Europe Automatic Transmission for Passenger Car Market Size, Share, Report 2034

Europe Automatic Transmission for Passenger Car Market By Fuel Type (Diesel, Gasoline, Battery Electric (BEV), Plug-in Hybrid (PHEV), and Hybrid (HEV)), By Transmission Type (Continuously Variable Transmission (CVT), Automatic Manual Transmission (AMT), Torque-Converter Automatic (AT), and Dual-Clutch Transmission (DCT)), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

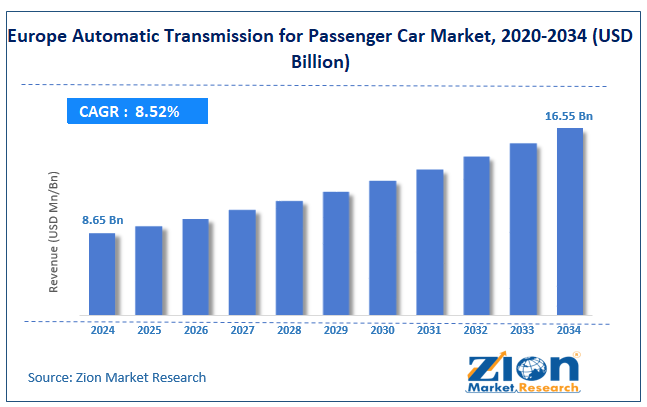

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8.65 Billion | USD 16.55 Billion | 8.52% | 2024 |

Europe Automatic Transmission for Passenger Car Industry Prospective

The Europe automatic transmission for passenger car market size was worth around USD 8.65 billion in 2024 and is predicted to grow to around USD 16.55 billion by 2034 with a compound annual growth rate (CAGR) of roughly 8.52 % between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the Europe automatic transmission for passenger car market is estimated to grow annually at a CAGR of around 8.52 % over the forecast period (2025-2034)

- In terms of revenue, the Europe automatic transmission for passenger car market size was valued at around USD 8.65 billion in 2024 and is projected to reach USD 16.55 billion by 2034.

- The market is projected to grow at a significant rate due to the rising demand for driving convenience reported across the region.

- Based on the fuel type, the hybrid (HEV) segment is growing at a high rate and will continue to dominate the market, as per industry projections.

- Based on the transmission type, the torque-converted automatic (AT) segment is anticipated to command the largest market share.

- Based on region, Germany is projected to dominate the market during the forecast period.

Europe Automatic Transmission for Passenger Car Market: Overview

The European automatic transmission for passenger cars refers to the production, distribution, and sale of automatic transmission systems installed in passenger cars. Automatic cars are significantly driven by manual counterparts as the former is equipped with an automatic gearbox that does not need to be handled manually. Automatic transmission for passenger vehicles promotes minimal assistance from the driver to shift gears. Most automatic transmissions designed for passenger cars use Torque-Converter Automatic (AT), Dual-Clutch Transmission (DCT), Automated Manual Transmission (AMT), Continuously Variable Transmission (CVT), or e-CVT technologies to deliver desired performance.

The Europe automatic transmission for the passenger cars industry will continue to witness steady growth during the forecast period. The regional market will be driven by the convenience offered by automatic cars, especially in the backdrop of rising traffic in urban and populated regions of Europe. Moreover, rising demand for energy-efficient vehicles powered by automatic transmission may open new avenues for extended growth in the regional sector. A major drawback for the European automatic transmission for passenger cars may emerge in the form of the high cost of procurement and the growing popularity of electric vehicles (EVs).

Europe Automatic Transmission for Passenger Car Market Dynamics

Growth Drivers

How will rising demand for convenience during driving fuel the Europe automatic transmission for passenger car market growth?

The Europe automatic transmission for the passenger car market growth is expected to be driven by the rising demand for driving convenience reported across the region. The growing traffic rate reported in urban parts of Europe has fueled greater adoption of automatic transmission in passenger cars. The most trafficked regions across Europe include Dublin, Paris, and London. The traffic rate is further driven by the growing tourism reported across Europe.

In 2024, the region hosted more than 745 million tourists from across the globe. As the number of residents and tourists continues to grow in Europe, traffic becomes more intense, leading to greater demand for passenger vehicles with automatic transmission. These cars are easy to drive and do not require manual labor. Furthermore, they offer comfort to the drivers over long driving hours, which is an essential safety aspect for passenger vehicles.

Surging demand for luxury and premium vehicles offers new avenues for extended growth

Europe is registering higher demand for luxury passenger cars, especially driven by the presence of some of the world’s leading premium car makers in the region. Germany, for instance, is one of the world’s largest producers of exclusive vehicles exported worldwide. In addition to this, the region is also witnessing increased market entry of Asian car makers in the region, with Japan and China taking the lead.

For instance, in September 2025, reports emerged suggesting that Hongqi, a China-based luxury automaker, would launch 15 models in Europe. These projects will work in favor of the Europe automatic transmission for the passenger car market in the coming years.

Restraints

Why will cost constraints impede the expansion of the Europe automatic transmission for passenger cars industry?

The Europe automatic transmission for passenger cars industry is projected to be restricted due to the high cost of production of automatic vehicles. According to industry research, the high cost of automatic transmission is influenced by the use of complex engineering solutions and expensive materials for vehicle production. Furthermore, the production of automatic transmissions continues to rise due to a surge in labor costs and prices of raw materials.

Opportunities

Rising sales of hybrid passenger vehicles are offering new growth opportunities to the industry players

The Europe automatic transmission for the passenger car market is projected to generate growth opportunities due to the rising sales and acceptance of hybrid vehicles. Industry research suggests greater integration of eCVTs in hybrid vehicles. These automobiles are equipped with an electric motor as well as an internal combustion engine powered by fuel. Hybrid vehicles are becoming more popular in Europe due to their performance efficiency and less impact on the environment. The regional regulatory authorities and governments have launched several new initiatives to reduce the consumption of non-renewable fuel for powering automobiles.

They have also announced several new schemes to promote the use of electric or hybrid vehicles to ensure minimal environmental damage caused by the automotive sector. In the first half of 2025, Europe recorded around 2,255,000 new registrations of hybrid electric cars. The number is expected to continue growing in the coming years as consumer awareness improves. Additionally, the growing number of hybrid vehicle manufacturers across the region will allow greater availability of the cars for the common population.

Challenges

How will competition from manual transmission challenge the Europe automatic transmission for passenger cars industry?

The Europe automatic transmission for the passenger car industry is projected to be challenged by the competition the industry faces from manual transmissions. The latter vehicles are affordable and also enjoy the presence of a mature service and maintenance infrastructure. In addition to this, growing advancements in manual transmissions for passenger cars, focusing on improving energy efficiency and reducing emissions, may fragment demand for automatic counterparts.

Europe Automatic Transmission for Passenger Car Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Europe Automatic Transmission for Passenger Car Market |

| Market Size in 2024 | USD 8.65 Billion |

| Market Forecast in 2034 | USD 16.55 Billion |

| Growth Rate | CAGR of 8.52% |

| Number of Pages | 230 |

| Key Companies Covered | Voith, ZF Friedrichshafen, Aisin Seiki, Ricardo, GKN Automotive, Allison Transmission, BorgWarner, Getrag (now part of Magna), Continental, Schaeffler, Jatco, Punch Powertrain, Bosch, Magna Powertrain, Valeo, and Others. |

| Segments Covered | By Fuel Type, By Transmission Type, and By Region |

| Regions Covered | Europe, Benelux Union, Rest of Europe |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Europe Automatic Transmission for Passenger Car Market: Segmentation

The Europe automatic transmission for the passenger car market is segmented based on fuel type, transmission type, and region.

Based on fuel type, the regional market segments are diesel, gasoline, battery electric (BEV), plug-in hybrid (PHEV), and hybrid (HEV). In 2024, the highest growth was listed in the hybrid (HEV) segment, driven by a growing focus on improving environmental conditions in the region. HEVs are expected to account for more than 35% of the regional market share during the forecast period. The gasoline segment is projected to emerge as the second-highest revenue generator in the coming years, led by growing demand for petrol-powered passenger vehicles.

Based on transmission type, the market divisions are continuously variable transmission (CVT), automatic manual transmission (AMT), torque-converted automatic (AT), and dual-clutch transmission (DCT). In 2024, the highest demand was listed in the torque-converted automatic (AT) segment, accounting for 41.05% of the total revenue. Torque-converted automatic (AT) technology is highly reliable and has witnessed greater integration in passenger cars. Moreover, the cost-efficiency of the technology will further promote segmental revenue in the coming years.

Europe Automatic Transmission for Passenger Car Market: Regional Analysis

Which factors will help Germany achieve higher revenue in the European automatic transmission for passenger cars industry?

The Europe automatic transmission for the passenger car market is expected to be led by Germany during the forecast period. In 2024, the region accounted for nearly 30% of revenue in the European automatic transmission for passenger cars segment. Germany is one of the world’s leading car makers. It is home to some of the world’s most famous automotive companies, such as Audi, Volkswagen Group, Opel, Bentley, Renault, and others. The regional market is expected to be driven by higher government initiatives to curb emissions caused by automobiles.

In June 2025, Germany announced the launch of a comprehensive package to promote the adoption of electric vehicles in the region. The country will provide special depreciation for EVs along with tax relief benefits. In addition to this, Germany will also spend on infrastructure expansion for EV production and integration in the region’s automotive sector. The rising market entry for Chinese car makers in Europe may accelerate the acceptance of automatic transmission for passenger cars. Additionally, increased investments in developing more effective automatic vehicles throughout Europe may work in favor of the regional market.

Europe Automatic Transmission for Passenger Car Market: Competitive Analysis

The Europe automatic transmission for passenger car market is led by players like;

- Voith

- ZF Friedrichshafen

- Aisin Seiki

- Ricardo

- GKN Automotive

- Allison Transmission

- BorgWarner

- Getrag (now part of Magna)

- Continental

- Schaeffler

- Jatco

- Punch Powertrain

- Bosch

- Magna Powertrain

- Valeo

Europe Automatic Transmission for Passenger Car Market: Key Market Trends

Increased demand for DCT

The regional industry is witnessing improved demand for Dual-Clutch Transmissions (DCT) in passenger cars. They are designed to deliver high performance and comfort. In addition to this, improvements in fuel efficiency of dual-clutch transmissions may promote market expansion in the future.

Higher sales of used cars

According to official reports, the industry is witnessing surging demand for used cars with automatic transmission. The pre-owned vehicle segment holds tremendous growth possibilities as people seek affordable but effective vehicles as personal cars.

The European automatic transmission for passenger car market is segmented as follows:

By Fuel Type

- Diesel

- Gasoline

- Battery Electric (BEV)

- Plug-in Hybrid (PHEV)

- Hybrid (HEV)

By Transmission Type

- Continuously Variable Transmission (CVT)

- Automatic Manual Transmission (AMT)

- Torque-Converter Automatic (AT)

- Dual-Clutch Transmission (DCT)

By Region

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- Netherlands

- Luxembourg

- Rest of Europe

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed