Continuous Testing Market Size, Share, Trends, Growth 2032

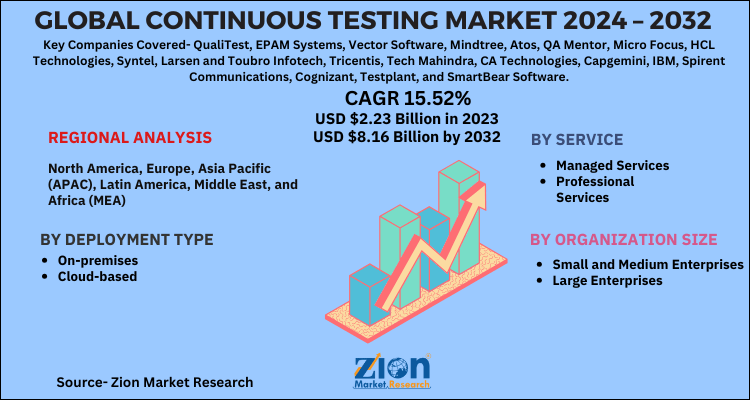

Continuous Testing Market By Service (Professional Services and Managed Services), By Deployment Type (Cloud-Based and On-Premises), By Organization Size (Large Enterprises and Small & Medium Enterprises), And By Region - Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.23 Billion | USD 8.16 Billion | 15.52% | 2023 |

Continuous Testing Market Insights

Zion Market Research has published a report on the global Continuous Testing Market, estimating its value at USD 2.23 Billion in 2023, with projections indicating that it will reach USD 8.16 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 15.52% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Continuous Testing industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Continuous Testing Market: Overview

Continuous testing is the method of executing automated tests for assessment of software quality at each phase of delivery pipeline. This is done for preventing business risks pertaining to delivery of the software. Moreover, escalating need for parallel use of testing in myriad departments and developing of cloud-based apps are some of the key factors expected to boost the demand for continuous testing.

Apparently, the key principle of continuous testing is to test timely, test regularly, and test rapidly for preventing the occurrence of the problem than recognizing or identifying it. Additionally, continuous testing involves release engineers, development team, and QA team and assists the firms in improving bug tracking along with responding promptly to the business risks.

Continuous Testing Market: Segmentation

Rapid digitization of businesses globally has resulted in massive need for developing new software and this has enhanced the need for automated testing of processes continuously. This, in turn, has resulted in huge demand for continuous testing in the recent years. With the onset of new technologies like IoT and its use in myriad sectors, the market for continuous testing is likely to gain momentum over the ensuing years. Additionally, surging acceptance of smart equipment and broadband connection along with improvement witnessed in IT infrastructure facility will accentuate the market trends.

Furthermore, introduction of 4G LTE as well as 5G network are some of the other key factors that will accelerate the market progression over the ensuing years. Apparently, constant quality monitoring has resulted in massive requirement for continuous testing and this is likely to result in amplification of the business landscape over the forthcoming years.

Continuous Testing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Continuous Testing Market |

| Market Size in 2023 | USD 2.23 Billion |

| Market Forecast in 2032 | USD 8.16 Billion |

| Growth Rate | CAGR of 15.52% |

| Number of Pages | 110 |

| Key Companies Covered | QualiTest, EPAM Systems, Vector Software, Mindtree, Atos, QA Mentor, Micro Focus, HCL Technologies, Syntel, Larsen and Toubro Infotech, Tricentis, Tech Mahindra, CA Technologies, Capgemini, IBM, Spirent Communications, Cognizant, Testplant, and SmartBear Software |

| Segments Covered | By Deployment Type, By Service, By Organization Size And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

North America Set To Become A Global Market Leader By 2032

The growth of the market in the region over the projected timeline is owing to escalating use of software development lifecycle process in the software firms for effectively testing of software in the countries like Canada and the U.S. Apart from this, availability of robust internet infrastructure facilities in these countries along with massive use of smartphones & web applications will prompt the product penetration in the sub-continent. This, in turn, will spearhead the regional market expansion in the years to come.

Continuous Testing Market: Competitive Space

The global continuous testing market profiles key players such as:

- QualiTest

- EPAM Systems

- Vector Software

- Mindtree

- Atos

- QA Mentor

- Micro Focus

- HCL Technologies

- Syntel

- Larsen and Toubro Infotech

- Tricentis

- Tech Mahindra

- CA Technologies

- Capgemini

- IBM

- Spirent Communications

- Cognizant

- Testplant

- SmartBear Software

The global continuous testing market is segmented as follows:

By Deployment Type

- On-premises

- Cloud-based

By Service

- Managed Services

- Professional Services

By Organization Size

- Small and Medium Enterprises

- Large Enterprises

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Continuous testing is a software testing practice that entails the execution of automated tests at various stages of the software development lifecycle (SDLC) to guarantee that the software is consistently deployable. It allows teams to identify and resolve defects early and frequently as code changes are made by integrating testing into the continuous integration (CI) and continuous delivery (CD) pipelines.

The demand for continuous testing is on the rise as organizations adopt Agile and DevOps methodologies to enhance collaboration and expedite software delivery. These practices are in alignment with continuous testing, which offers prompt feedback on code modifications.

Zion Market Research has published a report on the global Continuous Testing Market, estimating its value at USD 2.23 Billion in 2023, with projections indicating that it will reach USD 8.16 Billion by 2032.

The market is expected to expand at a compound annual growth rate (CAGR) of 15.52% over the forecast period 2024-2032.

The growth of the market in the region over the projected timeline is owing to escalating use of software development lifecycle process in the software firms for effectively testing of software in the countries like Canada and the U.S. Apart from this, availability of robust internet infrastructure facilities in these countries along with massive use of smartphones & web applications will prompt the product penetration in the sub-continent.

Key players influencing the market growth and profiled in the report include QualiTest, EPAM Systems, Vector Software, Mindtree, Atos, QA Mentor, Micro Focus, HCL Technologies, Syntel, Larsen and Toubro Infotech, Tricentis, Tech Mahindra, CA Technologies, Capgemini, IBM, Spirent Communications, Cognizant, Testplant, and SmartBear Software.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed