Compression Garments and Stockings Market Size, Share, Analysis, Trends, Growth, 2032

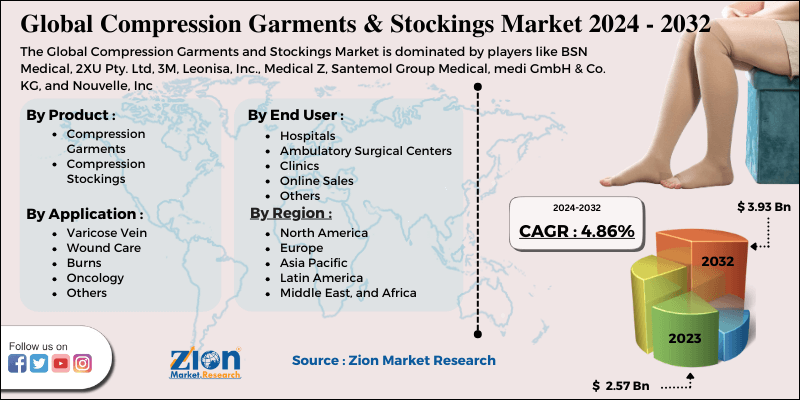

Compression Garments and Stockings Market By Product Type (Compression Garments and Compression Stockings), By Application (Varicose Vein, Wound Care, Burns, Oncology, and Others), By End User (Hospitals, Ambulatory Surgical Centers (ASC’s), Clinics, Online Sales, and Others) : Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-

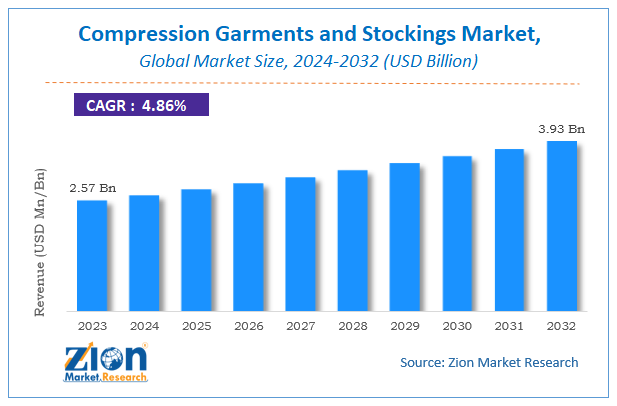

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.57 Billion | USD 3.93 Billion | 4.86% | 2023 |

Compression Garments and Stockings Market Insights

Zion Market Research has published a report on the global Compression Garments and Stockings Market, estimating its value at USD 2.57 Billion in 2023, with projections indicating that it will reach USD 3.93 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 4.86% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Compression Garments and Stockings Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Compression Garments and Stockings Market: Overview

Compression garments and stockings are clothing that fit around the skin for offering support to people suffering from medical conditions such as poor blood circulation in the legs. Compression garments and stockings are mainly used by people who have to stand for long period of time, which may cause disruptions in blood circulation. There is a wide range of compression garments and stockings based on their degree of tightness and type of disorders.

Compression garments and stockings have been primarily used for preventing of various medical blood disorders and halting growth of such disorders. Compression garments and stockings has been widely used for preventing deep vein thrombosis among individuals who stand for longer period of times. These are designed for increasing oxygen concentration in body parts with improper blood circulation. These can also be used by athletes, speeding muscle recovery and increasing blood pressure.

Compression Garments and Stockings Market: COVID-19 Impact Analysis

During COVID-19 pandemic, there has been significant decrease in the number of individuals sufferings from venous diseases. Closure of restaurants, bars, pubs, and hotels has accelerated the decrease in the number working as chefs and servants around the world. Such decrease in the number of working professionals who have to stand for longer period of time has led to decrease in the number of individuals suffering from irregular blood disorders. This trend has been hampering the demand for compression garments and stockings around the world. Further, lockdown restrictions imposed by governments across the globe has led to temporary or permanent closure of sport facilities and gymnasiums. Such a factor is expected to hamper the demand for compression garments and stockings. However, easing of restrictions and opening of malls and sport complexes should propel the compression garments and stockings market growth.

Compression Garments and Stockings Market: Growth Factors

Changing lifestyle and eating patterns among consumers in urban areas have accelerated prevalence of various blood circulation disorders such as varicose vein and deep vein thrombosis. Compression garments and stockings have been mainly used by working professionals for increasing blood flow in body parts with limited blood flow. Rise in the number of individuals suffering from such blood disorders is likely to stimulate the compression garments and stockings market growth.

Consumer awareness regarding prevention and treatment of various chronic diseases has been crucial for driving the demand for preventive healthcare measures taken by consumers. This rise in the consumer awareness has triggered the demand for preventive healthcare products, which is anticipated to drive the compression garments and stockings market growth. Further, rising consumer spending on health and wellbeing should also contribute to the growth of the compression garments and stockings market.

Compression Garments and Stockings Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Compression Garments and Stockings Market |

| Market Size in 2023 | USD 2.57 Billion |

| Market Forecast in 2032 | USD 3.93 Billion |

| Growth Rate | CAGR of 4.86% |

| Number of Pages | 130 |

| Key Companies Covered | BSN Medical, 2XU Pty. Ltd, 3M, Leonisa, Inc., Medical Z, Santemol Group Medical, medi GmbH & Co. KG, and Nouvelle, Inc |

| Segments Covered | By Product Type, By Application, By End User Type and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Product Type Segment Analysis Preview

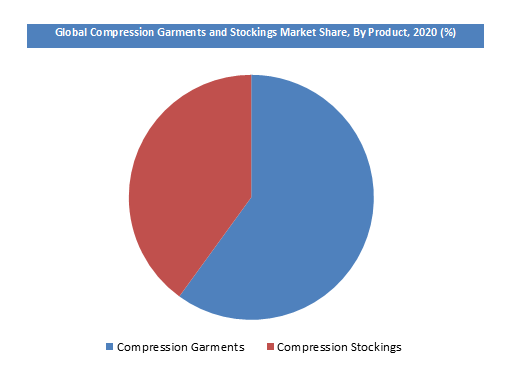

Based on products, compression garments segment held the largest market share in the global compression garments and stockings market in 2023.

Compression garments are utilized for treating injured blood vessels and preventing and stopping blood flow. Rising use of compression garments by athletes and patients for increasing blood flow and amount of oxygen in body organs, owing to increasing preventing measures taken by consumers. This trend is anticipated to stimulate the demand for compression garments market worldwide.

Application Segment Analysis Preview

Based on different types of applications, the varicose veins segment is anticipated to register highest CAGR over the projected period of 2024 – 2032. There has been rising prevalence of varicose veins owing to growing old age population, as risk of varicose veins rises with increasing age. Such rise in the number of individuals suffering from varicose veins has bolstered the demand for products utilized for prevention and treatment of such diseases. This trend is anticipated to fuel the demand for compression garments and stockings for treating varicose veins.

End User Segment Analysis Preview

In terms of end users, the hospitals segment held a majority share in the global compression garments and stockings market, contributing a market share of nearly 40% in 2023. Compression garments and stockings are utilized in healthcare facilities for avoiding swelling in leg and reducing progression of formation of blood clots among patients suffering from blood related diseases. Growing healthcare industry globally should bolster the demand for compression garments and stockings for treating DVT, burns, and injuries.

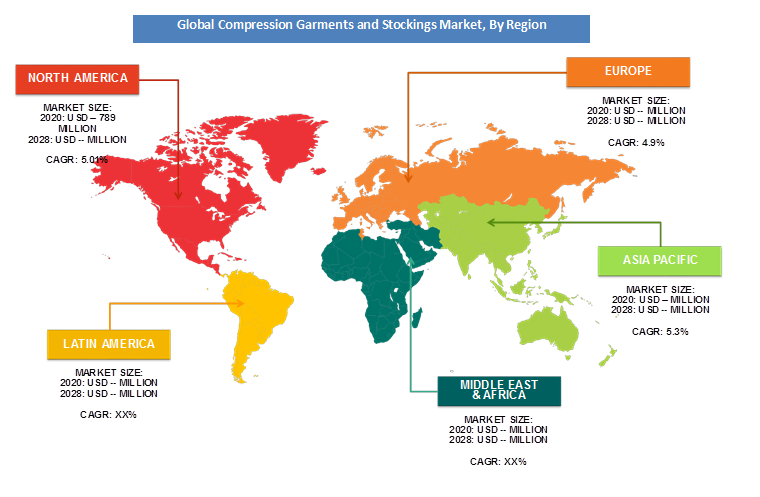

Regional Analysis Preview

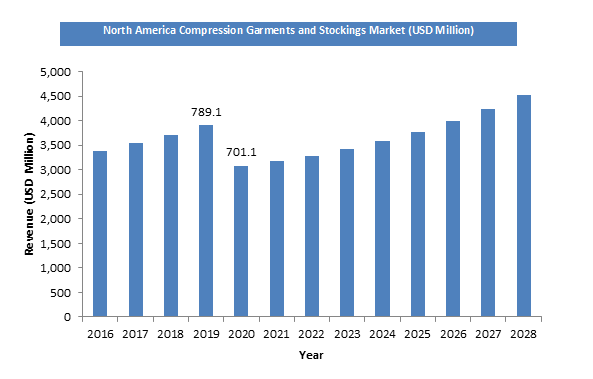

North America region held a major share of nearly 32% in the global compression garments and stockings market in 2023. Changing dietary patterns and lack of physical activity has led to an increase in the number of individuals with overweight or obesity in the United States and Canada, which has been driving the blood circulation disorders in the region This has been accelerating the number of individuals suffering from deep vein thrombosis or venous thromboembolism. Compression clothing is widely used in the region for treating venous thromboembolism, which should drive the North America compression garments and stockings market.

Asia Pacific region is expected to record the highest CAGR over the forecasted timeline. Rising urban population and hectic lifestyle in the region has led to soaring growth in the number of accidents and trauma and individuals suffering from irregular blood flow. Pertaining to rising consumer consciousness about preventive health and growing consumer spending on overall health, Asia Pacific market is expected to soar in the future.

Compression Garments and Stockings Market: Competitive Landscape

Some of key players in compression garments and stockings market are

- BSN Medical

- 2XU Pty. Ltd

- 3M

- Leonisa Inc.

- Medical Z

- Santemol Group Medical

- medi GmbH & Co. KG

- Nouvelle Inc.

The global Compression Garments and Stockings market is segmented as follows:

By Product Type

- Compression Garments

- Compression Stockings

By Application

- Varicose Vein

- Wound Care

- Burns

- Oncology

- Others

By End User Type

- Hospitals

- Ambulatory Surgical Centers (ASC’s)

- Clinics

- Online Sales

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Compression Garments and Stockings market was valued at USD 2.57 Billion in 2023.

The global compression garments and stockings market is expected to reach USD 3.93 Billion by 2032, growing at a CAGR of 4.86% from 2024 to 2032.

Changing lifestyle and eating patterns among consumers in urban areas have accelerated prevalence of various blood circulation disorders such as varicose vein and deep vein thrombosis. Compression garments and stockings have been mainly used by working professionals for increasing blood flow in body parts with limited blood flow. Rise in the number of individuals suffering from such blood disorders is likely to stimulate the compression garments and stockings market growth.

North America region held a major share of nearly 32% in the global compression garments and stockings market in 2020. Changing dietary patterns and lack of physical activity has led to an increase in the number of individuals with overweight or obesity in United States and Canada, which has been driving the blood circulation disorders in the region This has been accelerating the number of individuals suffering from deep vein thrombosis or venous thromboembolism. Compression clothing is widely used in the region for treating venous thromboembolism, which should drive the North America compression garments and stockings market.

Some of key players in compression garments and stockings market are BSN Medical, 2XU Pty. Ltd, 3M, Leonisa, Inc., Medical Z, Santemol Group Medical, medi GmbH & Co. KG, and Nouvelle, Inc.

List of Contents

Market InsightsMarket:OverviewCOVID-19 Impact AnalysisGrowth FactorsReport ScopeProduct Type Segment Analysis PreviewApplication Segment Analysis PreviewEnd User Segment Analysis PreviewRegional Analysis PreviewMarket:Competitive LandscapeThe global market is segmented as follows:By Product TypeBy ApplicationBy End User TypeBy RegionRelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed