Global Cold Rolling Oils/Lubricants Market Size, Share, Growth Analysis Report - Forecast 2034

Cold Rolling Oils/Lubricants Market By Product Type (Synthetic Cold Rolling Oils/Lubricants, Semi-Synthetic Cold Rolling Oils/Lubricants, Mineral Based Cold Rolling Oils/Lubricant), By Material (Steel, Copper, Aluminium, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

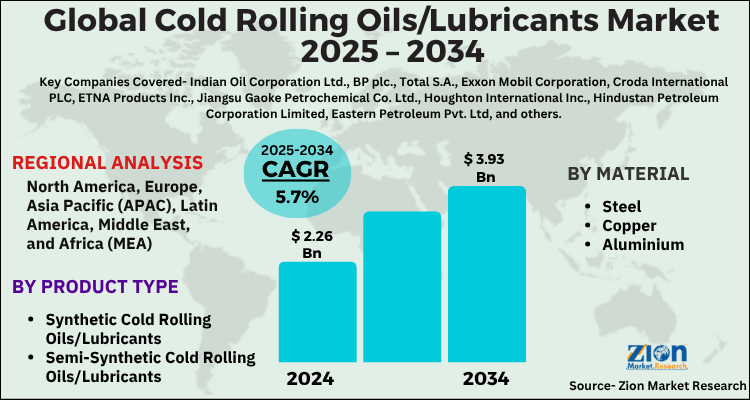

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.26 Billion | USD 3.93 Billion | 5.7% | 2024 |

Cold Rolling Oils/Lubricants Market: Industry Perspective

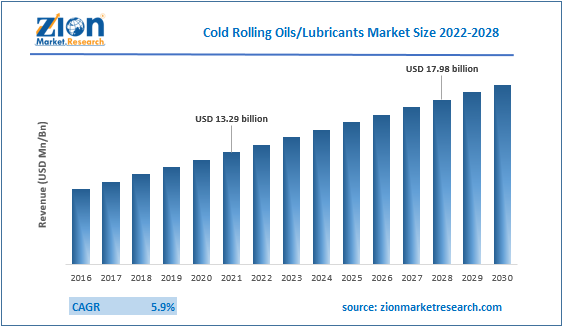

The global cold rolling oils/lubricants market size was worth around USD 2.26 Billion in 2024 and is predicted to grow to around USD 3.93 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 5.7% between 2025 and 2034. The report analyzes the global cold rolling oils/lubricants market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the cold rolling oils/lubricants industry.

Cold Rolling Oils/Lubricants Market: Overview

Cold rolling oils work well in both high and low-speed cold rolling mills and are suitable for the production of non-ferrous as well as ferrous sheet metal, such as copper alloys, copper, and stainless steel. Cold rolling is a method of passing metal across rollers at temperatures less than those of recrystallization. The hardness and yielding strength of the metal are increased by compressing and squeezing it. The highest surface quality of the end product is accomplished by lubricating the roll bite and chilling the metal strip & work rolls utilizing highly efficient clean cold rolling oil.

Cold rolling oil/lubricants are used primarily for reducing friction between two strips and helps in decreasing the heat generated from the strips when in contact with each other. This special lubricant is manufactured and designed for effective use in alloys to get the required shape. Evolution of manufacturing techniques and the emergence of electronic systems have resulted in various changes in the overall business scenario of using the oil or lubricants.

The rise in metal processing and steel production is anticipated to further boost the cold rolling oil market in the future. The cold rolling oil/lubricants are generously used with non-ferrous materials, such as aluminum, copper, and brass, among others. The increase in the production of non-ferrous materials, such as aluminum, is likely to be the major driver for the cold rolling oil market in the upcoming years. In addition to this, cold oil also helps in providing corrosion and stain protection for multiple alloys. This makes it one of the most widely used products in the overall manufacturing process of steel and metals. The changing industry dynamics has resulted in an increase in offshore investments, which is expected to positively impact the overall demand for cold rolling oil across the globe. However, the fluctuating raw material prices and unfavorable mining laws by the government might limit this market’s growth in the future. The strategic expansion of the key players present of the cold rolling market is likely to create new market opportunities in the years ahead.

Key Insights

- As per the analysis shared by our research analyst, the global cold rolling oils/lubricants market is estimated to grow annually at a CAGR of around 5.7% over the forecast period (2025-2034).

- Regarding revenue, the global cold rolling oils/lubricants market size was valued at around USD 2.26 Billion in 2024 and is projected to reach USD 3.93 Billion by 2034.

- The cold rolling oils/lubricants market is projected to grow at a significant rate due to rising demand for high-quality cold-rolled steel in automotive and construction sectors, technological advancements in lubrication formulations, and increasing emphasis on environmentally friendly and energy-efficient solutions.

- Based on Product Type, the Synthetic Cold Rolling Oils/Lubricants segment is expected to lead the global market.

- On the basis of Material, the Steel segment is growing at a high rate and will continue to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

COVID-19 Impact:

The COVID-19 outbreak had a devastating influence on production, rendering numerous sectors obsolete in a short amount of time. Manufacturing production throughout the world has been affected by disturbances in the supply chain and a lack of raw materials owing to global shutdown restrictions. With sales plummeting and markets collapsing, demand decreased, and many sectors were forced to close to make up for lost revenue. Metal demand fell, and revenues of cold rolling oils fell as well. As the economy recovers to normal and needs from end-use sectors such as automotive and construction rise, cold rolling oil shipments are likely to climb at a steady rate in the post-pandemic age.

Cold Rolling Oils/Lubricants Market: Growth Drivers

Growing demand for synthetic rolling oils to fuel the market growth

Rapidly increasing urbanization and industrialization have boosted the manufacturing sector, resulting in increased demand for metals in a variety of end-use sectors. With nations like Brazil, India, and China seeing tremendous growth in the industrial sector, synthetic rolling oils are likely to be extremely profitable. Synthetic rolling oils have a low coefficient of friction and a strong load-bearing capacity, making them a popular option among major manufacturers all over the world and driving up demand. Further, Due to the widespread use of rolled steel and aluminum in the automobile industry, demand for rolling oil is increasing at a rapid rate. Growing demands for cold-rolled steel are leading to the growth of the global cold steel rolling oil market, which is positively affecting the need for cold steel rolling oils.

Cold Rolling Oils/Lubricants Market: Restraints

Volatile prices of cold rolling oil limit the market growth

Pricing for cold-rolled steel coils has fluctuated in various nations in an attempt to close the gap between local and import prices. There have been considerable price swings in rolled steel throughout the time period studied, which can be inconvenient for purchasers and end-users. Buyers have been turned off by price increases in rolled steel during pandemics. In the United States, rolled steel prices increased by more than 200 % in 2020. Such unpredictability and volatility operate as a limitation on the rolled steel, restraining the market for rolling oils as a result.

Cold Rolling Oils/Lubricants Market: Opportunities

Increase in R&D activities to foster the market during the forecast period

Cold rolling oil customers in developed economies want oils with good load-bearing capacity, appropriate viscosity, and a low coefficient of friction. Manufacturers have considerably enhanced their responsiveness to such bespoke needs from clients by focusing on R&D and product innovation in the sophisticated production and refining of oils. This trend is projected to acquire momentum throughout the world in the near future, creating enormous opportunities and, in turn, fueling market development. In addition to this, growing funds in the industrial sector, an increase in production of metals like steel & aluminum, growing R&D of synthetic lubricants, varying necessities from diverse cold rolling processes, and increasing technological advancements are some of the key aspects that are predicted to boost the global cold rolling oils/lubricants market during the forecast period.

Cold Rolling Oils/Lubricants Market: Challenges.

Limited crude oil sources pose a challenge for market growth

The majority of industrial oils are generated directly from crude oil or petroleum, therefore supply and pricing variations hurt the cold rolling oils industry. Semi-synthetic oil or pure crude oil refined mineral oil, which are mineral oil with additives, are two common forms of rolling oil. As a result, the rolling lubricants sector is heavily reliant on crude oil. Because crude oil or petroleum is a limited resource, the necessity to move to renewable energy is becoming increasingly apparent. Thus, the limited nature of crude oil is likely to act as a challenge to market growth.

Cold Rolling Oils/Lubricants Market: Segmentation

The global cold rolling oils/lubricants market is divided based on product type, material type, and region. Based on the product type, the global market is categorized into mineral-based, semi-synthetic, and synthetic. The material type segment comprises aluminum, copper, steel, and others.

By Product, the cold rolling oil market includes synthetic, semi-synthetic, and mineral. Based on application, the market is categorized into steel, copper, aluminum, and others. By geography, Asia Pacific is anticipated to hold the largest market share in terms of revenue and volume. The growing production of steel and metal processing activities in China is likely to boost the region’s cold rolling oil market in the years ahead. North America is anticipated to show a considerable rate of growth during the forecast time period, due to the growing focus on improving metal processing activities across the region, which, in turn, is anticipated to drive the region’s cold rolling oil market.

Cold Rolling Oils/Lubricants Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cold Rolling Oils/Lubricants Market |

| Market Size in 2024 | USD 2.26 Billion |

| Market Forecast in 2034 | USD 3.93 Billion |

| Growth Rate | CAGR of 5.7% |

| Number of Pages | 205 |

| Key Companies Covered | Indian Oil Corporation Ltd., BP plc., Total S.A., Exxon Mobil Corporation, Croda International PLC, ETNA Products Inc., Jiangsu Gaoke Petrochemical Co. Ltd., Houghton International Inc., Hindustan Petroleum Corporation Limited, Eastern Petroleum Pvt. Ltd, and others. |

| Segments Covered | By Product Type, By Material, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

In September 2020, Total Lubrifiants, the world's fourth-largest multinational lubricants corporation acquired Lubrilog SAS. Lubrilog SAS, situated in Romans Sur Isère, is a French firm that specializes in the formulation and manufacture of ultra-high-performance synthetic lubricants.

In July 202, Jintian Ningbo Copper established a third copper cold rolling mill supplied by SMS GROUP successfully.

Cold Rolling Oils/Lubricants Market: Regional Landscape

Asia Pacific to hold the largest market share during the forecast period.

Among the regions, Asia Pacific is estimated to hold the maximum share in the global cold rolling oils/lubricants market during the forecast period. Major factor such as increasing industrialization in economies like China and India is fostering market growth in this region. In addition to this, low manufacturing prices, government incentives, and low labor costs are all driving cold rolling oil shipments in these areas. North America is also estimated to grow at a steady rate. The use of cold rolling oils and lubricants is predicted to increase in this region due to rising industrialization and a fast-developing manufacturing sector. The demand for cold rolling oils in Europe is projected to be influenced significantly by increased industrial activity across the continent.

Cold Rolling Oils/Lubricants Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the cold rolling oils/lubricants market on a global and regional basis.

The global cold rolling oils/lubricants market is dominated by players like:

- Indian Oil Corporation Ltd.

- BP plc.

- Total S.A.

- Exxon Mobil Corporation

- Croda International PLC

- ETNA Products Inc.

- Jiangsu Gaoke Petrochemical Co. Ltd.

- Houghton International Inc.

- Hindustan Petroleum Corporation Limited

- Eastern Petroleum Pvt. Ltd

The global cold rolling oils/lubricants market is segmented as follows;

By Product Type

- Synthetic Cold Rolling Oils/Lubricants

- Semi-Synthetic Cold Rolling Oils/Lubricants

- Mineral Based Cold Rolling Oils/Lubricant

By Material

- Steel

- Copper

- Aluminium

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global cold rolling oils/lubricants market is expected to grow due to increasing demand from the steel and aluminum industries, growing emphasis on energy efficiency, and the need for high-performance lubrication to enhance metal quality and processing speed.

According to a study, the global cold rolling oils/lubricants market size was worth around USD 2.26 Billion in 2024 and is expected to reach USD 3.93 Billion by 2034.

The global cold rolling oils/lubricants market is expected to grow at a CAGR of 5.7% during the forecast period.

Asia-Pacific is expected to dominate the cold rolling oils/lubricants market over the forecast period.

Leading players in the global cold rolling oils/lubricants market include Indian Oil Corporation Ltd., BP plc., Total S.A., Exxon Mobil Corporation, Croda International PLC, ETNA Products Inc., Jiangsu Gaoke Petrochemical Co. Ltd., Houghton International Inc., Hindustan Petroleum Corporation Limited, Eastern Petroleum Pvt. Ltd, among others.

The report explores crucial aspects of the cold rolling oils/lubricants market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed