Fluoropolymers Market Size, Share, Growth Analysis Report, 2032

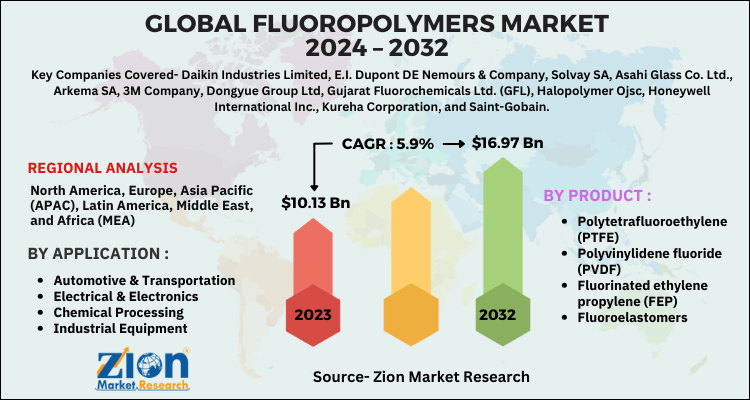

Fluoropolymers Market By Product (Polytetrafluoroethylene (PTFE), Polyvinylidene Fluoride (PVDF), Fluorinated Ethylene Propylene (FEP), and Fluoroelastomers), By Application (Automotive & Transportation, Electrical & Electronics, Chemical Processing, and Industrial Equipment), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

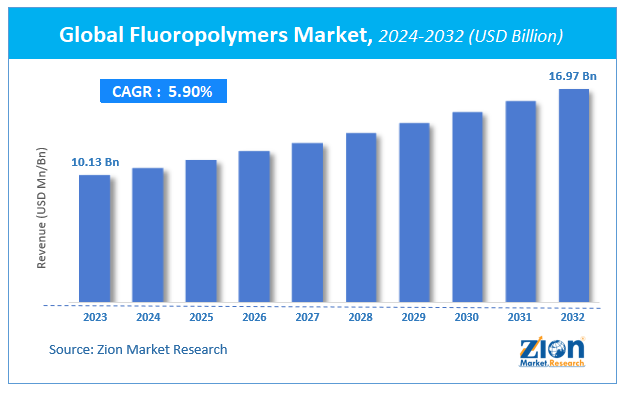

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 10.13 Billion | USD 16.97 Billion | 5.9% | 2023 |

Fluoropolymers Market Insights

Zion Market Research has published a report on the global Fluoropolymers Market, estimating its value at USD 10.13 Billion in 2023, with projections indicating that it will reach USD 16.97 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 5.9% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Fluoropolymers Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Fluoropolymers possess excellent properties such as chemical resistance, weather stability, low surface energy, low coefficient of friction, and low dielectric constant. These properties come from its special electronic structure of the fluorine atom, the stable carbon-fluorine covalent bonding, and the unique Intra and intermolecular interactions between fluorinated polymers. Due to fluoropolymer’s unique physical and chemical properties, they are widely applied in the electrical, construction, chemical, and automotive industries.

Global Fluoropolymers Market Overview

Fluoropolymers are polymers that have several strong carbon-fluorine bonds. Fluoropolymers possess many unique properties such as chemical resistance and mechanical and electrical insulation. These properties make fluoropolymers attractive as highly durable protective coatings in many different architectural coating formulations, particularly those intended for exterior applications due to the need for excellent weather ability. Fluoropolymers are very popular in industrial processing industries owing to their chemical and oil-resistant properties.

It is common to use plastic items in many various surgeries, such as corneas or heart valves. Such products can affect the body toxically, as they are not biocompatible. This also raises significant long-term questions about the overall health of the patient. This made the use of fluoropolymers in such medical procedures extremely attractive.

COVID-19 Impact Analysis:

The restrictions imposed by various nations to contain COVID had stopped the demand and supply resulting in a disruption across the whole supply chain. The downturn in the automotive and aerospace industries has experienced a significant decline due to the lack of labor and production facility closures. These all factors are responsible for the decline in sales of the market. However, the global markets are slowly opening to their full potential and theirs a surge in demand.

The market will remain bullish in the upcoming year. The significant decrease in the global Fluoropolymers market size in 2020 is estimated on the basis of the COVID-19 outbreak and its negative impact on economies and industries across the globe. Various scenarios have been analyzed on the basis of inputs from various secondary sources and the current data available about the situation.

Fluoropolymers Market: Growth Factors

The global fluoropolymer market is expected to grow at a steady rate within the forecast period. The unique properties of fluoropolymers are one of the major factors driving this market growth. Furthermore, a wide service temperature range, high melting point, high crystallinity, weather ability, and reflectivity to intense UV rays can be achieved using fluoropolymers over conventional polymers. Fluoropolymers are also utilized in miniaturization of circuit boards and electronics because of their dielectric property.

Moreover, fluoropolymers have wide applications in aircraft bearings and seals, high-capacity automotive, and coatings of kitchenware as they have low friction and non-stick properties. They can be used in various industries leading to their augmented adoption in the forecast period.

The worldwide fluoropolymer market is primarily driven increasing demand for the fluropolymer from various end user applications. Fluoropolymers exhibit properties superior to other polymeric substances and rubber which makes them ideally suitable for a wide range of applications, especially applications demanding extreme environments such as high chemical resistance, weldability, mechanical strength, high-temperature stability, etc. Automotive and transportation industry is the largest end user application for fluoropolymers. The increasing tendency towards lower vehicle weight, lower emissions, and enhanced fuel efficiency is expected to drive the consumption growth of fluoropolymers in the automotive and transportation industry. However, stringent government regulations regarding the fluoropolymers production and usage may hold back the market growth.

Fluoropolymers Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Fluoropolymers Market |

| Market Size in 2023 | USD 10.13 Billion |

| Market Forecast in 2032 | USD 16.97 Billion |

| Growth Rate | CAGR of 5.9% |

| Number of Pages | 190 |

| Key Companies Covered | Daikin Industries Limited, E.I. Dupont DE Nemours & Company, Solvay SA, Asahi Glass Co. Ltd., Arkema SA, 3M Company, Dongyue Group Ltd, Gujarat Fluorochemicals Ltd. (GFL), Halopolymer Ojsc, Honeywell International Inc., Kureha Corporation, and Saint-Gobain |

| Segments Covered | By Product, By Applications, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Fluoropolymers Market: Segmentation Analysis

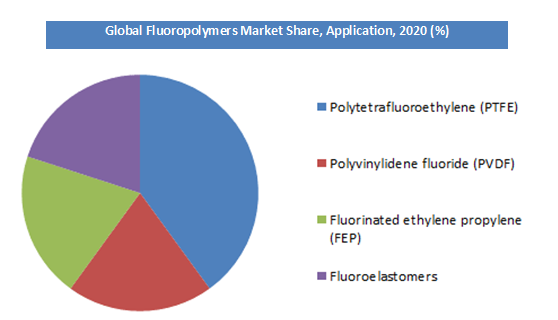

By Type Segment Analysis

The PTFE market dominated the global fluoropolymers industry accounting for around 62.3% of the overall volume in 2023. Enhanced wear resistance and chemical stability are key properties of PTFE to use in the manufacturing of gaskets, linings, washers, pump interiors, seals, and spacers for industrial applications.

By Application Segment Analysis

Based on application, the market is segmented into automotive & transportation, electrical & electronics, chemical processing, and industrial equipment applications. The industrial equipment segment accounted for the largest market share of around 28.15% of the global market share for fluoropolymers in 2023. Electrical & electronics was the second-largest application segment and is expected to grow at a fast pace in the forecast period.

Furthermore, the scope of another application segment for fluoropolymers is expected to expand in the near future owing to the increasing usage of fluoropolymers in emerging applications such as waterproof clothing, non-stick cookware, and dental filling.

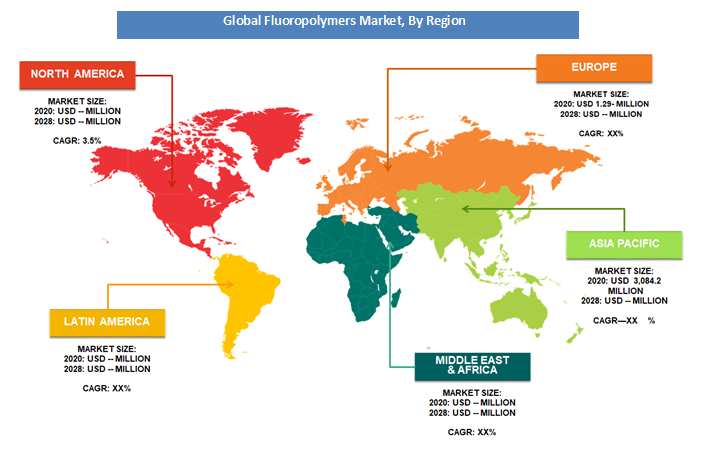

Fluoropolymers Market: Regional Analysis

Geographically, Asia Pacific was the leading market for fluoropolymers accounting for the maximum market share in 2023 and is expected to continue this trend in the forecast period. The growth in the region is mainly governed by major countries such as China, Japan, India, and South Korea.

China is one of the leading markets for construction, electrical and electronics, industrial and household appliances, and automotive industries in the region. Latin America and the Middle East & Africa regions are anticipated to witness a surge in fluoropolymers demand owing to construction sector growth in the region.

Fluoropolymers Market: Competitive Analysis

Some of the major players in the global Fluoropolymers market include:

- Daikin Industries Limited

- E.I. Dupont DE Nemours & Company

- Solvay SA

- Asahi Glass Co. Ltd.

- Arkema SA

- 3M Company

- Dongyue Group Ltd

- Gujarat Fluorochemicals Ltd. (GFL)

- Halopolymer Ojsc

- Honeywell International Inc.

- Kureha Corporation

- Saint-Gobain

The global Fluoropolymers Market is segmented as follows:

By Product

- Polytetrafluoroethylene (PTFE)

- Polyvinylidene fluoride (PVDF)

- Fluorinated ethylene propylene (FEP)

- Fluoroelastomers

By Applications

- Automotive & Transportation

- Electrical & Electronics

- Chemical Processing

- Industrial Equipment

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a study, the global Fluoropolymers market size was worth around USD 10.13 billion in 2023 and is expected to reach USD 16.97 billion by 2032.

The global Fluoropolymers market is expected to grow at a CAGR of 5.9% during the forecast period.

Some of the key factors driving the global Fluoropolymers Market growth Advancements in medical applications, and High demand in the end-use industries.

Asia Pacific is expected to dominate the Fluoropolymers market over the forecast period.

Some of the major players of global Fluoropolymers market includes Daikin Industries Limited, E.I. Dupont DE Nemours & Company, Solvay SA, Asahi Glass Co. Ltd., Arkema SA, 3M Company, Dongyue Group Ltd, Gujarat Fluorochemicals Ltd. (GFL), Halopolymer Ojsc, Honeywell International Inc., Kureha Corporation, and Saint-Gobain.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed