Global Feed Additives Market Size, Share, Growth Analysis Report - Forecast 2034

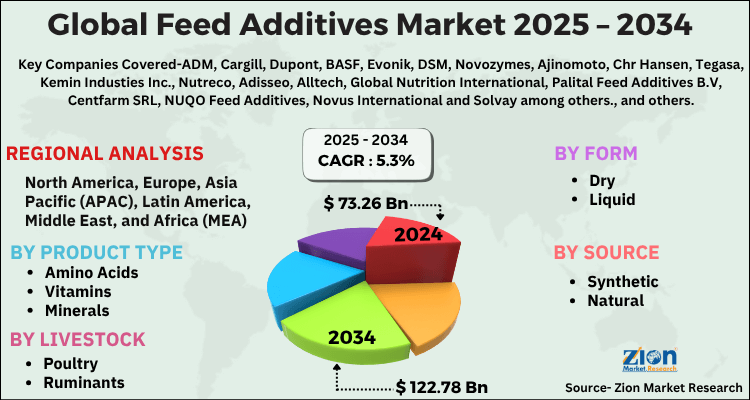

Feed Additives Market By Product Type (Amino Acids, Vitamins, Minerals, Enzymes, Probiotics, Prebiotics, Antioxidants, Acidifiers, Antibiotics, Flavors & Sweeteners), By Livestock (Poultry, Ruminants, Swine, Aquaculture, Others), By Form (Dry, Liquid), By Source (Synthetic, Natural), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 73.26 Billion | USD 122.78 Billion | 5.3% | 2024 |

Feed Additives Market: Industry Perspective

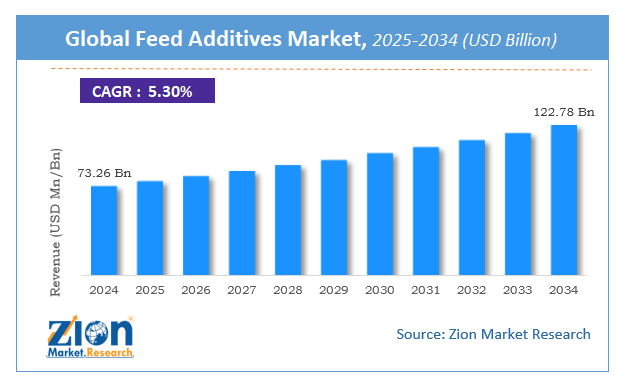

The global feed additives market size was worth around USD 73.26 Billion in 2024 and is predicted to grow to around USD 122.78 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 5.3% between 2025 and 2034. The report analyzes the global feed additives market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the feed additives industry.

Feed Additives Market: Overview

Feed Additives are the products or supplements that enhance the animal nutrition and are added to animal feed to provide complete nutrition to farm animals. They usually contain vitamins, minerals, amino acids and other required nutrients that ensure the optimum health of the animals, thus preventing them from diseases. The market is primarily driven by the increase in demand and consumption of livestock-based products such as meat, dairy and dairy-based products and eggs which is expected to drive the usage of feed additives in the feed. The sale and marketing regulations in many developed markets make it necessary for the feed additives to pass through an intense product efficacy check pipeline. Techniques such as nano-emulsification, lipid encapsulation and bioavailability enhancement by ligand mediated transport have been emerging as a mechanism to improve the performance and stability of feed additives.

Key Insights

- As per the analysis shared by our research analyst, the global feed additives market is estimated to grow annually at a CAGR of around 5.3% over the forecast period (2025-2034).

- Regarding revenue, the global feed additives market size was valued at around USD 73.26 Billion in 2024 and is projected to reach USD 122.78 Billion by 2034.

- The feed additives market is projected to grow at a significant rate due to Rising meat consumption and focus on animal health are driving demand. Regulatory support for safe and efficient livestock production also contributes.

- Based on Product Type, the Amino Acids segment is expected to lead the global market.

- On the basis of Livestock, the Poultry segment is growing at a high rate and will continue to dominate the global market.

- Based on the Form, the Dry segment is projected to swipe the largest market share.

- By Source, the Synthetic segment is expected to dominate the global market.

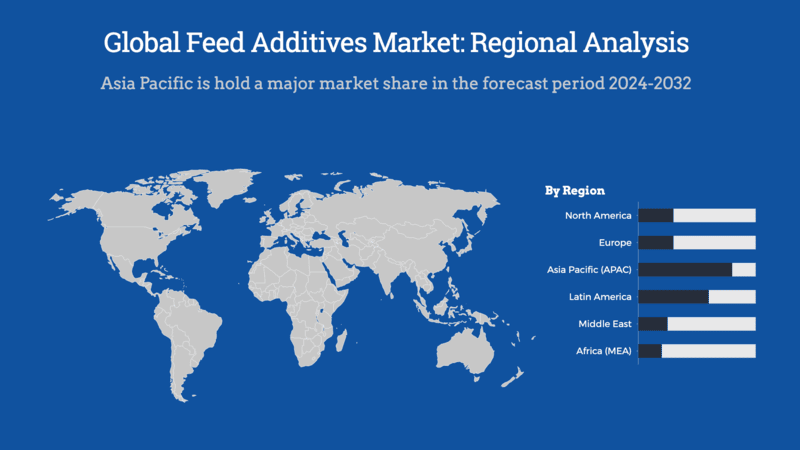

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Feed Additives Market: Growth Factors

The increase in the demand for the livestock products such as meat, dairy based products and eggs drives the usage of feed additives in feed required for the growth and development of farm animals. Also, the increasing awareness about the role and dynamics of the food nutrients on the mental and physical growth and development, has boosted the demand for the feed additives. The global population has also been increasing which is driving the global food demand, thus creative a positive impact on the feed additives market. The rising incomes, changing lifestyles and rising health consciousness has changed the dietary habits of the consumers increasing the protein content in their diets and decreasing the carbohydrates.

The industrialization of meat production, increasing concerns on the quality of livestock products and increasing focus on livestock disease prevention has also boosted the demand for the feed additives.

Feed Additives Market: Dynamics

Key Growth Drivers

The feed additives market is experiencing significant growth due to the rising global demand for animal protein, driven by population growth and changing dietary preferences. Livestock producers are increasingly using feed additives to enhance animal health, improve feed efficiency, and boost meat, milk, and egg production. Technological advancements in feed additive formulations, including probiotics, prebiotics, and enzyme-based products, are further supporting market expansion. Additionally, the growing awareness of animal nutrition and the implementation of stringent regulations on livestock production to ensure food safety are contributing to the increased adoption of feed additives.

Restraints

Despite its growth potential, the feed additives market faces several restraints. Fluctuations in the prices of raw materials, such as corn, soybean, and other grains, can increase production costs and impact profit margins for manufacturers. Regulatory challenges are another significant restraint, as feed additives must undergo rigorous testing and approval processes in different regions. Additionally, consumer concerns regarding the use of synthetic additives and antibiotics in animal feed may limit market growth. Strict environmental regulations regarding emissions from livestock farming also pose a challenge for feed additive producers.

Opportunities

The growing preference for natural and organic feed additives presents substantial opportunities for market players. Manufacturers are increasingly investing in the development of plant-based, probiotic, and herbal additives to cater to the rising demand for sustainable and clean-label animal products. Additionally, the increasing focus on aquaculture and the rising consumption of seafood are creating new growth avenues for specialized feed additives. Emerging economies, particularly in Asia-Pacific and Latin America, offer significant market potential due to expanding livestock production and the modernization of the agricultural sector. Collaborations and partnerships among key players to develop innovative products further drive opportunities in the feed additives market.

Challenges

The feed additives market faces several challenges, including the ongoing threat of livestock diseases, which can disrupt the supply chain and impact feed demand. Maintaining product quality and ensuring the stability and efficacy of additives during storage and transportation can also be challenging. Moreover, the limited availability of feed additives in some regions due to underdeveloped distribution networks can hinder market growth. Additionally, the growing popularity of alternative protein sources, such as plant-based and lab-grown meat, may reduce the demand for animal feed additives in the long term, posing a challenge to market sustainability.

Feed Additives Market: Segmentation Analysis

The global feed additives market is segmented based on Product Type, Livestock, Form, Source, and region.

Based on Product Type, the global feed additives market is divided into Amino Acids, Vitamins, Minerals, Enzymes, Probiotics, Prebiotics, Antioxidants, Acidifiers, Antibiotics, Flavors & Sweeteners.

On the basis of Livestock, the global feed additives market is bifurcated into Poultry, Ruminants, Swine, Aquaculture, Others.

By Form, the global feed additives market is split into Dry, Liquid.

In terms of Source, the global feed additives market is categorized into Synthetic, Natural.

Feed Additives Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Feed Additives Market |

| Market Size in 2024 | USD 73.26 Billion |

| Market Forecast in 2034 | USD 122.78 Billion |

| Growth Rate | CAGR of 5.3% |

| Number of Pages | 140 |

| Key Companies Covered | ADM, Cargill, Dupont, BASF, Evonik, DSM, Novozymes, Ajinomoto, Chr Hansen, Tegasa, Kemin Industies Inc., Nutreco, Adisseo, Alltech, Global Nutrition International, Palital Feed Additives B.V, Centfarm SRL, NUQO Feed Additives, Novus International and Solvay among others., and others. |

| Segments Covered | By Product Type, By Livestock, By Form, By Source, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Feed Additives Market: Regional Analysis

North America held a share of 38% in 2020. The growing demand for the meat has stimulated the production of livestock which has boosted the feed additives market in this region. The mass production of livestock and the increased consumption of animal sourced products has increased the demand for feed additives in this region. Also, there has been considerable increase in the consumption of livestock products such as dairy and dairy based products, eggs and meat which has led the manufacturers to produce the feed additives in large numbers.

Asia-Pacific is expected to have the CAGR of 9.2% from 2021 to 2028. This is due to the presence of large livestock population and their growth rate. Also, there has been increase in number of feed mills and feed production, mainly in the countries such as India and Japan. This has led to the increase in the number of feed mills in this region, thus increasing the feed production in this region. China dominates the production rate with Thailand and Indonesia as the emerging countries in the production.

Feed Additives Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the feed additives market on a global and regional basis.

The global feed additives market is dominated by players like:

- ADM

- Cargill

- Dupont

- BASF

- Evonik

- DSM

- Novozymes

- Ajinomoto

- Chr Hansen

- Tegasa

- Kemin Industies Inc.

- Nutreco

- Adisseo

- Alltech

- Global Nutrition International

- Palital Feed Additives B.V

- Centfarm SRL

- NUQO Feed Additives

- Novus International and Solvay among others.

The global feed additives market is segmented as follows;

By Product Type

- Amino Acids

- Vitamins

- Minerals

- Enzymes

- Probiotics

- Prebiotics

- Antioxidants

- Acidifiers

- Antibiotics

- Flavors & Sweeteners

By Livestock

- Poultry

- Ruminants

- Swine

- Aquaculture

- Others

By Form

- Dry

- Liquid

By Source

- Synthetic

- Natural

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Feed Additives are the products or supplements that enhance the animal nutrition and are added to animal feed to provide complete nutrition to farm animals.

The global feed additives market is expected to grow due to Rising meat consumption and focus on animal health are driving demand. Regulatory support for safe and efficient livestock production also contributes.

According to a study, the global feed additives market size was worth around USD 73.26 Billion in 2024 and is expected to reach USD 122.78 Billion by 2034.

The global feed additives market is expected to grow at a CAGR of 5.3% during the forecast period.

Asia-Pacific is expected to dominate the feed additives market over the forecast period.

Leading players in the global feed additives market include ADM, Cargill, Dupont, BASF, Evonik, DSM, Novozymes, Ajinomoto, Chr Hansen, Tegasa, Kemin Industies Inc., Nutreco, Adisseo, Alltech, Global Nutrition International, Palital Feed Additives B.V, Centfarm SRL, NUQO Feed Additives, Novus International and Solvay among others., among others.

The report explores crucial aspects of the feed additives market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed