Dry Separator Lithium Battery Market Size, Share, Trends, Growth 2034

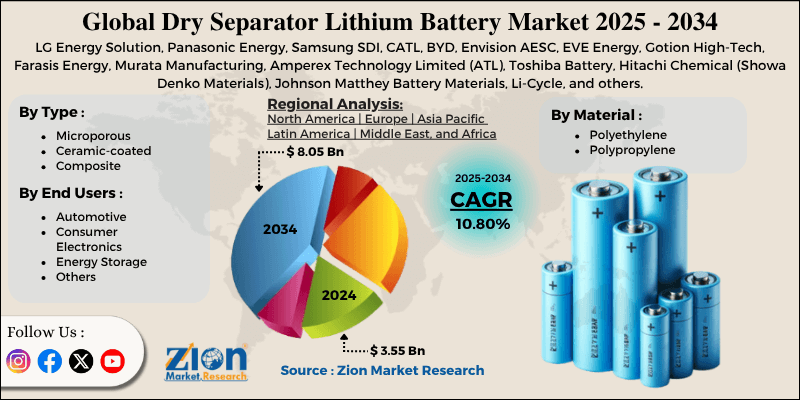

Dry Separator Lithium Battery Market By Type (Microporous, Ceramic-coated, Composite), By Material (Polyethylene, Polypropylene), By End Users (Automotive, Consumer Electronics, Energy Storage, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

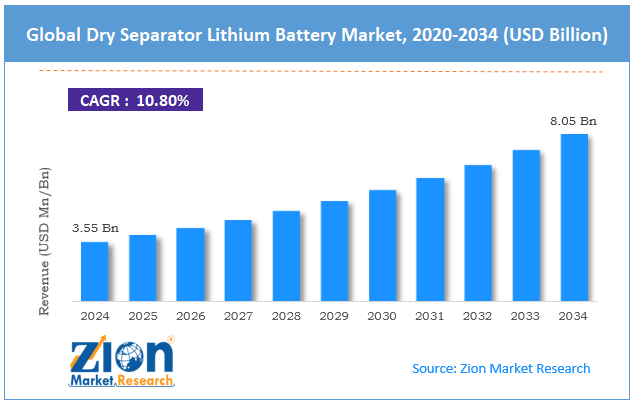

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.55 Billion | USD 8.05 Billion | 10.80% | 2024 |

Dry Separator Lithium Battery Industry Perspective:

The global dry separator lithium battery market size was around USD 3.55 billion in 2024 and is projected to reach USD 8.05 billion by 2034, with a compound annual growth rate (CAGR) of roughly 10.80% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global dry separator lithium battery market is estimated to grow annually at a CAGR of around 10.80% over the forecast period (2025-2034)

- In terms of revenue, the global dry separator lithium battery market size was valued at around USD 3.55 billion in 2024 and is projected to reach USD 8.05 billion by 2034.

- The dry separator lithium battery market is projected to grow significantly, driven by the push to commercialize solid-state batteries, growth in grid-scale renewable energy storage, and manufacturing cost-optimization initiatives.

- Based on type, the microporous segment is expected to lead the market, while the ceramic-coated segment is expected to grow considerably.

- Based on material, the polyethylene segment is the dominating segment, while the polypropylene segment is projected to witness sizeable revenue over the forecast period.

- Based on end users, the automotive segment is expected to lead the market, followed by the energy storage segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Dry Separator Lithium Battery Market: Overview

A dry separator lithium battery is a lithium-ion cell architecture that uses a dry, solid-process polymer separator in place of a liquid-soaked porous membrane to isolate the anode and cathode while allowing ion transport. These separators are made through solvent-free processes, enhancing thermal stability, mechanical strength, and safety under abuse conditions. The global dry separator lithium battery market is likely to expand rapidly, fueled by the shift in EV penetration toward high-safety chemistries, solvent-free manufacturing economies, and regulatory pressure on VOC emissions. Speedy electrification is compelling OEMs to adopt separators with higher thermal-shutdown margins to meet abuse-tolerance requirements. Dry separators reduce the probability of thermal runaway compared to wet-process films. This is becoming mandatory on premium BEV platforms following the 2023 EV fire recalls.

Moreover, the dry process removes NMP solvents and high-priced recovery towers, compressing OPEX/CAPEX for electrode lines. This lessens the cost floor per kWh and streamlines energy permitting. For gigafactories, solvent-free is a structural margin benefit. Furthermore, China's MIIT, the US DOE, and the EU Fit-for-55 are constraining compliance with solvent-emission standards for battery lines. Dry separator processing naturally meets low-VOC compliance without scrubbers. Regulation thus serves as a tailwind for adoption over wet-coated films.

Despite the growth, the global market is impeded by factors such as high tooling and line conversion costs and process yield learning curve. Migrating wet-separator lines to dry demands high-priced calendaring and handling upgrades. This CAPEX conversion delays ROI for legacy plants. Smaller players delay adoption despite well-known advantages.

Likewise, the dry process is sensitive to nip pressure, blinder distribution, and web tension. The initial lines show yields during the learning ramp. Yield drag erodes the benefit in the first 12-18 months. Nonetheless, the global dry separator lithium battery industry stands to gain from a few key opportunities, such as insurance-indexed safety procurement, government subsidies for solvent-free lines, and aerospace & eVTOL adoption. Fleets and utilities are starting to buy depending on certified ‘safety classes’. Dry separators can be branded as risk-reduced tiers. This creates price-premium segments. Climate-linked subsidies and green financing prefer low-VOC manufacturing. Dry separator factories can qualify for bonus credits. Policy arbitrage becomes a margin source.

Additionally, the aerospace industry demands safety and weight while imposing non-negotiable certification requirements. Dry separators tick axes and shorten safety case arguments. Acceptance in eVTOL batteries is a greenfield pull.

Dry Separator Lithium Battery Market Dynamics

Growth Drivers

How is the global dry separator lithium battery market boosted by the rapid scaling of gigafactories with “de-risked Capex” bias?

Over 200 Li-ion gigafactories are in the pipeline, according to BNEF 2024, and CFOs are removing NMP-dependent dryers and abatement stacks as a construction risk-reduction measure. Dry separator lines eliminate long, critical-path mechanical drying rooms, reducing timeline risk by 4-6 months on greenfield builds, according to S&P Mobility's 2024 report.

In Aug 2024, CATL declared its next European block as a 'dry-lean envelope' framework to fast-track COD exposure to IRA-associated OEMs. The bankability of plants improves as financiers and insurers discount solvent and fire-hazard premiums. The capex-per-GWh slope is not a strategic KPI, and dry routes score structurally better. The speedy scaling eventually augments the growth of the dry separator lithium battery market.

How do safety, form-factor, and reliability gains vs. wet separators augment the dry separator lithium battery market growth?

Dry-processed separators deliver better thermal-shrink stability and uniformity under high-rate EV cycling, supported by 2024 teardown data from CLSA Battery Labs showing 18-27% enhanced dimensional stability @180–200°C. EV recalls tied to wet-separator defects (Tesla China 2023, GM Bolt historical cases re-analyzed 2024 Asia Pacific safety note) are driving OEM QA rules upward.

In Feb 2024, LG Energy Solution published UL9540A stack results showing dropped propagation risk in dry stacks at identical SOC. Aviation packs and premium EVs are explicitly rewriting DFMEA controls to give dry separators a scoring uplift. The liability and insurance cost savings are becoming a part of the sales argument, not just the physics argument.

Restraints

Manufacturing yield and reliability pain in early industrial lines hinder the market growth

Dry lines remove solvent complexity but introduce powder-handling issues, uniform-coat uniformity issues, and cohesion issues in real factories. SNE Research (2024) reported sub-85% early yield across multiple Chinese dry pilot lines, vs 92-94% in mature wet lines, leading to cost blowouts. Feb-2024, a Tier-2 supplier in Jiangsu reported a 6-week outage after a line fire triggered by powder dispersion in a dry coater cell. Insurance underwriters price these 'unknowns' with loading factors that feed back into delivered cost. Yield drag + safety uncertainty acts as a bridge constraint until learning curves mature.

Opportunities

How do aviation, defense, space, rail, and heavy-duty EVs requiring high-stability envelopes open lucrative opportunities for the development of the dry separator lithium battery market?

Premium segments care about thermal-shrink, abuse response & puncture more than cents/kWh. CLSA Battery Lab 2024, measured 18-27% superior dimensional stability @180–200°C for dry stacks. EASA pre-cert rules for eVTOL (2026+) underscore propagation-risk controls that help satisfy. NATO logistics RFI Q1-2024 explicitly called out 'non-solvent processed separator stacks' for early dry penetration with protected margins. These requirements ultimately surge the demand, impacting the growth of the dry separator lithium battery industry.

Challenges

OEM platform freeze windows restrict switch-in timing challenge the market

Aerospace and automotive programs freeze battery designs 18-36 months before start of production; separator alterations mid-cycle trigger safety, cost, and regulatory requalification. In 2024, two European OEMs were hesitant about dry-integration windows for post-2007 SOPs despite verified LCAs, because calendars were locked. Hence, superior technology does not automatically translate into live sourcing – timing beats merit. Adoption can only occur at platform refresh junctures, slowing diffusion by design.

Dry Separator Lithium Battery Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Dry Separator Lithium Battery Market |

| Market Size in 2024 | USD 3.55 Billion |

| Market Forecast in 2034 | USD 8.05 Billion |

| Growth Rate | CAGR of 10.80% |

| Number of Pages | 212 |

| Key Companies Covered | LG Energy Solution, Panasonic Energy, Samsung SDI, CATL, BYD, Envision AESC, EVE Energy, Gotion High-Tech, Farasis Energy, Murata Manufacturing, Amperex Technology Limited (ATL), Toshiba Battery, Hitachi Chemical (Showa Denko Materials), Johnson Matthey Battery Materials, Li-Cycle, and others. |

| Segments Covered | By Type, By Material, By End Users, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Dry Separator Lithium Battery Market: Segmentation

The global dry separator lithium battery market is segmented by type, material, end user, and region.

Based on type, the global dry separator lithium battery industry is divided into microporous, ceramic-coated, and composite. The microporous dry separators segment holds a dominant market share due to well-developed manufacturability, broad compatibility, and cost-efficiency across ESS, EV, and portable cells. Their mechanical uniformity and thinness support high energy density without complex interface engineering. OEMs prefer microporous films for quick qualification and low line-conversion friction. Their supply depth and validated safety track record keep them structurally leading.

Based on material, the global dry separator lithium battery market is segmented into polyethylene and polypropylene. The polyethylene segment holds a leading share due to its microporous morphology, which delivers excellent shutdown behavior and uniform ion transport at high C-rates. PE films support ESS and EV duty cycles where thermal runaway mitigation is procurement-critical. Their consistency and manufacturability reduce qualification risk for Tier-1 cell lines. This structural blend of scale, safety, and cost keeps PE as the top material.

Based on end users, the global market is segmented into automotive, consumer electronics, energy storage, and others. The automotive segment leads, with EV battery procurement dwarfing other segments in both capex and GWh commitments. OEMs prioritize dry separators for thermal safety, density gains, and solvent-free compliance in next-generation platforms. Long qualification cycles lock in chosen separator frameworks for multi-year volume. This factor is attributed to the segmental dominance.

Dry Separator Lithium Battery Market: Regional Analysis

Asia Pacific to witness significant growth over the forecast period

Asia Pacific is anticipated to retain its leading role in the global dry separator lithium battery market, driven by a core of cell & separator manufacturing, automotive pull via Chinese EV export flywheel, and permitting, cost, and policy alignment. Asia Pacific houses more than 80% of the world's Li-ion cell capacity, with China holding nearly 75% and Japan and Korea jointly accounting for 10-12%. Separator lines are co-located with cell gigafactories to remove transport cost and qualification lag. This embedded clustering structurally locks the region as the demand and supply anchor for dry separators.

Moreover, China registered for nearly 60% of worldwide EV output (2024), with CATL-associated OEMs, BYD, and Tesla-Shanghai fueling stacked GWh demand. EV export rise to Latin America and Europe demands compliant high-safety separators, augmenting dry-process adoption in APAC first. Volume-associated purchasing offers APAC suppliers cost floors that others cannot match.

Furthermore, dry-process averts NMP-recovery CAPEX—a decisive lever in Asia Pacific, where build time and capex/ton are execution KPIs. Korea/China policy packages still subsidize battery value-chain tooling and tax incentives – decreasing delivered $/m². With permitting cycles 2-4x faster than US/EU, Asia Pacific brings capacity online first.

North America ranks as the second-leading region in the global dry separator lithium battery industry, driven by a gigafactory pipeline pull, IRA & Local-Content mandates forcing onshore supply, and capital access & Co-location with Cathode/Cell Lines. North America has declared more than 1.1-1.3 TWh of cell capacity by 2030, second only to the Asia Pacific. Dry separators are being specified early in EV cell lines in Canada and the United States to meet safety and solvent-free compliance requirements. This forward-booked capacity creates locked-in multi-year demand before lines are even live.

Moreover, the United States Inflation Reduction Act ties USD 35/kWh cell + USD 10/kWh pack tax credits to North American content. Dry-process lines avoid complex solvent abatement systems, simplifying them under IRA-driven speed builds. OEMs are pre-awarding separator supply to secure compliant supply chains for credit capture.

Furthermore, North America has raised >USD 60 billion in cell supply-chain capital since 2022, the largest outside Asia, enabling local separator co-location. Co-sitting lines with cathode and cell campuses decreases logistics, qualification latency, and scrap. This capital-led co-location dynamic cements the region as the structural second-leading.

Dry Separator Lithium Battery Market: Competitive Analysis

The leading players in the global dry separator lithium battery market are:

- LG Energy Solution

- Panasonic Energy

- Samsung SDI

- CATL

- BYD

- Envision AESC

- EVE Energy

- Gotion High-Tech

- Farasis Energy

- Murata Manufacturing

- Amperex Technology Limited (ATL)

- Toshiba Battery

- Hitachi Chemical (Showa Denko Materials)

- Johnson Matthey Battery Materials

- Li-Cycle

Dry Separator Lithium Battery Market: Key Market Trends

Localization of separator supply near cell & cathode hubs:

Europe and North America are compelling separation lines for colocation with cell factories for CBAM/IRA/CFP compliance. Co-location cuts shipping risk, audit latency, and scrap. Dry separators are over-represented in these new localized builds.

Qualification times shortening via OEM-supplier co-development:

Automakers are collapsing validation cycles by involving separator suppliers earlier in stack design. Digital twins and joint qualification shrink 18-24-month cycles to 9-14 months. This augments turnover from pilot to mass adoption for dry films.

The global dry separator lithium battery market is segmented as follows:

By Type

- Microporous

- Ceramic-coated

- Composite

By Material

- Polyethylene

- Polypropylene

By End Users

- Automotive

- Consumer Electronics

- Energy Storage

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A dry separator lithium battery is a lithium-ion cell architecture that uses a dry, solid-process polymer separator in place of a liquid-soaked porous membrane to isolate the anode and cathode while allowing ion transport. These separators are made through solvent-free processes, enhancing thermal stability, mechanical strength, and safety under abuse conditions.

The global dry separator lithium battery market is projected to grow due to rising demand for EVs and hybrid vehicles, miniaturization of consumer electronics, and increased energy density targets in batteries.

According to a study, the global dry separator lithium battery market size was around USD 3.55 billion in 2024 and is expected to grow to around USD 8.05 billion by 2034.

The CAGR value of the dry separator lithium battery market is expected to be around 10.80% during 2025-2034.

Limited supplier depth, long OEM qualification cycles, high line-conversion CAPEX, and process-yield instability collectively restrain the said market’s growth.

The automotive end-user segment is expected to dominate the market by 2034, as EV battery procurement will outpace safety-driven specification adoption and all other segments in GWh demand.

Asia Pacific is expected to lead the global dry separator lithium battery market during the forecast period.

The key players profiled in the global dry separator lithium battery market include LG Energy Solution, Panasonic Energy, Samsung SDI, CATL, BYD, Envision AESC, EVE Energy, Gotion High-Tech, Farasis Energy, Murata Manufacturing, Amperex Technology Limited (ATL), Toshiba Battery, Hitachi Chemical (Showa Denko Materials), Johnson Matthey Battery Materials, and Li-Cycle.

Strategic opportunities exist in licensing dry-process IP, co-locating dry-separator lines with gigafactories, and forming JV partnerships with OEMs to localize supply chains.

The report examines key aspects of the dry separator lithium battery market, including a detailed analysis of current growth factors and restraints, as well as future growth opportunities and challenges.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed