Fiber Optic Cable Market Size, Share, Trends, Growth & Forecast 2034

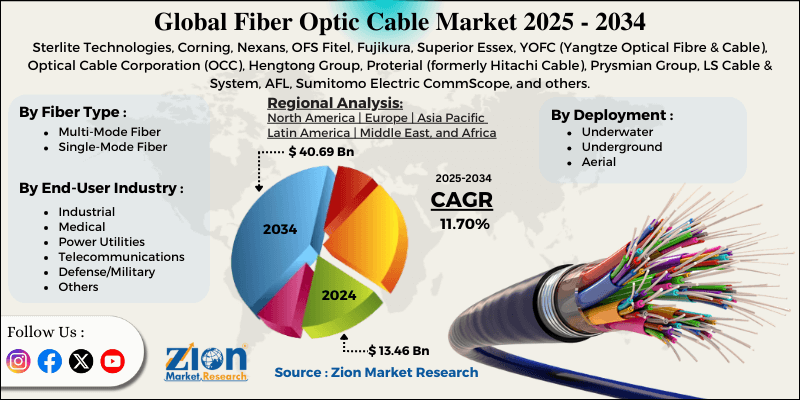

Fiber Optic Cable Market By Fiber Type (Multi-Mode Fiber and Single-Mode Fiber), By Deployment (Underwater, Underground, and Aerial), By End-User Industry (Industrial, Medical, Power Utilities, Telecommunications, Defense/Military, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

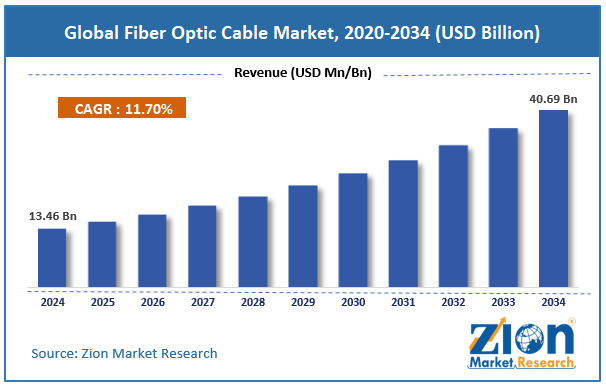

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 13.46 Billion | USD 40.69 Billion | 11.70% | 2024 |

Fiber Optic Cable Industry Perspective:

The global fiber optic cable market size was worth around USD 13.46 billion in 2024 and is predicted to grow to around USD 40.69 billion by 2034 with a compound annual growth rate (CAGR) of roughly 11.70% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global fiber optic cable market is estimated to grow annually at a CAGR of around 11.70% over the forecast period (2025-2034)

- In terms of revenue, the global fiber optic cable market size was valued at around USD 13.46 billion in 2024 and is projected to reach USD 40.69 billion, by 2034.

- The market is projected to grow at a significant rate due to the growing expansion of the internet industry worldwide.

- Based on the fiber type, the single-mode segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the end-user industry, the telecommunications segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Fiber Optic Cable Market: Overview

A fiber optic cable is a cable network consisting of glass fibers encapsulated in an insulating coating. Fiber optic cables are designed to carry out high-performance, long-distance data networking. They also facilitate modern telecommunication infrastructure. Fiber optic cables make use of light signals for transmitting data, unlike conventional electrical signals. Light pulses used by fiber optic cables are generated using small light-emitting diodes (LEDs) or lasers. According to industry research, fiber optic cables are a part of the most critical segments of modern internet architecture. They are also used in telephone systems worldwide and in the cable television industry. The two main segments of fiber optic cable include multi-mode and single-mode variants. The former leverages LEDs while the latter uses thin glass strands and a laser for generating light.

Some of the main advantages of fiber optic cables include minimal interference, higher data transfer capacity, and coverage of longer distances without losing signal strength. The demand for fiber optic cables is expected to be driven by the growing investments in developing internet infrastructure worldwide, especially in emerging economies. Moreover, investments in the expansion of data centers and networking solutions will facilitate higher revenue for the industry players in the coming years.

Fiber Optic Cable Market: Growth Drivers

Growing expansion of the internet industry worldwide will promote market expansion in the coming years

The global fiber optic cable market is expected to benefit from the rapid expansion of the internet sector worldwide. The rising population, increasing disposable income, and accelerated digitization are some of the leading factors for increased demand for faster and more reliable internet architecture. In addition to this, businesses worldwide rely heavily on high-capacity and superior-performance internet connectivity. According to industry analysis, businesses can lose more than USD 1.49 million per day in case of an internet outage. Fiber optic cables are the main elements supporting modern internet infrastructure in the majority parts of the world. Emerging economies such as India and African nations are investing heavily in upgrading the existing internet architecture with the ones facilitated by fiber optic cables.

For instance, in April 2023, the National Highways Authority of India (NHAI) announced its plans to develop around 10,000 kilometers of Optic Fibre Cables (OFC) infrastructure between the financial year 2024-2025. In May 2024, R&M, one of the leading developers and providers of high-end infrastructure solutions for data and communications networks, launched its new fiber optic plant in the Indian market.

Rising development of more efficient cables to push market revenue to new heights

Industry players are investing in developing more efficient and high-performance cables as end-user expectations continue to evolve. The recent innovations in fiber optic cable technology are expected to further help the industry thrive in the coming years. For instance, in April 2025, Ducab Group announced the launch of the Gulf Cooperation Council’s (GCC)first High Voltage (HV) fiber optic cable in Dubai.

The product offers high-voltage power transmission using breakthrough fiber optic technology. It offers assistance to greener, smarter, and highly resilient energy networks. Another such advancement in the global fiber optic cable market was listed in the form of the launch of high-density, 864F Micro Cables by STL in July 2024.

Fiber Optic Cable Market: Restraints

High cost of initial investment to limit market expansion in the future

The global fiber optic cable industry is projected to be restricted due to the high cost of initial investment associated with the market. Fiber optic cable layering is a resource-intensive process since it requires extensive labor hours. The cost of laying fiber optical cables in remote areas or rough terrains with poor goods transportation infrastructure may further increase the overall investment cost associated with the market.

Fiber Optic Cable Market: Opportunities

Expansion in data center industry and subsea infrastructure to generate growth opportunities during the forecast period

The global fiber optic cable market is expected to generate growth opportunities due to the rising expansion of the cables in the data center industry. According to official statistics, countries worldwide are scaling the development of robust data centers. The rapid growth of the Artificial Intelligence (AI) race is promoting increasing investments in data centers. These facilities are powered by high-bandwidth fiber links that also have extremely low latency rates. In August 2024, Lumen Technologies announced a partnership with Corning Incorporated. The latter is expected to supply substantial volumes of next-generation optical cable.

According to the agreement, Corning has to reserve 10% of its optical fiber capacity for each of the next two years to develop a robust connection between AI-equipped data centers by Lumen Technologies. Furthermore, the growing applications of fiber optical cable in subsea infrastructure globally may further open new avenues for improved growth for the market players. For instance, India has recently launched three new subsea cable projects as the country aims to take major steps in digital connectivity development. The country has invested in projects titled India-Asia-Express (IAX), 2Africa Pearls, and India-Europe-Express (IEX) and they are anticipated to quadruple internet capacity in the country.

Fiber Optic Cable Market: Challenges

Rising competition from alternate technologies and regulatory hurdles impact market revenue

The global fiber optic cable industry is projected to be challenged by the growing competition from alternative technologies such as wireless connectivity, microwave communication, and satellite internet. Additionally, the industry for fiber optic cables is heavily regulated and requires companies to obtain permits for regional official bodies to operate. It can further impact market expansion and regulatory policies continue to evolve.

Fiber Optic Cable Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Fiber Optic Cable Market |

| Market Size in 2024 | USD 13.46 Billion |

| Market Forecast in 2034 | USD 40.69 Billion |

| Growth Rate | CAGR of 11.70% |

| Number of Pages | 221 |

| Key Companies Covered | Sterlite Technologies, Corning, Nexans, OFS Fitel, Fujikura, Superior Essex, YOFC (Yangtze Optical Fibre & Cable), Optical Cable Corporation (OCC), Hengtong Group, Proterial (formerly Hitachi Cable), Prysmian Group, LS Cable & System, AFL, Sumitomo Electric CommScope, and others. |

| Segments Covered | By Fiber Type, By Deployment, By End-User Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Fiber Optic Cable Market: Segmentation

The global fiber optic cable market is segmented based on fiber type, deployment, end-user industry, and region.

Based on the fiber type, the global market divisions are multi-mode fiber and single-mode fiber. In 2024, the highest growth was listed in the single-mode segment. This type of fiber has an optic core of not more than 9 µm and hence can be used for transmitting data over longer distances with minimal interference. According to industry analysis, the multi-mode segment is projected to deliver a CAGR of more than 8.51% in the coming years.

Based on deployment, the global fiber optic cable industry is divided into underwater, underground, and aerial.

Based on the end-user, the global market divisions are industrial, medical, power utilities, telecommunications, defense/military, and others. In 2024, the highest revenue was listed in the telecommunications segment dominating nearly 29.6% of the total market. Increasing investment in 5G networking solutions and increasing spending on digital connections worldwide will facilitate exceptional segmental expansion in the future. The defense/military is projected to grow at a CAGR of over 14.03% during the projection period.

Fiber Optic Cable Market: Regional Analysis

North America to take the lead during the forecast period

The global fiber optic cable market is projected to be led by North America during the projection period. In 2024, the region held prominence over 28% of the global revenue. The regional dominance is a result of the increased adoption of advanced networking solutions across major economies such as the US and Canada.

Moreover, increasing government support and private investments in 5G infrastructure will facilitate higher demand for fiber optic cables in the coming years. Europe is a significant revenue generator. In 2024, it contributed to around 21.81% of the final revenue with countries such as Germany and the UK acting as key regional market drivers. The growing regional demand for low-latency and high-speed internet connectivity will fuel improved revenue in Europe.

During the projection period, the UK is expected to deliver a CAGR of more than 11.45% due to the increasing use of fiber optic cables for surveillance & security purposes. Asia-Pacific will emerge as the fastest-growing region during the forecast period. China, Japan, and India will lead regional expansion according to estimates. Japan is expected to account for nearly 20% of regional revenue by the end of the projection duration. Increasing investments in large-scale data centers, 5G and 6G networking solutions, and subsea infrastructure will propel regional expansion in the future.

Fiber Optic Cable Market: Competitive Analysis

The global fiber optic cable market is led by players like:

- Sterlite Technologies

- Corning

- Nexans

- OFS Fitel

- Fujikura

- Superior Essex

- YOFC (Yangtze Optical Fibre & Cable)

- Optical Cable Corporation (OCC)

- Hengtong Group

- Proterial (formerly Hitachi Cable)

- Prysmian Group

- LS Cable & System

- AFL

- Sumitomo Electric CommScope

The global fiber optic cable market is segmented as follows:

By Fiber Type

- Multi-Mode Fiber

- Single-Mode Fiber

By Deployment

- Underwater

- Underground

- Aerial

By End-User Industry

- Industrial

- Medical

- Power Utilities

- Telecommunications

- Defense/Military

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A fiber optic cable is a cable network consisting of glass fibers encapsulated in an insulating coating.

The global fiber optic cable market is expected to benefit from the rapid expansion of the internet sector worldwide.

According to study, the global fiber optic cable market size was worth around USD 13.46 billion in 2024 and is predicted to grow to around USD 40.69 billion by 2034.

The CAGR value of fiber optic cable market is expected to be around 11.70% during 2025-2034.

The global fiber optic cable market is projected to be led by North America during the projection period.

The global fiber optic cable market is led by players like Sterlite Technologies, Corning, Nexans, OFS Fitel, Fujikura, Superior Essex, YOFC (Yangtze Optical Fibre & Cable), Optical Cable Corporation (OCC), Hengtong Group, Proterial (formerly Hitachi Cable), Prysmian Group, LS Cable & System, AFL, Sumitomo Electric and CommScope.

The report explores crucial aspects of the fiber optic cable market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed