Cosmetic Packaging Market Size, Share, Growth and Forecast 2032

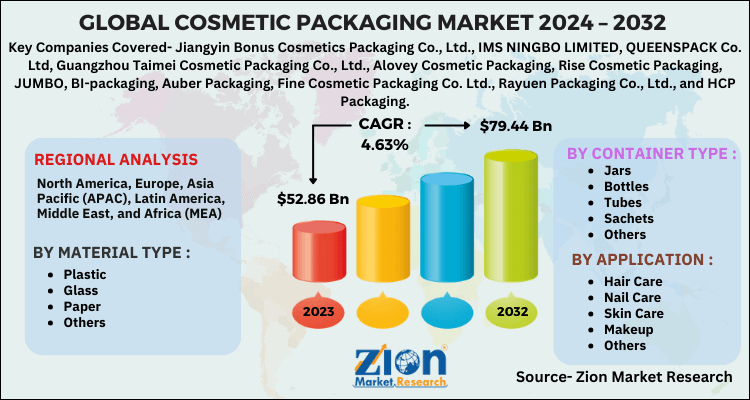

Cosmetic Packaging Market By Material Type (Plastic, Glass, Paper, and Others), By Container Type (Jars, Bottles, Tubes, Sachets, and Others), By Applications (Hair Care, Nail Care, Skin Care, Makeup, and Others) : Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

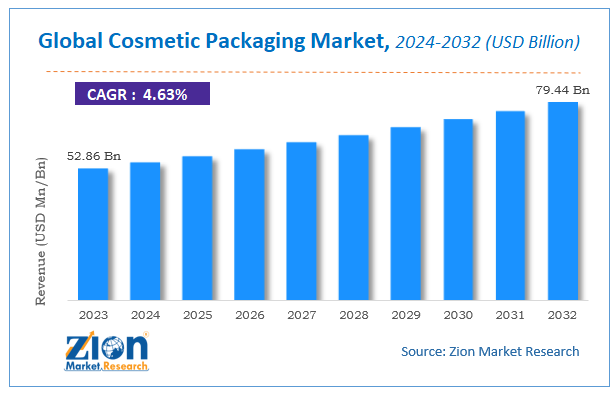

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 52.86 Billion | USD 79.44 Billion | 4.63% | 2023 |

Cosmetic Packaging Market Insights

According to Zion Market Research, the global Cosmetic Packaging Market was worth USD 52.86 Billion in 2023. The market is forecast to reach USD 79.44 Billion by 2032, growing at a compound annual growth rate (CAGR) of 4.63% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Cosmetic Packaging Market industry over the next decade.

Cosmetic Packaging Market Size Overview

Cosmetic packaging is referred to containers used for primary as well as secondary packaging of various types of cosmetic products such as skin care, hair care, grooming, and make up. Cosmetic packaging plays a key role in protecting cosmetic products while products are being processed, stored, and transported. These also help in preserving the product quality and extending product shelf life. Cosmetic packaging also help in displaying basic product information such as product ingredients, packaged and manufacturing dates, and shelf life of the product.

Cosmetic packaging also has an important role in building brand awareness among consumers as lucrative packaging of the product can help in shaping consumer perceptions about cosmetics. Further, innovative packaging designs used by cosmetic companies can also be helpful in stimulating consumer emotions to attract new customers. Packaging also helps companies in providing accurate product information, in turn, avoiding misleading information about consumer products.

Packaging is the process of enclosing, wrapping and protecting products for storage, distribution, sale, and use. Packaging can also be defined as the process of designing, evaluating, and producing packages. Cosmetic packaging depends on four major aspects such as the type of container, compatibility, functionality and protection of products. Cosmetic packaging is gaining huge demand in recent times owing to the huge demand for cosmetic products in China.

Cosmetic Packaging Market: Growth Factors

Changing demographics and evolving consumer taste and buying preferences have accelerated the demand for cosmetic products worldwide. This trend is anticipated to trigger the cosmetic packaging market growth. Also, rising consumer spending on overall wellbeing and appearance should bolster the demand for cosmetic products which enhance consumer experience. These trends may drive the use of customized as well as specialized packaging, which may augment market growth.

Rising demand for premium quality products among millennials and urban population owing to improving economic condition and improving lifestyle has increased utilization of high-quality packaging in cosmetic industry for preserving products quality and shelf life. Such trend in the cosmetic industry is likely to create new opportunities. Also, increasing government regulations and ban on use of single use packaging materials has influenced companies to adopt new environmentally friendly packaging materials for preventing harm of environment. Cosmetic companies are also emphasizing on sustainability and reducing product carbon footprint should also boost the demand for biodegradable cosmetic packaging, which may proliferate the market growth.

The sharp rise in the cosmetic industry in expected to drive the cosmetic packaging market in China in upcoming years. Moreover, major focus on innovative cosmetic packaging is likely to fuel the growth of the cosmetic packaging market in the forecast period.

However, fluctuations in the raw material of the packaging may obstruct the growth of the cosmetic packaging market in coming years. Nevertheless, increasing number of domestic players in this market may open opportunities for the cosmetic packaging market growth within the forecast period. Furthermore, development of new materials is considered to be the major driver opening new opportunities for the cosmetic packaging industry.

Cosmetic Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cosmetic Packaging Market |

| Market Size in 2023 | USD 52.86 Billion |

| Market Forecast in 2032 | USD 79.44 Billion |

| Growth Rate | CAGR of 4.63% |

| Number of Pages | 110 |

| Key Companies Covered | Jiangyin Bonus Cosmetics Packaging Co., Ltd., IMS NINGBO LIMITED, QUEENSPACK Co. Ltd, Guangzhou Taimei Cosmetic Packaging Co., Ltd., Alovey Cosmetic Packaging, Rise Cosmetic Packaging, JUMBO, BI-packaging, Auber Packaging, Fine Cosmetic Packaging Co. Ltd., Rayuen Packaging Co., Ltd., and HCP Packaging. |

| Segments Covered | By Material Type, By Container Type, By Application Type and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Material Type Segment Analysis

Plastic material segment accounted for the largest market share in the global cosmetic packaging market owing to easy availability and low cost of variety of plastics. Low cost plastic has increased the adoption of plastic as packaging material among cosmetic companies as plastic aids in easy manufacturing of containers and producing low weight containers. This major benefit of plastic over other packaging materials has triggered the plastic cosmetic packaging market.

Paper material segment is expected to gain significant market growth owing to increasing demand for biodegradable and organic packaging materials. Decreasing popularity of plastics among manufacturing companies pertaining to increasing restraints on use of single use plastic is likely to increase use of paper based cosmetic packaging worldwide.

Container Type Segment Analysis

Bottle container segment dominated the global cosmetic packaging market in 2020 owing to soaring use of plastic bottle packaging perfumes, liquid soaps, shampoos, lotions, and moisturizer. Growing demand for liquid soap, shampoos, and lotions due to rising consumer spending on skin care and hair care products should accelerate the use of bottles for packaging various cosmetics, boosting market growth.

Application Segment Analysis

Skin care segment held a major share in the global cosmetic packaging market in 2020. Skin care has become a key part of consumers daily routine as consumer are increasing focusing on maintain healthy skin and overall appearance. Increasing sales of beauty and skin care products has augmented use of cosmetic packaging for skin care products, which should propel skin care cosmetic packaging market growth.

Cosmetic Packaging Market: Regional Analysis

The Asia Pacific region accounted for a market share of about 40% in 2020 and is expected to grow at the fastest rate over the projected time period. Increasing population and improving disposable income has accelerated the demand for cosmetics in developing nations of Asia Pacific. This growth in the cosmetic industry in Asia Pacific is attributable to growth in the Asia Pacific cosmetic packaging market.

The North American region is estimated to grow at a CAGR of 3.8% over the projected period. The growth in the North American cosmetic packaging market is likely to be attributable to rising demand for premium quality packaging for preserving product quality and shelf life. Further, growing demand for recyclable packaging in United States and Canada is likely to contribute to the growth of the cosmetic packaging market growth.

Key Market Players & Competitive Landscape

Some of key players in cosmetic packaging market are-

- Jiangyin Bonus Cosmetics Packaging Co.

- IMS NINGBO LIMITED

- QUEENSPACK Co. Ltd

- Guangzhou Taimei Cosmetic Packaging Co.

- Alovey Cosmetic Packaging

- Rise Cosmetic Packaging

- JUMBO

- BI-packaging

- Auber Packaging

- Fine Cosmetic Packaging Co. Ltd.

- Rayuen Packaging Co.

- HCP Packaging.

The global Cosmetic Packaging market is segmented as follows:

By Material Type

- Plastic

- Glass

- Paper

- Others

By Container Type

- Jars

- Bottles

- Tubes

- Sachets

- Others

By Application Type

- Hair Care

- Nail Care

- Skin Care

- Makeup

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Cosmetic Packaging Market size is set to expand from $ 52.86 Billion in 2023

Cosmetic Packaging Market size is set to expand from $ 52.86 Billion in 2023 to $ 79.44 Billion by 2032, with an CAGR of around 4.63% from 2024 to 2032.

Changing demographics and evolving consumer taste and buying preferences have accelerated the demand for cosmetic products worldwide. This trend is anticipated to trigger the cosmetic packaging market growth. Also, rising consumer spending on overall wellbeing and appearance should bolster the demand for cosmetic products which enhance consumer experience. These trends may drive the use of customized as well as specialized packaging, which may augment market growth.

Increasing population and improving disposable income has accelerated the demand for cosmetics in developing nations of Asia Pacific. This growth in the cosmetic industry in Asia Pacific is attributable to growth in the Asia Pacific cosmetic packaging market.

Some of key players in cosmetic packaging market are Jiangyin Bonus Cosmetics Packaging Co., Ltd., IMS NINGBO LIMITED, QUEENSPACK Co. Ltd, Guangzhou Taimei Cosmetic Packaging Co., Ltd., Alovey Cosmetic Packaging, Rise Cosmetic Packaging, JUMBO, BI-packaging, Auber Packaging, Fine Cosmetic Packaging Co. Ltd., Rayuen Packaging Co., Ltd., and HCP Packaging.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed