Egg Carton And Trays Market Size, Share, Trends, Growth & Forecast 2034

Egg Carton And Trays Market By Carton Type (Standard/Regular Cartons, Specialty Cartons, Half-Dozen Cartons, Dozen Cartons), By Material Type (Molded Pulp, Plastic, Foam, Paperboard/Cardboard), By Egg Size (Large Eggs, Medium Eggs, Small Eggs), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

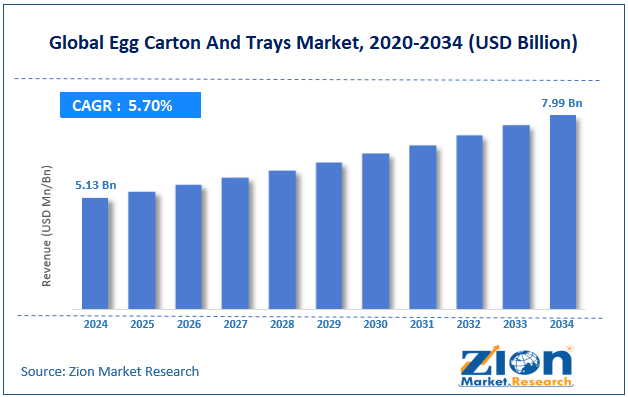

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.13 Billion | USD 7.99 Billion | 5.70% | 2024 |

Egg Carton And Trays Industry Perspective:

What will be the size of the global egg carton and trays market during the forecast period?

The global egg carton and trays market size was around USD 5.13 billion in 2024 and is projected to reach USD 7.99 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.70% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global egg carton and trays market is estimated to grow annually at a CAGR of around 5.70% over the forecast period (2025-2034)

- In terms of revenue, the global egg carton and trays market size was valued at around USD 5.13 billion in 2024 and is projected to reach USD 7.99 billion by 2034.

- The egg carton and trays market is projected to grow significantly, driven by rising poultry farming, demand for sustainable packaging, and innovation in biodegradable materials.

- Based on carton type, the dozen cartons segment is expected to lead the market, while the half-dozen cartons segment is expected to grow considerably.

- Based on material type, the molded pulp segment is the dominating segment, while the plastic segment is projected to witness sizeable revenue over the forecast period.

- Based on egg size, the large eggs segment is expected to lead the market, followed by the medium eggs segment.

- By region, the Asia Pacific is projected to dominate the global market during the forecast period, followed by North America.

Egg Carton And Trays Market: Overview

Egg cartons and trays are specially designed containers that store, protect, and transport eggs without breaking. They are made of materials such as foam, plastic, or molded pulp and feature individual compartments that cushion each egg and prevent it from cracking or rolling. The global egg carton and trays market is poised for notable growth, driven by rising global egg consumption, the expansion of the poultry industry, and the shift toward sustainable packaging. Growing awareness of eggs as an affordable protein source is driving global demand. Higher consumption drives elevated production, creating a need for protective packaging and thus driving the global market. Growth in poultry farming, mainly in developing nations, increases egg output. More eggs need safe handling and storage solutions. Trays and cartons become important for reducing breakage. Moreover, companies and consumers prefer recyclable, eco-friendly, and biodegradable cartons. This fuels innovation in sustainable materials. Demand for green packaging solutions is steadily growing.

Nevertheless, the global market faces limitations due to factors such as the high cost of sustainable materials and the volatility of raw-material prices. Eco-friendly cartons are usually more expensive than foam or plastic. This hampers adoption, mainly in cost-sensitive areas. Price remains a key barrier to broader use.

Likewise, varying costs of plastic, paper, and pulp impact production. Higher input prices may lower profit margins. This uncertainty hinders industry growth. Still, the global egg carton and tray industry benefits from several favorable factors, including eco-friendly, biodegradable innovations, customization and branding services, and smart packaging technologies. Manufacturers can develop recycled or compostable cartons. Eco-conscious users prefer sustainable options.

Hence, innovation offers fresh market segments. Tailored packaging with colors, logos, and designs appeal customers. Retailers can differentiate their products. Customized cartons improve industry competitiveness. Additionally, freshness indicators, QR codes, and tamper-evident features enhance usability. Technology increases consumer trust and traceability. Smart packaging adds value to products.

Egg Carton And Trays Market: Dynamics

Growth Drivers

How is the expansion of organized retail and e‑commerce channels propelling the egg carton and trays market?

The proliferation of hypermarkets, supermarkets, and online grocery platforms has elevated demand for durable, standardized, and tamper-evident egg packaging. Retailers need visually appealing cartons that protect eggs in last-mile delivery and on shelves, driving demand for engineered trays with advanced cushioning. E-commerce growth, especially, has sparked interest in secure packaging due to the need for damage-free transport. As distribution networks expand worldwide, packaging suppliers are supporting product designs with multi-channels retail needs.

How is the egg carton and trays market experiencing growth driven by technological innovation and smart packaging solutions?

Technological improvements in design and manufacturing are changing the landscape of the egg carton and trays market. Automation and robotics in stacking, molding, and quality control fuel production throughput and reduce labor intensity. Smart packaging features like traceability systems, QR codes, and improved shock-absorption designs enhance consumer engagement and food safety. These innovations not only enhance production efficiency but also open new differentiators for brands.

Restraints

Competitive pressure from alternative packaging materials adversely impacts the market progress

While molded pulp and fiber are dominant, competition from emerging polymers and plastics remains strong. Plastic cartons often offer perceived durability and a lower immediate cost to some buyers, narrowing the industry share for traditional buyers. This diverts sales from eco-friendly formats that are otherwise obtaining regulatory favors. The mixed preference slows uniform industry transition to sustainable formats.

Opportunities

How are digitization and traceability integration presenting favorable prospects for the expansion of the egg carton and trays market?

Technology integration in packaging is a key opportunity for differentiation in the egg carton and trays industry. Embedding barcodes, blockchain traceability, and QR codes in cartons allows consumers and retailers to verify origin, freshness, and handling. This is particularly appealing in export markets and e-commerce, where egg integrity is crucial and shipment times are longer. Digitized packaging can also enable real-time analysis for supply chain optimization, helping reduce losses from spoilage or breakage.

Challenges

Ensuring uniform quality across global supply chains restricts the market growth

Maintaining consistent strength, moisture resistance, and fit in different production lines is complex. Changes in raw material quality or production conditions may lead to breakage during transportation, thereby affecting brand reputation. As companies expand worldwide, standardizing equipment, quality assurance, and training becomes more challenging. Failure to achieve uniform quality may result in slow adoption in sensitive markets such as e-commerce channels and exports.

Egg Carton And Trays Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Egg Carton And Trays Market |

| Market Size in 2024 | USD 5.13 Billion |

| Market Forecast in 2034 | USD 7.99 Billion |

| Growth Rate | CAGR of 5.70% |

| Number of Pages | 214 |

| Key Companies Covered | Brødrene Hartmann A/S, Huhtamäki Oyj, Pactiv LLC, DFM Packaging Solutions, Dispak Ltd, Dolco Packaging, Mauser Packaging Solutions, UFP Technologies, Ulma Packaging, Ovotherm International Handels GmbH, Cascades Inc., Tekni Plex Inc., HZ Corporation, Al Ghadeer Group, Green Pulp Paper, and others. |

| Segments Covered | By Carton Type, By Material Type, By Egg Size, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Egg Carton And Trays Market: Segmentation

The global egg carton and trays market is segmented based on carton type, material type, egg size, and region.

Based on carton type, the global egg carton and trays industry is divided into standard/regular, specialty, half-dozen, and dozen cartons. The dozen carton segment accounts for 40% of the total market, holds the leading share of revenue, and is the most widely adopted format in grocery channels and retail supermarkets due to affordability, convenience, and standardized packaging regulations.

On the other hand, the half-dozen cartons segment captures 25% of the market share. They are steadily popular among urban consumers, smaller households, and specialty or premium egg brands that seek compact packaging options.

Based on material type, the global egg carton and trays market is segmented into molded pulp, plastic, foam, and paperboard/cardboard. The molded pulp segment dominates the market with 55% share. This is attributed to its broad adoption as a recyclable, protective, and compostable packaging solution that aligns with regulatory pressures and sustainability trends.

Conversely, the plastics segment accounts for 35% of the total market share, mainly rPET and PET, valued for their merchandising appeal, moisture resistance, and clarity, which has increased their popularity in retail and premium display applications.

Based on egg size, the global market is segmented into large, medium, and small eggs. The large eggs segment leads with 50% market share, as they are commonly purchased and preferred for foodservice, commercial use, and supermarkets worldwide.

Nonetheless, the medium eggs segment holds 40% of the market share, after large eggs, owing to their appeal and affordability in cost-sensitive regions and among smaller households.

Egg Carton And Trays Market: Regional Analysis

What enables the Asia Pacific to have a strong foothold in the global Egg Carton And Trays Market?

Asia Pacific is projected to maintain its dominant position with a 9.5% CAGR in the global egg carton and trays market, driven by a massive egg production and consumption base, dominant market shares in packaging demand, and urbanization and growing disposable incomes. Asia Pacific produces and consumes a large share of the global egg supply, accounting for 40% of worldwide egg production. This includes India and China, fueling the total regional volume. China alone produces tens of millions of tons of shell eggs every year, while India’s production continues robust growth. This high egg output naturally creates enormous demand for trays and cartons to pack, sell, and transport eggs.

Moreover, the APAC region accounts for nearly 35% of the worldwide egg packaging market, making it the leading region. The rapid expansion of e-commerce, organized retail, and modern cold chain networks is driving demand for standardized, reliable packaging solutions. These distribution improvements have augmented the adoption of retail-ready cartons and trays in the region.

Furthermore, expanding middle-class populations and urbanization in countries such as India, China, and Southeast Asia are driving consumer demand for branded, packaged eggs. Higher disposable incomes also shift consumption toward safer, visually appealing, and hygienic packaging formats. This socio-economic shift backs demand growth for premium and basic egg carton and tray products.

North America maintains its position as the second-leading region, with a 6.2% CAGR, in the global egg carton and trays industry, driven by significant market share, a well-developed industry, large egg production and consumption levels, and advanced packaging technology and infrastructure. North America captures a notable share of the market, accounting for nearly 32% in 2024, followed by the Asia Pacific. This rank is backed by Canada’s and the US's established egg production and poultry infrastructure. The region’s sophisticated market dynamics support consistent and high demand for cartons and trays.

Moreover, the US alone produces over 100 billion eggs each year, necessitating robust packaging solutions to manage this volume efficiently and safely. High per capita consumption assures steady retail demand for cartons in grocery stores, supermarkets, and other outlets. These large production-consumption cycles highlight the need for reliable and diversified packaging formats. North American markets benefit from mature packaging solutions, such as advanced thermoforming for plastics, automated molding lines, and optimized fiber pulp systems, which enhance quality and reduce breakage. Strong cold-chain systems and logistics further support effective distribution of egg packaging. This infrastructure strengthens appeal investment and advancement in carton and tray solutions.

Egg Carton And Trays Market: Competitive Analysis

The leading players in the global egg carton and trays market are:

- Brødrene Hartmann A/S

- Huhtamäki Oyj

- Pactiv LLC

- DFM Packaging Solutions

- Dispak Ltd

- Dolco Packaging

- Mauser Packaging Solutions

- UFP Technologies

- Ulma Packaging

- Ovotherm International Handels GmbH

- Cascades Inc.

- Tekni Plex Inc.

- HZ Corporation

- Al Ghadeer Group

- Green Pulp Paper

Egg Carton And Trays Market: Key Market Trends

Innovation in material performance and functional designs:

New product development focuses on moisture-resistant molded fiber trays and high-performance coatings that enhance durability and strength in refrigerated and transit environments. Manufacturers are also creating stackable, lightweight, and protective designs that improve handling and reduce breakage effectively. These advancements help cartons and trays better balance sustainability with practical performance.

Tailoring for automation and e‑commerce logistics:

Packaging designs are changing to support e-commerce last-mile delivery and automated distribution centers, requiring consistent dimensions and improved durability. As online grocery shopping increases worldwide, protective yet lightweight cartons and trays are in greater demand to prevent breakage during transport and shipping. Automation-friendly packaging also enhances efficacy in robotic handling systems and warehousing.

The global egg carton and trays market is segmented as follows:

By Carton Type

- Standard/Regular Cartons

- Specialty Cartons

- Half-Dozen Cartons

- Dozen Cartons

By Material Type

- Molded Pulp

- Plastic

- Foam

- Paperboard/Cardboard

By Egg Size

- Large Eggs

- Medium Eggs

- Small Eggs

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed