Global E-Cigarette Market Size, Share, Growth Analysis Report - Forecast 2034

E-Cigarette Market By Product Type {(Disposable E-Cigarettes (Single-Use), Closed System Vapes (CSV / Pod Systems)), Open System Vapes, RBA (Rebuildable Atomizer), RDA (Rebuildable Dripping Atomizer), RTA (Rebuildable Tank Atomizer), Heating-Not-Burning (HnB) Devices, E-Liquids,}, By Flavor (Tobacco, Menthol / Mint, Fruit, No-Flavour / Neutral, and Others), By Nicotine Category (Nicotine Salt (Salt-Nic), Freebase Nicotine, Nicotine-Free (0 mg), High-Nicotine E-Liquids (35-50 mg/ml), Low-Nicotine E-Liquids (3-18 mg/ml)), By Price Tier (Economy, Low-Mid, Mid, Premium, Ultra-Premium / Limited Edition), By Distribution Channel (Offline Retail, Online Retail,Travel Retail), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 27.96 Billion | USD 90.18 Billion | 12.26% | 2024 |

E-Cigarette Industry Perspective:

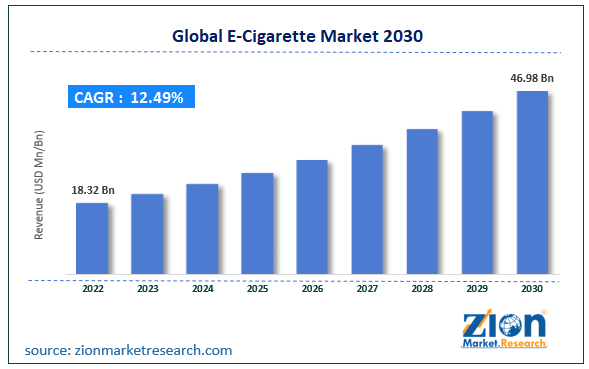

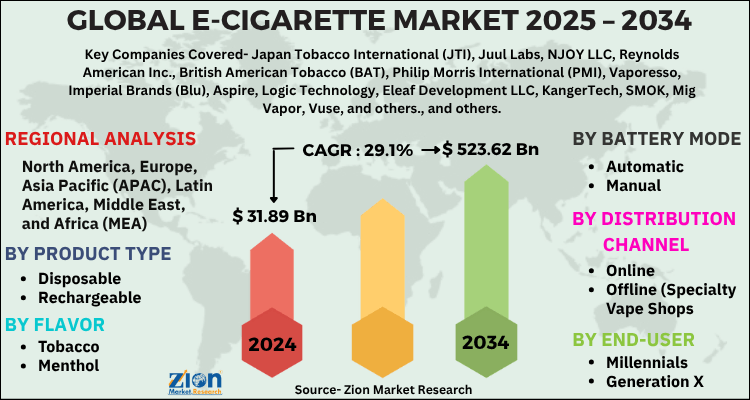

The global e-cigarette market size was worth around USD 27.96 Billion in 2024 and is predicted to grow to around USD 90.18 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 12.26% between 2025 and 2034. The report analyzes the global e-cigarette market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the e-cigarette industry.

E-Cigarette Market: Overview

An e-cigarette is an electronic version of a traditional cigarette that contains tobacco. E-cigarettes are also known as vapor pens in which a battery is installed to heat up an aerosol that contains a special liquid. The final content is then smoked by an inhaler. E-cigarettes are unlike conventional water vapor because the liquid content in the cartridges contains some amount of nicotine. It is extracted from tobacco. The other contents of e-cigarettes are certain chemicals, flavorings, and propylene glycol. These electronic cigarettes have become extremely popular with the younger generation due to strategic marketing tactics used by e-cigarette manufacturers.

However, recent studies have shown that even brands advertising their products as nicotine-free contain at least trace amounts of the addictive component. Although the industry for e-cigarettes is expanding rapidly, there are several challenges and growth barriers that it faces, especially influenced by recent research-related developments related to the safety of these electronic vapes. During the forecast period, the demand for e-vapes is likely to continue growing but may face harsher limitations than in previous years.

Key Insights

- As per the analysis shared by our research analyst, the global e-cigarette market is estimated to grow annually at a CAGR of around 12.26% over the forecast period (2025-2034).

- Regarding revenue, the global e-cigarette market size was valued at around USD 27.96 Billion in 2024 and is projected to reach USD 90.18 Billion by 2034.

- The e-cigarette market is projected to grow at a significant rate due to increasing smoking cessation efforts, rising popularity of vaping among youth, and innovation in flavored and nicotine-regulated products.

- Based on Product Type, the Disposable segment is expected to lead the global market.

- On the basis of Flavor, the Tobacco segment is growing at a high rate and will continue to dominate the global market.

- Based on the Battery Mode, the Automatic segment is projected to swipe the largest market share.

- By Distribution Channel, the Online segment is expected to dominate the global market.

- In terms of End-user, the Millennials segment is anticipated to command the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

E-Cigarette Market: Growth Drivers

Marketing e-cigarettes as substitutes for tobacco cigarettes to promote market growth

The global e-cigarette market is projected to grow owing to the increasing marketing of electronic cigarettes as effective substitutes for tobacco-infused cigarettes. Studies show that the majority of the world's population is addicted to tobacco smoking. A recent survey by the Pennsylvania State University concluded that 85% of the people who smoked were addicted to tobacco either to mild, moderate, or severe extent. The World Health Organization (WHO) reports suggest that more than 1.27 billion people across the globe are addicted to smoking which is known to be harmful to human health in the long run. Some of the medical conditions triggered by regular smoking include lung diseases, oral cancer, stroke, heart disease, diabetes, and chronic pulmonary diseases (CPDs).

Smoking is also known to increase the risk of contracting tuberculosis and problems of the immune system. It can have a severe impact on the emotional and social well-being of smokers and people around them.

In a bid to reduce dependency on tobacco-infused cigarettes, the manufacturers of e-cigarettes have promoted these vapes as safer alternatives. For instance, a recent study conducted by the Harm Reduction Journal concluded that an estimated number of 40.3 million in 49 countries was mainly limited to European countries while the rest of 152 nations had around 17.8 million buyers of e-cigarettes.

E-Cigarette Market: Restraints

Studies indicating e-cigarettes to contain harmful components may restrict the market

In recent times, more studies and research have been conducted to better understand if e-cigarettes are as safe as they are claimed. Several indicate that e-cigarettes also contain harmful chemicals and they can be as addictive as traditional cigarettes. For instance, a report published by the Centers for Disease Control and Prevention states that e-cigarette aerosols contain potentially harmful substances including nicotine. It is not recommended for use in children, teenagers, pregnant women, and people with a history of medical conditions. These prohibitions are the same as conventional cigarettes. However, there is limited research on the exact difference between cigarettes and their electronic versions and more studies are needed to identify the exact threats posed by overuse of e-cigarettes.

E-Cigarette Market: Opportunities

Increasing addition of new flavors to create growth opportunities

E-cigarette suppliers have been experimenting with various flavors to target new consumer sets. The rising number of flavor launches along with the ease of smoking provided by e-cigarettes could trigger higher growth possibilities for the e-cigarette industry. Additionally, companies supplying electronic cigarettes are undertaking a collaborative approach to make an entry into newer markets. In November 2018, popular e-cigarette maker Juul was reported to be considering a partnership with Altria, the maker of the popular cigarette brand Marlboro. Juul initially started out with a vision to eliminate cigarette smoking however, by selling a certain percentage of its stake to Marlboro, the company may have been shifting from its initial statement. Later confirmations showed that Altria invested nearly USD 12.8 billion in JuulL. In 2019, Juul and Big Tobacco were reported to be lobbying to raise the legal smoking age.

E-Cigarette Market: Challenges

Ban in several countries and strict measures taken against the sale of e-cigarettes to create challenges to growth

E-cigarettes are banned for sale and consumption in several countries owing to the health hazards posed by smoking e-cigarettes. In August 2022, an e-cigarette supplied by Juul in candy flavor caught fire and US officials had to immediately put a ban on the supply of these flavors. Additionally, in June 2023, the United States Food and Drugs Administration sent out warning letters to shops that were selling candy and fruit-flavored disposable e-cigarettes. The country has undertaken several steps to curb the sale of illegal disposable electronic cigarettes since they have a severe impact on the environment as well. As per Pan-American Health Organization, around 8 countries in North America have banned the sale of electronic cigarettes. These countries include Venezuela, Mexico, Brazil, Panama, Argentina, Uruguay, Suriname, and Nicaragua.

E-Cigarette Market: Segmentation

The global e-cigarette market is segmented based on distribution channel, product, and region.

Based on distribution channel, the global e-cigarette market segments are retail and online. In 2022, the highest growth was observed in the retail segment which dominated over 83.5% of the total share. E-cigarettes are readily available in gas stations and vape stores. Additionally, retail units have more flavors available and the sellers can help buyers meet their specific requirements by informing them about the different available options. The sale of e-cigarettes over online portals is highly restricted and sellers can be easily caught in countries that have banned the production and distribution of e-cigarettes.

Based on product, the e-cigarette industry divisions are modular devices, rechargeable, and disposable. In 2022, the rechargeable segment held control over 43.5% of the total revenue since these units are more affordable than their counterparts. Consumers only have to spend on buying cartridges and other accessories instead of buying a complete set which can be costly. The average cost of a typical e-vape is between USD 50 to USD 70 in which the price of the vape pen, which is a one-time cost, is USD 40 to USD 60 and the balance is for e-juice whenever required. Additionally, disposable e-cigarettes have stricter rules regulating their production and sale.

E-Cigarette Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | E-Cigarette Market |

| Market Size in 2024 | USD 27.96 Billion |

| Market Forecast in 2034 | USD 90.18 Billion |

| Growth Rate | CAGR of 12.26% |

| Number of Pages | 227 |

| Key Companies Covered | JUUL Labs, Vuse (British American Tobacco), RELX, Elf Bar, SMOK (Smoktech), Vaporesso (Smoore), Voopoo, Innokin, Aspire, GeekVape, KangerTech, NJOY, blu (Imperial Brands), Logic (Nicoventures / JTI), Smoore Technology, PAX Labs, Ploom (Japan Tobacco), IQOS (Philip Morris International), NuMark (Altria), Halo Cigs, and others., and others. |

| Segments Covered | By Product Type, By Flavor, By Nicotine Category, By Price Tier, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

E-Cigarette Market: Regional Analysis

Europe to dominate with the highest growth rate during the forecast period

The global e-cigarette market is expected to witness the highest growth rate in Europe. In 2022, the region accounted for 44.5% of the global revenue. This is because Europe has more relaxed laws for the production, distribution, and consumption of e-cigarettes as compared to other regions. For instance, although e-vapes can be sold, there are laws restricting the sale of e-cigarette tanks at a capacity of more than 2ml, and nicotine content is restricted to or less than 20 mg/ml/. The higher number of cigarette smokers in Europe are the leading consumers in the regional market since they are shifting toward e-cigarettes. A report by the National Institutes of Health concluded that over 48.5 million European citizens have used e-cigarettes and almost 76.8% have used nicotine-based electronic cigarettes.

In Asia-Pacific, the revenue is projected to be largely restricted owing to severe regulations around the sale of e-cigarettes. For instance, even though China allows the selling of e-vapes, there are several restrictions such as a sale ban near education facilities and minimum sales age. In India, the government has completely banned the production and use of e-cigarettes in all forms. Recently, the Indian government launched an online portal for reporting the sale of electronic cigarettes.

E-Cigarette Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the e-cigarette market on a global and regional basis.

The global e-cigarette market is dominated by players like:

- JUUL Labs

- Vuse (British American Tobacco)

- RELX

- Elf Bar

- SMOK (Smoktech)

- Vaporesso (Smoore)

- Voopoo

- Innokin

- Aspire

- GeekVape

- KangerTech

- NJOY

- blu (Imperial Brands)

- Logic (Nicoventures / JTI)

- Smoore Technology

- PAX Labs

- Ploom (Japan Tobacco)

- IQOS (Philip Morris International)

- NuMark (Altria)

- Halo Cigs

The global e-cigarette market is segmented as follows;

By Product Type

- Disposable E-Cigarettes (Single-Use)

- Standard Puff Disposables (300–800 puffs)

- Mid-Range Disposables (1,000–3,000 puffs)

- High-Capacity Disposables (5,000–10,000+ puffs)

- Nicotine Salt-Based Disposables

- Rechargeable Disposables

- Prefilled Flavour Disposables

- Closed System Vapes (CSV / Pod Systems)

- Prefilled Pod Devices

- Refillable Closed Pods

- Draw-Activated Pod Systems

- Button-Activated Pod Systems

- Temperature-Controlled Closed Pods

- Limited Edition & Signature Pods

- Open System Vapes

- Vape Mods

- Box Mods

- Pod Mods (Open-Fill)

- Refillable Tank Systems

- Sub-Ohm Devices

- Rebuildable Atomizers

- RBA (Rebuildable Atomizer)

- RDA (Rebuildable Dripping Atomizer)

- RTA (Rebuildable Tank Atomizer)

- Heating-Not-Burning (HnB) Devices

- Tobacco Heating Devices

- Non-Tobacco Heatsticks

- Disposable Heat-Not-Burn Pods

- E-Liquids

- Nicotine Salt (Salt-Nic) E-liquids

- Freebase Nicotine E-liquids

- Zero-Nicotine (0 mg) E-liquids

- Premium / Craft E-liquids

- Organic or Botanical E-liquids

By Flavor

- Tobacco

- Classic Tobacco

- Smooth Tobacco

- Rich Tobacco

- Tobacco-Mint Blend

- Menthol / Mint

- Ice Menthol

- Peppermint

- Spearmint

- Mint-Tobacco

- Fruit

- Citrus

- Berry

- Tropical fruits

- Watermelon / Melon

- Mixed fruit blends

- No-Flavour / Neutral

- Others

By Nicotine Category

- Nicotine Salt (Salt-Nic)

- Freebase Nicotine

- Nicotine-Free (0 mg)

- High-Nicotine E-Liquids (35–50 mg/ml)

- Low-Nicotine E-Liquids (3–18 mg/ml)

By Price Tier

- Economy

- Low-Mid

- Mid

- Premium

- Ultra-Premium / Limited Edition

By Distribution Channel

- Offline Retail

- Vape Specialty Stores

- Convenience Stores

- Forecourt / Gas Station Retail

- Supermarkets & Hypermarkets

- Tobacco Shops

- Pharmacy Chains (regulated markets only)

- Kiosks

- Online Retail

- Marketplace Platforms

- Brand E-commerce Websites

- Subscription Models (Auto-delivery)

- Social Commerce (Platform-regulated markets)

- Travel Retail

- Airport Duty-Free

- Cross-Border Retail Shops

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

An e-cigarette is an electronic version of a traditional cigarette that contains tobacco. E-cigarettes are also known as vapor pens in which a battery is installed to heat up an aerosol that contains a special liquid.

The global e-cigarette market is expected to grow due to increasing smoking cessation efforts, rising popularity of vaping among youth, and innovation in flavored and nicotine-regulated products.

According to a study, the global e-cigarette market size was worth around USD 27.96 Billion in 2024 and is expected to reach USD 90.18 Billion by 2034.

The global e-cigarette market is expected to grow at a CAGR of 12.26% during the forecast period.

North America is expected to dominate the e-cigarette market over the forecast period.

Leading players in the global e-cigarette market include Japan Tobacco International (JTI), Juul Labs, NJOY LLC, Reynolds American Inc., British American Tobacco (BAT), Philip Morris International (PMI), Vaporesso, Imperial Brands (Blu), Aspire, Logic Technology, Eleaf Development LLC, KangerTech, SMOK, Mig Vapor, Vuse, and others., among others.

The report explores crucial aspects of the e-cigarette market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed