Controlled Environment Agriculture Market Size, Share, Growth and Forecast 2034

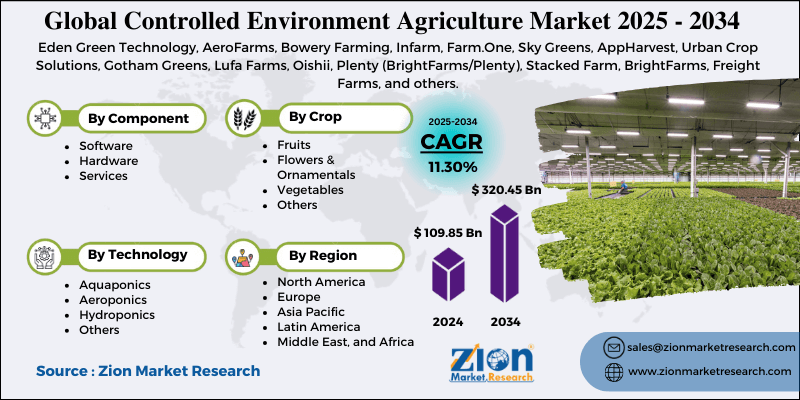

Controlled Environment Agriculture Market By Component (Software, Hardware, and Services), By Technology (Aquaponics, Aeroponics, Hydroponics, and Others), By Crop (Fruits, Flowers & Ornamentals, Vegetables, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

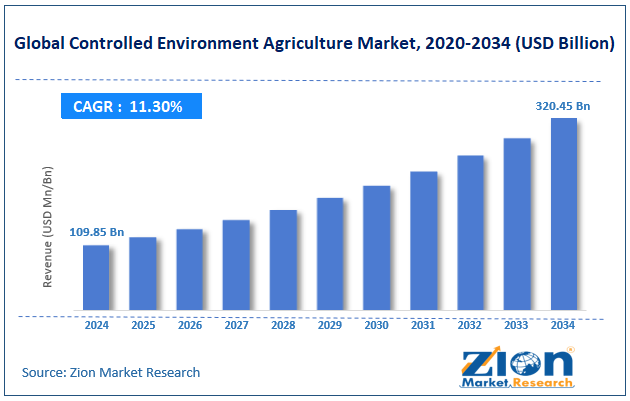

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 109.85 Billion | USD 320.45 Billion | 11.30% | 2024 |

Controlled Environment Agriculture Industry Perspective:

The global controlled environment agriculture market size was worth around USD 109.85 billion in 2024 and is predicted to grow to around USD 320.45 billion by 2034 with a compound annual growth rate (CAGR) of roughly 11.30% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global controlled environment agriculture market is estimated to grow annually at a CAGR of around 11.30% over the forecast period (2025-2034)

- In terms of revenue, the global controlled environment agriculture market size was valued at around USD 109.85 billion in 2024 and is projected to reach USD 320.45 billion, by 2034.

- The market is projected to grow at a significant rate due to the growing impact of climate change on traditional agricultural practices.

- Based on the component, the hardware segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the crop, the vegetable segment is anticipated to command the largest market share.

- Based on region, Europe is projected to dominate the global market during the forecast period.

Controlled Environment Agriculture Market: Overview

Controlled-environment agriculture (CEA) deals with the agricultural practice of growing plants in a technology-enabled closed infrastructure. CEA practice leverages plant science, engineering, and computer-controlled greenhouse ecosystems to optimize plant production and its quality. Furthermore, CEA is also used for promoting production efficiency in a micromanaged environment. CEA results in the production of year-round and healthy high-value plants. This is achieved by controlling essential parameters such as root-zone growing medium, carbon dioxide, light, and temperature.

In addition to this, crop production across horizontal or vertically placed racks can also result in limited use of land with higher crop yield as compared to traditional farming methods. During the forecast period, demand for controlled-environment agriculture is projected to grow due to the increasing demand for locally sourced food items. In addition to this, rapid climate change is a major growth driver for the increased adoption of controlled-environment agriculture worldwide. However, a major drawback for the industry is the high cost of investment required to build and maintain controlled-environment agricultural settings.

Controlled Environment Agriculture Market: Growth Drivers

Growing impact of climate change on traditional agricultural practices to fuel demand for CEA

The global controlled-environment agriculture market is expected to be driven by the rising impact of climate change on traditional cultivation practices. Drastic and sudden changes in weather conditions have resulted in less predictable seasons. This has created difficulties for farmers and crop cultivators worldwide to ensure optimal crop yield every season, unlike in previous years. Climate change affects several aspects of the food supply chain including reduced crop yields and declining crop quality.

Ultimately these changes also impact the overall food prices worldwide. According to the National Aeronautics and Space Administration (NASA), changes in climate conditions are expected to impact the production of wheat and maize as early as 2030 in the backdrop of growing greenhouse gas emissions worldwide.

As per the study titled Nature Food, maize production is projected to drop by 24% while wheat yield may register a decline of over 17%. Controlled-environment agriculture is considered an excellent alternative to traditional farming practices since it can help farmers mitigate the problems associated with climate change. CEA facilitates the year-round production of high-value and nutrition-rich crops in a controlled setting.

Increasing support from the regional governments to encourage novel CEA initiatives globally.

Regional governments worldwide are increasingly supporting sustainable agricultural practices as food demand increases. Additionally, a shortage of food supply will encourage higher adoption of novel agricultural practices that promote improved crop yield in minimum space. For instance, in November 2024, reports emerged suggesting that the Mission for Integrated Development of Horticulture (MIDH) will soon be increased in the Indian market.

The initiative will follow the introduction of new technologies such as precision farming, vertical farming, aquaponics, and hydroponics. The global controlled-environment agriculture market will continue to benefit as more state heads continue to incorporate new farming practices in the regional agriculture sector. The Inflation Reduction Act in the US will provide around USD 20 billion to support climate-smart agriculture in the region.

Controlled Environment Agriculture Market: Restraints

High cost of investment in the market to limit overall expansion trends during the forecast period

The global controlled environment agriculture industry is expected to be restricted by the high cost of investment associated with the market. CEA requires the installation of highly advanced technologies that promote protected agriculture. Some of these technologies include climate control systems, environmental sensors, robotic systems, vertical farming structures, and ultraviolet and ozone sterilization systems. The high cost of developing and maintaining the required infrastructure can discourage the entry of new players into the market.

Controlled Environment Agriculture Market: Opportunities

Introduction of novel CEA technologies to generate growth opportunities for industry players

The global controlled-environment agriculture market is expected to generate growth opportunities due to the growing introduction of new technologies in the market. In September 2024, Rivulis, a leading technology company in the irrigation system, announced the launch of Rivulis Artificial Intelligence (AI). The tool is designed to assist farmers in making informed decisions in terms of irrigation management. Rivulis AI is expected to deliver micro-irrigation solutions for crop cultivators.

On the other hand, in June 2025, Arugga AI Farming launched an autonomous plant-lowering robot for greenhouse-grown cucumbers and tomatoes. The innovation is named Louie and will be currently available in France, Belgium, and the Netherlands. The robot is designed to deliver plant lowering which is considered the most labor-intensive task in greenhouse horticulture. Louie can manage around 300 plants per hour and support plants that weigh up to 10 kilograms. The industry is expected to register higher investments in AI-driven technologies for controlled-environment agriculture including AI-led data capture, spraying, and greenhouse climate control.

Controlled Environment Agriculture Market: Challenges

Limited applications and lack of technical skills in farmers to challenge market growth

The global controlled-environment agriculture industry will be challenged by the limited applications of the technology in crop cultivation. CEA is currently considered ideal for non-staple crops such as tomatoes, cucumbers, microgreens, bell peppers, and specialty crops. Traditional outdoor farming is still the most predominant agricultural practice for staple crops. Additionally, a lack of sufficient technical skills among crop cultivators may further inhibit market expansion in the long run.

Controlled Environment Agriculture Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Controlled Environment Agriculture Market |

| Market Size in 2024 | USD 109.85 Billion |

| Market Forecast in 2034 | USD 320.45 Billion |

| Growth Rate | CAGR of 11.30% |

| Number of Pages | 216 |

| Key Companies Covered | Eden Green Technology, AeroFarms, Bowery Farming, Infarm, Farm.One, Sky Greens, AppHarvest, Urban Crop Solutions, Gotham Greens, Lufa Farms, Oishii, Plenty (BrightFarms/Plenty), Stacked Farm, BrightFarms, Freight Farms, and others. |

| Segments Covered | By Component, By Technology, By Crop, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Controlled Environment Agriculture Market: Segmentation

The global controlled environment agriculture market is segmented based on components, technology, crops, and regions.

Based on the components, the global market segments are software, hardware, and services. In 2024, the highest growth was listed in the hardware segment dominating more than 50% of the total revenue. The growing demand for critical hardware solutions such as heating, ventilation, and air conditioning (HVAC) systems, sensors, and light-emitting diodes (LEDs) across CEA centers will propel segmental revenue in the future. The software segment may register improved CAGR in the coming years.

Based on technology, the global controlled environment agriculture industry is divided into aquaponics, aeroponics, hydroponics, and others.

Based on the crop, the global market divisions are fruits, flowers & ornamentals, vegetables, and others. In 2024, the highest growth rate was listed in the vegetables segment with control over 39% of the final revenue. The increasing demand for organic and locally sourced essential vegetables with high nutritional value will fuel segmental growth in the coming years. The fruits segment is anticipated to emerge as the second-highest revenue generator during the projection period.

Controlled Environment Agriculture Market: Regional Analysis

Europe to witness the highest growth during the forecast period

The global controlled environment agriculture market is expected to be led by Europe during the forecast period. Countries such as France, Germany, Spain, and the Netherlands will fuel regional expansion in the coming years. Europe has been the front-runner in terms of adopting novel technologies for agricultural processes. The region has also widely promoted the adoption of climate-resistant, sustainable, and next-generation farming activities such as controlled-environment agriculture. In May 2025, Swiss Life Asset Managers and Planet Farms announced the launch of a new joint venture valued at EUR 20 million for CEA infrastructure. The partnership will also include the Cirimido facility owned by Planet Farms and upcoming projects in the Scandinavian regions and the United Kingdom.

North America is to be led by the US and Canada during the projection duration. The increasing demand for domestically produced food items will fuel the regional growth rate. In addition to this, the presence of several CEA-favoring government policies in North America and technologically skilled farmers may ease the process of further expansion of controlled-environment agriculture. In May 2024, Local Bounty Corporation, a leading US-based indoor agriculture company, launched its new CEA facility in Washington as investments in precision farming in the region continue to thrive.

Controlled Environment Agriculture Market: Competitive Analysis

The global controlled environment agriculture market is led by players like:

- Eden Green Technology

- AeroFarms

- Bowery Farming

- Infarm

- Farm.One

- Sky Greens

- AppHarvest

- Urban Crop Solutions

- Gotham Greens

- Lufa Farms

- Oishii

- Plenty (BrightFarms/Plenty)

- Stacked Farm

- BrightFarms

- Freight Farms

The global controlled environment agriculture market is segmented as follows:

By Component

- Software

- Hardware

- Services

By Technology

- Aquaponics

- Aeroponics

- Hydroponics

- Others

By Crop

- Fruits

- Flowers & Ornamentals

- Vegetables

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Controlled-environment agriculture (CEA) deals with the agricultural practice of growing plants in a technology-enabled closed infrastructure.

The global controlled-environment agriculture market is expected to be driven by the rising impact of climate change on traditional cultivation practices.

According to study, the global controlled environment agriculture market size was worth around USD 109.85 billion in 2024 and is predicted to grow to around USD 320.45 billion by 2034.

The CAGR value of controlled environment agriculture market is expected to be around 11.30% during 2025-2034.

The global controlled environment agriculture market is expected to be led by Europe during the forecast period.

The global controlled environment agriculture market is led by players like Eden Green Technology, AeroFarms, Bowery Farming, Infarm, Farm.One, Sky Greens, AppHarvest, Urban Crop Solutions, Gotham Greens, Lufa Farms, Oishii, Plenty (BrightFarms/Plenty), Stacked Farm, BrightFarms and Freight Farms.

The report explores crucial aspects of the controlled environment agriculture market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed