Distributed Temperature Sensing (DTS) Market Size, Share, Trends, Growth 2032

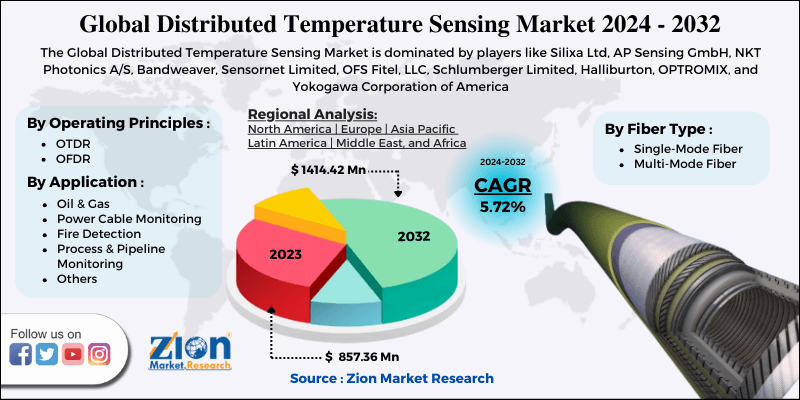

Distributed Temperature Sensing (DTS) Market By Operating Principle (OTDR And OFDR) By Fiber Type (Single-Mode Fiber And Multi-Mode Fiber) For Oil & Gas, Power Cable Monitoring, Fire Detection, Process & Pipeline Monitoring And Other Applications: Global Industry Perspective, Comprehensive Analysis And Forecast, 2024 - 2032-

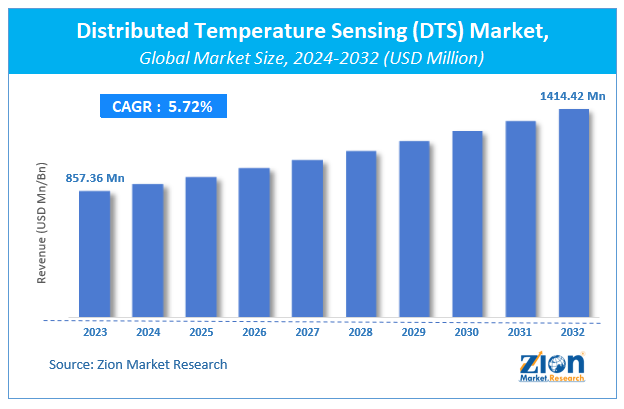

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 857.36 Million | USD 1414.42 Million | 5.72% | 2023 |

Distributed Temperature Sensing (DTS) Market Insights

According to Zion Market Research, the global Distributed Temperature Sensing (DTS) Market was worth USD 857.36 Million in 2023. The market is forecast to reach USD 1414.42 Million by 2032, growing at a compound annual growth rate (CAGR) of 5.72% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Distributed Temperature Sensing (DTS) Market industry over the next decade.

Distributed Temperature Sensing (DTS) Market: Overview

The Distributed Temperature Sensing (DTS) is employed for measuring temperature across various fiber optic applications using optical fibers. Numerous rewards of DTS include compact size, resistance to radiation, and immunity to electromagnetic interference. These compensations have propelled their usage for measuring and sensing temperature across various applications, like oil & gas, power & utility, among others.

Distributed temperature sensing is an evolving technology; therefore, its implementation across water-based applications has increased in recent years. A good range of geophysical methods is being considered for monitoring hydrologic processes at large scales and therefore the catchment. The demand for a few geophysical methods is on the increase, to quantify the fluxes between groundwater and surface water. All these factors are expected to contribute to the rising adoption of DTS.

The DTS using fiber optic cable is carried by sending a laser light along the fiber-optic cable. The photons within the light interact with the molecular structures of fiber and therefore the incident light scatters. The variation observed within the optical powers is employed for measuring the temperature. In hydrologic processes, the distribution temperature sensing is employed across various applications, like in characterizing the interaction of a stream and an estuary within the aquifer and determines transmissive fractures in bedrock boreholes.

The use of distributed temperature sensing for monitoring temperature patterns within the stream bed to work out various zones where groundwater is discharged is additionally on the increase. Distributed temperature sensing also enables monitoring of downhole temperature to review hydrogeological processes at spatial resolution and high frequency. Implementation of those sensors in passive mode for in-site investigation of in-well flow, groundwater flow, or for the estimation of subsurface thermal property is additionally on the increase. Such factors are substantially propelling the utilization of distributed temperature sensors thereby driving the market growth.

COVID-19 Impact Analysis:

The COVID-19 pandemic has spread across the planet and impacted numerous industries both positively so as negatively. The planet is struggling against the pandemic, which has to slow down down the worldwide economy. For now, the COVID-19 pandemic is first a health and humanitarian crisis, and businesses are rapidly regulating. While the crisis unfolds, leaders should also steel themselves against what's coming next. But not subsequent 'normal'. Normal isn't available to us anymore, and 'business as usual' even less. The new reality taking shape is formed of complexity, uncertainty, and opportunities. To adapt and thrive, organizations must accelerate and become resilient and agile. Our company can help leaders and organizations to address the deep changes needed during this new environment, from a nation, operations, and technology perspective, at scale and speed.

Distributed Temperature Sensing (DTS) Market: Growth Factors

Presently, questions of safety of the workers and manufacturing plants became enormously important, also, rules and regulations about safety standards have increased during recent years are anticipated to drive the DTS market. DTS provides continuous measurements of temperature and pressure through which leakage and fire might be detected to avoid any casualties. Furthermore, with real-time measurements, DTS systems became more dependable and organizations are relying on them for proper and precise information.

Fiber Type Segment Analysis Preview

In 2019, multimode fibers held the most important size of the distributed temperature sensing market. Multimode fibers have a comparatively large light-carrying core. These are offered in core sizes of 50µm and 62.5µm and are broadly utilized in DTS applications. The transmitted rays of sunshine are allowed to follow multiple paths within the fiber. The massive core diameter helps to propagate more optical power within the fiber. The signal undergoes dispersion since many modes are present, and hence there's more power loss as compared to single-mode fiber, which ultimately restricts the signal carrying capacity in terms of distance covered.

Operating Principle Segment Analysis Preview

Based on the measuring principle, the distributed temperature sensing market is categorized into Optical Time-Domain Reflectometry (OTDR) and Optical Frequency-Domain Reflectometry (OFDR). The previous principle is extensively used for measuring the losses within the telecom sector. Within the OTDR principle, a laser pulse is created from solid-state or semiconductor lasers and is shipped into the fiber. The backscattered light is analyzed for temperature monitoring. Most distributed temperature sensing systems are maintained by optical time-domain reflectometry operating principles, thereby holding a high market share.

Application Segment Analysis Preview

High demand from the oil & gas sector alongside the growing installation of power-conserving and tiny sensors in myriad Power Cable Monitoring applications is probably going to reinforce the expansion of distributed temperature sensing (DTS) market over the forecast period. aside from this, an increase in Brownfield operations & activities for constructing new structures on age-old locations is anticipated to enlarge the scope of distributed temperature sensing (DTS) market sphere over the approaching years.

Technical issues associated with distributed temperature sensing devices can hamper the distributed temperature sensing (DTS) market space within the years ahead. Nevertheless, the strict enforcement of safety standards alongside favorable government guidelines is anticipated to spice up demand for distributed temperature sensing (DTS) market over the following years, normalizing the impact of hindrances on the distributed temperature sensing (DTS) market, reports the study.

Distributed Temperature Sensing (DTS) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Distributed Temperature Sensing (DTS) Market |

| Market Size in 2023 | USD 857.36 Million |

| Market Forecast in 2032 | USD 1414.42 Million |

| Growth Rate | CAGR of 5.72% |

| Number of Pages | 120 |

| Key Companies Covered | Silixa Ltd, AP Sensing GmbH, NKT Photonics A/S, Bandweaver, Sensornet Limited, OFS Fitel, LLC, Schlumberger Limited, Halliburton, OPTROMIX, and Yokogawa Corporation of America |

| Segments Covered | By Operating Principles, By Fiber Type, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Distributed Temperature Sensing (DTS) Market: Regional Analysis Preview

Globally, Asia Pacific has been leading the worldwide distributed temperature sensing (DTS) market and is expected to continue in the dominant position within the forecast period. Escalating demand for the systems in oil & gas and power line monitoring applications is that the main factor behind the dominance of the distributed temperature sensing (DTS) market. The high number of market players being headquartered in APAC is another significant factor that's supporting the growth of distributed temperature sensing market within the region.

Distributed Temperature Sensing (DTS) Market: Players & Competitive Landscape

- Silixa Ltd

- AP Sensing GmbH

- NKT Photonics A/S

- Bandweaver

- Sensornet Limited

- OFS Fitel

- LLC

- Schlumberger Limited

- Halliburton

- OPTROMIX

- Yokogawa Corporation of America

The global Distributed Temperature Sensing (DTS) market is segmented as follows:

By Operating Principles

- OTDR

- OFDR

By Fiber Type

- Single-Mode Fiber

- Multi-Mode Fiber

By Application

- Oil & Gas

- Power Cable Monitoring

- Fire Detection

- Process & Pipeline Monitoring

- Others Applications

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to Zion Market Research, the global Distributed Temperature Sensing (DTS) Market was worth USD 857.36 Million in 2023. The market is forecast to reach USD 1414.42 Million by 2032.

According to Zion Market Research, the global Distributed Temperature Sensing (DTS) Market a compound annual growth rate (CAGR) of 5.72% during the forecast period 2024-2032.

Some of the key factors driving the global Distributed Temperature Sensing (DTS) market growth are increasing demand for labor safety at workplaces, reliability of DTS systems & sensors for sensing and monitoring applications in harsh environments, and rising applications in the oil & gas industry.

Asia Pacific region held a considerable share of the Distributed Temperature Sensing (DTS) market in 2020. The increasing construction activities worldwide and the expanding network of power transmission cables in technologically advancing countries in APAC, such as China and India, are contributing to the growth of the DTS market in this region.

Some of the major companies operating in the Distributed Temperature Sensing (DTS) market are Silixa Ltd, AP Sensing GmbH, NKT Photonics A/S, Bandweaver, Sensornet Limited, OFS Fitel, LLC, Schlumberger Limited, Halliburton, OPTROMIX, and Yokogawa Corporation of America, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed