D Xylose Test Market Size, Share, Trends Analysis, Growth 2034

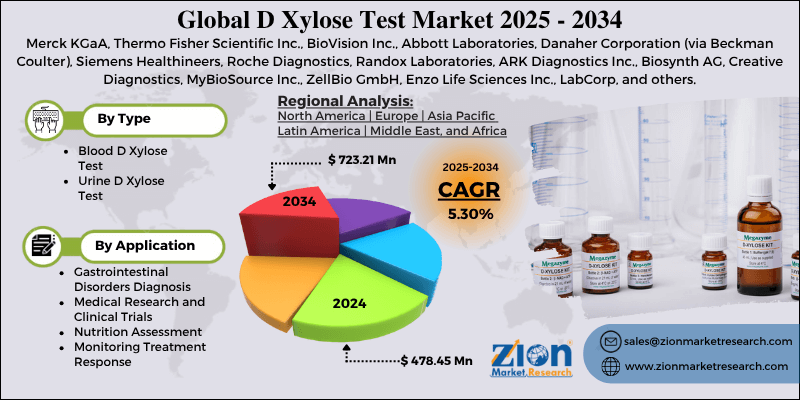

D Xylose Test Market By Type (Blood D Xylose Test, Urine D Xylose Test), By Application (Gastrointestinal Disorders Diagnosis, Medical Research and Clinical Trials, Nutrition Assessment, Monitoring Treatment Response), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

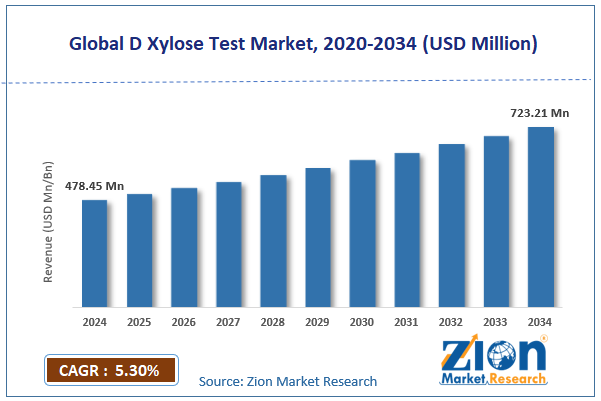

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 478.45 Million | USD 723.21 Million | 5.30% | 2024 |

D Xylose Test Industry Perspective:

The global D xylose test market size was worth around USD 478.45 million in 2024 and is predicted to grow to around USD 723.21 million by 2034, with a compound annual growth rate (CAGR) of roughly 5.30% between 2025 and 2034.

D Xylose Test Market: Overview

The D xylose test refers to a diagnostic procedure that assesses the small intestine's ability to absorb sugars. It comprises measuring the absorption of D-xylose, a form of sugar that is usually absorbed in the small intestine without the need for digestive enzymes. Once the patient consumes the standard dose, urine and blood samples are collected to evaluate how much sugar has been absorbed.

The global D xylose test market is projected to witness substantial growth, driven by the rising geriatric population, growing awareness of digestive health, and the high prevalence of malabsorption illnesses. The aging population generally suffers from impaired nutrient absorption because of chronic diseases or intestinal atrophy. The United Nations (UN) 2024 reports that more than 771 million individuals are over 65, strengthening the demand for routine malabsorption screening technologies like the D-xylose test.

Moreover, individuals are highly focused on gut health because of preventive care and functional medicine. Wellness initiatives and awareness campaigns have fueled the number of individuals undergoing diagnostic screenings for GI symptoms. Also, the rising cases of conditions like Crohn's disease, celiac disease, and lactose intolerance are a key propeller. Over 1% of the worldwide population suffers from celiac disease, which demands differential diagnostics via d-xylose testing.

Although drivers exist, the global market is challenged by factors like low sensitivity and specificity, less use in developed nations, and poor patient compliance. The test cannot distinguish between different types of malabsorption, thereby decreasing its reliability as a standalone diagnostic technique and frequently requiring confirmatory tests. Advanced markets like Europe and the United States are steadily phasing out d-xylose tests in favor of biopsy methods or more improved imaging, thus restricting demand.

The test comprises timed and fast sample collection, and urine retention, which may lessen compliance and lead to inaccurate results if not administered correctly. Even so, the global D xylose test industry is well-positioned due to bundling with preventive health suites, innovation in sample analysis, and collaboration with dieticians and GI experts. Adding d-xylose in preventive GI health checkups at clinics and wellness centers may increase awareness and adoption.

Additionally, the development of POC or point-of-care devices for real-time d-xylose measurement with capillary blood or saliva could transform test accessibility. Collaborating with nutritionists and digestive health experts may improve referrals for testing among patients with chronic digestive illnesses.

Key Insights:

- As per the analysis shared by our research analyst, the global D xylose test market is estimated to grow annually at a CAGR of around 5.30% over the forecast period (2025-2034)

- In terms of revenue, the global D xylose test market size was valued at around USD 478.45 million in 2024 and is projected to reach USD 723.21 million by 2034.

- The D xylose test market is projected to grow significantly owing to the growing awareness of gastrointestinal health, supportive reimbursement and regulatory policies, and surging cases of pediatric nutritional disorders.

- Based on type, the blood D xylose test segment is expected to lead the market, while the urine D xylose test segment is expected to grow considerably.

- Based on application, the gastrointestinal disorders diagnosis segment is the dominating segment, while the nutrition assessment segment is projected to witness sizeable revenue over the forecast period.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

D Xylose Test Market: Growth Drivers

Increasing diagnostic infrastructure and healthcare expenditure in emerging economies fuel the market growth

Developing markets like Brazil, Indonesia, and India are experiencing speedy advancements in diagnostic capabilities and the healthcare ecosystem. Governments are actively investing in growing laboratory testing facilities, mainly in underserved and rural areas.

For example, in India, the government’s Ayushman Bharat health program and the growth of diagnostic labs under PM-ABHIM have offered new avenues for better accessibility to tests like D-xylose. Thyrocare Technologies and Metropolis Healthcare included D-xylose test panels in their GI diagnostic packages in 2024, indicating an increasing awareness and use in developing nations.

Non-invasive diagnostic preferences and technological improvements substantially propel the market growth

The rising preference for speedy diagnostic and non-invasive tests is positively driving the adoption of D-xylose tests. Modern methods now use highly responsive liquid chromatography or enzyme spectrometry to evaluate D-xylose levels in urine and blood with optimal accuracy and sensitivity.

LabCorp and Quest Diagnostics have announced an upgraded D-xylose testing kit, featuring enhanced compatibility and faster turnaround times with automated lab systems. These technological improvements make the test more appealing to diagnostic centers and hospitals, driving its clinical uptake. Additionally, patients highly prefer non-invasive options like urine D-xylose testing over invasive procedures, thus driving the D xylose test market demand.

D Xylose Test Market: Restraints

Variability and inconvenience in test results negatively impact market progress

The accuracy of the D-xylose test can be affected by several external and physiological factors, including hydration status, renal function, improper patient preparation, and delayed gastric emptying. These factors create inter-patient variability, resulting in false negatives or false positives.

A 2023 clinical trial at the Mayo Clinic presented that up to 22% of D-xylose tests produced inconclusive or borderline results, mainly in senior patients or those with renal comorbidities. Moreover, the test needs multiple urine or blood samples over several hours, increasing inconvenience for patients. This complexity creates hesitation for routine use, mainly in time-sensitive or outpatient settings.

D Xylose Test Market: Opportunities

At-home testing kits and digital health integration favorably impact market growth

The convergence of diagnostics with remote settings and digital health platforms is offering novel delivery models for traditional tests like D-xylose. With improvements in telemedicine support and sample collection logistics, the test could soon be provided as an at-home test kit, primarily for routine monitoring of chronic gastrointestinal conditions. This opportunity notably impacts the growth of the global D xylose test industry.

Startups like LetsGetChecked in the UK and EverlyWell in the U.S. have started piloting at-home carbohydrate absorption kits, which comprise simplified D-xylose urine collection kits with application-based result tracking. D-xylose testing holds potential to transform into a patient-centric and convenient product for current GI care, as home-based diagnostics gain prominence.

D Xylose Test Market: Challenges

Decreasing use of standard diagnostic algorithms restricts the growth of market

The D-xylose test is actively being omitted from revised clinical guidelines for GI disorders because of transforming preferences for multifunctional and more direct tests. Newer protocols now focus on serologic tests, imaging, and endoscopy as primary tools, leaving less scope for the use of D-xylose.

The American College of Gastroenterology (ACG) has updated its malabsorption diagnostic guidelines, totally removing D-xylose testing from its recommendations for chronic diarrhea and celiac workups. Likewise, the NICE guidelines in the United Kingdom now prioritize duodenal biopsy and anti-tTG antibody testing. This trend in updated clinical practices notably decreases the demand and relevance of the D-xylose test.

D Xylose Test Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | D Xylose Test Market |

| Market Size in 2024 | USD 478.45 Million |

| Market Forecast in 2034 | USD 723.21 Million |

| Growth Rate | CAGR of 5.30% |

| Number of Pages | 212 |

| Key Companies Covered | Merck KGaA, Thermo Fisher Scientific Inc., BioVision Inc., Abbott Laboratories, Danaher Corporation (via Beckman Coulter), Siemens Healthineers, Roche Diagnostics, Randox Laboratories, ARK Diagnostics Inc., Biosynth AG, Creative Diagnostics, MyBioSource Inc., ZellBio GmbH, Enzo Life Sciences Inc., LabCorp, and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

D Xylose Test Market: Segmentation

The global D xylose test market is segmented based on type, application, and region.

Based on type, the global D xylose test industry is divided into blood D xylose test and urine D xylose test. The blood D xylose test segment registered a substantial market share. It offers more accurate and faster absorption results by measuring D-xylose levels in the blood, usually in one to two hours of ingestion. This test is widely adopted, particularly in diagnostic laboratories and hospital settings, due to its clinical preference and reliability among healthcare professionals for the precise and early detection of malabsorption.

Based on application, the global D xylose test market is segmented into gastrointestinal disorders diagnosis, medical research and clinical trials, nutrition assessment, and monitoring treatment response. The gastrointestinal disorders diagnostics segment fuels the global market. This test is mainly used for the detection of conditions like Crohn's disease, celiac disease, tropical sprue, and other malabsorption syndromes. The high worldwide cases of GI disorders and the rising focus on early diagnosis are fueling the demand in this domain. Diagnostic centers and hospitals routinely use D-xylose testing as a component of a diagnostic evaluation for chronic diarrhea, nutrient deficiencies, and weight loss.

D Xylose Test Market: Regional Analysis

North America to witness significant growth over the forecast period

North America is likely to sustain its leadership in the D xylose test market due to surging incidences of gastrointestinal diseases, advanced diagnostic capabilities, healthcare infrastructure, and intense focus on preventive healthcare. North America reports higher cases of malabsorption-associated diseases, especially celiac disease, which affects nearly 1 in 133 individuals, as per Beyond Celiac 2024.

The demand for accurate and early diagnostic tools, such as D-xylose tests, is increasing due to surging patient awareness and the growing use of screening tests. This continuous demand for diagnostics fuels industry dominance in the region. Canada and the United States have highly developed healthcare systems with broader access to hospital networks and diagnostic labs. More than 95% of the United States population can easily access basic diagnostic services, allowing routine malabsorption testing. This ecosystem supports the reliable and widespread use of d-xylose tests, primarily in outpatient gastroenterology departments.

Furthermore, the region focuses on routine screenings and preventive diagnostics, backed by private and government insurance coverage. The U.S. Preventive Services Task Force promotes early detection of diabetes through blood glucose testing. This emphasis strengthens the frequency of d-xylose test use in clinical applications.

Europe continues to hold the second-highest share in the D-xylose test industry, driven by the prevalence of malabsorption and celiac disorders, well-developed diagnostic laboratories and networks, and an aging population with increased nutrient absorption needs. Europe holds the leading number of celiac disease cases, affecting nearly 1 in 100 individuals, as per ESPGHAN 2024.

Moreover, Crohn's disease and lactose intolerance cases are highly prevalent in Eastern and Central Europe. These conditions fuel high demand for reliable malabsorption diagnostics tests, such as d-xylose tests.

Similarly, Europe boasts a high number of accredited diagnostic centers and laboratories, with organizations like Unilabs and Synlab offering the said test in GI panels. These laboratories operate in multiple EU nations, offering high-class results and standardized test procedures. This continuous infrastructure backs the strong regional dominance of the test.

Also, Europe holds a leading geriatric population, with more than 21% of Europeans aged 65+, according to Eurostat. Nutrient deficiencies and malabsorption are more common in this age group, notably requiring D-xylose tests and other diagnostic tests. This demographic trend drives the demand for such diagnostics.

D Xylose Test Market: Competitive Analysis

The leading players in the global D xylose test market are:

- Merck KGaA

- Thermo Fisher Scientific Inc.

- BioVision Inc.

- Abbott Laboratories

- Danaher Corporation (via Beckman Coulter)

- Siemens Healthineers

- Roche Diagnostics

- Randox Laboratories

- ARK Diagnostics Inc.

- Biosynth AG

- Creative Diagnostics

- MyBioSource Inc.

- ZellBio GmbH

- Enzo Life Sciences Inc.

- LabCorp

D Xylose Test Market: Key Market Trends

Adoption in geriatric and pediatric screening programs:

The test is gaining traction in geriatric and pediatric health checkups due to its value and non-invasive nature in accurately and early detecting nutrient absorbers. Public health bodies in Asia and Europe are surging the demand for D-xylose testing as a screening solution for malabsorption and undernutrition in vulnerable age groups.

Move toward home-based and point-of-care testing:

Advancements are growing in simplified sampling kits and portable D-xylose analyzers that can be used in home and outpatient settings. Companies are exploring rapid analysis and capillary blood collection solutions to decentralize testing, particularly in developing economies and rural areas where access to labs is limited.

The global D xylose test market is segmented as follows:

By Type

- Blood D Xylose Test

- Urine D Xylose Test

By Application

- Gastrointestinal Disorders Diagnosis

- Medical Research and Clinical Trials

- Nutrition Assessment

- Monitoring Treatment Response

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The D xylose test refers to the diagnostic procedure that assesses the small intestine's ability to absorb sugars. It involves measuring the absorption of D-xylose, a type of sugar that is typically absorbed in the small intestine without requiring digestive enzymes. Once the patient consumes the standard dose, urine and blood samples are collected to evaluate how much sugar has been absorbed.

The global D xylose test market is projected to grow due to growing cases of malabsorption disorders, improvements in diagnostic techniques, and a rise in POC testing demand.

According to study, the global D xylose test market size was worth around USD 478.45 million in 2024 and is predicted to grow to around USD 723.21 million by 2034.

The CAGR value of the D xylose test market is expected to be around 5.30% during 2025-2034.

North America is expected to lead the global D xylose test market during the forecast period.

The key players profiled in the global D xylose test market include Merck KGaA, Thermo Fisher Scientific Inc., BioVision Inc., Abbott Laboratories, Danaher Corporation (via Beckman Coulter), Siemens Healthineers, Roche Diagnostics, Randox Laboratories, ARK Diagnostics, Inc., Biosynth AG, Creative Diagnostics, MyBioSource, Inc., ZellBio GmbH, Enzo Life Sciences, Inc., and LabCorp.

The report examines key aspects of the D xylose test market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed