Consumer Network Attached Storage (NAS) Market Size, Share Report 2034

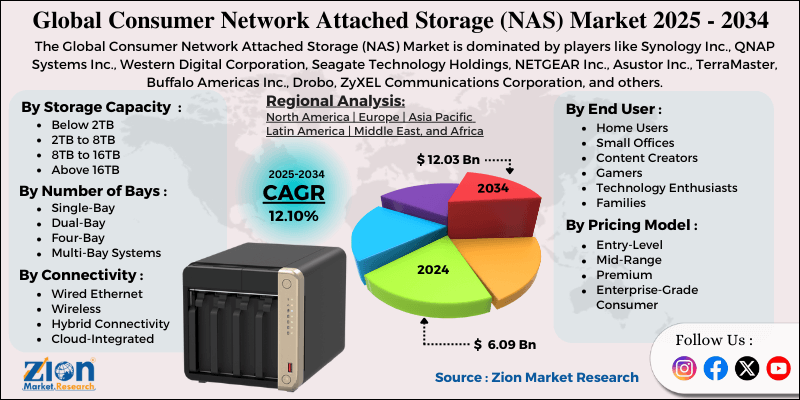

Consumer Network Attached Storage (NAS) Market By Storage Capacity (Below 2TB, 2TB to 8TB, 8TB to 16TB, Above 16TB), By End-User (Home Users, Small Offices, Content Creators, Gamers, Technology Enthusiasts, Families), By Number of Bays (Single-Bay, Dual-Bay, Four-Bay, Multi-Bay Systems), By Connectivity (Wired Ethernet, Wireless, Hybrid Connectivity, Cloud-Integrated), By Pricing Model (Entry-Level, Mid-Range, Premium, Enterprise-Grade Consumer), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

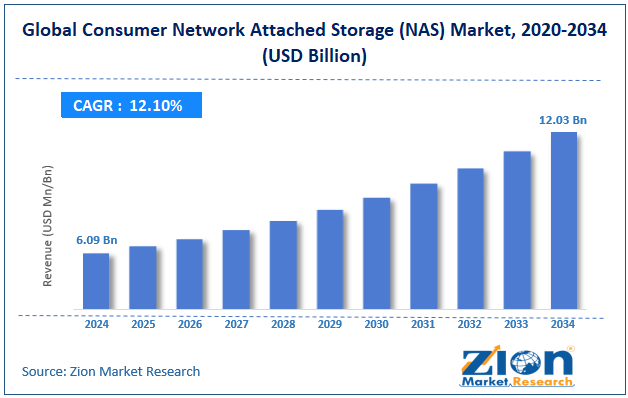

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.09 Billion | USD 12.03 Billion | 12.10% | 2024 |

Consumer Network Attached Storage Industry Perspective:

The global consumer network attached storage market size was worth approximately USD 6.09 billion in 2024 and is projected to grow to around USD 12.03 billion by 2034, with a compound annual growth rate (CAGR) of roughly 12.10% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global consumer network attached storage market is estimated to grow annually at a CAGR of around 12.10% over the forecast period (2025-2034).

- In terms of revenue, the global consumer network attached storage market size was valued at approximately USD 6.09 billion in 2024 and is projected to reach USD 12.03 billion by 2034.

- The consumer network attached storage market is projected to grow significantly due to the increasing volume of personal digital content, rising concerns about cloud service privacy and costs, and growing adoption of smart home ecosystems requiring centralized storage solutions.

- Based on storage capacity, the 2TB to 8TB segment is expected to lead the consumer network attached storage market, while the above 16TB segment is anticipated to experience significant growth.

- Based on end-user, the home users segment is expected to lead the consumer network attached storage market, while the content creators segment is anticipated to witness notable growth.

- Based on the number of bays, the dual-bay segment is the dominating segment, while the four-bay segment is projected to witness sizeable revenue over the forecast period.

- Based on connectivity, the wired Ethernet segment is expected to lead the market compared to the wireless segment.

- Based on region, North America is projected to dominate the global consumer network attached storage market during the estimated period, followed by the Asia Pacific.

Consumer Network Attached Storage Market: Overview

Consumer network attached storage devices are centralized systems that connect to a home or small office network and provide a single, reliable location for storing and accessing files, media, and backups across different devices. They function like personal cloud servers, storing photos, videos, documents, and music while allowing access from computers, phones, tablets, and smart televisions. These devices operate independently of individual computers, keeping files available at all times. They include simple interfaces for easy setup, automatic file synchronization, scheduled data backups, and media server functions that stream entertainment throughout the home. Users can retrieve their data remotely through an internet connection, and families or small teams can share folders and work on documents together. Security features such as passwords, encryption, and permission controls protect stored information. These systems use less energy than leaving multiple computers running and offer expandable storage options, making them an effective solution for organizing, safeguarding, and managing growing personal digital content.

The growing volume of personal digital content and increasing awareness of data privacy concerns are expected to drive growth in the consumer network attached storage market throughout the forecast period.

Consumer Network Attached Storage Market Dynamics

Growth Drivers

Explosion of personal digital content

The consumer network attached storage market is growing quickly as people create increasing amounts of digital content that exceed the storage space of ordinary computers and mobile devices. High-resolution phone cameras produce large photo and video files that fill device memory very quickly and push users toward bigger storage options. Photographers collect thousands of RAW images from digital cameras, and each file consumes significant space, adding up to several terabytes for complete libraries. Video creators generate steady volumes of footage for social media, personal memories, and creative work, and this content expands rapidly every month. Drone users capture high-quality aerial images and videos, and these recordings also require large storage space for long-term use.

Gamers save gameplay data and download extensive game libraries, and these files often reach several terabytes for serious gaming setups. Music lovers store audio in high-quality formats, which require more space than compressed versions. Families also scan documents and old photos, and these digital archives grow steadily with each new addition. Smart home cameras record frequent footage, and this video content increases daily for security needs. Work-from-home users store professional files on personal devices, creating a mix of data that increases pressure on storage systems.

How are growing privacy concerns and data sovereignty awareness driving the consumer network attached storage market growth?

The global consumer network attached storage industry is growing quickly as people feel uneasy about keeping personal information on corporate cloud servers and prefer storage solutions under their own control. High-profile data breaches at large technology companies have exposed millions of files and increased concern about the safety of cloud-based platforms. Privacy issues involving unauthorized access to user photos and documents have also reduced trust in cloud services for many individuals. Concerns about government surveillance and legal access requests lead people to avoid storing sensitive data on external servers.

Cloud service agreements often allow companies to scan and analyze uploaded content, which troubles users who value personal privacy and independence. Uncertainty related to the use of personal data for artificial intelligence systems and targeted advertising pushes many users toward private storage options. International data transfer concerns arise when cloud providers store information in foreign countries with different rules. Service outages and internet problems sometimes limit access to important files during critical moments. Slow upload and download speeds also make it difficult for users with limited connections to handle large videos.

Restraints

How are technical complexity and setup challenges discouraging adoption in the global consumer network attached storage market?

A major challenge for the consumer network attached storage market is the belief that many people hold that these systems demand complex technical skills for proper use. Initial setup requires network adjustments, drive preparation, account creation, and security steps, which can feel overwhelming for users without technical experience. RAID selection also needs some understanding of data protection methods, which many average consumers do not feel confident handling on their own. Network terms such as IP addresses, port forwarding, DHCP, and DNS frequently confuse users who have limited exposure to networking concepts. Troubleshooting slow speeds or connection problems often forces people to read complicated manuals or search online communities for practical solutions.

Compatibility differences across devices and operating systems sometimes cause features to work inconsistently, creating frustration for users who expect smooth performance. Remote access setup involves router changes and potential risks, which make people nervous about exposing their home networks to outside connections. Data migration, firmware updates, and hardware handling add extra steps that many users find difficult without strong support or clear guidance.

Opportunities

How is the integration with smart home ecosystems creating new opportunities for the consumer network attached storage market?

The consumer network attached storage industry is seeing strong opportunities as these systems become central hubs in growing smart home environments with many connected devices. Smart security cameras produce continuous video footage, and NAS systems offer larger space and better control compared to limited cloud options from camera brands. Home surveillance setups benefit from storing footage from multiple locations in a single location, making it easy to search recordings without complicated steps. Voice assistants help users request files, play media, and manage storage through simple spoken commands that work smoothly with smart speakers and home devices. Smart televisions stream personal media directly from NAS systems, removing the need for computers or extra hardware to access large libraries.

Home automation platforms use NAS storage for event logs, automation rules, and historical data, improving performance and ensuring reliable long-term system behavior. Video doorbells, baby monitors, and pet cameras also send recordings to NAS storage, providing long-term access without expensive subscription fees for families and homeowners. Music streaming, photo organization, document uploads, and extensive app ecosystems from major NAS brands help these systems function as complete home servers with many useful features.

Challenges

Limited cloud storage services

The consumer network attached storage market faces several challenges that limit wider adoption among everyday users. Many consumers find NAS setup processes difficult because installation requires network configuration, drive preparation, user management, and security adjustments. Compatibility issues across operating systems, smart devices, and applications also create confusion when certain features fail to work smoothly. Security risks increase when users leave default passwords in place, misconfigure remote access, or ignore firmware updates, thereby exposing systems to potential attacks.

Performance problems arise when home networks have slow routers, outdated cables, or weak Wi-Fi coverage, reducing transfer speeds and streaming quality. Remote access features depend heavily on stable internet connections, which creates reliability concerns in areas with inconsistent service. Cloud storage providers create additional pressure by offering easy, maintenance-free solutions that require no hardware or technical knowledge. Limited customer support and complex troubleshooting steps further discourage inexperienced users from adopting NAS systems.

Consumer Network Attached Storage (NAS) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Consumer Network Attached Storage (NAS) Market |

| Market Size in 2024 | USD 6.09 Billion |

| Market Forecast in 2034 | USD 12.03 Billion |

| Growth Rate | CAGR of 12.10% |

| Number of Pages | 212 |

| Key Companies Covered | Synology Inc., QNAP Systems Inc., Western Digital Corporation, Seagate Technology Holdings, NETGEAR Inc., Asustor Inc., TerraMaster, Buffalo Americas Inc., Drobo, ZyXEL Communications Corporation, and others. |

| Segments Covered | By Storage Capacity, By End User, By Number of Bays, By Connectivity, By Pricing Model, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Consumer Network Attached Storage Market: Segmentation

The global consumer network attached storage market is segmented based on storage capacity, end-user, number of bays, connectivity, pricing model, and region.

Based on storage capacity, the global consumer network attached storage industry is segmented into below 2TB, 2TB to 8TB, 8TB to 16TB, and above 16TB. The 2TB to 8TB segment leads the market due to the balance between adequate capacity for typical family media collections and reasonable pricing that fits consumer budgets.

Based on end-user, the industry is divided into home users, small offices, content creators, gamers, technology enthusiasts, and families. Home users lead the market due to their large demographic size, growing digital content collections across households, and increasing awareness of the importance of data backup for protecting family photos, videos, and important documents.

Based on the number of bays, the global consumer network attached storage market is categorized into single-bay, dual-bay, four-bay, and multi-bay systems. Dual-bay systems are expected to lead the market during the forecast period due to their optimal balance of redundancy protection through RAID mirroring, reasonable pricing compared to larger systems, and sufficient capacity expansion options.

Based on connectivity, the global market is segregated into wired Ethernet, wireless, hybrid connectivity, and cloud-integrated. Wired Ethernet holds the largest market share due to superior transfer speeds for large file operations and reduced security vulnerabilities.

Based on the pricing model, the global market is classified into entry-level, mid-range, premium, and enterprise-grade consumers. Mid-range systems hold the largest market share due to their inclusion of essential features most consumers require, and a balance of performance and affordability.

Consumer Network Attached Storage Market: Regional Analysis

North America leads the global market

North America leads the consumer network attached storage market because households and small businesses in the region create large volumes of digital content that require reliable storage solutions with easy access. High smartphone adoption, widespread use of high-resolution cameras, and strong interest in home media libraries encourage users to look for systems offering large capacity and smooth data management. Consumers in the United States and Canada also show strong awareness of digital privacy concerns, which motivates many families to store personal data inside the home instead of relying only on cloud services. Rapid growth of smart home ecosystems increases the need for NAS systems that store video footage, security recordings, and automation logs in one secure location. Widespread broadband coverage allows NAS devices to operate efficiently with remote access features that support flexible work routines in modern households.

Many North American families use NAS systems for streaming large media libraries to smart televisions, home theaters, and gaming consoles without interruptions. Small businesses and freelancers prefer NAS systems because these solutions offer data protection tools, multi-user access, and reliable backup features that support day-to-day operations. Consumers appreciate the long-term cost benefits of owning storage hardware instead of paying recurring cloud subscription fees for large volumes of personal content. Expanding the remote work culture increases demand for secure file storage and private collaboration options inside homes and small offices. Growing interest in digital archiving, personal media collections, and home server setups further strengthens the demand for NAS devices across North America.

What factors are contributing to the Asia Pacific’s growth?

Asia Pacific is emerging as the second-leading region in the consumer network attached storage market, as millions of households across the region are generating fast-growing volumes of digital content through smartphones, cameras, and smart home devices. Rising incomes in countries including China, India, Japan, and South Korea encourage families to invest in reliable storage systems offering secure access to important files and personal media collections. A rapid increase in smart home adoption across major cities creates strong demand for NAS devices that store security footage, home automation data, and video doorbell recordings in one organized system. Many consumers in Asia Pacific prefer storing important files locally inside the home to reduce dependence on cloud services with recurring subscription costs.

Expanding the remote work culture increases the need for reliable storage systems supporting professional documents, collaborative projects, and large multimedia files used by students and employees. Strong gaming communities across several countries drive demand for NAS systems offering space for game libraries, recorded gameplay, and downloaded media content. Photo and video creators across the region also use NAS devices to organize large volumes of high-resolution content from travel, events, and social media activities. Retail expansion and increasing awareness of NAS benefits help more households understand the value of long-term storage solutions. Rising interest in digital archiving, personal cloud setups, and home entertainment systems continues to push Asia Pacific forward as a fast-growing market for consumer NAS devices.

Recent Market Developments

- In April 2025, Synology Inc. announced that starting with its 2025 Plus Series NAS models, only Synology-branded or certified third-party drives would provide full functionality, citing improved system reliability and reduced compatibility issues.

- In July 2025, Seagate Technology introduced its new Exos M 30 TB and IronWolf Pro 30 TB hard drives using heat-assisted magnetic recording (HAMR) technology, making these high-capacity models available to mainstream NAS users.

Consumer Network Attached Storage Market: Competitive Analysis

The leading players in the global consumer network attached storage market are:

- Synology Inc.

- QNAP Systems Inc.

- Western Digital Corporation

- Seagate Technology Holdings

- NETGEAR Inc.

- Asustor Inc.

- TerraMaster

- Buffalo Americas Inc.

- Drobo

- ZyXEL Communications Corporation

The global consumer network attached storage market is segmented as follows:

By Storage Capacity

- Below 2TB

- 2TB to 8TB

- 8TB to 16TB

- Above 16TB

By End User

- Home Users

- Small Offices

- Content Creators

- Gamers

- Technology Enthusiasts

- Families

By Number of Bays

- Single-Bay

- Dual-Bay

- Four-Bay

- Multi-Bay Systems

By Connectivity

- Wired Ethernet

- Wireless

- Hybrid Connectivity

- Cloud-Integrated

By Pricing Model

- Entry-Level

- Mid-Range

- Premium

- Enterprise-Grade Consumer

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

List of Contents

Consumer Network Attached StorageIndustry Perspective:Key InsightsConsumer Network Attached Storage OverviewConsumer Network Attached Storage Market DynamicsReport ScopeConsumer Network Attached Storage SegmentationConsumer Network Attached Storage Regional AnalysisRecent Market DevelopmentsConsumer Network Attached Storage Competitive AnalysisThe global consumer network attached storage market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed