Embedded Systems Market Size, Share Report, Analysis, Trends, Growth 2032

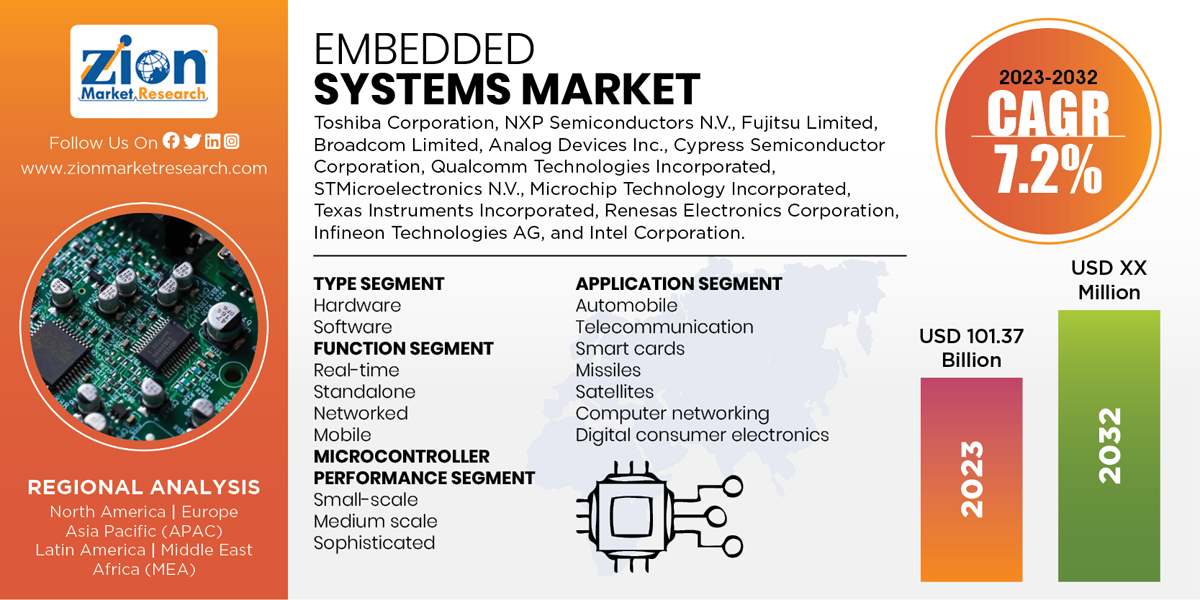

Embedded Systems Market Analysis By Type (Hardware and Software), by Functions (Real time, Standalone, Networked, and Mobile), by Microcontroller Performance (Small scale, Medium scale, and Sophisticated), by Application (Automobiles, Telecommunication, Smart cards, Missiles, Satellites, Computer networking, and Digital consumer electronics) - Global Industry Perspective, Comprehensive Analysis and Forecast 2024-2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

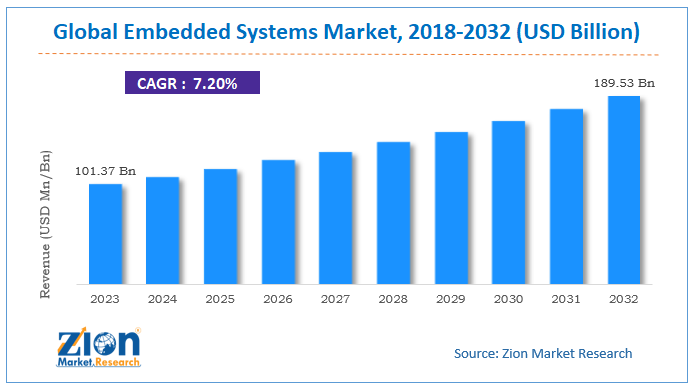

| USD 101.37 Billion | USD XX million | 7.2% | 2023 |

The global Embedded Systems market size accrued earnings worth approximately USD 101.37 Billion in 2023 and is predicted to gain revenue of about USD 189.53 Billion by 2032, is set to record a CAGR of nearly 7.2% over the period from 2024 to 2032.

Embedded Systems Market Overview

Embedded system, an electronic system is embedded in computer hardware and operates through software. Depending upon the application, it can be programmable or nonprogrammable. It is a system that performs single or multiple tasks as per a certain set of rules. In these kinds of systems, all the units get assembled and work together as per the program. Embedded systems are installed in many products such as cameras, automobiles, printers, washing machine, microwave ovens, etc. These systems use microcontrollers, microprocessors, and processors such as DSPs.

Embedded Systems Market Growth Dynamics

Embedded systems are majorly used in automobile and telecommunication industries. Its application in the industries is related to robotics in assembly line, mobile networking and computing, mobile access, multimedia and entertainment in car, body and engine safety, and cruise control system. In the last two decades, frequent information waves and technical transformation have propelled the telecom industry. “Internet of Things” has opened new opportunities in the sector, describing a unique blueprint for IT and telecom industries. Until 2020, it is projected that the ratio between human type communications to machine type communication will reach 1:30 that will help operators to enhance their subscriber base to 50 billion from 6 billion people. Furthermore, mobile broadband is contributing significantly to the industry’s development. Mobile broadband is entering into a golden age of development that is bringing the human race to a new level of ubiquity. Request Free Sample

Request Free Sample

Cloud computing is bringing new opportunities to the field of telecommunication. The popularity of broadband has given a base to cloud computing. The technology is overturning the conventional business model of media, hardware, and software. Users are switching to “buying services” from “buying products”. Cloud computing is projected to be a vital factor for telecom operators for their business development to realize extending network value.

The automotive industry has grown substantially in past few years. Many new markets have opened several opportunities and made their way through innovations. Considering the innovations taking place daily, industries and business models are subjected to rapid change, disruption, and growth. Globalization in the automotive industry has tremendously accelerated in the second half of 1990 owing to the establishment of mergers amongst key multinational manufacturers and construction of crucial overseas facilities. In 2015, nearly 72 million cars were sold globally and around 68 million cars were manufactured. The global automobile industry has registered significant transformation in the past two decades along with digitization of vehicles.

Embedded Systems Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Embedded Systems Market |

| Market Size in 2023 | USD 101.37 Billion |

| Market Forecast in 2032 | USD 189.53 Billion |

| Growth Rate | CAGR of 7.2% |

| Number of Pages | 203 |

| Key Companies Covered | Toshiba Corporation, NXP Semiconductors N.V., Fujitsu Limited, Broadcom Limited, Analog Devices Inc., Cypress Semiconductor Corporation, Qualcomm Technologies Incorporated, STMicroelectronics N.V., Microchip Technology Incorporated, Texas Instruments Incorporated, Renesas Electronics Corporation, Infineon Technologies AG, and Intel Corporation. |

| Segments Covered | By Type, By Function, By Microcontroller Performance, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Embedded Systems Market Segmentation Analysis

The study provides a decisive view of the embedded systems market by segmenting the market based on type, functions, microcontroller performance, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on the type, the segmentation of the embedded systems market includes hardware and software.

Based on functions, the segmentation of the embedded systems market includes real-time, standalone, networked, and mobile.

Based on microcontroller performance, the segmentation of the embedded systems market includes sophisticated, medium scale and small scale.

Based on application, the segmentation of the embedded systems market includes automobiles, telecommunication, smart cards, missiles, satellites, computer networking, and digital consumer electronics.

Regional Analysis

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Each region has been further segmented into countries such as the U.S., the UK, France, Germany, China, India, Japan, and Brazil.

Regional segmentation of global embedded systems includes North America, the Middle East & Africa, Latin America, Europe, and the Asia Pacific. The Asia Pacific will witness the fastest pace in the global embedded systems market between 2018 and 2024 owing to numerous trained professionals indulged in software development of the technology. Additionally, boosting a number of fabrication plants that includes “Taiwan Semiconductor Manufacturing Company” is helping to lower the manufacturing cost of the hardware components of the system.

The report covers detailed competitive outlook including the market share and company profiles of the key participants operating in the global embedded systems market such as Toshiba Corporation, NXP Semiconductors N.V., Fujitsu Limited, Broadcom Limited, Analog Devices Inc., Cypress Semiconductor Corporation, Qualcomm Technologies Incorporated, STMicroelectronics N.V., Microchip Technology Incorporated, Texas Instruments Incorporated, Renesas Electronics Corporation, Infineon Technologies AG, and Intel Corporation.

The report segments the global embedded systems market as follows:

Embedded Systems Market: Type Segment Analysis

- Hardware

- Software

Embedded Systems Market: Function Segment Analysis

- Real-time

- Standalone

- Networked

- Mobile

Embedded Systems Market: Microcontroller Performance Segment Analysis

- Small-scale

- Medium scale

- Sophisticated

Embedded Systems Market: Application Segment Analysis

- Automobile

- Telecommunication

- Smart cards

- Missiles

- Satellites

- Computer networking

- Digital consumer electronics

Embedded Systems Market: Regional Segment Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed