Dry Dock Services Market Size, Share, Trends, Growth and Forecast 2034

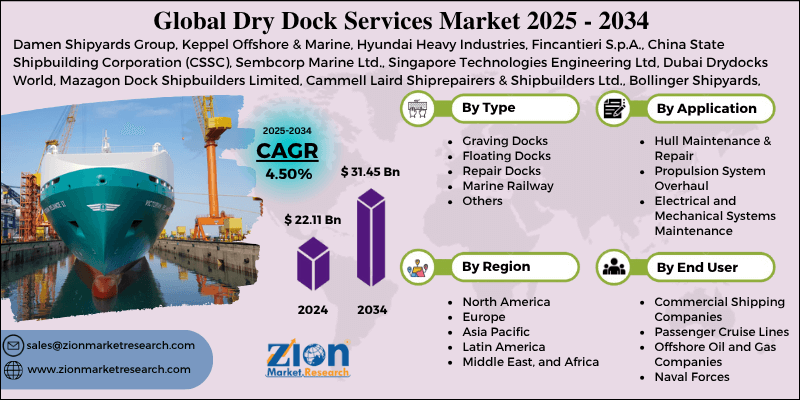

Dry Dock Services Market By Type (Graving Docks, Floating Docks, Repair Docks, Marine Railway, and Others), By Application (Hull Maintenance and Repair, Propulsion System Overhaul, Electrical and Mechanical Systems Maintenance, Safety and Compliance Inspections, and Others), By End-User (Commercial Shipping Companies, Passenger Cruise Lines, Offshore Oil and Gas Companies, Naval Forces, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

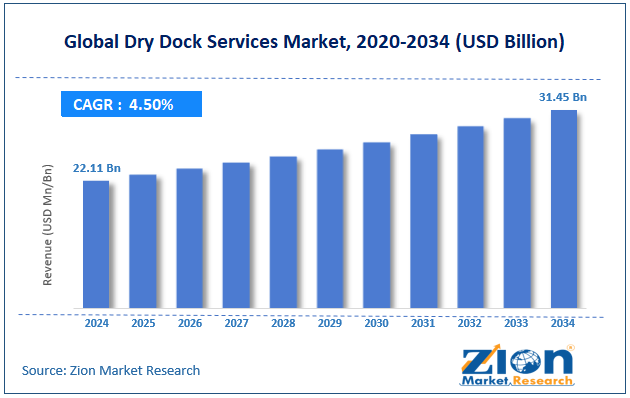

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 22.11 Billion | USD 31.45 Billion | 4.50% | 2024 |

Dry Dock Services Industry Perspective:

The global dry dock services market size was approximately USD 22.11 billion in 2024 and is projected to reach around USD 31.45 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.50% between 2025 and 2034.

Dry Dock Services Market: Overview

Dry dock services refer to the maintenance, repair, and examination of ships in a dedicated facility where vessels are taken out of the water for inspection and repair. These services are essential for tasks such as painting, hull cleaning, mechanical overhauls, and structural repairs. Dry docking promises vessel safety, prolongs operational lifespan, and ensures compliance with maritime regulations.

The global dry dock services market is expected to expand rapidly, driven by the rise in international seaborne trade, the growth of offshore oil and gas activities, and the advancement of naval and defense fleets. The UNCTAD estimated that the worldwide seaborne trade volume registered 12.5 billion tons in 2024. As the number of vessels increases, dry docking becomes crucial for maintenance. The rising growth in e-commerce and logistics is propelling shipping traffic.

Moreover, offshore platforms, service vessels, and rigs need periodic dry docking for system upgrades and corrosion control. Regions such as West Africa and the Gulf of Mexico are expanding their offshore activities, thereby boosting service demand.Nations such as China, India, and the United States are capitalizing on the expansion and modernization of their naval fleets. Regular dry dock cycles for submarines and warships support this advancement effort, thereby stabilizing the industry.

Although drivers exist, the global market is challenged by factors such as the low availability of skilled labor and the opportunity cost for ship owners, as well as downtime. Ship maintenance and repair need highly trained welders, marine inspectors, and engineers. Labor scarcity in regions like Africa and Southeast Asia may reduce capacity and delay service delivery.

Additionally, dry docking requires ships to be out of operation for weeks or days, resulting in significant revenue loss. This increases hesitancy among ship owners to schedule elective or frequent maintenance. Nonetheless, the global dry dock services industry stands to gain from several key opportunities, including smart docks, digitalization, and green dry docking for carbon-neutral vessels.

The incorporation of AI-based diagnostics, IoT, and predictive maintenance may transform dry dock operations. Similarly, dockyards offer real-time monitoring, faster turnaround times, and enhanced decision-making for customers. The growing demand for substitute fuel vessels, such as ammonia, LNG, and methanol, offers fresh opportunities for specialized retrofitting services. Green docking competencies may become a premium offering.

Key Insights:

- As per the analysis shared by our research analyst, the global dry dock services market is estimated to grow annually at a CAGR of around 4.50% over the forecast period (2025-2034)

- In terms of revenue, the global dry dock services market size was valued at around USD 22.11 billion in 2024 and is projected to reach USD 31.45 billion by 2034.

- The dry dock services market is projected to grow significantly due to the increasing number of aging vessels that require repeated maintenance, rising global seaborne trade volumes, and advancements in dry docking techniques.

- Based on type, the graving docks segment is expected to lead the market, while the floating docks segment is expected to grow considerably.

- Based on application, the hull maintenance and repair segment is the largest, while the propulsion system overhaul segment is projected to experience substantial revenue growth over the forecast period.

- Based on end-user, the commercial shipping companies segment is expected to lead the market compared to the naval forces segment.

- Based on region, Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Dry Dock Services Market: Growth Drivers

Increasing defense and naval spending propel market growth

Governments across the globe are heavily investing in naval advancement, which directly benefits the providers of dry dock services. According to SIPRI, the worldwide military shipbuilding and maintenance budgets are expected to $ 85 billion in 2024. Nations like India, Australia, and China are expanding their naval fleets, necessitating repetitive dry docking for carrier groups, submarines, and frigates.

India’s Mazagon Dock Shipbuilders Ltd declared contracts pricing INR 1,500 crore for naval ship overhauls, while Hudong-Zhonghua Shipyard of China added two novel dry docks in early 2025.

Digitalization and modernization of the docking infrastructure substantially boost the market growth

Progressive dry dock service providers are embracing and adopting tools such as AI-based predictive maintenance, augmented reality inspections, and IoT sensors, making their offerings more attractive to universal fleet operators. This is another growth propeller, fueling the dry dock services market.

Recent developments include Keppel Offshore & Marine of Singapore introducing a smart dock management system in 2024 and Spain's Navantia deploying 5G-based digital twins to simulate repair outcomes. These improvements are making dry dock services more data-driven and efficient, resulting in repeat business and high throughput.

Dry Dock Services Market: Restraints

Shortage of skilled maritime workforce hampers the market progress

The global dry dock services market is witnessing an increasing skills gap, mainly in mechanical repair, maritime engineering, and welding. With the growing complexity in vessels, with hybrid engines, electric propulsion, and digital navigation systems, dry dock operators struggle to find technicians with modernized repair competencies.

Dry Dock Services Market: Opportunities

Surge in offshore renewable vessel servicing positively impacts market growth

The rapid growth of the offshore wind energy industry is offering long-term prospects for dry dock service providers. Offshore wind vessels, such as cable layers, WTIVs, and SOVs, require repetitive, specialized maintenance due to the extreme marine operating conditions.

With more than 15 GW of novel offshore wind capacity installed worldwide in 2024 and over 250 GW planned by 2035, the support fleet is rapidly expanding, thereby impacting the global dry dock services industry.

Dry Dock Services Market: Challenges

The complexity of next-generation vessels may restrict the market growth

Modern vessels are being built with advanced propulsion systems, composite materials, fully electric or hybrid electric engines, and digital navigation systems.

While this advances vessel performance, it creates significant challenges for dry dock service providers, who must constantly upgrade their tools, skills, and infrastructure to manage such complexity.

Dry Dock Services Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Dry Dock Services Market |

| Market Size in 2024 | USD 22.11 Billion |

| Market Forecast in 2034 | USD 31.45 Billion |

| Growth Rate | CAGR of 4.50% |

| Number of Pages | 212 |

| Key Companies Covered | Damen Shipyards Group, Keppel Offshore & Marine, Hyundai Heavy Industries, Fincantieri S.p.A., China State Shipbuilding Corporation (CSSC), Sembcorp Marine Ltd., Singapore Technologies Engineering Ltd, Dubai Drydocks World, Mazagon Dock Shipbuilders Limited, Cammell Laird Shiprepairers & Shipbuilders Ltd., Bollinger Shipyards, Babcock International Group PLC, Sanoyas Shipbuilding Corporation, Meyer Werft GmbH & Co. KG, Japan Marine United Corporation (JMU), and others. |

| Segments Covered | By Type, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Dry Dock Services Market: Segmentation

The global dry dock services market is segmented based on type, application, end-user, and region.

Based on type, the global dry dock services industry is divided into graving docks, floating docks, repair docks, marine railways, and others. The graving docks segment held a significant share of the market due to their ability to manage large vessels, including cruise liners, naval vessels, and cargo ships. These are land-based and permanent structures that offer improved infrastructure, stability, and long-term serviceability. Their prominence is fueled by the increased demand for retrofitting and maintenance of high-value and large vessels, particularly in key regions such as North America and APAC.

Based on application, the global dry dock services market is segmented as hull maintenance and repair, propulsion system overhaul, electrical and mechanical systems maintenance, safety and compliance inspections, and others. The hull maintenance and repair segment leads the global market, accounting for the maximum revenue. This comprises painting, cleaning, structural repairs, corrosion control, and coating upgrades. The hull is prone to constant wear from marine organisms, saltwater, and physical impacts, increasing the need for maintenance to ensure safety, fuel efficiency, and vessel durability.

Based on end-user, the global market is segmented into commercial shipping companies, passenger cruise lines, offshore oil and gas companies, naval forces, and others. The commercial shipping companies segment registered a notable market share. This comprises container ships, cargo vessels, tankers, and bulk carriers that dominate worldwide trade routes. With more than 80% of the global trade by volume conveyed via sea, commercial fleets need regular dry docking for hull repair, regulatory compliance, and propulsion system upgrades. This operational frequency and volume of the vessels fuel the market dominance.

Dry Dock Services Market: Regional Analysis

Asia Pacific to witness significant growth over the forecast period

The Asia Pacific region held a dominant share of the global dry dock services market, owing to its leadership in fleet ownership and shipbuilding, rising maritime activity and regional trade, as well as a skilled and cost-effective labor pool.

The Asia Pacific is a leader in shipbuilding, accounting for over 90% of new ship deliveries in 2024, with South Korea, China, and Japan leading the way. These nations operate massive dry dock infrastructures to service their global and domestic fleets. Their dominance in fleet production ultimately translates into APAC becoming the center for repair and dry docking.

Additionally, the region's export and intra-Asia trade continue to expand, with seaborne trade in Asia projected to surpass 5.5 billion tons by 2025. This massive vessel activity demands repetitive maintenance cycles.

Therefore, dry dock service providers face growing and consistent demand from global and regional operators. In addition, APAC offers lower operational and labor costs compared to Western nations, making it an appealing destination for global shipping lines seeking economical repairs.

Likewise, countries like India and the Philippines supply the maximum share of the global maritime workforce, promising a skilled labor base for complicated repairs. This price-quality benefit drives competitiveness in the market.

Europe holds a second-leading position in the global dry dock services industry owing to well-developed maritime infrastructure and tradition, high volume of ferry and cruise traffic, and strong presence of naval and defense contracts. Europe boasts a long-established maritime legacy, with countries such as Norway, Germany, the Netherlands, and the United Kingdom maintaining high-quality shipyards.

The region is a leading hub for over 400 dry dock facilities, with the majority equipped to handle high-spec military, cruise, and commercial vessels. This sophisticated infrastructure accounts for a significant share of the global dry docking activity.

Moreover, Europe is a key center for cruise tourism, with Northern Europe and the Mediterranean among the leading regions for passenger traffic. In 2024, Europe accounted for more than 30% of universal cruise ship port calls, resulting in frequent dry dock maintenance, aesthetic overhauls, and upgrades.

Furthermore, European nations maintain improved naval fleets that need specialized and secure dry dock services. Nations such as the United Kingdom, Spain, and France allocate significant defense budgets for fleet maintenance. With the increasing geopolitical tensions in Eastern Europe, the demand for warship dry docking has risen, strengthening the region's naval dominance.

Dry Dock Services Market: Competitive Analysis

The key players in the global dry dock services market are:

- Damen Shipyards Group

- Keppel Offshore & Marine

- Hyundai Heavy Industries

- Fincantieri S.p.A.

- China State Shipbuilding Corporation (CSSC)

- Sembcorp Marine Ltd.

- Singapore Technologies Engineering Ltd

- Dubai Drydocks World

- Mazagon Dock Shipbuilders Limited

- Cammell Laird Shiprepairers & Shipbuilders Ltd.

- Bollinger Shipyards

- Babcock International Group PLC

- Sanoyas Shipbuilding Corporation

- Meyer Werft GmbH & Co. KG

- Japan Marine United Corporation (JMU)

Dry Dock Services Market: Key Market Trends

Smart dockyards and digitalization:

Dry dock operators are actively adopting AI-based diagnostics, IoT sensors, and predictive maintenance solutions to simplify operations. Real-time monitoring of vessels during docking helps reduce downtime and enhance efficiency. Smart dockyards are gaining attention, especially in Singapore, South Korea, and Europe.

Shift toward floating and modular dry docks:

There is a surging adoption of floating and modular dry docks due to their low cost, flexibility, and faster setup. These are common in the developing maritime regions that lack permanent infrastructure. Their mobility also enables them to service ships in shallow water or remote locations.

The global dry dock services market is segmented as follows:

By Type

- Graving Docks

- Floating Docks

- Repair Docks

- Marine Railway

- Others

By Application

- Hull Maintenance and Repair

- Propulsion System Overhaul

- Electrical and Mechanical Systems Maintenance

- Safety and Compliance Inspections

- Others

By End User

- Commercial Shipping Companies

- Passenger Cruise Lines

- Offshore Oil and Gas Companies

- Naval Forces

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Dry dock services refer to the maintenance, repair, and examination of ships in a dedicated facility where vessels are taken out of the water for inspection and repair. These services are crucial for jobs like painting, hull cleaning, mechanical overhauls, and structural repairs. Dry docking promises vessel safety, prolongs operational lifespan, and ensures compliance with maritime regulations.

The global dry dock services market is projected to grow due to the growth of oil & gas and offshore activities, increasing emphasis on vessel fuel efficacy upgrades, and heavy investments in maritime infrastructure.

According to study, the global dry dock services market size was worth around USD 22.11 billion in 2024 and is predicted to grow to around USD 31.45 billion by 2034.

The CAGR value of the dry dock services market is expected to be around 4.50% during 2025-2034.

Asia Pacific is expected to lead the global dry dock services market during the forecast period.

The key players profiled in the global dry dock services market include Damen Shipyards Group, Keppel Offshore & Marine, Hyundai Heavy Industries, Fincantieri S.p.A., China State Shipbuilding Corporation (CSSC), Sembcorp Marine Ltd., Singapore Technologies Engineering Ltd, Dubai Drydocks World, Mazagon Dock Shipbuilders Limited, Cammell Laird Shiprepairers & Shipbuilders Ltd., Bollinger Shipyards, Babcock International Group PLC, Sanoyas Shipbuilding Corporation, Meyer Werft GmbH & Co. KG, and Japan Marine United Corporation (JMU).

The report examines key aspects of the dry dock services market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed