Ethylene Tetrafluoroethylene Market Trend, Share, Growth, Size and Forecast 2032

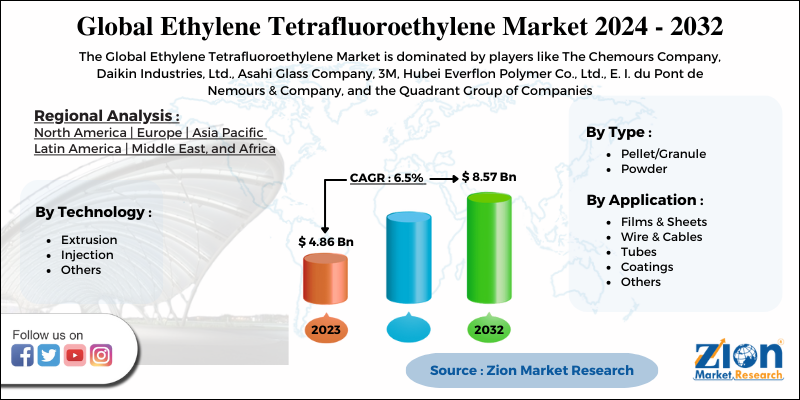

Ethylene Tetrafluoroethylene Market By Application (Wires & Cables, Films & Sheets, Coatings, Tubes, And Others (Foams And Membranes)), By Technology (Injection, Extrusion, And Others (Electrostatic Spraying/Fluid Dip Coating, Rotational Molding, And Blow Molding)), By Type (Powder And Pellet/Granule), And By Region - Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032-

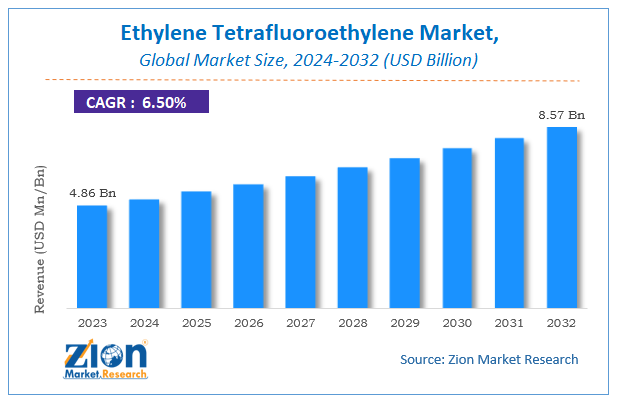

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.86 Billion | USD 8.57 Billion | 6.5% | 2023 |

Ethylene Tetrafluoroethylene Market Insights

According to Zion Market Research, the global Ethylene Tetrafluoroethylene Market was worth USD 4.86 Billion in 2023. The market is forecast to reach USD 8.57 Billion by 2032, growing at a compound annual growth rate (CAGR) of 6.5% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Ethylene Tetrafluoroethylene industry over the next decade.

The report offers valuation and analysis of Ethylene Tetrafluoroethylene market on a global as well as regional level. The study offers a comprehensive assessment of the industry competition, limitations, sales estimates, avenues, current & emerging trends, and industry-validated market data. The report offers historical data from 2016 to 2019 along with a forecast from 2020 to 2026 based on value (USD Million).

The report offers valuation and analysis of Ethylene Tetrafluoroethylene market on a global as well as regional level. The study offers a comprehensive assessment of the industry competition, limitations, sales estimates, avenues, current & emerging trends, and industry-validated market data. The report offers historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on value (USD Billion).

Global Ethylene Tetrafluoroethylene Market: Overview

Ethylene Tetrafluoroethylene (ETFE) is a fluorine-based polymer and was designed to resist corrosion. Moreover, it is a lubricous plastic having low co-efficient friction and hence is utilized in abrasives. It is light in weight and demonstrates high proportion of light transmission. Hence, it is preferred as one of the alternatives for glass in outdoor building constructions. Moreover, ETFE films are recyclable and can be self-cleaned. They are susceptible to punctures incurred due to sharp edges and hence are used in roof constructions. ETFE resins offer high resistance to ultraviolet light. The composite is used for encompassing electrical & fiber-optic cables utilized in low fume toxicity, high stress, and highly reliable conditions.

Global Ethylene Tetrafluoroethylene Market: Growth Factors

Escalating environmental concerns and need for green as well as eco-friendly constructions will create huge market demand over the forthcoming years. In addition to this, the compound is easily recyclable and hence is gaining popularity across myriad sectors. Furthermore, growing utility of the material for roof covering in stadiums as well as its usage in aerospace sector will prompt the business landscape. Nonetheless, strict EPA laws governing the use of the chemical compound can put brakes on the market growth in the near future.

Furthermore, massive product penetration in shopping malls, courtyards, and commercial building constructions will further accelerate the market growth over the forecast timeline. Apart from this, owing to its excellent wear & dirt resistance and durability the product finds a large number of applications in solar panels. Apparently, its massive demand in automotive & medical sectors can be attributed to its beneficial features like rust resistance and toughness.

Ethylene Tetrafluoroethylene Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Ethylene Tetrafluoroethylene Market |

| Market Size in 2023 | USD 4.86 Billion |

| Market Forecast in 2032 | USD 8.57 Billion |

| Growth Rate | CAGR of 6.5% |

| Number of Pages | 110 |

| Key Companies Covered | The Chemours Company, Daikin Industries, Ltd., Asahi Glass Company, 3M, Hubei Everflon Polymer Co., Ltd., E. I. du Pont de Nemours & Company, and the Quadrant Group of Companies |

| Segments Covered | By Type, By Technology, By Application And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

North America To Remain Market Leader Over 2024-2032

The growth of the market in the region over the estimated timeline is owing to massive product penetration in the automotive & construction sectors in the region. In addition to this, the composite is also utilized in aircraft wiring as well as spacecraft wiring due to its high tensile strength. The U.S. is predicted to be the major regional market revenue contributor in the years to come.

Global Ethylene Tetrafluoroethylene Market: Competitive Players

Key participants influencing the market growth and profiled in the report include

- The Chemours Company

- Daikin Industries, Ltd

- Asahi Glass Company

- 3M

- Hubei Everflon Polymer Co Ltd

- E. I. du Pont de Nemours & Company

- the Quadrant Group of Companies

The global ethylene tetrafluoroethylene market is segmented as follows:

By Type:

- Pellet/Granule

- Powder

By Technology:

- Extrusion

- Injection

- Others (Rotational Molding, Electrostatic Spraying/Fluid Dip Coating, and Blow Molding)

By Application

- Films & Sheets

- Wire & Cables

- Tubes

- Coatings

- Others (Membranes and Foams)

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Ethylene tetrafluoroethylene (ETFE) is a fluoropolymer that is highly regarded for its exceptional mechanical properties, thermal stability, and chemical resistance. It is a fluorinated polymer that is formed by the combination of tetrafluoroethylene and ethylene monomers.

ETFE is being utilised more frequently in architectural applications, including roofing and facades, as a result of its durability, transparency, and capacity to endure severe weather conditions. The demand for ETFE is driven by the trend towards modern, sustainable, and energy-efficient buildings.

According to Zion Market Research, the global Ethylene Tetrafluoroethylene Market was worth USD 4.86 Billion in 2023. The market is forecast to reach USD 8.57 Billion by 2032.

According to Zion Market Research, the global Ethylene Tetrafluoroethylene Market a compound annual growth rate (CAGR) of 6.5% during the forecast period 2024-2032.

The growth of the market in the region over the estimated timeline is owing to massive product penetration in the automotive & construction sectors in the region. In addition to this, the composite is also utilized in aircraft wiring as well as spacecraft wiring due to its high tensile strength. The U.S. is predicted to be the major regional market revenue contributor in the years to come.

Key participants influencing the market growth and profiled in the report include The Chemours Company, Daikin Industries, Ltd., Asahi Glass Company, 3M, Hubei Everflon Polymer Co., Ltd., E. I. du Pont de Nemours & Company, and the Quadrant Group of Companies.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed