Coil Coatings Market Size, Share, Analysis, Trends, Growth, 2034

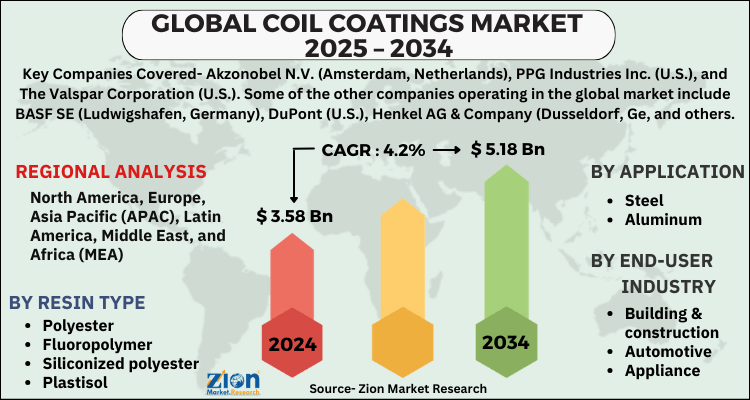

Coil Coatings Market By Resin Type (Polyester, Fluoropolymer, Siliconized Polyester, Plastisol, and Others). By Application (Steel and Aluminum). By End-User Industry (Building & Construction, Automotive, Appliance, and Others) And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2025 - 2034

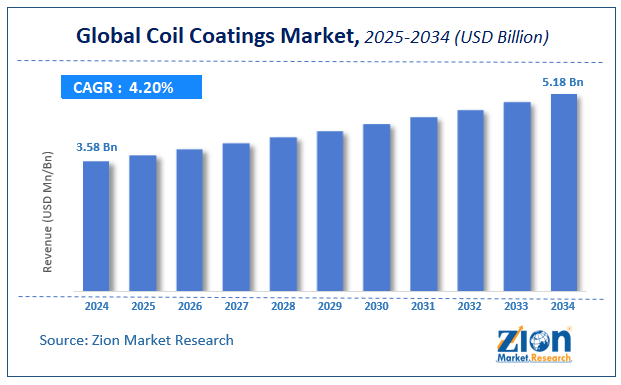

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.58 Billion | USD 5.18 Billion | 4.2% | 2024 |

Coil Coatings Industry Perspective:

The global Coil Coatings Market was worth around USD 3.58 Billion in 2024 and is predicted to grow to around USD 5.18 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 4.2% between 2025 and 2034. The report analyzes the global coil coatings market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the coil coatings industry.

The report analyzes the Coil Coatings Market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Coil Coatings Market.

Coil Coatings Market: Overview

Coil coating is an automated and continuous industrial process that coats metal coils effectively. The coatings work on a simple but successful concept of cleaning, pretreating, and coating flat coils, steel sheets, or aluminium sheets. The rapid expansion of the construction industry as a result of greater disposable income and increased government investment in public infrastructure is expected to drive sales. The increasing use of coil coating paint in pre-coated items or metals used in construction wall cladding and roofing will continue to drive the market. Additionally, rising disposable income and a higher standard of living fuel demand for modern furniture, which is predicted to drive up demand for functional coil-coated metals.

The automobile industry is also expected to drive global expansion. Color coated coils are commonly used by automakers because they give metals with a consistent and high-quality finish at a low cost. Moreover, the usage of these metals improves the design and aesthetics of home appliances and allows producers to customize the texture.

Key Insights

- As per the analysis shared by our research analyst, the global coil coatings market is estimated to grow annually at a CAGR of around 4.2% over the forecast period (2025-2034).

- Regarding revenue, the global coil coatings market size was valued at around USD 3.58 Billion in 2024 and is projected to reach USD 5.18 Billion by 2034.

- The coil coatings market is projected to grow at a significant rate due to increasing applications in construction, automotive, and industrial sectors due to their corrosion resistance, durability, and aesthetic appeal.

- Based on Resin Type, the Polyester segment is expected to lead the global market.

- On the basis of Application, the Steel segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-User Industry, the Building & Construction segment is projected to swipe the largest market share.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Coil Coatings Market: Driver

The Oil and Gas Industry is Helping the Market

There is a discernible increase in demand for oil and gas resources around the world, which is due to increased demand from the automobile and aerospace industries. Clearly, oil and gas are one of the key industries that use metals and alloys, particularly steel, in structures, pipelines, reactors, and other equipment that is an essential part of an oil and gas plant. Most steel products, it appears, go through the coil coating process before being employed in diverse applications. Steel and other metals used in the oil and gas industry are providing a revenue stream for coil coatings vendors.

Coil Coatings Market: Restraint

The high cost of processes involved in the manufacture of functional coil coatings is a factor impeding the growth of this market. The coil coating line, which includes various cleaning, heating, and coating tools and equipment, is used in the manufacturing process. The higher the expense of these machines' upkeep, the higher the cost of the process, and the higher the cost of functional coil coatings. Furthermore, due to the higher cost of pre-coated metal, consumers choose household appliances that require the production of fiber or plastic. This is due to the inexpensive pricing of these materials and the same performance as functional coil coatings. The functional coil coating process necessitates the employment of various coating machinery and tools. The usage of these tools for an extended period of time causes wear and tear, restricting the adoption of functional coil coatings.

Coil Coatings Market: Segmentation

The Coil Coatings Market is segregated based on resin type, application, and end-user industry.

By resin type, the market is classified into Polyester, Fluoropolymer, Siliconized Polyester, Plastisol, and Others. Polyester is expected to dominate the worldwide coil coatings market in the future years. Along with its numerous advantageous features, polyester coil paint is increasingly being employed in both the exteriors and interiors of buildings. Polyester is resistant to harsh weather, has outstanding formability, and has strong chemical resistance qualities. It can also give excellent flow properties at a variety of temperatures, making it suitable for use in pre-engineered buildings.

By end-user industry, the market is classified into Building & Construction, Automotive, Appliance, and Others. During the evaluation period, the construction segment is anticipated to continue at the forefront of the worldwide coil coatings market. The market is expected to grow because of an increase in the number of residential and commercial construction projects in both developed and emerging countries. Cleaner technologies for public infrastructure are expected to promote sales of color-coated coils. The growing popularity of the westernization trend throughout emerging nations is expected to result in high demand for personal residences among younger people, boosting the market growth.

Coil Coatings Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Coil Coatings Market |

| Market Size in 2024 | USD 3.58 Billion |

| Market Forecast in 2034 | USD 5.18 Billion |

| Growth Rate | CAGR of 4.2% |

| Number of Pages | 199 |

| Key Companies Covered | Akzonobel N.V. (Amsterdam, Netherlands), PPG Industries Inc. (U.S.), and The Valspar Corporation (U.S.). Some of the other companies operating in the global market include BASF SE (Ludwigshafen, Germany), DuPont (U.S.), Henkel AG & Company (Dusseldorf, Ge, and others. |

| Segments Covered | By Resin Type, By Application, By End-User Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Coil Coatings Market: Regional Landscape

The Asia Pacific now dominates the global coil coatings market demand and will do so in the future due to the presence of a large number of manufacturers and a significant end-user industry. The region's expanding automobile industry is driving up product demand. Furthermore, the region's expanding building activity will result in tremendous growth potential in the industry landscape. China leads the construction business, investing heavily in South East Asia as part of the Belt and Road Initiative. Construction activity in the country will move to projects that will improve inhabitants' quality of life. This trend is reflected in the ongoing PPP (Public-Private Partnership) program, which focuses on social infrastructure as well as environmental protection initiatives. Rising investment and government attempts to stimulate construction activity in the Asia Pacific would advance the region.

Coil Coatings Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the coil coatings market on a global and regional basis.

The global coil coatings market is dominated by players like:

- Akzonobel N.V. (Amsterdam

- Netherlands)

- PPG Industries Inc. (U.S.)

- and The Valspar Corporation (U.S.). Some of the other companies operating in the global market include BASF SE (Ludwigshafen

- Germany)

- DuPont (U.S.)

- Henkel AG & Company (Dusseldorf

- Germany)

- Kansai Paint Chemical Limited (Osaka

- Japan)

- The Beckers Group (Berlin

- Germany)

- The Sherwin-Williams Company (U.S.)

- and Wacker Chemie AG (Munich

- Germany)

Coil Coatings Market is segmented as follows:

By Resin Type

- Polyester

- Fluoropolymer

- Siliconized polyester

- Plastisol

- Others

By Application

- Steel

- Aluminum

By End-User Industry

- Building & construction

- Automotive

- Appliance

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global coil coatings market is expected to grow due to rising demand from the construction, automotive, and appliance industries, along with increasing focus on energy-efficient and corrosion-resistant coatings.

According to a study, the global coil coatings market size was worth around USD 3.58 Billion in 2024 and is expected to reach USD 5.18 Billion by 2034.

The global coil coatings market is expected to grow at a CAGR of 4.2% during the forecast period.

Asia-Pacific is expected to dominate the coil coatings market over the forecast period.

Leading players in the global coil coatings market include Akzonobel N.V. (Amsterdam, Netherlands), PPG Industries Inc. (U.S.), and The Valspar Corporation (U.S.). Some of the other companies operating in the global market include BASF SE (Ludwigshafen, Germany), DuPont (U.S.), Henkel AG & Company (Dusseldorf, Ge, among others.

The report explores crucial aspects of the coil coatings market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed