Commercial Telematics Market Size, Share, Growth & Trends 2032

Commercial Telematics Market By Type (OEM Telematics and Aftermarket Telematics), By Application (Insurance Telematics, Fleet / Asset Management, Satellite Navigation, Infotainment, Remote Alarm and Monitoring, Telehealth Solutions), By End User (Healthcare , Construction, Transportation and Logistics, Government and Utilities, and Insurance) : Global Industry Perspective, Comprehensive Analysis and Forecast, 2024- 2032

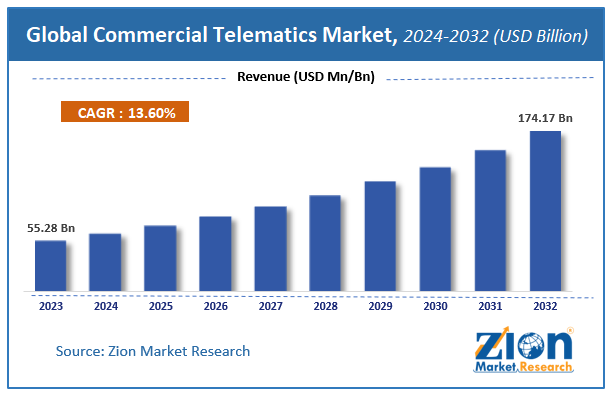

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 55.28 Billion | USD 174.17 Billion | 13.6% | 2023 |

Commercial Telematics Market Insights

Zion Market Research has published a report on the global Commercial Telematics Market, estimating its value at USD 55.28 Billion in 2023, with projections indicating that it will reach USD 174.17 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 13.6% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Commercial Telematics Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Market Overview

Telematics is a field that combines telecommunications with vehicle technologies and information technology. Telematics is generally referred to as joining of telecommunications and computer systems. Telematics has been increasingly used for integrating various computer-based systems for increasing operational efficiency. Telematics is also being utilized in integrating data from Global Positioning System (GPS) with various data collection systems.

Commercial telematics is referred to as telematics technology used by commercial fleets and fleet managements companies for transmission of information over a long distance. Commercial telematics is becoming a popular among automotive manufacturers as it helps in wireless communication and easy data transfer. Commercial telematics also helps in vehicle safety, interchanging safety information, receiving vehicle maintenance data, and fleet productivity. It helps companies in reducing overall fuel costs, planning destination, monitor driver behavior, help in maintenance, and increase driver safety.

Telemetric is an interdisciplinary field that includes telecommunications, vehicular technologies, road transportation, road safety, electrical engineering and computer science. Commercial telematics market includes the telematics used by the light, medium and heavy commercial vehicles. Commercial telematics is preferably used in a variety of applications such as infotainment, insurance telematics, fleet/asset management, satellite navigation, telehealth solutions, and others like including emergency warning systems. OEM telematics and aftermarket telematics are two main types of commercial telematics.

The global commercial telematics market is mainly driven by the increasing demand for connectivity, helping government rules & regulations and increasing application across various industries, mainly in the healthcare and insurance sector. Increasing market penetration of smart phones, reducing connectivity cost, accessibility of high-speed internet technologies is another driving factor that is expected to boost the commercial telematics market during the years to come. However, a high initial cost concerned in deploying telematics technology and lack of awareness is a major restraint that may slow down the growth of commercial telematics market. Furthermore, increasing digital insurance and integration of web & mobility is likely to open new opportunities for commercial telematics market in near future.

Growth Factors

Transportation and logistics by road has increased in recent years owing to growth in trade on global, regional, and country levels, which has been proliferating the demand for transportation by road. Fleet owners have been emphasizing on meet new market demands such as fast, reliable, and safe product transportation. Such trend has influenced fleet managers to adopt new technologies to ensure effective and safe logistic support, which has been a key growth fueling factor for the global commercial telematics market growth.

Global telematics industry has experienced significant growth as there has been increasing adoption of various communication technologies by vehicles manufacturers for data collection and analyzing. Automotive companies are focusing on adopting telematics for exchanging information at large distances and offering enhanced safety. This trend is anticipated to generate opportunities for the global commercial telematics market. Further, rise of data analytics and advanced computing technologies are expected to extend capabilities of telematics in vehicle management applications, which may drive the global commercial telematics market in the future.

Commercial Telematics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Commercial Telematics Market |

| Market Size in 2023 | USD 55.28 Billion |

| Market Forecast in 2032 | USD 174.17 Billion |

| Growth Rate | CAGR of 13.6% |

| Number of Pages | 140 |

| Key Companies Covered | Verizon Communications Inc., AT&T, TomTom, MiX Telematics Ltd., OnStar LLC., BMW, Trimble Navigation Limited, and Telefonica |

| Segments Covered | By Type, By Application, By End User Type and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Type Segment Analysis Preview

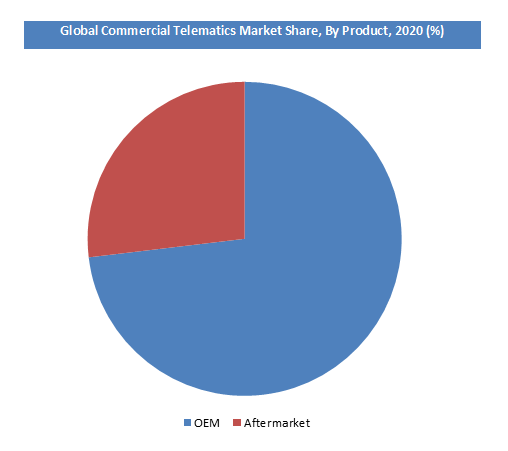

Depending upon types of commercial telematics, the OEM telematics segment held a major share in the global commercial telematics market in 2020. Automotive companies are introducing new technologies in their newly developed vehicles extending product capabilities of fleets. Adoption of advance technologies by vehicle manufacturers for ensuring lower fuel cost, effective management, and improving data-based decision-making abilities should increase in the OEM commercial telematics market growth. Further, rising investment in emerging technologies by companies is also expected to generate avenues for the market growth.

Aftermarket commercial telematics segment is anticipated to grow significantly over the projected period, registering a CAGR of 14.5% over the period 2021-2028. Growing trend of fleet upgrading and modification is likely to trigger integration of new technologies in old fleet systems. Consumers with fleet in good condition may opt for integration of existing components with commercial telematics. Such a trend should also drive the aftermarket commercial telematics market.

Application Segment Analysis Preview

Based on applications, the satellite navigation segment is anticipated to record highest CAGR of nearly 15.0% in the future. Commercial telematics and GPS can be combined to access precise location and safety maintenance information of a fleet. Commercial telematics navigation has gained traction among fleet managers for tracking vehicle through cellular networks and get real time access. Such trends in the fleet management is expected to trigger the use of telematics for satellite navigation applications.

End User Segment Analysis Preview

Based on end users, the transportation and logistics segment is likely to constitute largest market share in the global commercial telematics market in 2020. Transportation and logistics companies have been extensively focusing on reducing operational costs, maintaining vehicle safety, and monitoring driver health and behavior. Such trend has bolstered the demand for advance technologies that can offer real time data for tracking, which should create growth opportunities for commercial telematics in transportation and logistics market.

Regional Analysis Preview

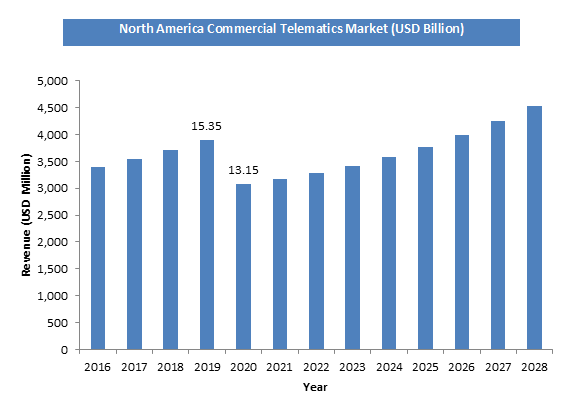

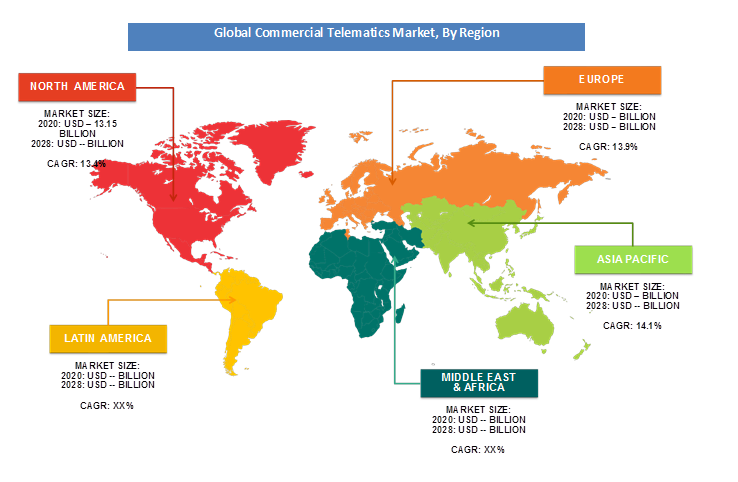

North America region dominated the global commercial telematics market in 2020. Advancements in telematics and development of new communication technologies have lured companies to utilized such technologies to extend their product abilities in offering real time data exchange and collections. This should boost the North America commercial telematics market. Also, presence of major companies that provide integration and development services is expected to attract fleet owners, which should generate new growth avenues for the market.

In terms of revenue, North America dominates the commercial telematics market. North America was followed by Europe and Asia-Pacific in the same year. Asia Pacific commercial telematics market is expected to grow at a moderate rate due to the rapidly growing number of automobiles sold in the region. Europe is expected to be the fastest growing region in next few years. Latin America and the Middle East & Africa is also expected to have moderate growth during the coming years.

Key Market Players & Competitive Landscape

Some of key players in commercial telematics market are:

- Verizon Communications Inc.

- AT&T

- TomTom

- MiX Telematics Ltd.

- OnStar LLC.

- BMW

- Trimble Navigation Limited

- Telefonica.

The global Commercial Telematics market is segmented as follows:

By Type

- OEM Telematics

- Aftermarket Telematics

By Application

- Insurance Telematics

- Fleet / Asset Management

- Satellite Navigation

- Infotainment

- Remote Alarm and Monitoring

- Telehealth Solutions

By End User Type

- Healthcare

- Construction

- Transportation and Logistics

- Government and Utilities

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Commercial Telematics market was valued at USD 39 Billion in 2020.

The global commercial telematics market is expected to reach USD 108 Billion by 2028, growing at a CAGR of 13.9% from 2021 to 2028.

Transportation and logistics by road has increased in recent years owing to growth in trade on global, regional, and country levels, which has been proliferating the demand for transportation by road. Fleet owners have been emphasizing on meet new market demands such as fast, reliable, and safe product transportation. Such trend has influenced fleet managers to adopt new technologies to ensure effective and safe logistic support, which has been a key growth fueling factor for the global commercial telematics market growth.

North America region dominated the global commercial telematics market in 2020. Advancements in telematics and development of new communication technologies have lured companies to utilized such technologies to extend their product abilities in offering real time data exchange and collections. This should boost the North America commercial telematics market. Also, presence of major companies that provide integration and development services is expected to attract fleet owners, which should generate new growth avenues for the market.

Some of key players in commercial telematics market are Verizon Communications Inc., AT&T, TomTom, MiX Telematics Ltd., OnStar LLC., BMW, Trimble Navigation Limited, and Telefonica.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed