Cotton Textile Market Size, Share, Trends, Growth & Forecast 2034

Cotton Textile Market By Type (Cotton Apparel, Home Textiles, Industrial Textiles), By End-User (Apparel and Fashion, Home Furnishing, Healthcare and Medical, Automotive, Sports and Outdoor, Agriculture and Farming), By Distribution Channel (Offline, Online), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

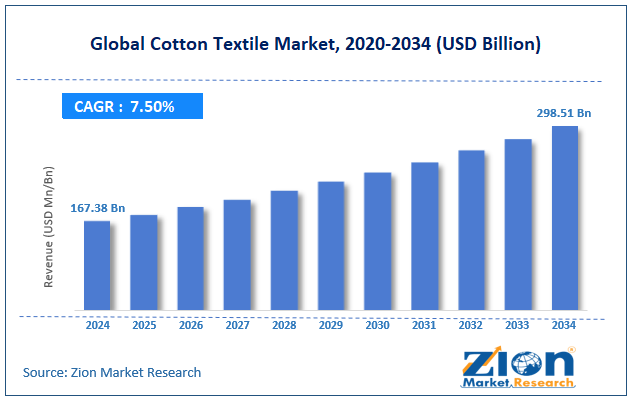

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 167.38 Billion | USD 298.51 Billion | 7.50% | 2024 |

Cotton Textile Industry Perspective:

The global cotton textile market size was approximately USD 167.38 billion in 2024 and is projected to reach around USD 298.51 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.50% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global cotton textile market is estimated to grow annually at a CAGR of around 7.50% over the forecast period (2025-2034)

- In terms of revenue, the global cotton textile market size was valued at around USD 167.38 billion in 2024 and is projected to reach USD 298.51 billion by 2034.

- The cotton textile market is projected to grow significantly due to increasing disposable incomes, urbanization, technological advancements in textile manufacturing, and the expansion of online retail channels and e-commerce.

- Based on product type, the cotton apparel segment is expected to lead the market, while the home textiles segment is anticipated to experience significant growth.

- Based on end-user, the apparel and fashion segment is the largest, while the home furnishings segment is projected to witness substantial revenue growth over the forecast period.

- Based on the distribution channel, the offline segment is expected to lead the market compared to the online segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Cotton Textile Market: Overview

The cotton textile sector encompasses the production of garments and fabrics made from natural cotton fibers, one of the most widely used raw materials in the global textile industry. Renowned for its breathability, durability, and softness, cotton is the preferred choice for a wide range of applications, including home furnishings, industrial uses, and clothing. The global cotton textile market is expected to expand rapidly, driven by growing demand for sustainable and natural fibers, the rise of fashion retail and e-commerce, and a surging demand for furnishings and home textiles. Consumers are increasingly opting for eco-friendly fabrics over synthetic ones due to growing concerns about sustainability. Cotton, being renewable and biodegradable, benefits remarkably from this trend. The leading brands that encourage eco-labels and organic cotton certifications are experiencing substantial growth.

Moreover, online retail platforms are driving demand for cotton apparel due to their broader range of options and easy accessibility. The top fashion brands, such as H&M and Zara, continue to rely on cotton-based products to meet the growing demand for affordability and sustainability. Furthermore, cotton remains a leading choice for towels, linens, curtains, and upholstery due to its durability and comfort. Growing home décor and urbanization trends worldwide are augmenting the demand for high-quality cotton fabrics.

Despite the growth, the global market is impeded by factors such as high dependence on weather conditions and growing competition from synthetic fibers. Cotton farming depends on favorable climatic conditions. Floods, droughts, or pest infestations may disturb supply, leading to price variations and affecting textile manufacturers. Additionally, synthetic fibers like nylon and polyester are more economically priced and more durable than cotton, thereby reducing the industry's reliance on cotton textiles. Polyester production has increased by more than 60% over the past decade, driven by its versatility and low cost.

Nonetheless, the global cotton textile industry stands to gain from several key opportunities, including the growing demand for sustainable and organic cotton, as well as advancements in functional fabrics and cotton blends. Consumers are increasingly choosing organic cotton products that are free from chemicals and pesticides. Global brands like Nike and Levi's are actively investing in sustainable cotton initiatives, offering significant growth opportunities. Manufacturers are creating performance fabrics and cotton-polyester blends with wrinkle resistance, anti-bacterial, and moisture-wicking properties to appeal to modern consumers.

Cotton Textile Market: Growth Drivers

How does fast-fashion influence consumer preferences and boost the cotton textile market growth?

Changing consumer trends are transforming cotton textile demand, with affordability, sustainability, and comfort as key priorities. Fast-fashion brands like Zara and Shein continue to fuel high-volume demand for affordable cotton fabrics, while the premium segment demands high-quality and organic cotton. Recent fashion trends, such as casualization and athleisure, have post-pandemic augmented the demand for breathable fabrics. This dual demand scenario is forcing manufacturers to maintain flexibility, balancing commodity for fast fashion with premium organic varieties for high-end users.

How does technological innovation & automation fuel the cotton textile market growth?

Advanced technologies, including IoT-based spinning machines, AI-driven demand forecasting, and waterless dyeing solutions, are revolutionizing the cotton textile production process. Recent news highlights that Bangladesh and India are actively investing in smart textile machinery to gain a competitive edge.

Furthermore, blockchain-based supply chain tracking is being prioritized to promise cotton origin transparency, mainly for organic certifications. These technological upgrades not only enhance efficiency but also address sustainability issues by reducing energy and water consumption. Hence, these efforts ultimately help progress the global cotton textile market.

Cotton Textile Market: Restraints

Rising wages and labor shortages negatively impact market progress

Cotton textile production is labor-intensive, especially in weaving, spinning, and finishing processes. Several producing economies, such as Bangladesh, Pakistan, and India, are experiencing growing minimum wages and labor scarcity, which is leading to surging operational costs. News coverage has underscored labor unrest and strikes in many regions, disturbing supply chains. These labor challenges restrain mid-sized and small cotton textile companies from scaling production effectively and maintaining competitive pricing.

Cotton Textile Market: Opportunities

How do premiumization and fashion diversification offer advantageous conditions for the cotton textile market development?

Consumers are increasingly seeking premium, high-quality cotton fabrics, which often comprise blends of luxury and long-staple cotton. Reports indicate that the premium cotton apparel segment achieved an 8% CAGR between 2021 and 2023 worldwide. Fashion trends such as organic casual wear, athleisure, and high-end workwear drive the demand for cotton blends that offer improved durability and comfort.

According to the news, luxury brands are incorporating long-staple Pima and Egyptian cotton into their collections, thereby presenting a point of differentiation. This trend allows manufacturers to command high margins and enter specialized segments, impacting the cotton textile industry.

Cotton Textile Market: Challenges

Global supply chain disturbances restrict the market growth

Cotton textile supply chains are vulnerable to shipping congestion, geopolitical tensions, and post-strike disruptions. Freight costs increased by more than 40% in 2023, while delays in Chinese and Indian ports adversely impacted export schedules. According to reports, trade uncertainties and geopolitical conflicts are disrupting the flow of raw cotton to major markets, such as the EU and the U.S. These challenges result in higher costs, longer lead times, and increased uncertainty for brands and manufacturers. Supply chain fragility limits industry growth and investment in fresh capacity.

Cotton Textile Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cotton Textile Market |

| Market Size in 2024 | USD 167.38 Billion |

| Market Forecast in 2034 | USD 298.51 Billion |

| Growth Rate | CAGR of 7.50% |

| Number of Pages | 215 |

| Key Companies Covered | Arvind Limited, Vardhman Textiles, Welspun India, Raymond Ltd., Alok Industries, Shandong Ruyi Technology Group, Cone Denim, Century Textiles and Industries, Birla Century, Parkdale Mills, Loyal Textiles, Nahar Group of Companies, Monti Textile Group, Sapphire Textile Mills, Texhong Textile Group, and others. |

| Segments Covered | By Type, By End-User, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Cotton Textile Market: Segmentation

The global cotton textile market is segmented based on type, end-user, distribution channel, and region.

Based on type, the global cotton textile industry is divided into cotton apparel, home textiles, and industrial textiles. The cotton apparel segment holds a significant market share due to its widespread use in daily clothing, sportswear, and fashion wear. Its softness, moisture absorption, and breathability increase its global preference. The growth of e-commerce, fast fashion brands, and rising disposable income fuels strong demand, while the shift towards sustainable clothing propels the segment's leadership.

Based on end-user, the global cotton textile market is segmented as apparel and fashion, home furnishing, healthcare and medical, automotive, sports and outdoor, and agriculture and farming. The apparel and fashion segment captures a leading market share, driven by its breathability, comfort, and versatility for casual, ethnic, and formal wear. Fast fashion trends, growing populations, and the rise of e-commerce in the developing regions drive the demand remarkably. Moreover, the shift towards organic and sustainable cotton further amplifies the segment's dominance in the global market.

Based on the distribution channel, the global market is segmented into offline and online. The offline distribution segment dominates the global market, as consumers prefer to visit physical stores to inspect fabric quality and fit before making a purchase. Traditional retail formats, such as department stores, supermarkets, and brand outlets, dominate the segment. Easy availability and strong wholesale networks in both rural and urban markets promise continued reliance on offline channels, notwithstanding the progress in digital channels.

Cotton Textile Market: Regional Analysis

What enables Asia Pacific's strong foothold in the global Cotton Textile Market?

The Asia Pacific is expected to maintain its leading position in the global cotton textile market, driven by its significant cotton production and raw material availability, robust textile manufacturing, and cost-effective labor and production capabilities. The Asia Pacific region holds a leading position in cotton production, with China and India being the primary producers globally. India produced more than 5.7 metric tons of cotton in 2023, while China registered nearly 5.4 million metric tons, promising an abundant supply of raw material. This large-scale production reduces input costs for textile manufacturers and enhances the competitive edge of the APAC region.

Moreover, countries such as Pakistan, China, Bangladesh, and India have well-developed textile manufacturing clusters. China alone accounts for more than 30% of worldwide textile exports, while India holds a leading share in fabric and cotton yarn production. This robust manufacturing base enables cost-efficient and large-scale production, thereby enhancing the regional prominence of cotton textiles.

Furthermore, the APAC region offers the lowest labor costs globally, significantly reducing overall manufacturing expenses. For instance, the average labor cost in India is less than USD 2 per hour, compared to more than USD 20 in established economies. This cost-benefit analysis appeals to global apparel brands to source cotton textiles from the APAC region.

North America ranks as the second-largest region in the global cotton textile industry, driven by a strong fashion and apparel market, high cotton production, and rising demand for home textiles. North America, led by the United States, holds the leading apparel markets, fueling primary demand for cotton textiles. The United States apparel market alone was valued at more than USD 330 billion in 2023, with cotton being the preferred fabric for both premium and casual wear. High consumer demand for sustainable and comfortable clothing drives this trend. The United States is the leading cotton producer, promising a supply of raw materials for domestic manufacturers. In 2023, the U.S. produced nearly 3.15 metric tons of cotton, primarily from states such as Mississippi, Georgia, and Texas. This production capability aligns with the local export and textile industries.

Additionally, North America boasts a robust market for home textiles, including towels, bed linens, and upholstery, driven by premium furnishing and home décor preferences. The United States home textile industry was estimated to be worth more than USD 40 billion in 2023, with cotton products leading the way due to their durability and comfort. Growing consumer spending on home improvement also propels the growth.

Cotton Textile Market: Competitive Analysis

The prominent players in the global cotton textile market include:

- Arvind Limited

- Vardhman Textiles

- Welspun India

- Raymond Ltd.

- Alok Industries

- Shandong Ruyi Technology Group

- Cone Denim

- Century Textiles and Industries

- Birla Century

- Parkdale Mills

- Loyal Textiles

- Nahar Group of Companies

- Monti Textile Group

- Sapphire Textile Mills

- Texhong Textile Group

Cotton Textile Market: Key Market Trends

Rising demand for sustainable and organic cotton:

Consumers are increasingly opting for organic cotton products due to concerns about environmental impact and the use of chemicals. Worldwide organic cotton production increased by 48% in 2023, driven by brands such as Nike and H&M adopting sustainable sourcing practices. Certifications such as the Global Organic Textile Standard (GOTS) are gaining prominence, driving this trend.

Growing popularity of blended fabrics:

Performance fabrics and cotton-polyester blends are in high demand due to their wrinkle resistance, durability, and comfort. This trend caters to the athleisure and activewear markets, which progressed by 7.5% worldwide in 2023. These blends offer functionality without compromising the natural feel of cotton.

The global cotton textile market is segmented as follows:

By Type

- Cotton Apparel

- Home Textiles

- Industrial Textiles

By End-User

- Apparel and Fashion

- Home Furnishing

- Healthcare and Medical

- Automotive

- Sports and Outdoor

- Agriculture and Farming

By Distribution Channel

- Offline

- Online

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The cotton textile sector encompasses the production of garments and fabrics made from natural cotton fibers, one of the most widely used raw materials in the global textile industry. Renowned for its breathability, durability, and softness, cotton is the preferred choice for a wide range of applications, including home furnishings, industrial uses, and clothing.

The global cotton textile market is projected to grow due to changing lifestyle trends, a rising population, the increasing use of cotton in industrial and medical applications, and a growing demand for sustainable and natural fabrics.

According to study, the global cotton textile market size was worth around USD 167.38 billion in 2024 and is predicted to grow to around USD 298.51 billion by 2034.

The CAGR value of the cotton textile market is expected to be approximately 7.50% from 2025 to 2034.

Macroeconomic factors, such as rising labor costs, inflation, currency fluctuations, and trade policies, will influence cotton textile production pricing, costs, and global demand in the coming years.

Significant challenges include competition from synthetic fibers, volatile cotton prices, labor-intensive production, high water usage, and stringent environmental regulations.

Asia Pacific is expected to lead the global cotton textile market during the forecast period.

The key players profiled in the global cotton textile market include Arvind Limited, Vardhman Textiles, Welspun India, Raymond Ltd., Alok Industries, Shandong Ruyi Technology Group, Cone Denim, Century Textiles and Industries, Birla Century, Parkdale Mills, Loyal Textiles, Nahar Group of Companies, Monti Textile Group, Sapphire Textile Mills, and Texhong Textile Group.

The competitive landscape in the cotton textile market is characterized by regional and global players competing through sustainable initiatives, product innovation, robust distribution networks, and effective pricing strategies.

The report examines key aspects of the cotton textile market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed