Commercial Paper Market Size, Share, Trends, Growth & Forecast 2034

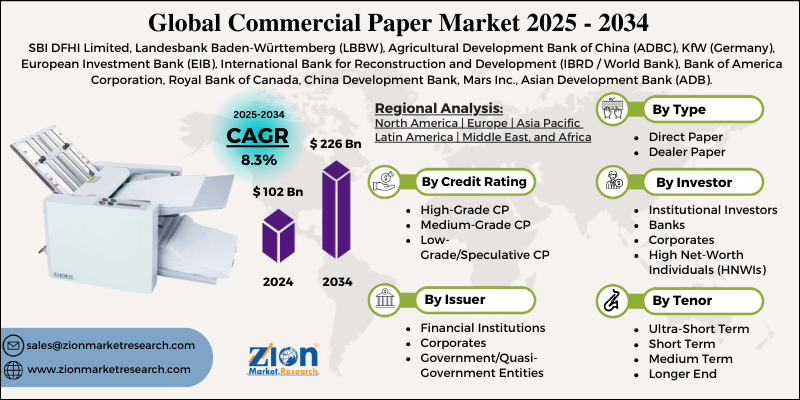

Commercial Paper Market By Issuer (Financial Institutions, Corporates and Government/Quasi-Government Entities), By Investor (Institutional Investors, Banks, Corporates, and High Net-Worth Individuals (HNWIs)), By Tenor (Ultra-Short Term, Short Term, Medium Term, and Longer End), By Type (Direct Paper and Dealer Paper), By Credit Rating (High-Grade CP, Medium-Grade CP, and Low-Grade/Speculative CP), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

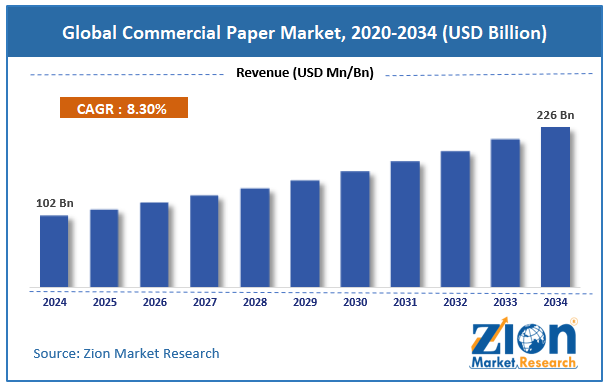

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 102 Billion | USD 226 Billion | 8.3% | 2024 |

Commercial Paper Industry Perspective:

The global commercial paper market size was worth around USD 102 billion in 2024 and is predicted to grow to around USD 226 billion by 2034, with a compound annual growth rate (CAGR) of roughly 8.3% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global Commercial Paper market is estimated to grow annually at a CAGR of around 8.3% over the forecast period (2025-2034).

- In terms of revenue, the global commercial paper market size was valued at around USD 102 billion in 2024 and is projected to reach USD 226 billion by 2034.

- Expansion of institutional investors is expected to drive the commercial paper market over the forecast period.

- Based on the issuer, the financial institutions and corporate segment is expected to hold the largest market share over the forecast period.

- Based on the investor, the institutional Investors segment is expected to dominate the market over the projected period.

- Based on the tenor, the short term segment is expected to dominate the market over the projected period.

- Based on the type, the direct paper segment is expected to dominate the market over the projected period.

- Based on the credit rating, the High-Grade CP segment is expected to dominate the market over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Commercial Paper Market: Overview

Businesses, banks, and other qualifying organizations issue commercial paper (CP) as an unsecured, short-term financial instrument to meet their short-term funding needs. It is often used to pay for working capital needs, which lets businesses manage their cash flow without having to employ more expensive or complicated ways to get money. CPs are a cheap way to keep things running smoothly without affecting the company's finances. CPs generally offer lower interest rates compared to traditional borrowing methods, making them attractive for issuers.

Also, CPs are easily traded in the secondary market, providing liquidity for investors. The commercial paper market is driven by several factors, including rising corporate and institutional liquidity needs, lower borrowing costs compared to bank loans, the expansion of institutional investors, the growth of emerging markets, and others. However, the regulatory limitation might be a major impediment to industry expansion.

Commercial Paper Market: Growth Drivers

How do rising corporate and institutional liquidity needs drive the commercial paper market growth?

The commercial paper market is developing significantly because businesses and organizations need more cash on hand. A growing number of companies are using commercial paper to get short-term loans and handle their working capital cycles. Businesses and institutional investors require cash on hand to deal with working capital needs, changes in cash flow, and seasonal or cyclical gaps in funding. Commercial paper is a fast, cheap, and flexible way to earn money for a short time. It helps businesses run more efficiently and provides them with additional funding options beyond standard bank loans. The growing interest in liquidity has led to increased CP issuance and a shift toward shorter maturities. This gives both issuers and investors more options and lowers credit risk.

Commercial Paper Market: Restraints

Why does sensitivity to market liquidity hinder the commercial paper industry's growth?

The commercial paper market is quite sensitive to the overall liquidity of the market, especially when there is a sudden increase in demand or a financial crisis. This makes it a very important area for both issuers and investors to pay attention to. In normal market conditions, commercial paper is seen as a liquid asset due to its short maturities and is issued regularly. However, most investors choose to buy and retain it, which limits trading in the secondary market.

Also, the liquidity in commercial paper is "adequate but thin," and dealer banks typically provide liquidity by repurchasing paper that has already been deposited instead of trading it actively on the secondary market. The market relies on a small number of core dealers and experiences significant investor activity, which makes it vulnerable if dealers' balance sheets or risk limitations are limited, especially during times of crisis. Thus, this is expected to hamper the industry expansion.

Commercial Paper Market: Opportunities

How does the growing launch of the CP program offer a potential opportunity for commercial paper market growth?

There is an abundance of new commercial paper (CP) programs now that companies, sovereign funds, and financial institutions are trying to improve their short-term liquidity, diversify their capital raising, and lower their funding costs. Companies that use CP programs don't have to rely as much on bank loans or long-term bonds, which gives them more options for how they organize their capital. They also offer a cheap way to handle short-term financial needs, everyday business costs, and the best way to manage cash flow cycles.

Major organizations, such as Saudi Arabia's Public Investment Fund (PIF) and companies like BME, have created CP programs that have achieved high ratings from agencies and are meant for a wide range of international issuance. This indicates a considerable demand from investors and confidence among institutions.

In October 2024, Sonnedix España Commercial Paper set up a new commercial paper program on BME's fixed income market, MARF. The maximum amount that could be owed was €75 million. The initiative would only give out commercial papers with nominal units of €100,000 to qualified and professional investors. They will be due in up to 24 months. Thus, the increasing number of CP programs offers a potential opportunity for the commercial paper industry expansion.

Commercial Paper Market: Challenges

Why does limited access to smaller firms pose a major challenge to market expansion??

Smaller businesses can't easily get into the commercial paper (CP) market because only big, highly creditworthy companies can issue it due to rules and the risk preferences of investors. CP offers usually require a lot of money (at least $100,000 in the US and ₹5 lakhs in India), which makes it hard for smaller businesses and investors to become involved directly. Commercial paper is unsecured debt; therefore, businesses with bad credit can't get investors unless they offer extra security or guarantees, which CP market rules don't allow. Therefore, the limited access to smaller firms poses a major challenge for the sector to grow.

Commercial Paper Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Commercial Paper Market |

| Market Size in 2024 | USD 102 Billion |

| Market Forecast in 2034 | USD 226 Billion |

| Growth Rate | CAGR of 8.3% |

| Number of Pages | 214 |

| Key Companies Covered | SBI DFHI Limited, Landesbank Baden-Württemberg (LBBW), Agricultural Development Bank of China (ADBC), KfW (Germany), European Investment Bank (EIB), International Bank for Reconstruction and Development (IBRD / World Bank), Bank of America Corporation, Royal Bank of Canada, China Development Bank, Mars Inc., Asian Development Bank (ADB), National Securities Depository Limited (NSDL), Henkel AG & Co. KGaA, Fresenius SE & Co. KGaA, CT Commercial Paper LLC, and others. |

| Segments Covered | By Issuer, By Investor, By Tenor, By Type, By Credit Rating, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Commercial Paper Market: Segmentation

The global commercial paper industry is segmented based on issuer, investor, tenor, type, credit rating, and region.

Based on the issuer, the global commercial paper market is bifurcated into financial institutions, corporate, and government/quasi-government entities. The financial institutions and corporations are expected to capture the largest market share over the projected period. Corporations and financial institutions are using commercial paper in increasing numbers to help with working capital needs, handle changes in cash flow, and fulfill seasonal or cyclical needs. CP is the best choice because it is flexible, cheap, and can swiftly meet short-term finance demands. Additionally, laws and liquidity regimes that facilitate growth (such as the RBI in India and the SEC in the US) encourage more people to join and expand, which in turn makes both issuers and investors more confident.

Based on the investor, the global commercial paper industry is bifurcated into institutional investors, banks, corporates, and High Net-Worth Individuals (HNWIs). The institutional investors segment holds the major market share. The segment expansion is attributed to several significant factors, including rising demand for short-term investment choices giving attractive rates, greater market liquidity, and digitalization, which enables more efficient trading and investment procedures.

Based on the tenor, the global commercial paper market is bifurcated into ultra-short term, short term, medium term, and longer end. The short term segment is growing significantly because it provides issuers with a quick and low-cost alternative to meet immediate funding demands, resulting in increased market turnover and revenue creation.

Based on the type, the global commercial paper industry is bifurcated into direct paper and dealer paper. The direct paper segment dominates the market growth. The market's expansion is driven by increasing business and institutional demand for low-cost, flexible short-term finance, improved market accessibility through digitization, and good economic conditions supporting liquidity demands.

Based on the credit rating, the global commercial paper market is bifurcated into High-Grade CP, Medium-Grade CP, and Low-Grade/Speculative CP. The High-Grade CP held the prominent revenue share over the projected period. High-grade CP issuers have good credit ratings, which appeal to institutional investors looking for safe, short-term investments with little default risk. This confidence helps to maintain demand and revenue growth in this category.

Commercial Paper Market: Regional Analysis

Why does North America dominate the commercial paper market over the projected period??

North America is expected to dominate the global commercial paper market over the projected period. The market is getting larger because businesses and banks want more short-term loans with low interest rates. The US has the biggest economy in North America and holds the largest share of the commercial paper market. This is because it has a modern financial system, a large corporate sector, and a well-established set of rules that keeps the market stable, protects investors, and fosters openness.

Also, because North America is so powerful, both local and foreign issuers and investors want to do business there. The US dollar is the world's reserve currency. This makes it easier to trade and gives people more faith in the globe. Many large businesses and regional banks utilize commercial paper to borrow money for short periods, manage their working capital, and optimize their cash flow.

Further, the presence of major players and increasing commercial paper program offers a lucrative opportunity to the North American market. For instance, in June 2025, the Sacramento Municipal Utility District (SMUD) (AA) has successfully issued the first Green Commercial Paper (CP) notes by a U.S. municipal electric utility. Barclays was the only dealer for the new $25 million tax-exempt Series L CP, which was issued on April 29, 2025, for 36 days at a rate of 3.15%. It drew in one new impact fund investor. The Kestrel-Verified Green Commercial Paper Certificate was also included in the sale for the first time. This is an independent review done by Kestrel, the best verifier of green bonds in US public finance.

Commercial Paper Market: Competitive Analysis

The global commercial paper market is dominated by players like:

- SBI DFHI Limited

- Landesbank Baden-Württemberg (LBBW)

- Agricultural Development Bank of China (ADBC)

- KfW (Germany)

- European Investment Bank (EIB)

- International Bank for Reconstruction and Development (IBRD / World Bank)

- Bank of America Corporation

- Royal Bank of Canada

- China Development Bank

- Mars Inc.

- Asian Development Bank (ADB)

- National Securities Depository Limited (NSDL)

- Henkel AG & Co. KGaA

- Fresenius SE & Co. KGaA

- CT Commercial Paper LLC

The global commercial paper market is segmented as follows:

By Issuer

- Financial Institutions

- Corporates

- Government/Quasi-Government Entities

By Investor

- Institutional Investors

- Banks

- Corporates

- High Net-Worth Individuals (HNWIs)

By Tenor

- Ultra-Short Term

- Short Term

- Medium Term

- Longer End

By Type

- Direct Paper

- Dealer Paper

By Credit Rating

- High-Grade CP

- Medium-Grade CP

- Low-Grade/Speculative CP

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Businesses, banks, and other qualifying organizations issue commercial paper (CP) as an unsecured, short-term money market instrument to meet their short-term financial needs.

The commercial paper market is being driven by several factors such as rising corporate and institutional liquidity needs, lower cost of borrowing vs. bank loans, expansion of institutional investors, growth of emerging markets, and others.

The regulatory limitation might be a major impediment to the commercial paper industry's expansion.

Based on the type, the direct paper segment is expected to dominate the industry growth during the projected period.

The increasing liquidity needs by the corporates and banks and the growing launch of several programs are the major impacting factors for the industry growth over the projected period.

According to the report, the global commercial paper market size was worth around USD 102 billion in 2024 and is predicted to grow to around USD 226 billion by 2034.

The global commercial paper market is expected to grow at a CAGR of 8.3% during the forecast period.

The global commercial paper industry growth is expected to be driven by the North American region. It is currently the world’s highest revenue-generating market due to the presence of major players and increasing short-term loan needs by large organizations in the area.

The global commercial paper market is dominated by players like SBI DFHI Limited, Landesbank Baden-Württemberg (LBBW), Agricultural Development Bank of China (ADBC), KfW (Germany), European Investment Bank (EIB), International Bank for Reconstruction and Development (IBRD / World Bank), Bank of America Corporation, Royal Bank of Canada, China Development Bank, Mars, Inc., Asian Development Bank (ADB), National Securities Depository Limited (NSDL), Henkel AG & Co. KGaA, Fresenius SE & Co. KGaA, and CT Commercial Paper, LLC, among others.

The market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed