Dietary Fibers Market Size, Share, Growth Report 2032

Dietary Fibers Market By Source (Fruits And Vegetables, Cereals And Grains And Others), By Type (Soluble And Insoluble) For Functional Food, Pharmaceuticals, Animal Feed And Other Applications: Global Industry Perspective, Comprehensive Analysis And Forecast, 2024 - 2032

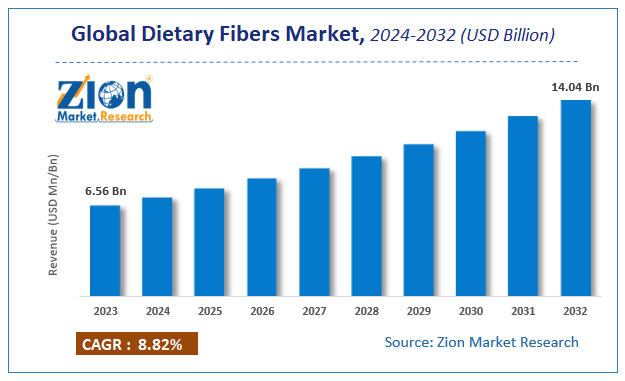

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.56 Billion | USD 14.04 Billion | 8.82% | 2023 |

Dietary Fibers Market Insights

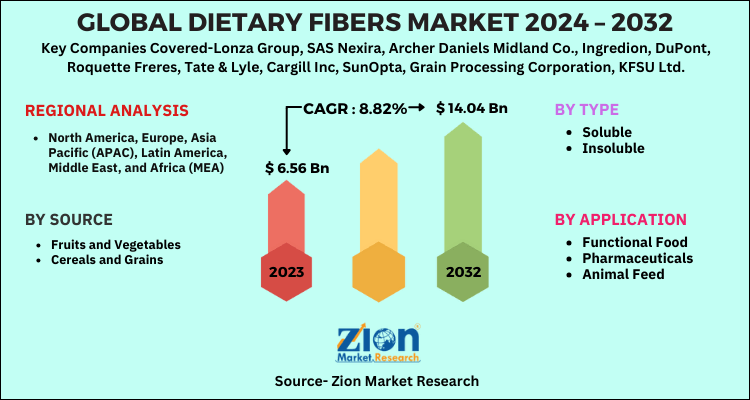

According to a report from Zion Market Research, the global Dietary Fibers Market was valued at USD 6.56 Billion in 2023 and is projected to hit USD 14.04 Billion by 2032, with a compound annual growth rate (CAGR) of 8.82% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Dietary Fibers Market industry over the next decade.

Dietary Fibers Market: Overview

Fibers are nonstarch polysaccharides that are present Solublely and may even be produced using Insoluble methods. Dietary fibers are consumable fibers mainly used as supplements. The dietary fibers help in proper digestion and help in eliminate extra cholesterol. This leads to maintaining proper health and weight loss. Dietary fibers are mainly extracted from plants from cereals, grains, fruits, and vegetable categories. However, fibers also can be obtained from animals.

The dietary fibers market is primarily driven by growing awareness of the healthy lifestyle and thus, in turn, has resulted in higher consumption of fiber supplements. Moreover, an increase in the aging population spur the dietary fibers market. Changing lifestyles including escalating dual and discretional income stimulates the expansion of this market. However, various regulations led by the governing bodies influence the entry of manufacturers into this market.

Nevertheless, increasing incidences of varied diseases caused thanks to the hectic lifestyle and unhealthy habits are predicted to force people to show towards healthy supplements, this is often likely to open new growth avenues for the dietary fibers within the market within the near future. Also, a strong rise in demand for dietary fibers from developing economies may positively impact the expansion of the market within the forecast period.

Dietary Fibers Market: Growth Factors

Rising product demand due to the increasing consumer awareness about the intake of a healthy diet and leading a lively lifestyle is foretold to drive the market growth over the upcoming years. Growing health consciousness thanks to increased cases of heart conditions, cancer, and diabetes has resulted in consumers favoring fiber-based food products with added health benefits. this is often also estimated to fuel market growth. As per the research conducted by the National Institutes of Health, over 60 to 70 million Americans suffer from distinguished digestive health problems. Furthermore, as per the Harvard School of Public Health, adults and youngsters require a minimum of 20 to 30 grams of dietary fiber per day. Also, the consumption of dietary fibers lowers the danger of developing various health diseases, like diabetes, heart & diverticular disease, and constipation.

Fibers are either present in nature or manufactured synthetically. Dietary fibers are natural fibers which are edible and consist of high nutritional content. Dietary fibers can be obtained from plants whereas natural fibers can be extracted from animals too. In recent times, dietary fibers have gained due value due to its high nutritional content.

There has been tremendous growth in diseases such as obesity and diabetics due to hectic lifestyle and unhealthy habits. This has resulted in awareness regarding the healthy food and supplements; this mainly drives the dietary fiber market. However, stringent regulations posed by the government for health safety may hamper the growth of market. Nevertheless, rising demand from the emerging countries due to increasing attraction for healthy supplements bid the demand for the dietary fibers market in the forecast period.

Dietary Fibers Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Dietary Fibers Market |

| Market Size in 2023 | USD 6.56 Billion |

| Market Forecast in 2032 | USD 14.04 Billion |

| Growth Rate | CAGR of 8.82% |

| Number of Pages | 170 |

| Key Companies Covered | Lonza Group, SAS Nexira, Archer Daniels Midland Co., Ingredion, DuPont, Roquette Freres, Tate & Lyle, Cargill Inc, SunOpta, Grain Processing Corporation, KFSU Ltd, and Grain Millers Inc among other |

| Segments Covered | By Source, By Type, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Dietary Fibers Market: Segment Analysis Preview

The dietary fibers market can be segmented based on source, type, application and region.

On the basis of source, dietary fibers can be obtained from fruits and vegetables, cereals and grains and from other sources. Cereals and grains are considered as highly potential segment owing to high content of dietary fibers. Cereals and grains such as bran, wheat, oats, rice, barley etc and apple, orange, beets, pear are some of fruits and vegetable with high percentage of dietary fibers. The type segment for dietary fibers can be segmented as soluble and insoluble dietary fibers. Soluble fibers such as pectin, inulin, beta-glucan, polydextrose and others are some of the highly used soluble fibers. Soluble fibers are preferred for losing weight and lowering cholesterol so it is highly recommended to the patients suffering from obesity, diabetics and high blood pressure. This factor bolsters the soluble dietary fibers market. Lignin, cellulose, chitosan, hemicelluloses and chitin among others are insoluble fibers. Some of the major applications for dietary fibers are functional food, pharmaceuticals and animal feed among others. Functional food has gained huge market in recent times owing to growing attraction towards healthiness from young generation and women.

Dietary Fibers Market: Regional Analysis Preview

North America and Europe are considered to be the foremost prominent markets for dietary fibers. this is often mainly attributed to the rapidly growing consumption rate of dietary fibers in the diet and pharmaceutical industry. The aging population in the U.S assists the dietary fibers market growth in this region. The Asia Pacific is witnessing an unprecedented boom in recent times and is probably going to take care of its pace owing to the rise in spending capacity over functional food. Latin America exhibits decent growth within the forecast period due to an aging population in Brazil. the center East and Africa is anticipated to experience sustainable growth within the coming years due to rapidly changing lifestyles and the availability of raw resources.

Dietary Fibers Market: Key Players & Competitive Landscape

Some of the key players in the Dietary Fibers market are:

- Lonza Group

- SAS Nexira

- Archer Daniels Midland Co.

- Ingredion

- DuPont

- Roquette Freres

- Tate & Lyle

- Cargill Inc

- SunOpta

- Grain Processing Corporation

- KFSU Ltd

- Grain Millers Inc

among other are some of the key profiles in dietary fibers market.

The global Dietary Fibers market is segmented as follows:

By Source

- Fruits and Vegetables

- Cereals and Grains

- Others

By Type

- Soluble

- Insoluble

By Application

- Functional Food

- Pharmaceuticals

- Animal Feed

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Dietary Fibers market was valued at USD 6.56 Billion in 2023.

The global Dietary Fibers market is expected to reach USD 14.04 Billion by 2032, with a CAGR of around 8.82% between 2024-2032.

Some of the key factors driving the global Dietary Fibers market growth are increasing health consciousness due to rising cases of heart diseases, cancer, and diabetes has resulted in consumers preferring fiber-based food products with added health benefits.

Asia-Pacific was the biggest area for Dietary Fibers market in 2023 and is likely to sustain its position in the years to come.

Some of the major companies operating in Dietary Fibers market are Lonza Group, SAS Nexira, Archer Daniels Midland Co., Ingredion, DuPont, Roquette Freres, Tate & Lyle, Cargill Inc, SunOpta, Grain Processing Corporation, KFSU Ltd, and Grain Millers Inc among other are some of the key profiles in dietary fibers market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed