Fiber Optic Cables for Military & Aerospace Market Size, Share, Report 2034

Fiber Optic Cables for Military and Aerospace Market By Type (Multi-Mode and Single-Mode), By Application (Navigation Systems & Inertial Guidance, Avionics & On-board Communications, Radar, Surveillance, Reconnaissance & Sensor Systems, Weapon Systems, Tactical & Communications Networks, Structural Health Monitoring & Environmental/Physical Sensing, and Others), By End-Use (Civil, Military, and Space), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

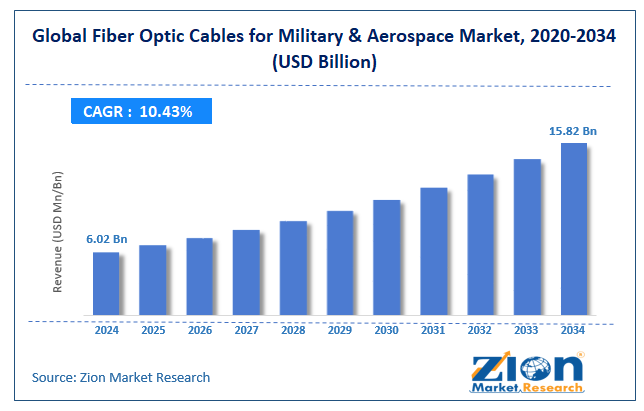

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.02 Billion | USD 15.82 Billion | 10.43% | 2024 |

Fiber Optic Cables for Military and Aerospace Industry Prospective:

The global fiber optic cables for military & aerospace market size was worth around USD 6.02 billion in 2024 and is predicted to grow to around USD 15.82 billion by 2034 with a compound annual growth rate (CAGR) of roughly 10.43 % between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global fiber optic cables for military & aerospace market is estimated to grow annually at a CAGR of around 10.43 % over the forecast period (2025-2034).

- In terms of revenue, the global fiber optic cables for military & aerospace market size was valued at around USD 6.02 billion in 2024 and is projected to reach USD 15.82 billion by 2034.

- The market is projected to grow at a significant rate due to being positively influenced by the growing military expenditure worldwide.

- Based on the type, the single-mode segment is growing at a high rate and will continue to dominate the global market, as per industry projections.

- Based on the application, the tactical & communication networks segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Fiber Optic Cables for Military and Aerospace Market: Overview

Fiber optic cables are new and advanced materials that enable secure, encrypted, and high-speed communication. Fiber optic cables, until a few years ago, were considered impractical. However, over the years, these communication cables have become an integral part of the modern military and aerospace industries. Fiber optic cables are powered by light for communication purposes instead of electricity. Hence, they are widely popular to ensure high-speed information exchange in critical settings such as aerospace and defense. According to industry analysis, fiber optic cables in military & aerospace applications allow intelligence, real-time, controlled, and targeted exchange of information. During the forecast period, demand for fiber optic cables for military & aerospace is expected to continue growing, driven by several factors.

For instance, increasing military expenditure worldwide, along with growing investments in developing robust aerospace infrastructure, will propel global market growth in the long run. Additionally, advancements in fiber optics technology, along with the greater need for cables for projects in outer space, will create new growth opportunities. The industry may face growth limitations due to the high cost of investment and competition from alternative technologies.

Fiber Optic Cables for Military and Aerospace Market Dynamics

Growth Drivers

What will be the influence of increasing military expenditure on the fiber optic cables of the military & aerospace market growth?

The global fiber optic cables for military & aerospace market is expected to be positively influenced by the growing military expenditure worldwide. In the last decade, several economies have registered higher investments in upgrading military infrastructure, including communication channels for secure exchange of information. These investments are further fueled by growing global social-political conflict and geopolitical tensions. For instance, in October 2025, the US Army was reported to be seeking private investments from agencies such as KKR, Apollo, Cerberus, and Carlyle to raise USD 150 billion. The military agency is expected to use the fund to modernize its military infrastructure in the coming decade.

According to official reports, the North Atlantic Treaty Organization (NATO) bought defense equipment worth USD 21 billion from the US in 2024 alone. Similarly, other countries, including developing nations, are working on strengthening their military base to ensure national security against internal and external harmful elements. Secure communication is an integral part of the comprehensive defense infrastructure, creating demand for fiber optic cables in the long run.

Surging investments in the aerospace sector are offering higher growth opportunities to the industry players

The global fiber optic cables for military & aerospace market is expected to be further influenced by the growing investments in the aerospace industry. Rising demand for military and commercial aircraft has fueled the use of fiber optics for real-time communication. According to industry analysis, fiber optic cables can withstand harsh environments, including moisture, heat, and vibration.

In addition to this, fiber optic cables are lightweight compared to copper cables, ensuring that the aircraft’s weight remains low. The ineffectiveness of magnetic fields in disturbing the performance of fiber optic cables further encouraged the use of the communication systems in the aerospace industry. As investments in the aerospace industry seek new heights, demand for fiber optic cables will continue to grow.

Restraints

How will the high cost of investment limit fiber optic cables for the military & aerospace market growth?

The global industry for fiber optic cables for military & aerospace is expected to be restricted due to the high amount of investment associated with the market. As compared to copper-based cable communication systems, fiber optics is more advanced and hence expensive to deploy and maintain. In addition to this, the overall expense of using fiber optic solutions is further influenced by the use of specialized connectors and certifications.

Opportunities

Growing advancements in fiber optic cable technology offer new growth opportunities

The global industry for fiber optic cables for military & aerospace market is expected to generate growth opportunities due to rising advancements in the technology. Reports suggest increased investments in next-generation fiber optic cables that will allow more secure, faster, and reliable data transfer. The growing expansion of end applications, including unmanned vehicles and electronic warfare (EW), has created demand for more robust fiber optic cables.

In August 2025, Nortech Systems, one of the world’s leading providers of digital connectivity solutions and data management engineering, announced a patent for non-magnetic expanded beam fiber optic cables. According to official claims, the technology is ruggedized for effective performance even in the most demanding environments. It introduces a hybrid solution that works as an integration of electrical and optical elements.

In August 2025, Pasternack, a leading provider of microwave and millimeter-wave products, launched its five-year range of fiber optic cable assemblies along with same-day delivery. The company will offer standard and custom solutions to meet the needs of evolving consumer groups.

Challenges

Competition from alternative technologies is expected to challenge market expansion during the forecast period

The global fiber optic cables for military & aerospace market is expected to be challenged by the growing introduction of alternative technologies. Some of the prominent competing solutions include wireless communication systems, Free‑Space Optical (FSO) communication, and copper cable networks. The growing technological advancements in alternative solutions will lead to fragmented revenue for fiber optic cables for military & aerospace applications.

Fiber Optic Cables for Military and Aerospace Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Fiber Optic Cables for Military & Aerospace Market |

| Market Size in 2024 | USD 6.02 Billion |

| Market Forecast in 2034 | USD 15.82 Billion |

| Growth Rate | CAGR of 10.43% |

| Number of Pages | 240 |

| Key Companies Covered | Corning Incorporated, Prysmian Group, TE Connectivity plc, Sumitomo Electric Industries, Ltd., Radiall, Carlisle Interconnect Technologies, Collins Aerospace, Optical Cable Corporation, W. L. Gore & Associates, Inc., OFS Fitel, LLC, AFL, Timbercon, Inc., Nexans, Amphenol Corporation, and Lynxeo SAS |

| Segments Covered | By Type, By Application, By End-Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, and The Middle East & Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Fiber Optic Cables for Military and Aerospace Market: Segmentation

The global fiber optic cables for military & aerospace market is segmented based on type, application, end-use, and region.

Based on type, the global market segments are multi-mode and single-mode. In 2024, the highest growth was listed in the single-mode segment, driven by higher applications of the cable type in the military and aerospace sectors. As per industry research, single-mode fiber optic cables deliver higher efficiency in terms of transmission over long distances. Additionally, due to their high bandwidth, single-mode solutions are highly preferred.

Based on application, the global market divisions are navigation systems & inertial guidance, avionics & on-board communications, radar, surveillance, reconnaissance & sensor systems, weapon systems, tactical & communication networks, structural health monitoring & environmental/physical sensing, and others. In 2024, the highest revenue was listed in the tactical & communication networks, driven by significant demand for secure and rapid communication in military and aerospace applications. Significant CAGR is expected to be observed in the structural health monitoring & environmental/physical sensing and avionics & on-board communications segments during the forecast period.

Fiber Optic Cables for Military and Aerospace Market: Regional Analysis

Why will North America take the lead in the fiber optic cables for the military & aerospace market?

The global fiber optic cables for military & aerospace market is expected to be led by North America during the forecast period. The US will dominate the regional industry, driven by the presence of a robust military infrastructure with a global footprint. The US is one of the world’s largest producers and suppliers of defense technologies equipped with high-end features. The US military exports, according to official reports, witnessed unprecedented growth between 2021 and 2024, driven by rising exports of the technologies to other countries, with Ukraine emerging as the most prominent importer of US defense systems.

Europe is a significant market with higher growth potential. The regional industry is led by France and Germany. The former has witnessed increased domestic investments in expanding its military infrastructure. Moreover, the growing demand for fiber optic cables for the regional aerospace industry will fuel higher revenue across Europe in the coming years. The ongoing regional investments in technological expansion of fiber optic cables, fueled by growing spending on the commercial aerospace industry, will promote market expansion in the long run.

Fiber Optic Cables for Military and Aerospace Market: Competitive Analysis

The global fiber optic cables for military and aerospace market is led by players like;

- Corning Incorporated

- Prysmian Group

- TE Connectivity plc

- Sumitomo Electric Industries Ltd.

- Radiall

- Carlisle Interconnect Technologies

- Collins Aerospace

- Optical Cable Corporation

- W. L. Gore & Associates, Inc.

- OFS Fitel, LLC

- AFL

- Timbercon, Inc.

- Nexans

- Amphenol Corporation

- Lynxeo SAS

Fiber Optic Cables for Military and Aerospace Market: Key Market Trends

Surging investments in outer space projects

One of the leading sectors fueling demand for fiber optic cables for military & aerospace applications has emerged in the form of growing investments in projects related to outer space. These initiatives drive demand for robust and high-performance fiber optic cables offering growth opportunities to the industry players.

Miniaturization of fiber optic cables

The demand for miniaturized fiber optic cables has increased in the last few years. This trend is driven by growing investments in light-weight aircrafts including military-grade and commercial vehicles. Miniaturized solutions will offer extended growth in the coming years.

The global fiber optic cables for military and aerospace market is segmented as follows:

By Type

- Multi-Mode

- Single-Mode

By Application

- Navigation Systems & Inertial Guidance

- Avionics & On-board Communications

- Radar

- Surveillance

- Reconnaissance & Sensor Systems

- Weapon Systems

- Tactical & Communications Networks

- Structural Health Monitoring & Environmental / Physical Sensing

- Others

By End-Use

- Civil

- Military

- Space

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed