent mandates about the use of plastic in packaging are anticipated to prove to be a major challenge for multiple flexible packaging companies across the world.

Global Flexible Packaging Market: Segmentation

The global flexible packaging market is segregated based on type, material, technology, application, and region.

Based on Type, the global flexible packaging market is divided into Bags, Wraps, Pouches, Rollstock, Others (Include Labels, Stick Packs And Sachets).

By Material, the market is divided into plastic, aluminum foil, and others (including coating, ink, coating, and adhesive). The plastic segment is expected to maintain a dominant outlook throughout the forecast period but is expected to see a decline in popularity by the end of the forecast period owing to increasing efforts to phase out plastic from the packaging industry to comply with sustainability goals.

By Technology, the global flexible packaging market is split into Flexography, Rotogravure, Digital Printing, Others (Include Screen, Offset, And Letterpress Printing).

By Application, the flexible packaging market is segmented into food, beverage, pharma & health care, personal care & cosmetics, and others (including consumer goods, oil & lubricants, agriculture, automotive, household products, tobacco, and sporting goods). The food and beverages segments are expected to lead the market. The pharma and health segment is anticipated to see a substantial increase in demand through 2028.

Flexible Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Flexible Packaging Market |

| Market Size in 2024 | USD 282.15 Billion |

| Market Forecast in 2034 | USD 438.17 Billion |

| Growth Rate | CAGR of 4.5% |

| Number of Pages | 135 |

| Key Companies Covered | Sealed Air Corporation (US), Amcor (Australia), Berry Global Inc. (US), Mondi (South Africa), Sonoco (US), Huhtamaki (Finland), Coveris (Austria), Transcontinental Inc. (Canada), and Clondalkin Group (The Netherlands), and others. |

| Segments Covered | By Type, By Material, By Technology, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Flexible Packaging Market: Regional Analysis

Asia Pacific region leads the global flexible packaging market in terms of revenue and volume share and is anticipated to hold a dominant stance over the forecast period through 2028. Increasing disposable income, the growing popularity of e-commerce and online shopping, the presence of key flexible packaging companies, and rising demand for ready-to-eat foods and consumables are some of the major factors propelling market growth through 2028.

The market for flexible packaging in Europe is expected to significant demand owing to the rising demand for packaging in the pharmaceutical industry vertical. The personal care and cosmetics industry in this region is also expected to drive flexible packaging market growth over the forecast period.

Recent Developments

- In November 2021 – Smurfit Kappa a leading name in the packaging industry announced that it had started production of its new packaging bags with a new and more sustainable thermos-laminated film. The films of this new lamination are bonded without adhesives and hence make for a more sustainable option than conventional films.

Flexible Packaging Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the flexible packaging market on a global and regional basis.

The global flexible packaging market is dominated by players like:

- Sealed Air Corporation (US)

- Amcor (Australia)

- Berry Global Inc. (US)

- Mondi (South Africa)

- Sonoco (US)

- Huhtamaki (Finland)

- Coveris (Austria)

- Transcontinental Inc. (Canada)

- and Clondalkin Group (The Netherlands)

The global flexible packaging market is segmented as follows:

By Type

- Bags

- Wraps

- Pouches

- Rollstock

- Others (include Labels, stick packs and sachets)

By Material

- Plastic

- Aluminum Foil

- Others (Include Coating, Ink, Coating, And Adhesive)

By Technology

- Flexography

- Rotogravure

- Digital Printing

- Others (including Screen, Offset, And Letterpress Printing)

By Application

- Food

- Beverage

- Pharma & Health Care

- Personal Care & Cosmetics

- Others (Includes Consumer Goods, Oil & Lubricants, Agriculture, Automotive, Household Products, Tobacco, And Sporting Goods)

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Flexible packaging is a type of packaging made from easily shaped materials like plastic, foil, or paper. It is used to package a wide variety of products and is valued for being lightweight, cost-effective, and offering extended shelf life through airtight sealing.

The global flexible packaging market is expected to grow due to increasing demand for lightweight, sustainable, and cost-effective packaging solutions in various industries.

According to a study, the global flexible packaging market size was worth around USD 282.15 Billion in 2024 and is expected to reach USD 438.17 Billion by 2034.

The global flexible packaging market is expected to grow at a CAGR of 4.5% during the forecast period.

Asia-Pacific is expected to dominate the flexible packaging market over the forecast period.

Leading players in the global flexible packaging market include Sealed Air Corporation (US), Amcor (Australia), Berry Global Inc. (US), Mondi (South Africa), Sonoco (US), Huhtamaki (Finland), Coveris (Austria), Transcontinental Inc. (Canada), and Clondalkin Group (The Netherlands), among others.

The report explores crucial aspects of the flexible packaging market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed