Dairy Products Packaging Market Size, Share Report, Analysis, Trends, Growth 2034

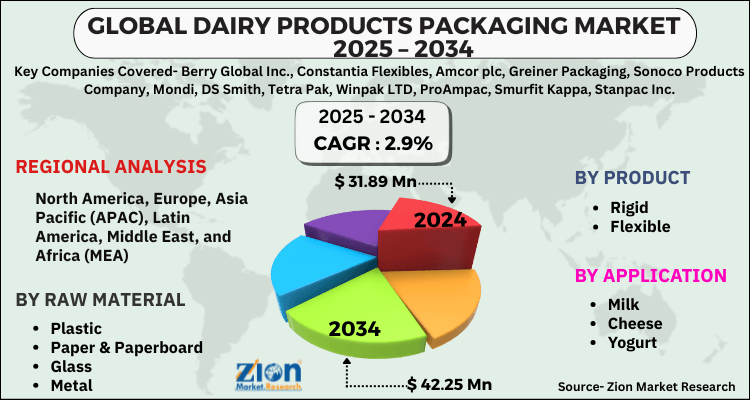

Dairy Products Packaging Market - By Raw material (Plastic, Paper & Paperboard, Glass, and Metal), By Product (Rigid and Flexible), By Application (Milk, Cheese, Yogurt, and Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

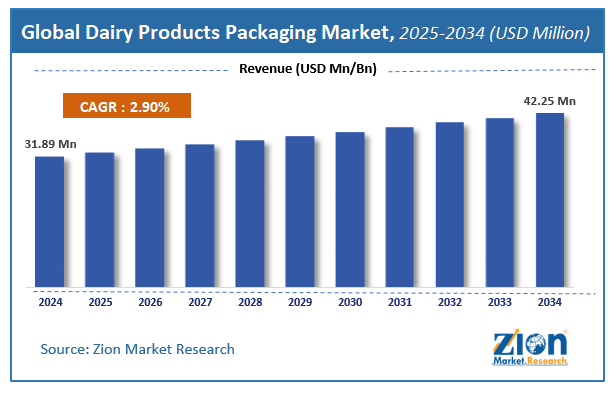

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 31.89 Million | USD 42.25 Million | 2.9% | 2024 |

Dairy Products Packaging Market: Industry Perspective

The global dairy products packaging market was worth around USD 31.89 Million in 2024 and is estimated to grow to about USD 42.25 Million by 2034, with a compound annual growth rate (CAGR) of roughly 2.9% between 2025 and 2034

The report analyzes the dairy products packaging market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the dairy products packaging market.

Dairy Products Packaging Market: Overview

The dairy products packaging market is expected to rise at a steady CAGR through the forecast period and plays a crucial in the global dairy products marketplace. Packaging is crucial in the dairy industry as it is a part of distribution and marketing as well, so the demand for a good packaging solution in the dairy industry is always high.

Rising consumption of dairy products, increasing demand for fresh products, rising international import and export activities, and the demand for antiseptic packaging to keep the products contamination-free are some major factors that could boost dairy products packaging market growth through 2028.

Key Insights

- As per the analysis shared by our research analyst, the global dairy products packaging market is estimated to grow annually at a CAGR of around 2.9% over the forecast period (2025-2034).

- Regarding revenue, the global dairy products packaging market size was valued at around USD 31.89 Million in 2024 and is projected to reach USD 42.25 Million by 2034.

- The dairy products packaging market is projected to grow at a significant rate due to growing dairy consumption and need for sustainable packaging solutions.

- Based on Raw material, the Plastic segment is expected to lead the global market.

- On the basis of Product, the Rigid segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Milk segment is projected to swipe the largest market share.

- Based on region, Asia-Pacific & Europe is predicted to dominate the global market during the forecast period.

Dairy Products Packaging Market: Growth Drivers

Increasing Demand from a Growing Population

Dairy products have been an essential part of a healthy diet and hence have been a staple in meals across the world. As the population of the world increases so does the consumption of dairy products as well and this is projected to subsequently favor dairy products packaging market growth through 2028. Increasing awareness of health and fitness has spawned a demand for protein-rich dairy products and this trend is expected to be further bolstered over the forecast period. The dairy products packaging market is expected to rise at a steady pace through 2028 on the back of the aforementioned factors.

Dairy Products Packaging Market: Restraints

Regulations Against Use of Plastics in Packaging

Dairy product packaging consists of plastic and this is a major environmental concern as waste management becomes a prime concern to combat the climate emergency that the world is facing. Governments across the world are implementing regulations to constrain the use of plastics in packaging to avoid harmful waste and reduce waste volume. Dairy product packaging companies are struggling to find alternatives to plastic and the ones that are available have a huge impact on profit margins and result in a drop in overall revenue potential. Strict regulations and necessary compliance are expected to restrain dairy products packaging market growth to a certain extent through 2034.

Dairy Products Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Dairy Products Packaging Market |

| Market Size in 2024 | USD 31.89 Million |

| Market Forecast in 2034 | USD 42.25 Million |

| Growth Rate | CAGR of 2.9% |

| Number of Pages | 190 |

| Key Companies Covered | Berry Global Inc., Constantia Flexibles, Amcor plc, Greiner Packaging, Sonoco Products Company, Mondi, DS Smith, Tetra Pak, Winpak LTD, ProAmpac, Smurfit Kappa, Stanpac Inc, Alfipa, Sealed Air, Graham Packaging, and others., and others. |

| Segments Covered | By Raw material, By Product, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Dairy Products Packaging Market: Segmentation

The global dairy products packaging market is segregated based on raw material, product, application, and region.

By raw material, the market is divided into glass, paper & paperboard, plastic, metal, and others. The paperboard segment is expected to emerge as highly popular over the forecast period owing to its high recyclable potential and compliance with the new sustainability norm that is rising among consumers. The potential of increasing the shelf life is expected to drive demand for more sustainable dairy packaging solutions.

By Application, the dairy products packaging market is segmented into milk, cheese, yogurt, and others. Milk is the most popular dairy product and is consumed on a global scale, since its composition is highly nutrient-rich it is considered as one of the building blocks of a healthy diet. This is what makes milk the most popular dairy product and demand for packaging of this commodity has a dominant outlook in the dairy products packaging marketplace through 2028.

Dairy Products Packaging Market: Regional Landscape

North America region leads the global dairy products packaging market in terms of revenue and volume share and is anticipated to maintain its dominant stance through the forecast period. Increasing production of dairy products in this region and rising sales of the same are expected to be major factors responsible for the dairy products packaging market growth in this region. Increasing consumption of cheese and yogurt products is also predicted to boost dairy products packaging market growth through the forecast period.

The market for dairy product packaging in the Asia Pacific region is projected to exhibit growth at the fastest CAGR through 2028. The increasing consumption of dairy products by the rising population in nations of China, India, and Indonesia is expected to be a major factor propelling the dairy products packaging market growth in this region. The presence of key dairy product providers, increasing purchasing power, and rising awareness about health and fitness are some other factors that guide dairy products packaging market growth through 2028.

Recent Developments

- In June 2021 – Huhtamaki a global food packaging giant announced the complete acquisition of Jiangsu Hihio-Art Packaging Co. Ltd. which will aid Huhtamaki in strengthening its position in the Asian market and propel sales of packaging solutions such as folding cartons, bags, paper wraps, etc.

Dairy Products Packaging Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the dairy products packaging market on a global and regional basis.

Some of the main competitors dominating the global dairy products packaging market include -

- Berry Global Inc.

- Constantia Flexibles

- Amcor plc

- Greiner Packaging

- Sonoco Products Company

- Mondi

- DS Smith

- Tetra Pak

- Winpak LTD

- ProAmpac

- Smurfit Kappa

- Stanpac Inc

- Alfipa

- Sealed Air

- Graham Packaging

The global dairy products packaging market is segmented as follows:

By Raw Material

- Plastic

- Paper & Paperboard

- Glass

- Metal

By Product

- Rigid

- Flexible

By Application

- Milk

- Cheese

- Yogurt

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Dairy products packaging refers to the process and materials used to contain, protect, preserve, and present dairy items like milk, cheese, yogurt, butter, and cream for storage, transport, and sale. It's a critical aspect of the dairy industry because dairy is highly perishable and sensitive to contamination, temperature, and light.

The global dairy products packaging market is expected to grow due to increasing demand for extended shelf-life dairy products, rising adoption of eco-friendly packaging materials, and growing dairy consumption.

According to a study, the global dairy products packaging market size was worth around USD 31.89 Million in 2024 and is expected to reach USD 42.25 Million by 2034.

The global dairy products packaging market is expected to grow at a CAGR of 2.9% during the forecast period.

Asia-Pacific & Europe is expected to dominate the dairy products packaging market over the forecast period.

Leading players in the global dairy products packaging market include Berry Global Inc., Constantia Flexibles, Amcor plc, Greiner Packaging, Sonoco Products Company, Mondi, DS Smith, Tetra Pak, Winpak LTD, ProAmpac, Smurfit Kappa, Stanpac Inc, Alfipa, Sealed Air, Graham Packaging, and others., among others.

The report explores crucial aspects of the dairy products packaging market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed