Global Dog Foods Market Size, Share, Growth Analysis Report - Forecast 2034

Dog Foods Market By Product Type (Dry Dog Food, Wet Dog Food, Treats & Mixers), By Ingredient Type (Animal-based, Plant-based, Insect-based), By Life Stage (Puppy, Adult, Senior), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Pet Stores, Online Retail, Veterinary Clinics), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

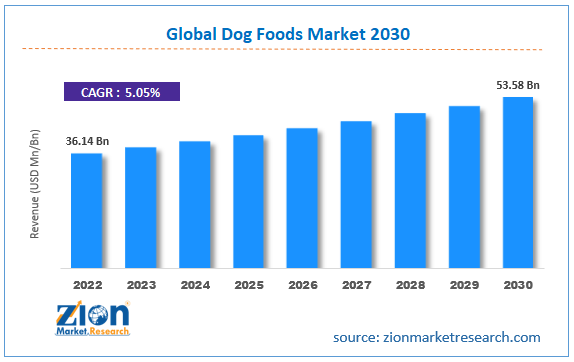

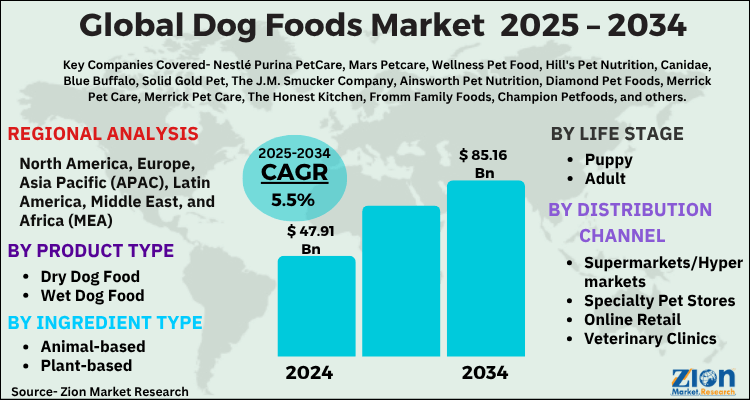

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 47.91 Billion | USD 85.16 Billion | 5.5% | 2024 |

Global Dog Foods Market: Industry Perspective

The global dog foods market size was worth around USD 47.91 Billion in 2024 and is predicted to grow to around USD 85.16 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 5.5% between 2025 and 2034. The report analyzes the global dog foods market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the dog foods industry.

Global Dog Foods Market: Overview

Dog Food is a specially formulated food product meant for consumption by dogs and other canines. In general, dogs are considered omnivores and show carnivorous tendencies or bias. Every dog has a different eating preference. For instance, certain dogs may prefer consuming dry crunchy food while some may like moist and soft food. The end goal of dog food is to ensure that dogs consume essential nutrients and each brand offers specific compositions. However, the general makeup of dog food consists of cereals, byproducts, vitamins, grains, and minerals. Certain dog food brands also include lamb, beef, liver, chicken, or other meat products. Dogs typically require 37 essential nutrients that can be divided into 6 main groups that are fats, protein, vitamins, carbohydrates, minerals, and vitamins. A good commercially available dog food should contain all these components. It is not recommended to be consumed by humans and follows separate production standards or protocols. The demand for dog food is on the rise and market players are expected to continue bringing new products into the commercial world as the number of pet adopters reaches new levels every year.

Global Dog Foods Market: Growth Drivers

Increasing dog adoption rate to drive market growth

The global dog foods market is projected to grow owing to the increasing number of dog adopters across the globe. Out of all animal adoption cases worldwide, most pets belong to the canine category, specifically dogs. One of the major driving factors of increasing dog adoption is the cultural norm since dogs have been a part of the household for decades due to their protective instincts. Certain species of these animals are more aggressive and act as guard dogs while others act more as companions. For instance, examples of breeds falling in the former category include Rottweilers, German Shepherds, Belgian Malinois, and others. As pet adoption is on the rise, the demand for efficient dog foods has increased over the years.

Rising awareness about animal food needs will trigger a better growth rate

The dog food market sales size will be further impacted by the increasing awareness of the importance of correct animal food requirements. Earlier most dogs consumed regular human food however, as more efforts were made toward improving consumer awareness, a growing number of the population is now aware of the difference in dog and human nutrition requirements. In September 2023, PetSmart Charities, a leading animal welfare organization in the US, announced the first-ever Pet Hunger Awareness Day™ to be followed on 26th September. With this move, the organization aims to promote awareness regarding pet hunger including stray animals. In a similar event, in August 2022, Petcurean, a leading producer of flagship high-end pet food brands, launched a new social awareness program called Giving Away to Give Back aiming to improve donations rates in Non-Profit Organizations (NGOs).

Dog Foods Market: Restraints

High cost of dog foods to restrict market growth

The global dog foods industry growth is expected to be restricted by the high cost of dog foods, especially premium products. The low-cost variations may still add up to high costs over long periods leading to many people providing regular food to their pet or companion dogs. In addition to this, the nutrition requirements of each dog may be different and the caretakers must be aware of the exact food needs of their pets. Overconsumption may lead to health concerns while low intake may cause serious deficiencies. Several factors dissuade a large part of the population from adopting dogs or feeding stray animals leading to a restricted target market group.

Dog Foods Market: Opportunities

Increasing demand for vegan and organic brands has high growth potential

The global dog foods market is expected to come across several growth opportunities as the demand for chemical-free and organic dog foods is on the rise. Some of the benefits of organic dog food include reduced risk of exposure to harmful pesticides and easier digestion. Furthermore, these variants may not trigger any form of allergic reaction. In recent times, the rate of organic dog food brands has increased steadily. In July 2023, The Rockster, a European dog food company announced its entry into the US market. The Rockster offers the world’s first bio-organic and superfood products meant for dogs and Phillips Pet Food & Supplies will act as its prime distributor in the US location. The debut makes The Rockster the only brand in the US offering bio-organic pet food. In September 2021, Freshpet (FRPT) launched its first-ever vegetarian, fresh dog food named Spring & Sprout. The product is expected to offer the benefits of completely plant-based protein along with cage-free eggs. It is also added with vegetables and fruits for added nutrition.

Rising market sales through online sales platforms will deliver high revenue

The industry for dog foods will further be impacted by the positive sales trend exhibited by online sales platforms including official websites, e-commerce chains, and specially dedicated companies with large supply chain networks for pet food. In March 2022, Petco Health and Wellness Company, Inc. and Freshpet launched a new partnership through which they will deliver customized and fresh subscription-based meals to parents of the pet.

Dog Foods Market: Challenges

Changing regulatory compliance and rising safety concerns may growth barriers against growth

The global dog foods market growth is likely to be challenged by the dynamic nature of regulatory compliance measures. For instance, every country has specific standards and regulations that must be met before the product becomes commercially available in the regional market. For instance, the European Pet Food Industry Federation (FEDIAF) is responsible for maintaining compliance throughout European countries. Meeting these protocols and standards is time-consuming and highly resource-intensive.

Key Insights

- As per the analysis shared by our research analyst, the global dog foods market is estimated to grow annually at a CAGR of around 5.5% over the forecast period (2025-2034).

- Regarding revenue, the global dog foods market size was valued at around USD 47.91 Billion in 2024 and is projected to reach USD 85.16 Billion by 2034.

- The dog foods market is projected to grow at a significant rate due to Rising pet ownership and growing awareness of pet nutrition drive demand. Premiumization and trend toward natural/organic products also boost market growth.

- Based on Product Type, the Dry Dog Food segment is expected to lead the global market.

- On the basis of Ingredient Type, the Animal-based segment is growing at a high rate and will continue to dominate the global market.

- Based on the Life Stage, the Puppy segment is projected to swipe the largest market share.

- By Distribution Channel, the Supermarkets/Hypermarkets segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Global Dog Foods Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Dog Foods Market |

| Market Size in 2024 | USD 47.91 Billion |

| Market Forecast in 2034 | USD 85.16 Billion |

| Growth Rate | CAGR of 5.5% |

| Number of Pages | 214 |

| Key Companies Covered | Nestlé Purina PetCare, Mars Petcare, Wellness Pet Food, Hill's Pet Nutrition, Canidae, Blue Buffalo, Solid Gold Pet, The J.M. Smucker Company, Ainsworth Pet Nutrition, Diamond Pet Foods, Merrick Pet Care, Merrick Pet Care, The Honest Kitchen, Fromm Family Foods, Champion Petfoods, and others., and others. |

| Segments Covered | By Product Type, By Ingredient Type, By Life Stage, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Dog Foods Market: Segmentation Analysis

The global dog foods market is segmented based on Product Type, Ingredient Type, Life Stage, Distribution Channel, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2025 to 2034.

Based on Product Type, the global dog foods market is divided into Dry Dog Food, Wet Dog Food, Treats & Mixers.

On the basis of Ingredient Type, the global dog foods market is bifurcated into Animal-based, Plant-based, Insect-based.

By Life Stage, the global dog foods market is split into Puppy, Adult, Senior.

In terms of Distribution Channel, the global dog foods market is categorized into Supermarkets/Hypermarkets, Specialty Pet Stores, Online Retail, Veterinary Clinics.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Global Dog Foods Market: Regional Analysis

The global dog foods market from 2025 to 2034 is expected to witness strong regional growth, with North America maintaining dominance due to high pet ownership rates, premiumization trends, and a strong presence of key market players offering organic and specialized diets. Europe follows closely, driven by increasing humanization of pets and demand for sustainable, grain-free, and veterinary-prescribed dog food products. The Asia-Pacific region is projected to register the fastest growth, fueled by rising disposable incomes, urbanization, and growing awareness about pet nutrition in countries like China, India, and South Korea. Meanwhile, Latin America and the Middle East & Africa are emerging markets, showing steady growth supported by improving economic conditions, increasing pet adoption, and a gradual shift from homemade food to commercial pet food options.

Global Dog Foods Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the dog foods market on a global and regional basis.

The global dog foods market is dominated by players like:

- Nestlé Purina PetCare

- Mars Petcare

- Wellness Pet Food

- Hill's Pet Nutrition

- Canidae

- Blue Buffalo

- Solid Gold Pet

- The J.M. Smucker Company

- Ainsworth Pet Nutrition

- Diamond Pet Foods

- Merrick Pet Care

- Merrick Pet Care

- The Honest Kitchen

- Fromm Family Foods

- Champion Petfoods

- Others

Global Dog Foods Market: Segmentation Analysis

The global dog foods market is segmented as follows;

By Product Type

- Dry Dog Food

- Wet Dog Food

- Treats & Mixers

By Ingredient Type

- Animal-based

- Plant-based

- Insect-based

By Life Stage

- Puppy

- Adult

- Senior

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Pet Stores

- Online Retail

- Veterinary Clinics

Global Dog Foods Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Dog Food is a specially formulated food product meant for consumption by dogs and other canines. In general, dogs are considered omnivores and show carnivorous tendencies or bias. Every dog has a different eating preference. For instance, certain dogs may prefer consuming dry crunchy food while some may like moist and soft food. The end goal of dog food is to ensure that dogs consume essential nutrients and each brand offers specific compositions. However, the general makeup of dog food consists of cereals, byproducts, vitamins, grains, and minerals. Certain dog food brands also include lamb, beef, liver, chicken, or other meat products.

The global dog foods market is expected to grow due to Rising pet ownership and growing awareness of pet nutrition drive demand. Premiumization and trend toward natural/organic products also boost market growth.

According to a study, the global dog foods market size was worth around USD 47.91 Billion in 2024 and is expected to reach USD 85.16 Billion by 2034.

The global dog foods market is expected to grow at a CAGR of 5.5% during the forecast period.

North America is expected to dominate the dog foods market over the forecast period.

Leading players in the global dog foods market include Nestlé Purina PetCare, Mars Petcare, Wellness Pet Food, Hill's Pet Nutrition, Canidae, Blue Buffalo, Solid Gold Pet, The J.M. Smucker Company, Ainsworth Pet Nutrition, Diamond Pet Foods, Merrick Pet Care, Merrick Pet Care, The Honest Kitchen, Fromm Family Foods, Champion Petfoods, and others., among others.

The report explores crucial aspects of the dog foods market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed