Digital Freight Brokerage Market Trend, Share, Growth, Size and Forecast 2032

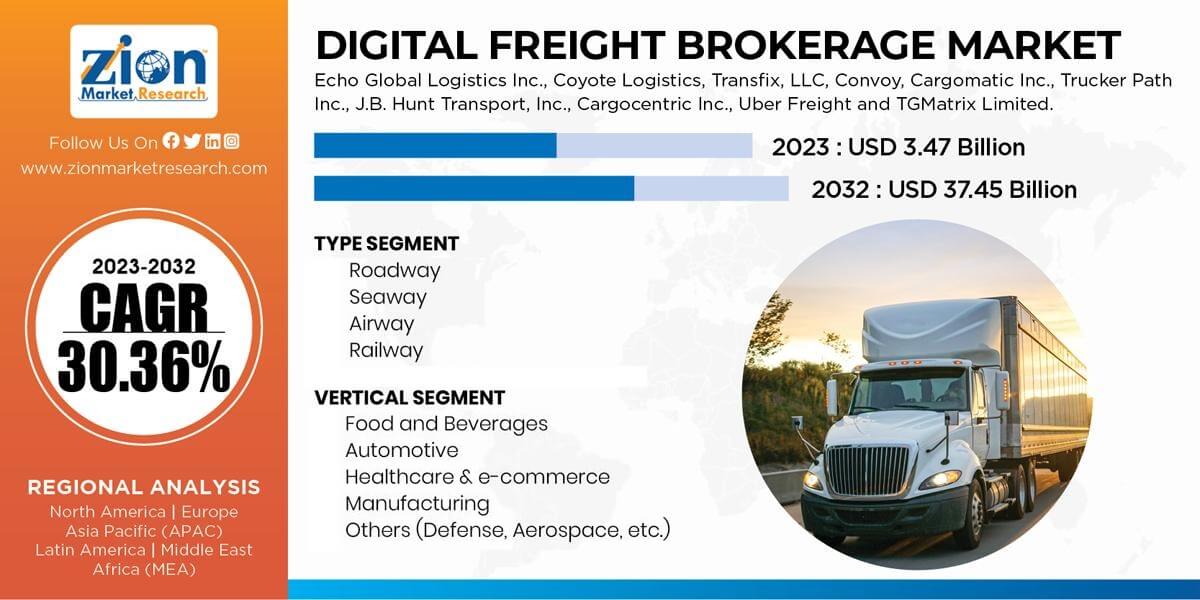

Digital Freight Brokerage Market by Type (Roadway, Seaway, Airway, and Railway) and by Vertical (Food and Beverages, Automotive, Retail & E-commerce, Healthcare, Manufacturing, and Others [Defense, Aerospace, etc.]), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast 2024-2032

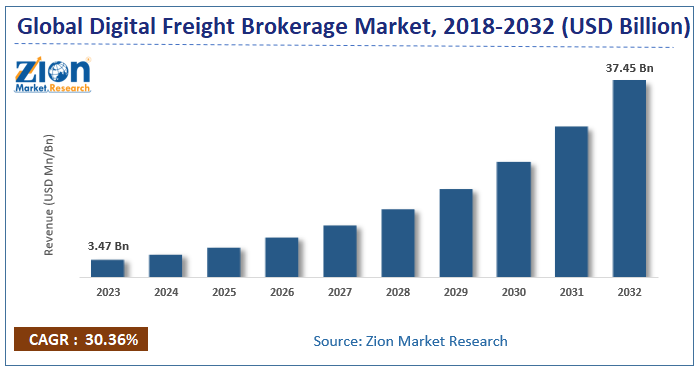

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.47 Billion | USD 37.45 Billion | 30.36% | 2023 |

Digital Freight Brokerage Industry Perspective:

The global Digital Freight Brokerage Market size accrued earnings worth approximately USD 3.47 Billion in 2023 and is predicted to gain revenue of about USD 37.45 Billion by 2032, is set to record a CAGR of nearly 30.36% over the period from 2024 to 2032.

Key Insights

- As per the analysis shared by our research analyst, the digital freight brokerage market is anticipated to grow at a CAGR of 30.36% during the forecast period.

- The global digital freight brokerage market was estimated to be worth approximately USD 3.47 billion in 2023 and is projected to reach a value of USD 37.45 billion by 2032.

- The growth of the digital freight brokerage market is being driven by the increasing need for efficient, transparent, and cost-effective freight management solutions across global supply chains.

- Based on the type, the roadway segment is growing at a high rate and is projected to dominate the market.

- On the basis of vertical, the food and beverages segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Digital Freight Brokerage Market Overview

The digital freight broker is a web or mobile-based tool aimed to match the demand of carrier supply and shipper demand, in the form of apps. They act as the mediator between transport that takes the product to its destination and the manufacturer.

Brokers need an easy-to-use, versatile, and fully-featured platform to bridge technology between a distribution/warehouse models and legacy order processing. The digital freight brokerage platform needs to evaluate outbound shipping orders and inbound procurement in order to recommend the best case routing solutions. The real-time shipment tracking and managed supply chain platform are expected to grow at a high pace in the coming years.

In order to give the users of this report a comprehensive view of the digital freight brokerage market, we have included competitive landscape and analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein the type and vertical segments are benchmarked based on their market size, growth rate, and general attractiveness.

Digital Freight Brokerage Market Growth Dynamics

The high demand for digitalization in freight management is also expected to propel the growth of digital freight brokerage market in the coming years. Just, in the U.S., about 33.8 million trucks are registered for business purposes and around 83% of goods are transported by truck at some point or another. The adoption of digital technology for freight management is helping a number of long-time freight brokers to reconsider their position in the industry, and enhancing their capability to keep up with advancing technologies to fulfill the demand of the customer.

The report provides company market share analysis in order to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new technology launch, agreements, partnerships, collaborations & joint ventures, research & development, technology and regional expansion of major participants involved in the market on the global and regional basis. Moreover, the study covers price trend analysis, the product portfolio of various companies according to the region.

Recent Development

- In June 2025, project44 launched its Decision Intelligence offering. The company evolved its Movement platform into the Decision Intelligence Platform, announcing new features that use AI to move beyond simple visibility to actively automate freight decisioning and orchestration, enabling smarter, faster supply chain operations for its customers.

- In July 2024, German digital freight firm Sennder agreed to acquire the European Surface Transportation (EST) operations of U.S. rival C.H. Robinson. This acquisition, which was expected to close in late 2024, was a positive move for Sennder as it was projected to double its annual revenue to €1.4 billion and create a Top 5 Full Truck Load (FTL) player in Europe, significantly scaling its freight-network and digital capabilities across the continent.

- In February 2024, shipping giant CMA CGM successfully completed the multibillion-dollar acquisition of Bolloré Logistics. This move enhances integrated digital logistics and brokerage capabilities across CMA CGM's global network and bolsters its presence in air and ocean freight forwarding.

- In November 2023, Flexport acquired the assets and technology of the shuttered digital-freight unicorn Convoy. The acquisition allowed Flexport to integrate Convoy’s advanced digital freight matching and full-truckload platform into its product lineup, strengthening its ability to offer customers an end-to-end logistics service. The move was viewed as a strategic maneuver to enhance Flexport's technology stack and quickly gain ground in the U.S. trucking market.

Digital Freight Brokerage Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Digital Freight Brokerage Market |

| Market Size in 2023 | USD 3.47 Billion |

| Market Forecast in 2032 | USD 37.45 Billion |

| Growth Rate | CAGR of 30.36% |

| Number of Pages | 206 |

| Key Companies Covered | Echo Global Logistics Inc., Coyote Logistics, Transfix, LLC, Convoy, Cargomatic Inc., Trucker Path Inc., J.B. Hunt Transport, Inc., Cargocentric Inc., Uber Freight and TGMatrix Limited. |

| Segments Covered | By Type, By Vertical, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Digital Freight Brokerage Market Segmentation Analysis

The study provides a decisive view of the digital freight brokerage market by segmenting the market based on type, vertical, and regions. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on the type, the market is segmented into roadway, seaway, airway, and railway.

Based on vertical, the digital freight brokerage market is segmented into food and beverages, automotive, healthcare & e-commerce, manufacturing, and others (defense, aerospace, etc.).

Regional Analysis:

North America accounted for the highest share of the global market for digital freight brokerage in the 2023 and region is projected to continue with its regional supremacy over the forthcoming years as well. The growth of this regional market is attributed with a large number of digital freight brokers in the region, and strong IT infrastructure in the U.S. The Asia Pacific is projected to grow at a high CAGR due to rising adoption of smartphones, growing internet penetration, advantages of the digital platform, and improved wireless connectivity. Moreover, strong manufacturing base and growing industrialization are expected to significantly boost the growth of digital freight brokerage market over the forecast period. The growing economy of the region is also contributing towards the high growth of digital freight brokerage in the Asia Pacific over the coming years.

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa with its further categorization into major countries including the U.S., U.K., Germany, France, Italy, Spain, China, Japan, India, Brazil, etc. This segmentation includes demand for digital freight brokerage market based on the individual type and verticals in all the regions and countries.

The report also includes detailed profiles of end players such as

- Echo Global Logistics Inc.

- Coyote Logistics

- Transfix, LLC

- Convoy

- Cargomatic Inc.

- Trucker Path Inc.

- J.B. Hunt Transport, Inc.

- Cargocentric Inc.

- Uber Freight

- TGMatrix Limited.

This report segments the global digital freight brokerage market as follows:

Global Digital Freight Brokerage Market: Type Segment Analysis

- Roadway

- Seaway

- Airway

- Railway

Global Digital Freight Brokerage Market: vertical Segment Analysis

- Food and Beverages

- Automotive

- Healthcare & e-commerce

- Manufacturing

- Others (Defense, Aerospace, etc.)

Global Digital Freight Brokerage Market: Regional Segment Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed