Nicotine Replacement Therapy Market Size, Share, Trends, Growth and Forecast 2034

Nicotine Replacement Therapy Market By Product (Inhalers, Gum, Transdermal Patches, Sublingual Tablets, Lozenges, E-Cigarettes, and Heat-not-burn Tobacco Products), By Distribution Channel (Offline and Online), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.20 Billion | USD 14.08 Billion | 12.86% | 2024 |

Nicotine Replacement Therapy Market: Industry Perspective

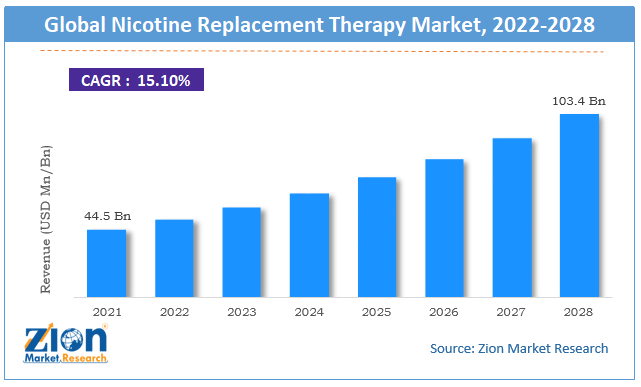

The nicotine replacement therapy market size was worth around USD 4.20 Billion in 2024 and is predicted to grow to around USD 14.08 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 12.86% between 2025 and 2034. The report analyzes the global nicotine replacement therapy market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the nicotine replacement therapy industry.

Nicotine Replacement Therapy Market: Overview

The use of nicotine patches, inhalers, gums, sprays, and lozenges by smokers that are free of the harmful substances found in tobacco is known as nicotine replacement therapy. Nicotine replacement therapy involves drugs that supply nicotine at a low dose as opposed to smoking, which contains a large amount of nicotine and consequently leads to lung cancer, asthma, and other chronic issues. By reducing or eliminating tobacco use, nicotine replacement treatment lowers the frequency and potency of cravings. Technological improvements and the rise in nicotine replacement treatment (NRT) use encourage the practice of nicotine replacement therapy.

Growing public awareness of smoking's harmful effects is a major market driver. The number of smokers is increasing and has topped 1.1 billion individuals worldwide. People are choosing smoking cessation therapies as a result of government measures, including the "affordable care act," insurance rules, and campaigns to raise knowledge of the harmful effects of smoking on health through counseling. More people have been moving to cutting-edge goods due to ongoing technological developments in the field of nicotine replacement therapy. NRT adoption is anticipated to be sped up by innovations like heat-not-burn products, sweetened chewing gum, and lozenges. However, one of the most significant barriers to the market's expansion is the ban on e-cigarettes.

COVID-19 Impact:

The COVID-19 outbreak has somewhat impacted sales of NRT products. Health agencies like WHO, CDC, and others have recommended smokers give up smoking as a preventive precaution. The lungs are harmed by cigarette smoke, which increases a person's susceptibility to COVID-19. Higher product uptake can be attributed to the populace's growing understanding of the negative consequences of tobacco smoke. The restriction on online sales and the elimination of the ability for consumers to purchase NRT products was first enforced in France. This was mostly done to stop people from stockpiling goods after hearing that nicotine can help fight the COVID-19 virus. The global market will therefore experience significant expansion over the upcoming year, marking a modest growth rate.

Key Insights

- As per the analysis shared by our research analyst, the global nicotine replacement therapy market is estimated to grow annually at a CAGR of around 12.86% over the forecast period (2025-2034).

- Regarding revenue, the global nicotine replacement therapy market size was valued at around USD 4.20 Billion in 2024 and is projected to reach USD 14.08 Billion by 2034.

- The nicotine replacement therapy market is projected to grow at a significant rate due to growing awareness of the detrimental health effects of smoking, leading more individuals to seek cessation methods.

- Based on Product Type, the Patches segment is expected to lead the global market.

- On the basis of End-Users, the Hospitals segment is growing at a high rate and will continue to dominate the global market.

- Based on the Distribution Channel, the Hospital Pharmacy segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Nicotine Replacement Therapy Market: Growth Drivers

Growing understanding of the adverse effects of smoking is driving the market growth

Growing public knowledge of smoking's detrimental consequences is anticipated to be a key market driver. Over 1.1 billion people smoke around the world. Government programs like the "affordable care act," insurance requirements, and campaigns to increase knowledge of the detrimental effects of smoking on health through counseling are all contributing to the rise in the use of nicotine replacement therapies. Favorable reimbursement policies will also accelerate the global nicotine replacement therapy market's expansion.

Nicotine Replacement Therapy Market: Restraints

Myths about NRT that suppress product adoption restraints the market demand

The number of persons who want to stop smoking is decreased despite the widespread understanding of the negative effects of smoking spread via awareness programs, television advertisements, fliers, and other means. Additionally, product uptake remains low despite the introduction of successful NRT treatments and increased public awareness. According to a study by the World Health Organization (WHO), there are myths concerning these products. These include the products' inability to stop smoking, ineffectiveness, adverse effects, and high cost. As a result, the fallacies currently spreading about the items have reduced their adoption rate, resulting in lower sales.

Nicotine Replacement Therapy Market: Opportunity

Technological progress is boosting opportunities in the market

People are switching to more advanced goods due to ongoing technological advancements in the market for nicotine replacement therapy. It is predicted that innovations like heat-not-burn products, flavored chewing gum, and lozenges would help NRT become more widely accepted. Tobacco industry behemoths like British American Tobacco have created safer, smokeless substitutes. These advancements differ from conventional cigarettes in that they are recognized by society and have a range of effectiveness, encourage consumer adoption, and boost global nicotine replacement therapy market growth. In the upcoming years, this will open up new market prospects.

Nicotine Replacement Therapy Market: Segmentation

The global nicotine replacement therapy market has been segmented on the basis of product, distribution channels, and region.

Based on product, the worldwide nicotine replacement therapy market is segmented into inhalers, gum, transdermal patches, sublingual tablets, lozenges, e-cigarettes, and heat-not-burn tobacco products. In 2021, e-cigarettes had the most significant market share of 52.1%. The market growth is projected to be further fueled by the growing knowledge that e-cigarettes are safer than traditional cigarettes, particularly among the younger generation. The vendors' wide range of customization options, including temperature control and nicotine doses, is anticipated to help the product demand. Additionally, growing e-cigarette technologies like pod systems and squonk mods have gained popularity and user adoption in recent years.

The worldwide nicotine replacement therapy market is segmented as offline and online based on distribution channels. In 2021, the offline segment's revenue share was 83.9%, which was the highest. The segment growth is supported by the accessibility of NRT items such as transdermal patches, gels, gums, e-cigarettes, and heated tobacco products in retail chains like Walgreens and Walmart Stores, Inc. Additionally, the affiliations between hospitals and these chains help the business expand.

Recent Developments

- In July 2021, Philip Morris International Inc paid USD 813.1 million to acquire Fertin Pharma from private equity firm EQT. Products from Fertin Pharma include chewing gums, tablets, and powders that have pharmacological and nutraceutical uses and aid in the hazardous cessation of cigarette smoking.

Nicotine Replacement Therapy Market: Regional Landscape

North America dominated the nicotine replacement therapy market in 2021

The prevalence of smoking-related ailments and the rise in pro-smoking government measures, along with rising e-cigarette and heated tobacco acceptance, are anticipated to have a beneficial effect on the development of the North American market. This area dominates with the most prominent retail sales of NRT goods in the U.S. and Canada. The number of smokers in the area who adhere to the smoking ban is rising, which has resulted in a more robust demand for products like gum, inhalers, etc. Additionally, the United States has higher smoking cessation rates than other nations, which has resulted in rising sales of these goods. Approximately 68% of Americans have decided to stop smoking, according to a survey conducted by the Centers for Disease Control and Prevention (CDC). As a result, it is projected that this will increase product sales in the years to come. Additionally, gums are more commonly used in the U.S. than other treatments on the market to quit smoking.

Nicotine Replacement Therapy Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Nicotine Replacement Therapy Market |

| Market Size in 2024 | USD 4.20 Billion |

| Market Forecast in 2034 | USD 14.08 Billion |

| Growth Rate | CAGR of 12.86% |

| Number of Pages | 254 |

| Key Companies Covered | Pfizer Inc. (US), GlaxoSmithKline plc (UK), Novartis AG (Switzerland), Mylan N.V. (US), Teva Pharmaceutical Industries Ltd.(Israel), Sanofi (France), AstraZeneca (UK), Johnson & Johnson Private Limited (US), Merck & Co Inc. (US), Cipla Inc. (US), Takeda Pharmaceutical Company Limited (Japan), Perrigo Company plc (Ireland), McNeil AB (Sweden), Imperial Brands (UK), Philip Morris Products S.A. (US), BAT (UK), NJOY (US), Fertin Pharma (Denmark), Glenmark Pharmaceuticals Limited (India), Pierre Fabre Group (France), and others. |

| Segments Covered | By Product Type, By End-Users, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Nicotine Replacement Therapy Market: Competitive Landscape

- Cipla Inc.

- Pfizer Inc.

- Johnson & Johnson Services

- British American Tobacco p.l.c.

- Philip Morris Products S.A. (Altria Group)

- Imperial Brands

- Glenmark

- Japan Tobacco Inc.

Global Nicotine Replacement Therapy Market is segmented as follows:

By Product

- Nicotine Replacement Therapy

- E-cigarettes

- Heat-not-burn Tobacco Products

By Distribution Channel

- Offline

- Online

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global nicotine replacement therapy market is expected to grow due to rising health awareness, supportive government policies, and continuous product innovation.

According to a study, the global nicotine replacement therapy market size was worth around USD 4.20 Billion in 2024 and is expected to reach USD 14.08 Billion by 2034.

The global nicotine replacement therapy market is expected to grow at a CAGR of 12.86% during the forecast period.

North America is expected to dominate the nicotine replacement therapy market over the forecast period.

Leading players in the global nicotine replacement therapy market include Pfizer Inc. (US), GlaxoSmithKline plc (UK), Novartis AG (Switzerland), Mylan N.V. (US), Teva Pharmaceutical Industries Ltd.(Israel), Sanofi (France), AstraZeneca (UK), Johnson & Johnson Private Limited (US), Merck & Co Inc. (US), Cipla Inc. (US), Takeda Pharmaceutical Company Limited (Japan), Perrigo Company plc (Ireland), McNeil AB (Sweden), Imperial Brands (UK), Philip Morris Products S.A. (US), BAT (UK), NJOY (US), Fertin Pharma (Denmark), Glenmark Pharmaceuticals Limited (India), Pierre Fabre Group (France), among others.

The report explores crucial aspects of the nicotine replacement therapy market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed