Global Fertility Services Market Size, Share, Growth Analysis Report - Forecast 2034

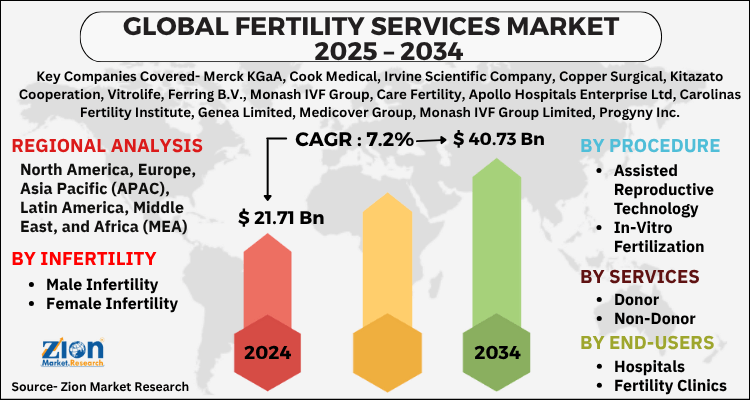

Fertility Services Market By Infertility (Male Infertility, Female Infertility), By Procedure (Assisted Reproductive Technology, In-Vitro Fertilization, Artificial Insemination, Surrogacy, Others), Services (Donor, Non-Donor), End-User (Hospitals, Fertility Clinics, Clinical Research Institutes, Surgical Centers), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

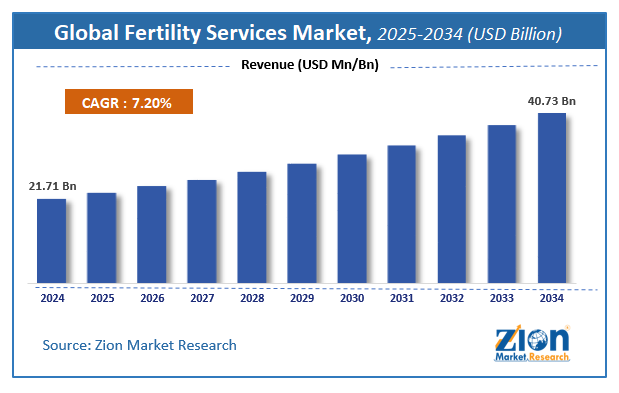

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 21.71 Billion | USD 40.73 Billion | 7.2% | 2024 |

Fertility Services Market: Industry Perspective

The global fertility services market size was worth around USD 21.71 Billion in 2024 and is predicted to grow to around USD 40.73 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 7.2% between 2025 and 2034. The report analyzes the global fertility services market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the fertility services industry.

The services provided regarding fertilization to the infertile population are known as fertility services. In these services, the healthcare professionals assist for reproduction through various techniques, such as IVF, ART, surrogacy, and a few others. Increasing infertility ratio is one of the major factors triggering the growth of the fertility services market. Moreover, growing public awareness about infertility and the available treatment options will also boost the market significantly during the forecast period. The decreasing fertility rate in males and females can be due to numerous reasons, such as increasing cases of prostate cancer is one of the leading cause of infertility in males as it requires removal of the prostate gland which leads to infertility.

Fertility Services Market: Overview

The fertility service sector is an exclusive service that helps people like couples, single mothers, the LGBT community, and poor marginal people. Treatments like Vitro Fertilization, Artificial Insemination, and surrogacy are given to the new mothers for getting pregnant. Low sperm count, low sperm mobility, and abnormal sperm have become common these days which results in many hormonal imbalances and impairment of sex organs. Rashes and overheated testicles are common reasons for pregnancy issues that are treated in the infertility service sector. Even the probability of getting conceived could come down for women due to many issues like smoking, constant consumption of alcohol, eating disorders, obesity, and stress.

There are many varieties of reasons for impotency of people and all of them can be diagnosed and treated in the fertility service sector. Fertility service sectors are filled with mechanisms and techniques that involve any kind of procreation to start a family. They cure and mend all kinds of genetic issues and infertility problems that help out in conception.

In Vitro fertilization, artificial insemination, surrogacy, and all other methods are employed by the fertility service sectors to cure impotency. Even the male infertility issues have a resolution here and it is offered at affordable prices. The proper functioning of the hypothalamus and pituitary glands is also structured and resurrected in this fertility service sector.

Key Insights

- As per the analysis shared by our research analyst, the global fertility services market is estimated to grow annually at a CAGR of around 7.2% over the forecast period (2025-2034).

- Regarding revenue, the global fertility services market size was valued at around USD 21.71 Billion in 2024 and is projected to reach USD 40.73 Billion by 2034.

- The fertility services market is projected to grow at a significant rate due to rising infertility rates, increasing awareness about assisted reproductive technologies, and advancements in ivf procedures.

- Based on Infertility, the Male Infertility segment is expected to lead the global market.

- On the basis of Procedure, the Assisted Reproductive Technology segment is growing at a high rate and will continue to dominate the global market.

- Based on the Services, the Donor segment is projected to swipe the largest market share.

- By End-User, the Hospitals segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Fertility Services Market: Growth Drivers

The rate of infertility has increased due to factors such as a rise in alcohol consumption and intake of drugs. Stress levels and smoking has also seen a rapid increase due to environmental factors which indirectly has shot up the demand. These reasons have contributed heavily to the market growth

The delay in pregnancies in women also escalates the market growth. The technological advancements across the world in infertility treatment also aid market growth prospectively. Poor sperm morphology and low sperm count in men along with an increase in accessibility are also augmenting growth. Apart from all this, the rise in accessibility and increasing proximity of healthcare facilities act as growth drivers of the market incessantly. The recent spike in modernization along with all the research and development sectors also boosts the market growth.

The insurance coverage for IVF procedures and an increase in the number of IVF procedures due to male infertilities and ovarian failures spike up the demand for fertility services. The government funding programs and novel IVF solutions have become more prominent. Same-sex marriages have also become a trend that stimulates growth exclusively. Late parenthood as a lifestyle coupled with rising disposable income also triggers market growth. The increasing number of prostate cancer has increased the demand for the Fertility Services Market exquisitely. There are also some favorable reimbursement policies for some leverage of fertility mechanisms which aids the market substantially.

Fertility Services Market: Restraints

Strenuous maintenance issues along with increased costs of ART’s techniques hinder the market growth

Maintenance of the devices used in IVF or ART procedures combined with treatment costs impedes market growth considerably. There are also some ethical considerations with respect to following this treatment method which hampers the market growth. The reimbursement policies in many developing countries seem to be lacking which also hampers the improvement of the market rate.

Fertility Services Market: Opportunities

Recent innovations in IVF Technologies combined with rising infertility clinics across the world provide opportunities for market growth

Innovations in IVF Technologies such as embryo scope and capsule IVF increase the demand and leverage of fertility services. Apart from this, the rise in the utilization and emergence of fertility clinics and the rampant increase in same-sex marriage trigger lots of innovations in procreation techniques. This provides lucrative opportunities for the expansion of the market.

Fertility Services Market: Challenges

The high cost of devices used in the IVF techniques along with the pricing of these treatments pose a challenge to the market growth

The production and maintenance cost of devices used in IVF techniques are too high which impacts the market negatively. The maintenance of these devices and the treatment costs for ART procedures are also high which dwindles the demand for leveraging these procedures. Hence the expense required for these services is a challenge for the market growth

Inadequate reimbursement policies in developing countries and lack of insurance coverage or funding also pose challenges to the market

The reimbursement policies in some countries are not very satisfactory for this kind of treatment. The insurance coverage for IVF procedures is also a little less in numbers and quantity. This factor poses a challenge to the market growth as very few people leverage the service because of this reason.

Fertility Services Market: Segmentation Analysis

The global fertility services market is segmented based on Infertility, Procedure, Services, End-User, and region.

Based on Infertility, the global fertility services market is divided into Male Infertility, Female Infertility.

On the basis of Procedure, the global fertility services market is bifurcated into Assisted Reproductive Technology, In-Vitro Fertilization, Artificial Insemination, Surrogacy, Others.

By Services, the global fertility services market is split into Donor, Non-Donor.

In terms of End-User, the global fertility services market is categorized into Hospitals, Fertility Clinics, Clinical Research Institutes, Surgical Centers.

Fertility Services Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Fertility Services Market |

| Market Size in 2024 | USD 21.71 Billion |

| Market Forecast in 2034 | USD 40.73 Billion |

| Growth Rate | CAGR of 7.2% |

| Number of Pages | 205 |

| Key Companies Covered | Merck KGaA, Cook Medical, Irvine Scientific Company, Copper Surgical, Kitazato Cooperation, Vitrolife, Ferring B.V., Monash IVF Group, Care Fertility, Apollo Hospitals Enterprise Ltd, Carolinas Fertility Institute, Genea Limited, Medicover Group, Monash IVF Group Limited, Progyny Inc., Virtus Health.,, and others. |

| Segments Covered | By Infertility, By Procedure, By Services, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Regional Landscape:

Europe is leading in the fertility services market value. This is due to the increasing number of obesity issues and other impotency issues which spikes up the demand for these services. North America trails as the second-largest contributor to the fertility services market because of the increase in arrhythmic diseases and favorable reimbursement policies for patients with growing demand for advanced treatment methods and improving healthcare infrastructures. Asia-Pacific region trails as the next top market due to the increase in adoption of digital devices, and the launch of new procreation techniques.

Fertility Services Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the fertility services market on a global and regional basis.

The global fertility services market is dominated by players like:

- Merck KGaA

- Cook Medical

- Irvine Scientific Company

- Copper Surgical

- Kitazato Cooperation

- Vitrolife

- Ferring B.V.

- Monash IVF Group

- Care Fertility

- Apollo Hospitals Enterprise Ltd

- Carolinas Fertility Institute

- Genea Limited

- Medicover Group

- Monash IVF Group Limited

- Progyny Inc.

- Virtus Health.

Global Fertility Services Market is segmented as follows:

By Infertility

- Male Infertility

- Female Infertility

By Procedure

- Assisted Reproductive Technology

- In-Vitro Fertilization

- Artificial Insemination

- Surrogacy

- Others

By Services

- Donor

- Non-Donor

By End-Users

- Hospitals

- Fertility Clinics

- Clinical Research Institutes

- Surgical Centres

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The services provided regarding fertilization to the infertile population are known as fertility services.

The global fertility services market is expected to grow due to rising infertility rates due to lifestyle changes, increasing maternal age, and environmental factors.

According to a study, the global fertility services market size was worth around USD 21.71 Billion in 2024 and is expected to reach USD 40.73 Billion by 2034.

The global fertility services market is expected to grow at a CAGR of 7.2% during the forecast period.

North America is expected to dominate the fertility services market over the forecast period.

Leading players in the global fertility services market include Merck KGaA, Cook Medical, Irvine Scientific Company, Copper Surgical, Kitazato Cooperation, Vitrolife, Ferring B.V., Monash IVF Group, Care Fertility, Apollo Hospitals Enterprise Ltd, Carolinas Fertility Institute, Genea Limited, Medicover Group, Monash IVF Group Limited, Progyny Inc., Virtus Health.,, among others.

The report explores crucial aspects of the fertility services market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed