Decorative Concrete Market Size, Share, Trends, Value 2034

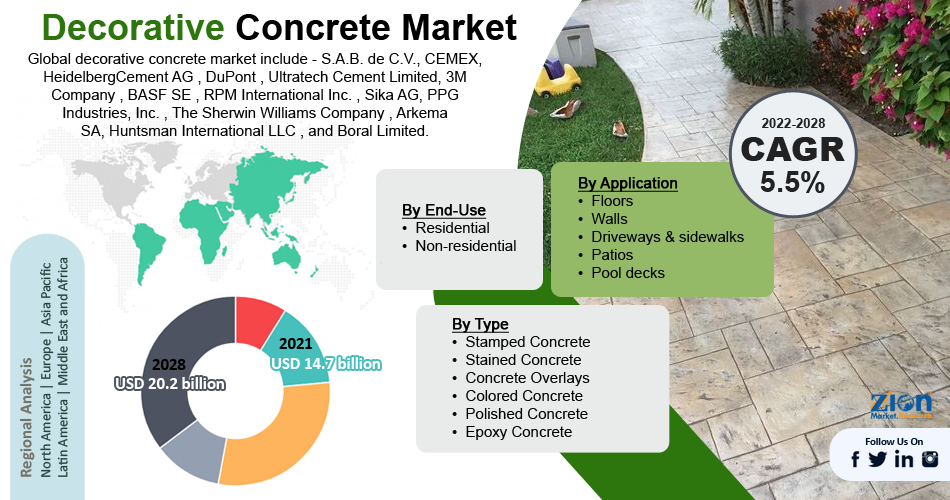

Decorative Concrete Market By Type (Stamped Concrete, Stained Concrete, Concrete Overlays, Colored Concrete, Polished Concrete, Epoxy Concrete, and Others (Concrete Dyes, Engravings, And Knockdown Finish)), By Application (Floors, Walls, Driveways & sidewalks, Patios, Pool Decks, and Others (including Ceilings and Countertops)), By End-Use (Residential and Non-residential), And By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 19.35 Billion | USD 33.47 Billion | 5.63% | 2024 |

Decorative Concrete Industry Perspective:

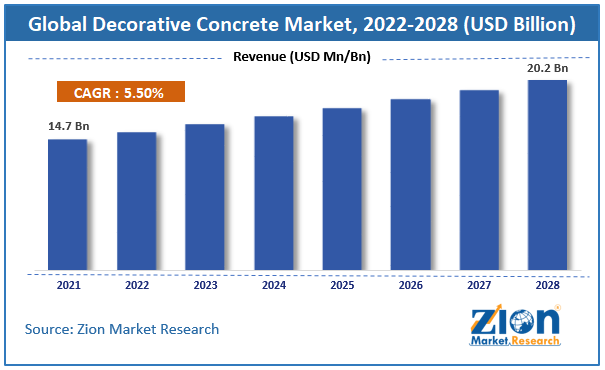

The global decorative concrete market size was worth around USD 19.35 Billion in 2024 and is predicted to grow to around USD 33.47 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 5.63% between 2025 and 2034. The report analyzes the global decorative concrete market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the decorative concrete industry.

Decorative Concrete Market: Overview

Concrete that has been finished to produce a beautiful surface is known as decorative concrete. It typically comes in a variety of patterns, hues, and textures that are used to produce decorative effects. Ordinary concrete is typically given a decorative appearance to make it appropriate for use in interior and external design applications. In the near future, it's anticipated that there will be a rise in the demand for remodeling and renovation projects for homes and businesses. Demand for modern and appealing materials in residential, commercial, and industrial structures is significantly increasing in the global construction industry. The market for decorative concrete is being driven by this factor, which has inspired various construction material producers to create appealing concretes. Rising populations in established and emerging nations alike are continuously pressuring the construction sector to buy more goods, which is fueling the expansion of the global decorative concrete market. The market for decorative concrete is also benefiting from the world's accelerating urbanization and commercialization. The market is growing further as a result of the pressure on contractors and builders to buy decorative concrete in big quantities and the advent of green cement and other sophisticated building materials. Market limitations may be caused by things like the high cost of treatment and the lack of awareness about decorative concrete in underdeveloped nations.

Key Insights

- As per the analysis shared by our research analyst, the global decorative concrete market is estimated to grow annually at a CAGR of around 5.63% over the forecast period (2025-2034).

- Regarding revenue, the global decorative concrete market size was valued at around USD 19.35 Billion in 2024 and is projected to reach USD 33.47 Billion by 2034.

- The decorative concrete market is projected to grow at a significant rate due to growing demand for aesthetic flooring and paving solutions, increased residential and commercial construction, and innovations in coloring and stamping techniques.

- Based on Type, the Stamped Concrete segment is expected to lead the global market.

- On the basis of Application, the Floors segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-Use Industry, the Residential segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Decorative Concrete Market: Growth Drivers

A rise in the demand for stamped concrete for flooring projects to drive market growth

One of the main reasons for the increase in demand is the increased demand for stamped concrete, particularly for the construction of hotel flooring and other commercial structures. This is primarily because stamped concrete has many advantages, including a good aesthetic appeal for floors, resistance to sliding, and resilience to wear & tear brought on by high foot traffic. In the Middle East and Africa as well as the Asia Pacific, a major increase in demand is anticipated. It is anticipated that significant investments in housing constructions and quick industrialization in these areas' developing nations will increase demand for stamped concrete. The aesthetic appeal of a building or other structure is enhanced with stamped concrete, which will increase demand for it in the years to come. All of these factors are projected to drive the global decorative concrete market growth.

Decorative Concrete Market: Restraints

Price volatility for raw commodities to restrict the market growth

Prices for the energy and raw materials used to make decorative concrete are erratic, and this tendency is expected to persist during the projected period. The fluctuating price of crude oil and petroleum could push up the price of raw materials, which would then push up the price of decorative concrete coatings, color pigments, cement, adhesives, and sealants. As a result, the cost of decorative concrete is directly impacted by the cost of these components. Vendors raise the price of their goods or cut their profit margins in response to rising raw material costs, which will have a negative impact on the expansion of the market.

Decorative Concrete Market: Opportunities

An increase in remodeling and renovation projects worldwide to offer growth avenues for market growth

The demand for decorative concrete will increase during the projected year due to an increase in remodeling and renovation activities in non-residential spaces. The structures of their establishments are also being renovated by hotel and resort owners in an effort to increase their clientele and improve the lodging quality. For instance, JW Marriott debuted a new hotel in Canberra, Australia, in September 2019. The hotel boasts the newest design highlights and polished concrete flooring, which enhances the visual appeal of the floors. The industry's growing investments in residential development and retail are also anticipated to accelerate the adoption of decorative concrete.

Decorative Concrete Market: Challenges

In emerging economies, there is a lack of knowledge regarding decorative concrete.

The market for decorative concrete is expected to rise thanks to the building sector's rapid expansion. People are less aware of these beautiful concrete uses and the advantages they provide, nevertheless, in several emerging or undeveloped APAC, African, and South American nations. In rising economies in APAC and South America, there is a lack of knowledge regarding the toughness, endurance, and adaptability of decorative concrete materials and solutions. Customers must be made aware of the good effects and advantages of decorative concrete on the environment and how it may support a healthy lifestyle in order for this business to grow.

Decorative Concrete Market: Segmentation

The global decorative concrete market is segregated on the basis of type, application, end-use, and region.

Based on by type, the market is divided into stamped concrete, stained concrete, concrete overlays, colored concrete, polished concrete, epoxy concrete, and others (including concrete dyes, engravings, and knockdown finish). Over the course of the forecast period, the stamped concrete sector is anticipated to hold a bigger market share in the decorative concrete market worldwide. This market is growing since stamped concrete is being used more frequently by contractors for patios, driveways, pathways, and pool decks. With its low cost and excellent durability, stamped concrete is becoming more and more popular, which is supporting the segment's revenue growth. The usage of stamped concrete for large-area flooring solutions in the construction of residential and commercial complexes is another factor fueling the growth of this market. The popularity of stamped concrete is anticipated to expand due to other crucial considerations including ease of installation and lower labor costs. Additionally, stamped concrete's sustainability and accessibility are raising demand for it.

Based on end-use, the market is divided into non-residential and residential. By 2028, the non-residential sector is anticipated to account for a sizable percentage of the market with to growth of almost 5.6 percent.

Based on application, the global decorative concrete market is divided into floors, walls, driveways & sidewalks, patios, pool decks, and others (including ceilings and countertops). By 2028, the flooring sector will dominate the decorative concrete market globally. With its lifespan, sturdiness, and durability, decorative concrete can take the place of standard flooring solutions (such as tiles and plywood). Popular flooring applications for decorative concrete include its attractive appearance and ease of upkeep. The segment's income is growing as decorative concrete is used more frequently to create floors and walls inside and outside of buildings. With the availability of a wide variety of decorative concrete in various textures based on consumer preferences for aesthetically pleasing floors and walls, its use is expanding. This is anticipated to provide this segment's growth a significant boost.

Recent Developments

- In September 2020, Arkema enhances Bostik by acquiring Ideal Work (Italy), a company specializing in decorative flooring technologies. This initiative is consistent with Arkema's focused growth strategy for adhesives and is built on cutting-edge technologies that perfectly complement Bostik's current construction market offering. Bostik will be able to broaden its product line and establish itself in a niche market for flooring renovation and decoration thanks to Ideal Work's solutions, which complement current product lines in the fields of floor preparation and flooring adhesives.

Decorative Concrete Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Decorative Concrete Market |

| Market Size in 2024 | USD 19.35 Billion |

| Market Forecast in 2034 | USD 33.47 Billion |

| Growth Rate | CAGR of 5.63% |

| Number of Pages | 255 |

| Key Companies Covered | Ardex Group, BASF SE, Bomanite, Cemex S.A.B. de C.V., Decorative Concrete Supply, GCP Applied Technologies, L.M. Scofield Company, LATICRETE International Inc., Proline Concrete Tools, Sika AG, Stampcrete International, The QUIKRETE Companies, Tnemec Company Inc., Vexcon Chemicals Inc., W. R. Meadows Inc., and others. |

| Segments Covered | By Type, By Application, By End-Use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Decorative Concrete Market: Competitive Landscape

Some of the main competitors dominating the global decorative concrete market include - S.A.B. de C.V., CEMEX, HeidelbergCement AG , DuPont , Ultratech Cement Limited, 3M Company , BASF SE , RPM International Inc. , Sika AG, PPG Industries, Inc. , The Sherwin Williams Company , Arkema SA, Huntsman International LLC , and Boral Limited.

Decorative Concrete Market: Regional Landscape

North America will dominate the global market for decorative concrete due to increased construction activity.

The development of technology in the building and construction sector is what is fueling the growth of the decorative concrete market in North America. Particularly in Florida, Georgia, North Carolina, Washington, Utah, Tennessee, Ohio, California, Idaho, and South Carolina, single-family homes are increasing across the US.

One of the main market drivers for decorative concrete has been the use of flooring systems with aesthetic appeal and decorative elements in residential applications. It is projected that increasing regional government investments in the construction of commercial buildings will fuel the growth of the North American industry.

Decorative Concrete Market: Competitive Space

The global Decorative Concrete market profiles key players such as:

- S.A.B. de C.V

- CEMEX

- HeidelbergCement AG

- DuPont

- Ultratech Cement Limited

- 3M Company

- BASF SE

- RPM International Inc

- Sika AG

- PPG Industries, Inc.

- The Sherwin Williams Company

- Arkema SA

- Huntsman International LLC

- Boral Limited.

Global Decorative Concrete Market is segmented as follows:

By Type

- Stamped Concrete

- Stained Concrete

- Concrete Overlays

- Colored Concrete

- Polished Concrete

- Epoxy Concrete

- Others (include concrete dyes, engravings, and knockdown finish)

By Application

- Floors

- Walls

- Driveways & sidewalks

- Patios

- Pool decks

- Others (include ceilings and countertops)

By End-Use

- Residential

- Non-residential

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global decorative concrete market is expected to grow due to growth in residential and commercial construction, demand for aesthetic flooring solutions, and durability of concrete finishes.

According to a study, the global decorative concrete market size was worth around USD 19.35 Billion in 2024 and is expected to reach USD 33.47 Billion by 2034.

The global decorative concrete market is expected to grow at a CAGR of 5.63% during the forecast period.

North America is expected to dominate the decorative concrete market over the forecast period.

Leading players in the global decorative concrete market include Ardex Group, BASF SE, Bomanite, Cemex S.A.B. de C.V., Decorative Concrete Supply, GCP Applied Technologies, L.M. Scofield Company, LATICRETE International Inc., Proline Concrete Tools, Sika AG, Stampcrete International, The QUIKRETE Companies, Tnemec Company Inc., Vexcon Chemicals Inc., W. R. Meadows Inc., among others.

The report explores crucial aspects of the decorative concrete market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed