Elemental Sulfur Market Size, Share, Trends, Growth and Forecast 2032

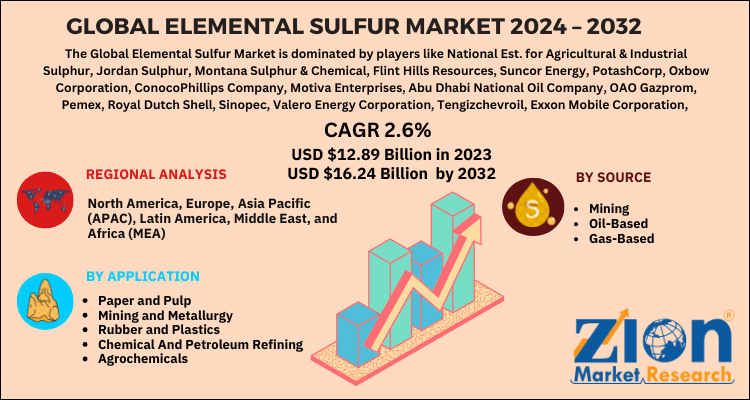

Elemental Sulfur Market By Application (Paper and Pulp, Mining and Metallurgy, Rubber and Plastics, Chemical And Petroleum Refining, Agrochemicals, and Others), and By Source (Mining, Oil-Based, and Gas-Based): Global Industry Perspective, Comprehensive Analysis and Forecast 2024 - 2032

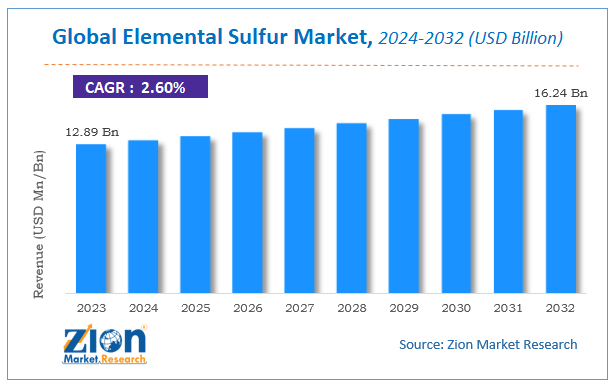

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 12.89 Billion | USD 16.24 Billion | 2.6% | 2023 |

Elemental Sulfur Market Insights

Zion Market Research has published a report on the global Elemental Sulfur Market, estimating its value at USD 12.89 Billion in 2023, with projections indicating that it will reach USD 16.24 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 2.6% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Elemental Sulfur industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Global Elemental Sulfur Market: Overview

Sulfur is used in the manufacturing processes of carbon sulfides, sulfhydric, sulfite, and sulfuric acids, and sulfurous gas, among others. Furthermore, sulfur is used for producing insecticides, fertilizers, black gunpowder, detergents, pharmaceuticals, disinfectants, and dyestuffs, among other things. Varied sulfur products are used as additives in flammable scentless gases, to identify leakage via sulfur’s trademark aroma. The growth of the global elemental sulfur market can be attributed to the growing demand of vulcanization of rubber.

Global Elemental Sulfur Market: Growth Factors

The growing demand of elemental sulfur from the fertilizer manufacturing industry and the increasing use of sulfur for rubber vulcanization are the major growth drivers in the global market for elemental sulfur. The decline in the prices of crude oil has led the oil refineries globally to engage in capacity expansion among other brownfield operations. Rubber manufacturing involves the process of vulcanization, for which elemental sulfur is a primary ingredient.

This is also fuelling the development of the global elemental sulfur market. The agrochemical industry is the largest consumer of elemental sulfur, as it utilizes elemental sulfur for manufacturing phosphate fertilizer, which is anticipated to show a healthy growth in the future. Huge costs related to mining and enactment of strict environmental protection laws regarding sulfur usage might hamper the expansion of this market on a global scale.

Global Elemental Sulfur Market: Segmentation

The global elemental sulfur market can be divided based on application and source.

Based on application, the elemental sulfur market can be classified into paper and pulp, mining and metallurgy, rubber and plastics, chemical and petroleum refining, and agrochemicals, among others.

On the basis of source, the elemental sulfur market can be categorized into mining, oil-based, and gas-based, among others.

Elemental Sulfur Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Elemental Sulfur Market |

| Market Size in 2023 | USD 12.89 Billion |

| Market Forecast in 2032 | USD 16.24 Billion |

| Growth Rate | CAGR of 2.6% |

| Number of Pages | 110 |

| Key Companies Covered | National Est. for Agricultural & Industrial Sulphur, Jordan Sulphur, Montana Sulphur & Chemical, Flint Hills Resources, Suncor Energy, PotashCorp, Oxbow Corporation, ConocoPhillips Company, Motiva Enterprises, Abu Dhabi National Oil Company, OAO Gazprom, Pemex, Royal Dutch Shell, Sinopec, Valero Energy Corporation, Tengizchevroil, Exxon Mobile Corporation, Marathon Petroleum Corporation, and The Saudi Arabian Oil Company, among several others |

| Segments Covered | BY Application, By Source And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Elemental Sulfur Market: Regional Analysis

Based on regions, the global market for elemental sulfur can be divided into five main regions: North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa. The Asia Pacific region is projected to dominate the market for elemental sulfur in the upcoming years. This is due to increasing demand for elemental sulfur by the rubber and petroleum refining industries, development of the agricultural sector, and rising sulfuric acid consumption for mining activities. The North American region is expected to show good growth potential in the global elemental sulfur market in future. This is due to elemental sulfur’s extensive use for manufacturing inorganic fertilizers. The Middle East and African region are anticipated to hold a substantial share in the market for elemental sulfur in the upcoming years. As elemental sulfur is extensively utilized in the production of H3PO4 and Africa’s production capacity of H3PO4 is expected to increase in future, this will fuel the growth of the elemental sulfur market in this region.

Global Elemental Sulfur Market: Competitive Players

The key market players of the global market for elemental sulfur include-

- National Est. for Agricultural & Industrial Sulphur

- Jordan Sulphur

- Montana Sulphur & Chemical

- Flint Hills Resources

- Suncor Energy

- PotashCorp

- Oxbow Corporation

- ConocoPhillips Company

- Motiva Enterprises

- Abu Dhabi National Oil Company

- OAO Gazprom

- Pemex

- Royal Dutch Shell

- Sinopec

- Valero Energy Corporation

- Tengizchevroil

- Exxon Mobile Corporation

- Marathon Petroleum Corporation

- The Saudi Arabian Oil Company

- among several others.

The Elemental Sulfur market is segmented as follows:

By Application

- Paper and Pulp

- Mining and Metallurgy

- Rubber and Plastics

- Chemical And Petroleum Refining

- Agrochemicals

- Others

By Source

- Mining

- Oil-Based

- Gas-Based

Elemental Sulfur Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global fertilizer consumption has been increasing owing to increasing demand for fertilizer for booting the agricultural output. Further, the rubber and plastic industry has also seen a rapid growth owing to use of these in packaging. These trends have fueled the market growth.

Global Elemental Sulfur Market size valued at US$ 12.89 Billion in 2023, set to reach US$ 16.24 Billion by 2032 at a CAGR of about 2.6% from 2024 to 2032.

The Asia Pacific Elemental Sulfur market is projected to hold the largest share globally in years ahead, mainly due to rising consumption of agrochemicals and rubber and plastic products.

Some main participants of the Elemental Sulfur market are Royal Dutch Shell, Sinopec, Valero Energy Corporation, Exxon Mobile Corporation, Marathon Petroleum Corporation, and The Saudi Arabian Oil Company.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed