Global Cold Chain Equipment Market Size, Share, Growth Analysis Report - Forecast 2034

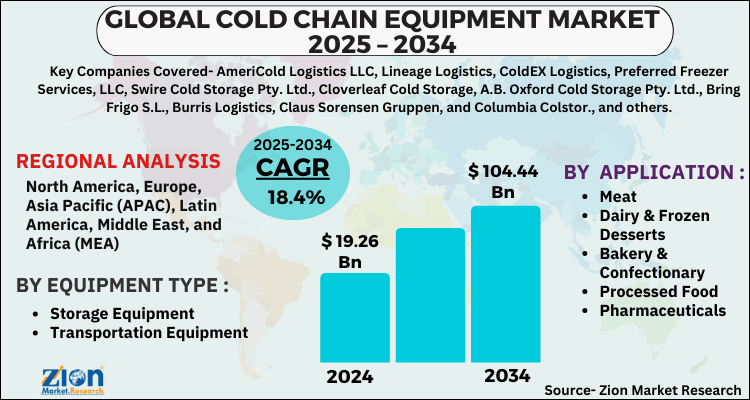

Cold Chain Equipment Market By Equipment Type (Storage Equipment and Transportation Equipment), By Application (Meat, Dairy & Frozen Desserts, Bakery & Confectionary, Processed Food, Pharmaceuticals, and Vegetables & Fruits), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

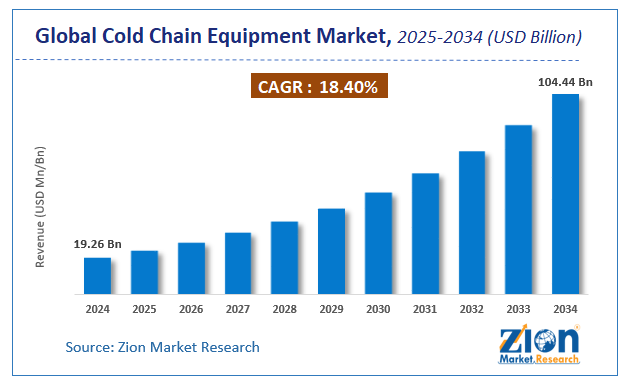

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 19.26 Billion | USD 104.44 Billion | 18.4% | 2024 |

Cold Chain Equipment Market Size

The global cold chain equipment market size was worth around USD 19.26 Billion in 2024 and is predicted to grow to around USD 104.44 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 18.4% between 2025 and 2034.

The report analyzes the global cold chain equipment market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the cold chain equipment industry.

Cold Chain Equipment Market: Overview

Vaccines, specialty chemicals, and medicines are to be stored & transported at a specific temperature for retaining their features and cold chain equipment serves this purpose. Moreover, cold chain equipment includes ice-packs, refrigerators, vaccine carriers, foam pads, biotech items, insulin, and cold boxes. Escalating demand for frozen diet across the world has resulted in huge need for cold chain equipment in recent years. Furthermore, cold chain equipment is a key component of immunization supply chain in healthcare sector. Reportedly, cold chain equipment such as freezers, cold rooms, vaccine carriers, cold boxes, and refrigerators are expected to comply with performance protocols set by World Health Organization.

Key Insights

- As per the analysis shared by our research analyst, the global cold chain equipment market is estimated to grow annually at a CAGR of around 18.4% over the forecast period (2025-2034).

- Regarding revenue, the global cold chain equipment market size was valued at around USD 19.26 Billion in 2024 and is projected to reach USD 104.44 Billion by 2034.

- The cold chain equipment market is projected to grow at a significant rate due to increasing demand for temperature-sensitive goods, particularly in the food and pharmaceutical sectors, coupled with advancements in refrigeration and monitoring technologies.

- Based on Equipment Type, the Storage Equipment segment is expected to lead the global market.

- On the basis of Application, the Meat segment is growing at a high rate and will continue to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Cold Chain Equipment Market: Growth Drivers

Growth of cold chain equipment market over ensuing years can be credited to storing of processed food & frozen products. In addition to this, altering lifestyle of individuals has resulted into rise in intake of food & drinks and this will prop up cold chain equipment demand over forecasting years. Furthermore, strict government norms for food & pharmaceutical safety during storage & transit will propel expansion in size of cold chain equipment market. Moreover, escalating popularity of chilled & frozen, ready-to-eat diet, and packaged foods will open new growth avenues for cold chain equipment industry.

Additionally, consumers are transiting their food preferences towards value-added food categories including salads, cheese, ready-to-eat diet, fresh vegetables, and processed meat. Apparently, the most commonly utilized cold chain equipment for storing & transporting these kinds of foods include boxes, walk-in-refrigerators, and milk coolers. This will enlarge the scope of cold chain equipment business. Apart from this, there is humungous need for baby food & organic fruit pulps and cold chain equipment is used to store these products along with maintaining their key nutrients for elongated timespan.

Supply chain management that facilitates the transportation and storage of perishable goods are called as a cold chain. A cold chain is series of storage and distribution activities at the desired temperature. The cold chain is helpful to preserve the food and various products such as pharmaceutical and agricultural products. Cold chain equipment is the heart of cold chain industry. Cold chain equipment includes storage and transportation equipment or components. The cold chain equipment market is growing at a rapid pace owing to rising market for frozen food products.

Cold chain equipment such as refrigerators, deep freezers, warehouses helps to preserve and avoid the wastage of agricultural produce and perishable food products such as meat, seafood, fruit & vegetables, and fish. The advancements in the pharmaceutical industry are also expected to drive the market for cold chains equipment market during the years to come. Moreover, increasing the population of the world has resulted in growing demand for both food and pharmaceuticals. This, in turn, has been resulted into growing need for cold chains equipment.

Cold Chain Equipment Market: Segmentation

The global cold chain equipment market is segmented based on Equipment Type, Application, and region.

Based on Equipment Type, the global cold chain equipment market is divided into Storage Equipment and Transportation Equipment.

On the basis of Application, the global cold chain equipment market is bifurcated into Meat, Dairy & Frozen Desserts, Bakery & Confectionary, Processed Food, Pharmaceuticals, and Vegetables & Fruits.

Cold Chain Equipment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cold Chain Equipment Market |

| Market Size in 2024 | USD 19.26 Billion |

| Market Forecast in 2034 | USD 104.44 Billion |

| Growth Rate | CAGR of 18.4% |

| Number of Pages | 187 |

| Key Companies Covered | AmeriCold Logistics LLC, Lineage Logistics, ColdEX Logistics, Preferred Freezer Services, LLC, Swire Cold Storage Pty. Ltd., Cloverleaf Cold Storage, A.B. Oxford Cold Storage Pty. Ltd., Bring Frigo S.L., Burris Logistics, Claus Sorensen Gruppen, and Columbia Colstor., and others. |

| Segments Covered | By Equipment Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Cold Chain Equipment Market: Regional Landscape

Asia Pacific Cold Chain Equipment Market To Register Double Digit Growth With 22% CAGR Over 2025-2034

Expansion of cold chain equipment industry in Asia Pacific zone over forecasting timespan is subject to increase in transport of temperature sensitive medicines across the sub-continent. Apart from this, rapidly expanding food sector in APAC is projected to contribute notably towards regional market size. Presence of key manufacturers in sub-continent will push growth of regional market over upcoming years.

Cold Chain Equipment Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the cold chain equipment market on a global and regional basis.

The global cold chain equipment market is dominated by players like:

- AmeriCold Logistics LLC

- Lineage Logistics

- ColdEX Logistics

- Preferred Freezer Services

- LLC

- Swire Cold Storage Pty. Ltd.

- Cloverleaf Cold Storage

- A.B. Oxford Cold Storage Pty. Ltd.

- Bring Frigo S.L.

- Burris Logistics

- Claus Sorensen Gruppen

- and Columbia Colstor.

The global cold chain equipment market is segmented as follows;

By Equipment Type

- Storage Equipment

- Transportation Equipment

By Application

- Meat

- Dairy & Frozen Desserts

- Bakery & Confectionary

- Processed Food

- Pharmaceuticals

- and Vegetables & Fruits

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global cold chain equipment market is expected to grow due to rising investments in cold storage infrastructure, increasing demand for temperature-sensitive pharmaceuticals and perishable food products, growing adoption of IoT and automation in logistics, and stringent regulations for food and drug safety.

According to a study, the global cold chain equipment market size was worth around USD 19.26 Billion in 2024 and is expected to reach USD 104.44 Billion by 2034.

The global cold chain equipment market is expected to grow at a CAGR of 18.4% during the forecast period.

North America is expected to dominate the cold chain equipment market over the forecast period.

Leading players in the global cold chain equipment market include AmeriCold Logistics LLC, Lineage Logistics, ColdEX Logistics, Preferred Freezer Services, LLC, Swire Cold Storage Pty. Ltd., Cloverleaf Cold Storage, A.B. Oxford Cold Storage Pty. Ltd., Bring Frigo S.L., Burris Logistics, Claus Sorensen Gruppen, and Columbia Colstor., among others.

The report explores crucial aspects of the cold chain equipment market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed