Corporate Wellness Market Statistics, Trends, Forecast- 2032

Corporate Wellness Market By Service (Health Risk Assessment, Fitness, Smoking Cessation, Health Screening, Nutrition & Weight Management, Stress Management, and Others), By End-User (Small-Scale Organizations, Medium-Scale Organizations, and Large-Scale Organizations), and By Region: Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032

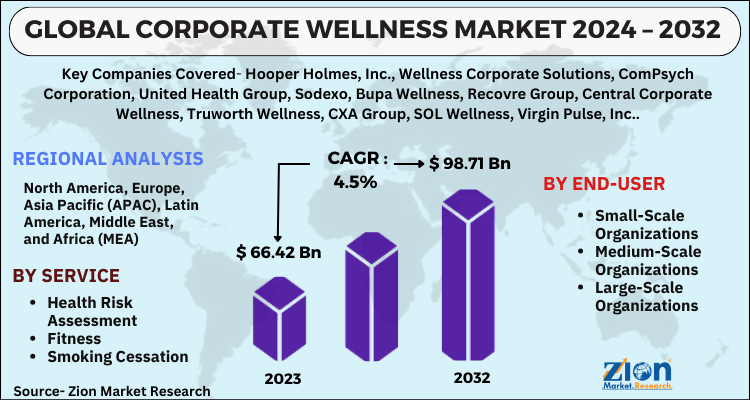

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 66.42 Billion | USD 98.71 Billion | 4.5% | 2023 |

Corporate Wellness Market: Industry Perspective

The global corporate wellness market size was worth around USD 66.42 billion in 2023 and is predicted to grow to around USD 98.71 billion by 2032 with a compound annual growth rate (CAGR) of roughly 4.5% between 2024 and 2032.

The report analyzes the global corporate wellness market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the corporate wellness industry.

The report covers a forecast and an analysis of the corporate wellness market on a global and regional level. The study provides historical data for 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD Billion). The study includes drivers and restraints of the corporate wellness market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the corporate wellness market on a global level.

Corporate wellness is about people. Since the last decade, companies have started adopting a holistic approach for their employees instead of just addressing their health-related risks. Several organizations worldwide have started introducing wellness programs for their employees to prevent various types of diseases and improve productivity. Corporate wellness programs benefit organizations in enhancing their work productivity along with reducing the overall operational costs. The rising incidences of chronic diseases and obesity witnessed among the employees are increasing their treatment costs, and thereby the cost to the company. To combat this, several companies are addressing the benefits of corporate wellness programs, which will help their workforce to maintain a healthy life, lessen stress, and improve productivity. This, in turn, is likely to drive the global corporate wellness market in the future. Growing demand for corporate wellness programs owing to the rising insurance costs is anticipated to result in the increased financial burden on organizations, which is projected to prominently fuel the corporate wellness market growth on a global scale in the years ahead.

By service, the corporate wellness market is divided into health risk assessment, nutrition and weight management, smoking cessation, health screening, fitness, stress management, and others. The health risk assessment segment is estimated to hold a major share of the global corporate wellness market in 2024, due to the increasing health screening activities in various organizations, which, in turn, allows the organizations to apply strategic and beneficial initiatives to manage the recognized employee’s health risks. By end-user, the global corporate wellness market is segmented into small-scale organizations, medium-scale organizations, and large-scale organizations. Large-scale organizations are anticipated to dominate the corporate wellness market in terms of revenue in the future, owing to the high adoption of corporate wellness programs. The small- and medium-scale organizations are anticipated to show significant CAGR, due to the increasing awareness of employee wellness and health management.

In order to give the users of this report a comprehensive view of the corporate wellness market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides a company market share analysis to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new technology launches, agreements, partnerships, collaborations & joint ventures, research & development, technology, and regional expansion of major participants involved in the market on a global and regional basis. Moreover, the study covers price trend analysis and product portfolio of various companies according to regions.

Corporate Wellness Market: Segmentation Analysis

The study provides a decisive view of the corporate wellness market by segmenting the market based on service, end-user, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

By service, the market is segmented into health risk assessment, fitness, smoking cessation, health screening, nutrition and weight management, stress management, and others.

By end-user, the market is segmented into small-scale organizations, medium-scale organizations, and large-scale organizations.

Corporate Wellness Market: Regional Analysis

The regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa which is further divided into major countries including the U.S., Germany, France, UK, China, Japan, India, and Brazil.

Corporate Wellness Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Corporate Wellness Market |

| Market Size in 2023 | USD 66.42 Billion |

| Market Forecast in 2032 | USD 98.71 Billion |

| Growth Rate | CAGR of 4.5% |

| Number of Pages | 110 |

| Key Companies Covered | Hooper Holmes, Inc., Wellness Corporate Solutions, ComPsych Corporation, United Health Group, Sodexo, Bupa Wellness, Recovre Group, Central Corporate Wellness, Truworth Wellness, CXA Group, SOL Wellness, Virgin Pulse, Inc., Interactive Health, Inc., FitLinxx, Inc., and ConneXions Asia, among others |

| Segments Covered | By Service, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Corporate Wellness Market: Competitive Analysis

Some of the major players in the global corporate wellness market include:

- Hooper Holmes, Inc.

- Wellness Corporate Solutions

- ComPsych Corporation

- United Health Group

- Sodexo

- Bupa Wellness

- Recovre Group

- Central Corporate Wellness

- Truworth Wellness

- CXA Group

- SOL Wellness

- Virgin Pulse, Inc.

- Interactive Health, Inc.

- FitLinxx, Inc.

- ConneXions Asia

The global corporate wellness market is segmented as follows;

Global Corporate Wellness Market: Service Analysis

- Health Risk Assessment

- Fitness

- Smoking Cessation

- Health Screening

- Nutrition and Weight Management

- Stress Management

- Others

Global Corporate Wellness Market: End-User Analysis

- Small-Scale Organizations

- Medium-Scale Organizations

- Large-Scale Organizations

Global Corporate Wellness Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Corporate wellness refers to initiatives and programs implemented by organizations to promote and support the overall health and well-being of their employees. It encompasses physical, mental, emotional, and financial health, aiming to create a healthier and more productive workforce.

According to a study, the global corporate wellness market size was worth around USD 66.42 billion in 2023 and is expected to reach USD 98.71 billion by 2032.

The global corporate wellness market is expected to grow at a CAGR of 4.5% during the forecast period.

North America is expected to dominate the corporate wellness market over the forecast period.

Leading players in the global corporate wellness market include Hooper Holmes, Inc., Wellness Corporate Solutions, ComPsych Corporation, United Health Group, Sodexo, Bupa Wellness, Recovre Group, Central Corporate Wellness, Truworth Wellness, CXA Group, SOL Wellness, Virgin Pulse, Inc., Interactive Health, Inc., FitLinxx, Inc., and ConneXions Asia, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed