eSIM Market Size, Growth, Global Trends, Forecast 2034

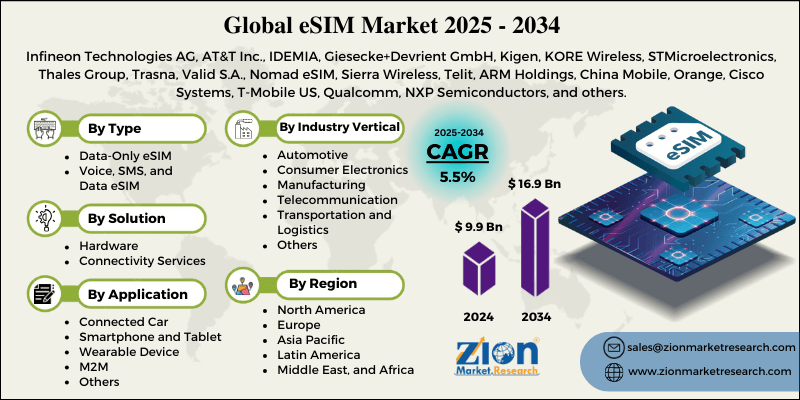

eSIM Market By Type (Data-Only eSIM and Voice, SMS, and Data eSIM), By Solution (Hardware and Connectivity Services), By Application (Connected Car, Smartphone and Tablet, Wearable Device, M2M, and Others), By Industry Vertical (Automotive, Consumer Electronics, Manufacturing, Telecommunication, Transportation and Logistics, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

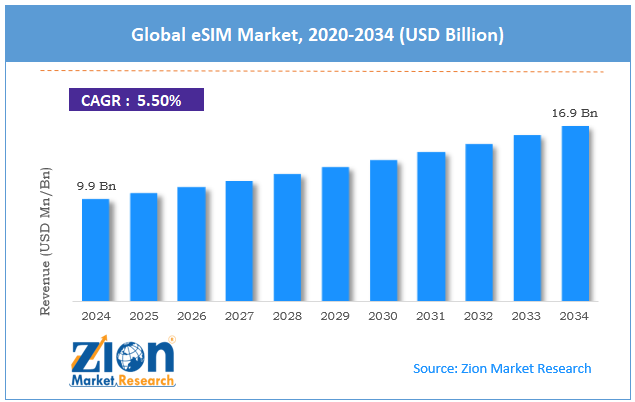

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9.9 Billion | USD 16.9 Billion | 5.5% | 2024 |

eSIM Industry Perspective:

The global eSIM market size was worth around USD 9.9 billion in 2024 and is predicted to grow to around USD 16.9 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.5% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global eSIM market is estimated to grow annually at a CAGR of around 5.5% over the forecast period (2025-2034).

- In terms of revenue, the global eSIM market size was valued at around USD 9.9 billion in 2024 and is projected to reach USD 16.9 billion by 2034.

- Expansion in the 5G network is expected to drive the eSIM market over the forecast period.

- Based on the type, the Data-Only eSIM segment is expected to hold the largest market share over the forecast period.

- Based on the solution, the hardware segment is expected to dominate the market over the projected period.

- Based on the application, the M2M segment is expected to dominate the market over the projected period.

- Based on the industry vertical, the automotive segment is expected to dominate the market over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

eSIM Market: Overview

An eSIM is a digital SIM that is directly integrated into the hardware of a device, including smartphones or smartwatches, removing the need for a physical plastic card. It acts as a regular SIM card, allowing users to connect to a cellular network, but it provides more flexibility by allowing remote download and control of network provider profiles and data plans without the need to physically swap cards. The eSIM market is being driven by several factors such as a rise in IoT / M2M deployments, growth & rollout of 5G networks, consumer demand for flexibility & convenience, automotive & connected car use cases, regulatory push/ government initiatives &, and others. However, regulatory and policy barriers act as a major restraint to the eSIM market growth.

eSIM Market: Growth Drivers

Why does the growth & rollout of 5G networks drive the eSIM market growth?

The global eSIM market is experiencing rapid growth, and the implementation of 5G networks is a significant factor driving the increasing adoption and expansion of eSIMs among businesses. 5G has far higher data rates, less latency, and more connections, which makes eSIM deployment in IoT, consumer devices, and critical infrastructure much easier from the beginning. eSIM technology is a key part of 5G's value proposition because it lets devices be set up, operated, and switched between networks from a distance, doing away with the need for physical SIM cards.

5G-eSIM synergy is also employed in IoT industries, including smart cities, manufacturing, fleet management, and healthcare, to make connections that are reliable, scalable, and flexible. The growing use of 5G networks is pushing device makers to make eSIM the standard for new devices.

eSIM Market: Restraints

How do regulatory & policy barriers hinder the eSIM market growth?

The eSIM market faces significant legal and regulatory barriers to global adoption, despite the rapid advancement of technology and growing demand. Some governments ban or extensively regulate the use of eSIMs because they are worried about digital sovereignty, security, or want to keep state control over telecommunications. Turkey, for instance, doesn't let locals or new immigrants use the services of many overseas eSIM providers. Instead, passengers have to install eSIMs before they can enter the country.

Also, the fact that there are no common eSIM standards and certification requirements across all areas makes it hard for device makers and users to use eSIM profiles across borders. Also, several regulatory bodies are worried about remote provisioning and user identity management, which has made it harder to get eSIMs approved for use. Thus, the aforementioned facts hamper the market growth.

eSIM Market: Opportunities

How does the growing product launch offer a potential opportunity for eSIM industry growth?

The eSIM market is predicted to grow substantially in 2025, with a lot of new products coming out for different devices, operator services, and platforms. This is because more people want them, and gadgets are getting better. For instance, in June 2025, emnify, a global leader in IoT connections, announced that it would start selling its Consumer eSIM solution, specifically designed for enterprise device fleets.

As more and more consumer device makers transition to eSIM-only devices, such as Apple's decision to remove physical SIM slots from its iPads, businesses are finding it increasingly challenging to efficiently deploy and manage eSIMs on a large scale. Emnify's solution solves these problems by offering "zero-touch" eSIM provisioning, which gets rid of the need for SIM logistics and gives one full control over the connectivity.

Emnify's Consumer eSIM solution is possible because the IoT connection provider's backend is connected to a customer's Mobile Device Management (MDM) system. This lets eSIMs be set up with only one click. Due to the integration, eSIM profiles are sent to devices through a customer's MDM and are immediately activated when the device starts up, so users don't need to take any action. This makes deployments easier, eliminates manual tasks, and reduces the number of mistakes.

eSIM Market: Challenges

Why does limited carrier/network support pose a major challenge to market expansion?

Limited carrier and network support is still a big problem for widespread eSIM adoption, even if there are more compatible devices and operator integrations happening quickly. It's not always possible to use eSIM with all devices. Some devices, including older versions and inexpensive phones, may not support it. Also, some carriers have limits or limited implementations that make it hard to activate or transfer plans.

For instance, all major networks in India offer eSIM, but the devices that function with it, the providers one may choose from, and the plan documents are all different. The activation process is also not always the same, especially for eSIMs that work with international travel. In some countries, it can be challenging for both travelers and locals to activate or use eSIMs due to local laws or a lack of carrier support. Therefore, the limited carrier/network support poses a major challenge to the eSIM industry expansion.

eSIM Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | eSIM Market |

| Market Size in 2024 | USD 9.9 Billion |

| Market Forecast in 2034 | USD 16.9 Billion |

| Growth Rate | CAGR of 5.5% |

| Number of Pages | 215 |

| Key Companies Covered | Infineon Technologies AG, AT&T Inc., IDEMIA, Giesecke+Devrient GmbH, Kigen, KORE Wireless, STMicroelectronics, Thales Group, Trasna, Valid S.A., Nomad eSIM, Sierra Wireless, Telit, ARM Holdings, China Mobile, Orange, Cisco Systems, T-Mobile US, Qualcomm, NXP Semiconductors, and others. |

| Segments Covered | By Type, By Solution, By Application, By Industry Vertical, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

eSIM Market: Segmentation

The global eSIM industry is segmented based on type, solution, application, industry vertical, and region.

Based on the type, the global eSIM market is bifurcated into Data-Only eSIM and Voice, SMS, and Data eSIM. The Data-Only eSIM is expected to capture the largest market share over the projected period. Data-only eSIMs are only meant to connect to data services. These are typically used in tablets, smartwatches, and Internet of Things (IoT) gadgets that need an internet connection instead of regular voice calls or text messages. Data-only eSIMs let it access data smoothly without needing a real SIM card. This makes them great for apps that use a lot of mobile data.

Based on the solution, the global eSIM industry is bifurcated into hardware and connectivity services. The hardware segment holds the major market share. The hardware category has the real parts that make technology work. This includes making and selling eSIM chips, modules, and items that have built-in SIM technology. Hardware solutions are very important for device makers and IoT integrators that want to add eSIM features to their devices. These hardware solutions make it possible for devices to connect to and switch between mobile networks without requiring a physical SIM card.

Based on the application, the global eSIM market is bifurcated into connected car, smartphone and tablet, wearable device, M2M, and others. The M2M segment is growing significantly. M2M applications require the transmission of data between connected devices. eSIMs serve an important role in a variety of industries, including healthcare, logistics, agriculture, and manufacturing, by enabling safe and efficient M2M communications. These apps support remote monitoring, predictive maintenance, and automation. Furthermore, the rapid rise of M2M connections presents profitable growth potential for the overall market.

Based on the industry vertical, the global eSIM industry is bifurcated into automotive, consumer electronics, manufacturing, telecommunication, transportation and logistics, and others. The automotive segment dominates the market growth. The emergence of connected cars drives the industry growth.

eSIM Market: Regional Analysis

Why does North America dominate the eSIM market over the projected period?

North America is expected to dominate the global eSIM market over the projected period. Customers like eSIM because it's easy to use on smartphones, computers, and wearables. Customers seek devices that let them interact in many ways and travel worldwide, so mobile phones are the most popular type. 5G networks are also making eSIM use cases better by giving the IoT and automotive industries the fast, low-latency connections they need. 5G Americas forecasts that by 2029, North America will have 772 million 5G connections, which is a 197% penetration rate.

Additionally, an increasing number of firms are transitioning to digital platforms and embracing the Internet of Things (IoT), particularly in smart cities, healthcare, manufacturing, and the automotive sector. This necessitates that eSIM be built into connected devices, allowing data to be sent and monitored immediately. Additionally, the emergence of autonomous cars drives industry growth in this area.

eSIM Market: Competitive Analysis

The global eSIM market is dominated by players like:

- Infineon Technologies AG

- AT&T Inc.

- IDEMIA

- Giesecke+Devrient GmbH

- Kigen

- KORE Wireless

- STMicroelectronics

- Thales Group

- Trasna

- Valid S.A.

- Nomad eSIM

- Sierra Wireless

- Telit

- ARM Holdings

- China Mobile

- Orange

- Cisco Systems

- T-Mobile US

- Qualcomm

- NXP Semiconductors

The global eSIM market is segmented as follows:

By Type

- Data-Only eSIM

- Voice, SMS, and Data eSIM

By Solution

- Hardware

- Connectivity Services

By Application

- Connected Car

- Smartphone and Tablet

- Wearable Device

- M2M

- Others

By Industry Vertical

- Automotive

- Consumer Electronics

- Manufacturing

- Telecommunication

- Transportation and Logistics

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

An eSIM is a digital SIM that is directly integrated into the hardware of a device, including a smartphone or smartwatch, removing the need for a physical plastic card.

The eSIM market is being driven by several factors such as a rise in IoT / M2M deployments, growth & rollout of 5G networks, consumer demand for flexibility & convenience, automotive & connected car use cases, regulatory push/ government initiatives & and standardization.

The regulatory and policy barriers are acting as a major restraint to the eSIM market growth.

Based on the industry vertical, the automotive segment is expected to dominate the industry growth during the projected period.

The emergence of connected cars and rising investment in 5G networks are the major impacting factors for the industry growth over the projected period.

According to the report, the global eSIM market size was worth around USD 9.9 billion in 2024 and is predicted to grow to around USD 16.9 billion by 2034.

The global eSIM market is expected to grow at a CAGR of 5.5% during the forecast period.

The global eSIM industry growth is expected to be driven by the North American region. It is currently the world’s highest-revenue-generating market, driven by the presence of major players and increasing digitalization in the industry.

The global eSIM market is dominated by players like Infineon Technologies AG, AT&T Inc., IDEMIA, Giesecke+Devrient GmbH, Kigen, KORE Wireless, STMicroelectronics, Thales Group, Trasna, Valid S.A., Nomad eSIM, Sierra Wireless, Telit, ARM Holdings, China Mobile, Orange, Cisco Systems, T-Mobile US, Qualcomm, and NXP Semiconductors, among others.

The market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed